Jerry Held - UC Berkeley School of Information

advertisement

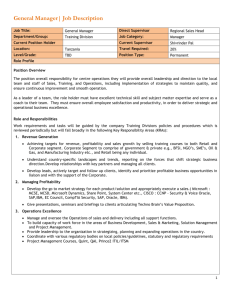

U.S. v. Oracle Corp. Economic Issues Dan Wall Latham & Watkins LLP Modern Computing Environment Function Ties together disparate computing environments Performs business processes Runs programs (Java, C), integrates multiple programs, manages user security Stores data (e.g., invoices, orders, personnel records) Runs logic for hardware Hardware on which software applications run System Systems Integration Services Enterprise Applications Software (“EAS”) Application Server Solutions Accenture, IBM, Cap Gemini, EDS, In-House, Others SAP, Oracle, PS, Others IBM, Microsoft, BEA Oracle, SAP, JBoss, Others Database Oracle, IBM, Microsoft, Sybase, MySQL, Others Operating Systems Unix, Windows, Linux Mainframe MVS, Others Server Computers IBM, Sun, Dell, HP, Others EAS Within the Enterprise Customer Interface The “Back Office” Corporate Administration Financial management Human resources Central procurement Executive information / decision support systems Product marketing / support Field service & support Order entry Sales management Customer information systems Product configuration Supply Chain Advanced planning & scheduling Supply chain inventory visibility Warehouse / inventory mgmt Transportation International trade systems Manufacturing Resource planning Maintenance, repair, operations Engineering/design Product data management Production management C U S T O M E R S S U P P L I E R S FMS Applications Financial Management Systems (“FMS”) Applications General ledger (“GL”) Accounts payable (“A/P”) Accounts receivable (“A/R”) Asset management Treasury management Travel and expense management Others … HR Applications Human Resources (“HR”) Applications Human resources Payroll Time & attendance Benefits Compensation Training Learning Performance appraisal Others … Industry Verticals Federal Government Communications State and Local Government Utilities Education Healthcare Providers Financial Services Retail Professional Services Process Manufacturing Discrete Manufacturing Agriculture & Mining Stack Competition Consulting Services Oracle Consulting Partners IBM GlobalServices SAP Consulting Partners E-Business Suite Microsoft Business Solutions Partners mySAP Partners Applications Development Tools Oracle Tools / J2EE Visual Studio .NET Rational / WebSphere NetWeaver / J2EE J2EE Application Server 10g .NET WebSphere NetWeaver JBoss/Apache Database Database 10g MS SQL Server DB2 MySQL and others MySQL Operating System Linux Windows Linux Linux Linux Middleware Suite Real Competition: The Stack D5822R A Non-Starter In FMS Or In HRMS Getting to DOJ’s Market Cut out the “Mid-Market” • DOJ focuses on the very largest corporations in the world. • Thousands of large enterprises are excluded from the market – because they indisputably turn to other vendors. <2000 Companies 10-15,000 Companies 200 Word Market Definition Price Discrimination A constant DOJ theme, but: • • • Price discrimination in the form of different, customer-specific pricing was simply noted, not explained. Price discrimination market definition theory was not pursued. DOJ never established that having fewer choices translated to unfavorable treatment. The Secret (Better?) Market SAP Will Remain the Leading Firm “ERP” (EAS Suites) • • SAP Worldwide ERP Revenues: Sum of Oracle and PeopleSoft: $5.0 billion $3.1 billion Source: IDC, May 2004 (D5572) FMS SAP Worldwide FMS Revenues: Sum of Oracle and PeopleSoft: • • $1.06 billion $673 million Source: IDC, Sept. 2003 (D5543) HRM • • SAP Worldwide HRM Revenues: Sum of Oracle and PeopleSoft: $514 million $652 million Source: IDC, July 2003 (D5815) From Oracle’s Opening Statement “Localized Competition” Theory “Reality” (Assuming 3-firm market) Customer Size ERP Vendor Market Positioning AMS SAP PeopleSoft Oracle Lawson Microsoft Vertical Scope Sources of Customer Leverage Lost enterprise bids are very costly. • Variable costs are low; lost revenue is lost profit. Follow-on business. • More modules, pillars, infrastructure needs. Reference value. Control of key information. • They can learn what is important about vendors while concealing what is important about them. A credible “do nothing” option. From Oracle’s Opening Statement Nothing Critical Will Change Today Post-Merger One or two firms negotiating with buyer. Unchanged Buyers with leverage that don’t need to buy at all. Unchanged Buyers can conceal their reserve price and vendor preferences. Unchanged Seller costs of losing are huge; price discrimination is very risky. Unchanged