Internet Stocks: Value and Trading Strategy

advertisement

Internet Stocks: Value and

Trading Strategy

Rob Freund

Petter Hellman

Ole Hvidsten

Jiong Shao

Rick Solano

Main Points

•

•

•

•

•

•

Value in theory

Internet shortcomings for traditional value

Modifications to theory for Internet stocks

Trading strategy

Conclusion

Questions

Value in Theory

•

•

•

•

Investors want money

Industry growth vs. age curve

Graph

New industry - growth important

Mature industry - returns important

Internet Shortcomings

• Modern valuation theory created during a

time when there was no emerging societyconvulsing technology

• Valuation theory based on earnings and net

income.

• Internet terminal values are unclear.

• Can’t use current performance to

extrapolate future performance.

Laying Odds on Success of Firm’s Value

Proposition

Total Market Capitalization of Industry

(e.g. Retail: $1.45T %, FCF Margin = 5%)

{

Expected Market Cap position of firm (PV $)

(e.g. Amazon: Market Share = 10%

MCAP = $145B)

Payoff to investors

if firm successful

Bet placed by

investors

{

Current Market Cap of firm

(e.g. Amazon MCAP as of 8-31-99 = $14.14B)

Current Value of firm using existing financial

performance baseline

(e.g. Not Applicable - no earnings)

Price of bet influenced by factors affecting expected future outcome (e.g. starting QB

breaks leg day before Superbowl) - IN THIS CASE, MARKET HAS SET 10-1

ODDS ON AMAZON CROSSING THE FINISH LINE IN THIS POSITION

Hypothesis for Future Returns

• We must find a proxy to indicate the

potential for future income.

• Potential proxy candidates:

–

–

–

–

MCAP/Sales

PSSG

PSSA

Sales growth

Trading Strategy

• Sort stocks during a particular time period and

pick top 25%

• Stock sorted on the income proxy

• Positions taken at the end of the second month

following the quarter used for analysis

• Returns calculated over three month holding

period

• Stock returns were compared to a “buy and hold”

strategy of stocks included in the H & Q Internet

Index

Results

Index

Conclusion

• Must use a proxy for earnings

• A buy and hold strategy can be beaten

• Current value is based on investor perceived

future potential

Questions?

Industry Growth vs. Time

Growth

Rate

Return

Time

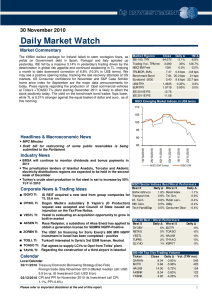

Results of Various Sort-Trading Strategies

Average

Quarterly

Returns

Calendar Buy and Hold

Quarter

Strategy

1995 - Q0

1995 - Q1

-8.89%

1995 - Q2

23.47%

1995 - Q3

2.32%

1995 - Q4

-19.27%

1996 - Q1

20.42%

1996 - Q2

-28.84%

1996 - Q3

-14.75%

1996 - Q4

-9.36%

1997 - Q1

-5.36%

1997 - Q2

17.30%

1997 - Q3

3.14%

1997 - Q4

16.58%

1998 - Q1

10.19%

1998 - Q2

-27.46%

1998 - Q3

82.28%

1998 - Q4

26.25%

1999 - Q1

10.97%

1999 - Q2

2.94%

B&H

Strategy

$

1.00

$

0.91

$

1.12

$

1.15

$

0.93

$

1.12

$

0.80

$

0.68

$

0.62

$

0.58

$

0.68

$

0.70

$

0.82

$

0.91

$

0.66

$

1.20

$

1.51

$

1.68

$

1.73

Average

Quarterly

Returns

MCAP / Sales MCAP / Sales

Stategy

Strategy

$

1.00

25.98% $

1.26

36.75% $

1.72

-25.07% $

1.29

-12.54% $

1.13

20.68% $

1.36

-26.92% $

1.00

-6.22% $

0.93

-24.32% $

0.71

-9.40% $

0.64

0.81% $

0.65

14.74% $

0.74

9.76% $

0.81

15.55% $

0.94

-28.25% $

0.67

96.25% $

1.32

77.89% $

2.35

21.16% $

2.85

9.77% $

3.13

Average

Quarterly

Returns

PSSG

Strategy

PSSG

Strategy

$

1.00

$

0.82

$

1.14

$

1.41

$

1.24

$

1.37

$

1.00

$

0.82

$

0.78

$

0.71

$

0.67

$

0.57

$

0.71

$

0.88

$

0.90

$

1.61

$

1.74

$

2.19

-18.48%

40.33%

23.36%

-12.44%

11.15%

-27.49%

-17.72%

-4.82%

-8.42%

-6.11%

-14.40%

23.62%

23.38%

3.12%

78.58%

8.09%

25.88%

6.53% $

2.34

Average

Quarterly

Returns

PSSA

Strategy

PSSA

Strategy

$

1.00

$

0.82

$

1.17

$

1.44

$

1.03

$

1.08

$

0.96

$

0.60

$

0.41

$

0.47

$

0.45

$

0.42

$

0.47

$

0.53

$

0.35

$

0.54

$

0.54

$

0.65

-18.48%

43.17%

23.36%

-28.25%

5.00%

-11.46%

-37.47%

-31.59%

14.63%

-3.42%

-7.42%

11.88%

11.97%

-34.49%

54.98%

0.25%

20.90%

19.63% $

0.78

Average

Quarterly

Returns

Sls Growth

Strategy

-18.48%

43.17%

23.36%

-49.59%

5.70%

-27.49%

-19.32%

21.56%

-9.45%

3.50%

-9.15%

20.76%

29.51%

1.60%

84.57%

-9.48%

30.97%

8.57% $

Average

Total

Return

9.21%

13.30%

10.33%

4.94%

Sls Growth

Strategy

$

1.00

$

0.82

$

1.17

$

1.44

$

0.73

$

0.77

$

0.56

$

0.45

$

0.55

$

0.49

$

0.51

$

0.46

$

0.56

$

0.73

$

0.74

$

1.36

$

1.23

$

1.61

10.74%

Using a simply MCAP to Sales ratio to sort yields the highest return

1.75

MCAP to Sales and Sales Growth

Ratio

• Incorporate sales and sales growth into a

valuation parameter

• Based on PEG (price to earnings and

earnings growth)

• Formula - MCAP/(S*DS)

• As the firm/industry matures, growth

declines, so actual sales must pick up the

value slack

H & Q Internet index

Due to MCAP weighting - the index return has been significantly skewed

by a few extraordinarily successful stocks

Traditional vs. Internet

• Traditional

–

–

–

–

Players exist and stable

Market size identifiable

Can estimate terminal value because market size known

Extrapolate current performance based on short-term management

guidance

• Internet

– Terminal value unknown

– Can’t use current performance to extrapolate

• Factors determining mature market performance

– Margins

– Market Size

– Market Share