S+RA Treasurer*s Speech to 2011 AGM

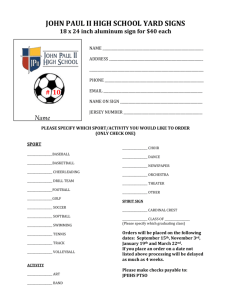

advertisement

S+RA Treasurer’s Speech to 2012 AGM Your Royal Highness, my Lords, Ladies and Gentlemen. You have already heard from Andy of the achievements of the Sport and Recreation Alliance over the last year. It is against this very successful backdrop that I am able to present the Alliance’s annual accounts for the year ending 31st March 2012 and, after any questions, ask for their adoption by the meeting. This is the first time that I will have the pleasure of addressing you as Treasurer and would like to acknowledge the efforts of my predecessor, John Crowther, who left things in such fine shape. Since it is my first appearance I would also beg that you go easy on me. At last year’s AGM, John commented on the challenging financial climate that the Sport and Recreation Alliance would have to navigate, particularly as we faced the impact of tighter public finances. I am pleased report that, notwithstanding these continuing pressures, the management team, with the support of the Board, have delivered a very satisfactory financial result. Despite a further reduction in Sport England funding, of which more later, we still managed to secure a pre-tax surplus of £56,375, compared to a loss of £140,365 in the previous year. While I would like to take the credit for this apparent dramatic turnaround in our financial fortunes, the reality is that this is largely due to the impact of the accounting for pensions in our accounts. As you may recall, the London Pension Fund Authority advised us in December 2010 that the Alliance should make a further contribution of £146,673 over the next three years to cover an anticipated pension deficit. Accounting standards required us to charge this deficit to our income and expenditure account in the year it was advised , thus turning a modest surplus in 2011 into a loss of £140,365. Without a repeat of that large one-offcharge in 1 2012, we are now able to deliver a small surplus. If you are confused by this, then all I can say is “welcome to the world of pensions accounting”! On the income side, and after very careful consideration, the Alliance accepted a baseline 5% cut in its annual contractual funding from Sport England for 2011/12, which followed on from a 3% cut in the preceding year. This continues a long term trend of some very tight agreements. For perspective, over the last five years we have received a 2% reduction in our funding level when the Consumer Price Index has increased by some 15%. This excellent financial performance is in no small part due to the laser like focus on costs from Tim, Geoff and the rest of the leadership team. Operating expenses in 2011/2012, excluding project costs, were down 14% from the previous year while total income, excluding project income, was down 2%. All of this has been done while delivering against our key mission, objectives and goals. In my view, I reiterate my predecessor’s view that we represent unrivalled value for money. I should also add that this good financial performance would not have been possible without the contribution of Sport and Recreation Ventures Ltd. Over the past five years they have contributed over £600,000 to the operations of the Alliance through successful partnerships with organisations such as Perkins Slade, Traveleads, Haysmactintyre, Grange Hotels, the Media Group, Microtrading, Farrer & Co, Rocketseed, Cabbell Publishing, Utility Aid, IMG, and other current and potential new Partners. represented here today. Our thanks must go to those organisations and Andrew Peters and his Ventures Board for maintaining the continued flow of funds. From a balance sheet perspective, you will note that the good P&L performance is reflected in a strong balance sheet, and that our reserves continue to meet our target of holding nine months’ worth of operating expenses. Before moving on to the key issue of our funding from Sport England, I think it would be remiss of me, as the new Treasurer, not to provide a perspective on the financial management of the organisation. 2 When I was a young, bright-eyed and bushy-tailed new Finance Director at the Procter & Gamble Company, I was given some advice that has stood me in good stead for the past thirty years. Specifically, in the first day in the job, I was urged to focus on the three c’s. The first is cash. Someone once said to me that “profit is a figment of an accountant’s imagination, but cash is real, tangible and the thing that really counts”. I am pleased to say that this organisation is very cash conscious. It is prudent in its use and careful with its deployment. In particular, you will be pleased to know that we have a clear policy for the investment of our reserves. We take advantage of the government’s guarantee of £85,000 per bank and that, where amounts in excess of that are invested in any one institution, we do so only with institutions with a strong credit rating. The Finance Committee and the Board approve the strategy annually and an update of the current status is given at every Board meeting. The second “c” is controls and this is especially important since we have “form” in this area. Good controls can be difficult to achieve in small organisations, but I am satisfied that we have sufficient separation of duties to provide a good level of controls for an organization of our size and complexity. The third “c” relates to costs. I am pleased to say that we have a good culture insofar as control of costs is concerned. Our offices are modest, we are not ostentatious in the way we go about our business, our non-Executive Directors all offer their services on a totally voluntary basis, our Pension Fund is fully funded and the Leadership Team are constantly seeking ways to do more with less. Overall, therefore, I have been dealt a strong hand by my predecessor and I offer him my profuse thanks. I would now like to move on to the question of our funding from Sport England. For the current financial year ending 31st March 2013, we have agreed a standstill level of funding. This has been agreed within the framework of the funding discussions currently underway with Sport England. 3 While this is a welcome level of funding in the current economic climate, I have to say that we are now close, in my view, to the level at which any further reduction would seriously impact on our ability to deliver against our objectives. There is no fat left. Any further cuts would be into muscle and bone. Our discussions with Sport England have made progress, but the speed at which they have progressed can only politely be described as “pedestrian”. It was, after all, some 20 months ago that we first met with them to discuss this topic. As my predecessor said this time last year, while we continue to seek a solution it remains a possibility that agreement may not be possible. In that case, we may have to go to arbitration which is the disputes procedure provided for under the contract. In the view of the Alliance’s Board, the extensive legal advice we have sought, including an opinion from a leading QC, continues to reaffirm our position. We have been and remain totally consistent in the approach taken over the last four decades to seeking the funding that we are entitled to under the contract. It is not we who are seeking any new interpretation or variation. From a personal standpoint, not only is the legal case very clear to me, but so is the moral case. In 1972, the CCPR signed over to the Sports Council assets estimated to be worth in the order of £50 million pounds. These assets not only comprised physical assets such as Bisham Abbey, Lilleshall, Crystal Palace, Plas-y-Brenin and others, but also bonds, shares, equipment, other assets and staff. They were transferred in exchange for contractual funding in perpetuity for the Alliance to fulfil its role as the independent voice of sport and recreation. Now lest you think we are being unreasonable in our position, I would like to provide an interesting perspective. In the 1970’s interest rates were running in double digits. Had we formalised an annuity at that time based upon those interest rates and those asset values, we would have received an annual income in perpetuity of a multiple of the current funding level of £1.5 million. 4 Frankly, in my opinion, we and our predecessors have been reasonable to an extreme Having said that, I am encouraged by the progress made to date, although I am not in a position to assure members that a satisfactory agreement will be reached without recourse to arbitration. In any event you can rest assured that the Board will be resolute in its quest to obtain a fair and just negotiated settlement that secures the financial future of the organisation. Finally, I would like to thank the Finance Committee and Geoff Obee for their valuable support and advice throughout the year. They have made my induction relatively painless and have suffered no end of dumb questions from me with patience and good humour. Your Royal Highness, that completes my report for this year and I would be pleased to take any questions Questions Can I now ask the meeting to adopt the 2011/12 Accounts please? 5