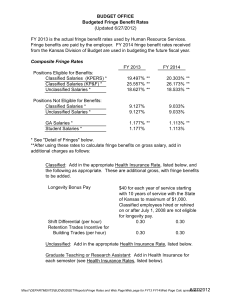

Employee benefits

advertisement

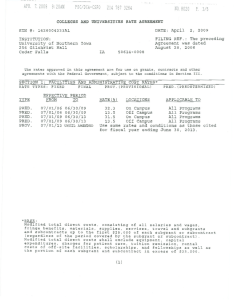

Employee benefits Session-15 Benefits • Benefit – An indirect compensation given to an employee or group of employees as a part of organizational membership. • Strategic Perspectives on Benefits – Benefits absorb social costs for health care and retirement. – Benefits influence employee decisions about employers (e.g., recruitment and retirement). – Benefits are increasingly seen as entitlements. What are fringe benefits? • Fringe benefits are benefits which employees receive from their employment but which are not included in their salary cheque or wages. • They include such things as company cars, private medical insurance paid for by the employer and cheap loans. FEATURES OF FRINGE BENEFITS • An employee enjoys them in addition to the salary he/she receives. • They are not given for specific jobs performed but to make jobs more attractive. • They are not linked to productivity so do not reward performance in any way, criteria used is other than performance. • They have an indirect impact on workers’ efficiency. If impact is direct, it is not a fringe benefit. NEED FOR FRINGE BENEFITS • Employee demands • Trade Union demands • Employer’s preference • As a social security • To improve human relations Types of Fringe Benefits • Pay for time not worked Hours of work Paid holidays Shift premium Holiday pay Paid vacation • Employee security Retrenchment compensation Lay off compensation Types of Fringe Benefits •Safety and health Workmen’s compensation Act Health benefits(Sickness benefit, Maternity benefit, Disablement benefit, Dependant’s benefit, Medical benefit) Voluntary arrangements • Welfare and recreation Canteens Consumer stores Credit societies Housing Legal aid Holiday homes Educational facilities Parties and picnics Types of Fringe Benefits • Old age and retirement Provident fund Pension Deposit link insurance Gratuity Medical benefits Calculation of EPF,EPS & EDLI Scheme Name Employee contribution Employer contribution 12% 3.67% Employees’ Pension scheme 0 8.33% Employees Deposit linked insurance 0 0.5% EPF Administrative charges 0 1.1% EDLIS Administrative charges 0 0.01% Employee provident fund Benefit Design • Decisions Affecting Benefit Design: – How much total compensation? – What part of total compensation should benefits comprise? – What expense levels are acceptable for each benefit? – Which employees should get which benefits? – What are we getting in return for the benefit? – How will offering benefits affect turnover, recruiting, and retention of employees? – How flexible should the benefits package be? Benefits Administration • Benefits Communication – Benefits Statements • Annual “personal statement of benefits” that translates the benefits into monetary terms to show their worth. – The Internet and Benefits Communication • Web-based HR information systems allows employees to change their benefit choices, track their benefit balances, and seek benefit information on-line. Typical Division of HR Responsibilities: Benefits Administration Most common benefits provided in India •HRA •Gratuity •Housing loan •Medical reimbursement/allowances •Insurance •Leave travel allowances •Conveyance allowances •Education allowances •Superannuation •Car loan •Social/sports club membership •Home furnishing Flexible Benefits Plans (Cafeteria Plans) Benefit plans that enable individual employees to choose the benefits that are best suited to their particular needs Advantages •More appreciation of benefits offered •Better match between benefits and employee preference Disadvantages •Increased design and administrative costs