2,6

advertisement

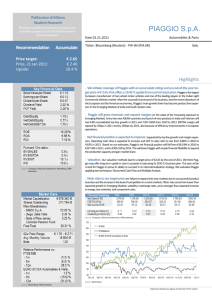

Deutsche Börse Student Research Piaggio & C. Spa Università degli Studi di Padova Facoltà di Economia OUR ANALYSIS IN BRIEF Current price: € 2,37 Fair Value: € 2,59 - 2,85 (twelve months) Target Price: € 2,6 Upside: 9% Rating: HOLD Market Cap (EurM) 877 Shares Outstanding (M) 372 Main Shareholder IMMSI Spa (53,6%) 2nd Shareholder Diego Della Valle (5%) Free float 39% 52 weeks price change 1,77 - 2,71 Beta vs FTSE MIB 0,7 2 COMPANY DESCRIPTION • Biggest European motorcycle manufacturer. • Two Business Units: 2W and LCV. • Seven well-differentiated brands. • Strong presence in developed countries. • Growing focus on emerging countries (Asia). 3 INDUSTRY OVERVIEW: 2W DEVELOPED COUNTRIES •Scooters used for fast urban transportation. •Motorcycles as recreational vehicles. •Preference for power and design (premium vehicles). •Flat registrations. •The Japanese manufacturers (Yamaha and Honda) dominate the market in the EU and US. EMERGING COUNTRIES •2W serve family and work transportation purposes. •Small size, low cost are paramount. •Premium products have10% market share. •Growing registrations. •New Asian manufacturers are emerging. 4 INDUSTRY OVERVIEW: LCV EUROPE •LCV are used for cargo transportation in city centers. •Key feature is small-size/high capacity ratio. •Piaggio focuses on <2,5 tons. •Market is declining, but Piaggio performed better than industry (-18% vs -20%) in 2009. INDIA •LCV to overcome lack of infrastructure. •Affordable and versatile vehicles. •Piaggio is leader for 3W (+14 YoY in ’09). •Growth expectations are 15-18% YoY. •Piaggio’s share is 41% in 3W and 5% in 4W. Key competitor: Bajaj 5 COMPETITIVE POSITIONING •Piaggio focuses on 2W and LCV. •In general, the market is dominated by Japanese manufacturers. •Piaggio has 7 different brands, some are icons (Vespa). •The strategy consists in premiumisation. Piaggio focuses on a well-defined niche, and is therefore relatively small if compared to the Japanese manufacturers 6 FINANCIAL ANALYSIS: Link to European market is still strong 7 FINANCIAL ANALYSIS REGISTRATIONS: Flat 2W and LCV in developed countries strategy: maintain the market share. Growth is expected in emerging countries, especially thanks to: •introduction of 2W in India in mid-2012 •launch of new 2W designed for the Asian market •development in the LCV (new engines, focus on 4W) PROFITABILITY: Improvement thanks to a larger share of units made in the Asian plants. 8 DCF VALUATION PV of Free Cash Flow 308 PV of Terminal Value 1001 Estimated Enterprise Value 1309 Net Financial Position 346 Estimated Equity Value 963 Nr. of shares (M) 372 FAIR VALUE (EUR) 2,59 9 MULTIPLE VALUATION P/E EV/Sales EV/EBITDA 2010 2011E 2012E 2010 2011E 2012E 2010 2011E 2012E Honda Motor 16,9 12,75 11,2 2,2 1,3 1,15 12,4 9,2 8,1 Mahindra & Mahindra 19,6 13,35 11,75 0,4 0,95 0,8 4,6 7,05 5,65 Yamaha Motor 19,2 13,35 11,2 1,7 0,9 0,75 10,4 6,9 5,85 Bajaj Auto 23,6 12,8 8,1 0,4 0,4 0,3 9 6,8 5 Harley Davidson 21,8 15,7 13,2 3,2 2,35 1,85 15,5 10,9 8,35 19,6 13,35 11,2 1,7 0,95 0,8 10,4 7,05 5,85 38 55 66 1496 1661 1770 191 219 238 740 730 734 2543 1578 1416 1989 1547 1390 -346 -338 -323 -346 -338 -323 Median Piaggio Median EV NFP Median Equity 740 730 734 2198 1241 1092 1644 1209 1067 Number of shares 372 372 372 372 372 372 372 372 372 Target Price AVERAGE TARGET PRICE 1,96 3,34 2,85 10 3,25 RISK ANALYSIS AND RATING WHY SLOW AND STEADY (DOES NOT) WIN THE RACE... •Piaggio is still heavy focused on the flat European market. •Asian countries are expected to grow, but Piaggio concentrates on a premium niche with little numbers (market share will remain approx. 2,5% in 2W in India and Vietnam). •New 2W vehicles in Asia will be introduced only in 2011 (2012 in India). MAIN RISKS TO OUR ANALYSIS •Negative impact on operating leverage as revenues slow down (-2% in revenues may impact up to -22% on EPS in 2013). •Cyclicality of demand. Performance will be disappointing in the event of an economic setback. •Regulations, especially in developed countries, may push the industry players towards eco-sustainable solutions. •Exposure to emerging countries: weak enforcement of industrial property regulations may encourage product imitation by competitors. •Food inflation in Asia may reduce the income share dedicated to transportation. For all these reasons, considered the fair value range between Eur 2,59 and Eur 2,85, we considered appropriate a 12-months target price of Eur 2,6 and a HOLD recommendation. 11 Thank You For Your Attention! 12 UNITS SOLD FORECAST 13 SWOT ANALYSIS 14 INCOME STATEMENT 2009A 2010E 2011E 2012E 2013E 2014E 2015E Net Sales 1452 1458 1623 1731 1833 1882 1946 Other Sales 37,2 37,6 38,0 38,4 38,9 39,4 39,9 Total Revenues 1487 1496 1661 1770 1872 1921 1986 Operating Costs -1284 -1305 -1442 -1532 -1614 -1654 -1707 EBITDA 203 191 219 238 258 267 279 D&A -96 -97 -98 -99 -100 -101 -102 EBIT 106 94 121 138 158 166 177 Net Fianancial income (Charges) -30 -33 -33 -33 -32 -32 -32 Pre-Tax 76 61 88 106 126 134 145 Tax -27 -23 -34 -40 -48 -51 -55 Net Income 49 38 55 65 78 83 90 15 BALANCE SHEET 2009A 2010E 2011E 2012E 2013E 2014E 2015E Fixed Assets 892 902 912 922 932 962 972 NWC 17 26 41 56 71 86 101 Total Risk Funds -134 -134 -134 -134 -134 -134 -134 NET CAPITAL EMPLOYED 776 794 819 844 869 914 939 GROSS CAPITAL EMPLOYED 909 920 953 978 1003 1048 1073 Shareholder’s Equity 422 446 479 518 565 615 669 Net Financial Debt 352 346 338 323 302 297 268 16 WACC 17 SENSITIVITY ANALYSIS 15,5% 15,0% 14,5% EBITDA 14,0% margin 13,5% 13,0% 12,5% 12,0% 0,5% 2,71 2,54 2,38 2,22 2,05 1,89 1,72 1,56 Growth Rate 1,0% 1,5% 2,0% 2,92 3,16 3,45 2,74 2,97 3,24 2,57 2,78 3,03 2,39 2,59 2,82 2,21 2,40 2,62 2,04 2,21 2,41 1,86 2,02 2,20 1,68 1,83 1,99 18 2,5% 3,78 3,55 3,32 3,10 2,87 2,64 2,42 2,19 SENSITIVITY ANALYSIS Normalized WACC 8,00% 8,05% 8,15% 8,20% 8,25% 8,30% 8,35% 12,0% Normalized Growth Rate 0,5% 1,0% 1,5% 2,0% 2,5% 2,26 2,44 2,62 2,90 3,19 2,25 2,43 2,63 2,87 3,16 2,23 2,41 2,61 2,85 3,13 2,22 2,39 2,59 2,82 3,10 2,20 2,37 2,57 2,80 3,07 2,19 2,36 2,55 2,78 3,04 2,17 2,34 2,53 2,75 3,02 2,16 2,32 2,51 2,73 2,99 19 3,0% 2,10 2,09 2,08 2,06 2,05 2,04 2,02 2,01