The Development Bank of South Africa and its Footprint

advertisement

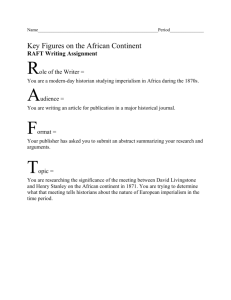

ActionAid South Africa - Draft Discussion Paper – Financing for Development? The Development Bank of South Africa and its Footprint in Africa 30th November 2013 Contents 1. Introduction ............................................................................................................. 2 2. South Africa’s Transition from Apartheid ................................................................. 3 3. DBSA – the early years ........................................................................................... 4 4. The DBSA and the Transition ................................................................................. 4 5. The DBSA Today .................................................................................................... 9 6. Straddling the Tension between the “D” and the “B”?............................................ 10 7. The Development Context .................................................................................... 11 8. The DBSA beyond South Africa ............................................................................ 14 9. Gearing for the Future – DBSA, BRICS and International Relations ..................... 16 10. Conclusions and Recommendations for ActionAid and progressive civil society more broadly ..................................................................................................... 19 References: ................................................................................................................. 23 1. Introduction ActionAid South Africa, in partnership with ActionAid International seeks to embark on a study project into the role, conduct, and impact of public finance institutions in Brazil, Russia, India, China, and South Africa (BRICS) that provide development project finance in Africa. Part of the study will also examine the role of South African public institutions, in particular the Development Bank of South Africa (DBSA) in promoting private investment in Africa, the nature of these investments and the relevant policy framework/s under which these are undertaken and its developmental impact. In the context of BRICS and the announcement at the 2013 Durban Summit of its intention to establish a development bank, this paper lays the basis for an understanding of the mandate, strategy and operations of public finance institutions in South Africa e.g. The Development Bank of Southern Africa, the Land and Agriculture Development Bank and others such as the soon to be launched SA Partnership for Development Agency (SAPDA) by the Department for International Relations and Co-operation (DIRCO). In the medium to long term ActionAid will examine: I. II. III. IV. How and whether the mandate, strategy and operations are compatible with similar institutions in Africa e.g. the African Development Bank and in other selected countries. How and whether land acquisition and usage projects financed and facilitated by the South African institutions, either enable or prevent the promotion, respect, and protection of rights-based approaches to sustainable development which eradicates poverty and inequality and places human development and environmental protection above profit. How and whether such projects are aligned with SA’s foreign policy commitments and relevant international treaties and instruments with particular emphasis on human rights, equity and ecology issues. What are the main issues and challenges for South African Development Finance Institutions (DFIs) in the context of BRICS. Multi state groupings and blocs both formal and informal are part and parcel of international politics relations and co-operation. What makes the newly formed BRICS bloc significant is the potential power it has in the context of the current global political economy to contribute to build new narratives towards the realisation of a just, equitable, sustainable and peaceful global society. This paper is explorative. It is part of the process of understanding the DBSA and to make a few initial suggestions of possible areas of engagement with the institution in line with its mandate on working with people across the globe to eliminate poverty. As part of this process the paper suggests some ideas on building collaboration and solidarity action with potential civil society partners interested in issues of development and, whether and how development finance institutions in BRICS and other developing economies could build new models of sustainable development which emphasises the indivisibility between human development and environmental protection for future generations. Final Draft 2|P a g e 2. South Africa’s Transition from Apartheid South Africa’s negotiated transition from an apartheid pariah state to a democratic state after the first non-racial elections on 27 April 1994 and the subsequent adoption of a new constitution, heralded an opportunity for the progressive forces to build a new agenda for a better life for its people on the one hand and construct a new set of international relations with nation states on the other. The former exiled liberation movements, led by the African National Congress together with the internal mass democratic movement now in power, set about dismantling old laws and institutions whilst simultaneously creating new laws and building new institutions in line with prescripts of the new constitution and a vision of a united, democratic, non-racial, non-sexist South Africa. This period was described as the “honeymoon period” and a new activist optimism swept the country. Whilst the democratic government together with its social partners, civil society and citizens as a whole were mobilised in transforming society as envisioned in the Reconstruction and Development Programme (RDP), this process was not immune and isolated from the global political economy, including and more especially its role and relationships with African states. The RDP was drafted by the African National Congress (ANC), the South African Communist Party (SACP) and the Congress of South African Trade Unions (Cosatu) in consultation with key mass based organisations and supported by a wide range of policy research institutes. It represented a programme by a government-in-waiting to build post-apartheid South Africa – through reconstruction, restructuring and development. In summary the RDP created the following development targets for the democratic government: The creation of 2.5 million jobs over a ten-year period; The building of one million houses by the year 2000; The connection to the national electricity grid of 2.5 million homes by the year 2000; The provision of running water and sewerage to one million households; The distribution of 30% of agricultural land to emerging black farmers; The development of a new focus on primary health care; The provision of ten years of compulsory free education for all children; The encouragement of massive infrastructural improvements through public works; and The restructuring of state institutions by 1997 to reflect the broader race, class and gender composition of society. An important commitment of this programme was one of co-operation with Southern African states. During this period, following the independence of Namibia and the transition to a democracy in SA, the Southern Africa Development Coordinating Conference (SADCC) at a conference in Windhoek in August 1992 adopted the Windhoek Declaration paving the way for the formation of what we know today as the Southern Africa Development Community. It must be noted that the precursor to the SADCC was the Frontline States, created in the 1960’s by the liberation movements and newly independent states with the sole purpose of eliminating colonialism and apartheid in Southern Africa. Final Draft 3|P a g e 3. DBSA – the early years One of the institutions earmarked for restructuring and transformation was the Development Bank of Southern Africa (DBSA). Initiated in 1979 by then apartheid state Prime Minister PW Botha to promote private sector financing for development in the “Southern Africa region” and formally established in 1983, the DBSA comprised of South Africa on the one hand, and the leaders of the four nominally independent homelands, Transkei, Venda, Bophuthatswana and Ciskei (the so-called “TBVC states”) on the other. Their grand plan was the creation of a “constellation of Southern African states” through the policy of “separate development” with SA as a white republic at the helm and black citizens assigned to a homeland according to their ethnic identity. A total of ten homelands were created to facilitate the implementation of forced removals to their respective homelands which then served as labour sending areas to South Africa and as reservoirs for the masses of unemployed people. . According to former Chairman, Jay Naidoo, the DBSA “was set up as part of a political strategy aimed at strengthening the homelands, which the apartheid regime created under its separate development policies”. This, together with other initiatives, formed part of the apartheid state’s “securocrats’” determined to push for its programme of “winning hearts and minds” against the perceived danger of communism in South Africa whilst they pursued their military ventures in the frontline states. According to the DBSA their primary role was then “to promote economic development in its broadest sense, increase productivity and thus raise the standard of living of the people in less developed areas of the Southern African economic region” of the Bank’s membership. Within the first three years the Bank was administering projects to the value of R1, 5 billion. (Note the exchange rate between the US dollar and the Rand at the time was USD 1 to R2.23. See www.businesstech.co.za). Following the unbanning of the liberation movements in February 1990 and the release of Nelson Mandela, the big issue was whether the Bank created to support apartheid would survive and be relevant in a post-apartheid South Africa. The government had committed to providing funding of R2,5 billion over a five year period (note the average exchange rate in this period was USD 1 to R3, 55). The leadership of the Bank adopted a strategy called “DBSA 2000” aimed at escalating its anti-poverty programme. 4. The DBSA and the Transition Between 1990 and 1994 during the negotiations towards the transition to democracy, the Bank began corporate governance restructuring and repositioning of the institution. Since 1994 the Bank has gone through a process of evolution. The demise of the apartheid homelands and their reincorporation into a unified South Africa rendered the 1993 DBSA founding agreement invalid and the role of the council of governors was transferred to the treasury with the Minister of Finance as the political head. In the words of Professor Final Draft 4|P a g e Wiseman Nkuhlu, the then Chairman and a development academic, the “DBSA has a crucial role to play in shaping the future development of the country”. By 1994 over a 10 year period the Bank’s assets had increased to R6 billion (USD 1 : R3,55). However, after the democratic elections on 27 April 1994 with the installation of the new ANC-led government of national unity, there was uncertainty over the Bank’s future and status. Given the human and financial resources at its disposal the new government enlisted the Bank’s support in a range of new interventions in support of priorities under its RDP. One of the main over-arching principles of the RDP was a policy of growth through redistribution. However, barely two years into its implementation, the government unilaterally adopted a new conservative macro-economic policy, the Growth, Employment and Redistribution (GEAR), as a sign of its commitment to high economic growth by reducing state spending and the budget deficit, lowering corporate taxes, relaxing foreign exchange controls, promoting privatisation and encouraging wage restraint. These neo-liberal economic policy prescripts were taken largely from the development models of the World Bank and the IMF and was designed to attract foreign investment. Under this policy, unlike the RDP, the state would play a facilitation role rather than an interventionist role. Internally though the Bank was going through a tough period adapting to the prescripts of a united, non-racial, non-sexist democracy. Several senior managers deserted the Bank due to uncertainty. The discriminatory pay scale based on race and gender had to be eliminated and parity achieved. At the end of 1994 the Minister of Finance appointed a transformation team, headed by the Chairman of the Board, Prof Nkuhlu, to consult with stakeholders on a future role and governance of the Bank. Whilst the DBSA was positioning itself for the new dispensation, the new government outlined a proposal to develop a family of five development finance institutions each focusing on specific areas. These were 1) Industrial Development Corporation (IDC), 2) Land Bank, 3) National Housing Finance Corporation, 4) Khula, which later became the Small Enterprise Finance Agency (SEFA) and 5) DBSA. The main government strategy for the DFIs was that they: i. ii. iii. iv. Must be independent and under the control of their boards which in turn are accountable to government; Should be capitalised but not sustained by the state; Should maximise the development impact of the government and at the same time not crowd out the private sector; Should be able to take risks that the private sector will not take. The transformation task team had made proposals for the Bank’s internal restructuring, focusing on human resources and affirmative action in management positions and attempts to modernise and streamline operations. New units such as gender and affirmative action, risk management and operations evaluation were set up. Job evaluation and performance management systems were also set up. Final Draft 5|P a g e By April 1997, through the passing of the DBSA Act (No.13 of 1997), the Bank was repositioned and declared a statutory body with a development mandate to fund public infrastructure. At this stage the Bank had an asset base of R12-billion. It had disbursed over R2-billion in project funding, more than double the previous year on projects at local government level and for policy development. It had streamlined its business units from 57 down to 24 and reduced the number of managers by a similar ratio. By the time of its 20th anniversary in 2003, and as South Africa approached its first “decade of freedom and democracy”, the Bank had grown from a staff compliment of 198 since its inception to 485 and defined its role as a financer, advisor and partner with a new vision, which was: “To further the progressive realisation of an empowered and integrated region, free of poverty, inequality and dependency. To be a leading change agent for sustainable socio-economic development in the SADC region and a strategic partner in Africa south of the Sahara.” In February 2007 the SA government undertook a comprehensive high-level presidential review of South Africa’s DFIs. The review, which ran for just over a year was headed by the national treasury and conducted in consultation with the national departments responsible for these institutions: the Departments of Trade and Industry, Public Works, Labour, Housing, and Agriculture and Land Affairs. This review focused on 12 institutions, including the four major DFIs: the Development Bank of Southern Africa (DBSA), the Industrial Development Corporation (IDC), the Land and Agricultural Development Bank (Land Bank) and the National Housing Finance Corporation (NHFC). Other institutions included were the Khula Enterprise Finance, the National Empowerment Fund (NEF), the Independent Development Trust (IDT), the Umsobomvu Youth Fund (UYF), the National Urban Reconstruction and Housing Agency (NURCHA), the Rural Housing Loan Fund (RHLF), the Micro Agricultural Finance Institutions of South Africa (MAFISA) and the South African Micro Finance Apex Fund (SAMAF). Taken as a whole, the DFIs form South Africa’s development finance system (DFS). As a developmental state, the DFIs exist as public institutions to promote social and economic development in line with the public policy objectives by providing finance that supports job creation, low-cost housing, agricultural development, micro, small, and medium business development, industrial development and infrastructure development. In doing so, the state attempts to intervene and direct the nature and from of development rather than leaving this to market forces. The review reports that each of the twelve DFIs have different histories and were developed by the different departments. Together they have total assets of more than R120 billion whilst as the report notes that only half of this is dedicated to development. The report further notes the limited impact, issues of overlap and duplication of funding as a result of the lack of coordination and alignment with government policy. A key recommendation that emerged from the review was the need by government through legislation to establish “as a matter of urgency” a Development Finance System Council Final Draft 6|P a g e (DFSC) to “monitor and make decisions concerning development finance institutions for the optimal functioning of the development finance system” to avoid overlap and duplication of funding. This council will operate under the leadership of the national minister of finance and comprises the executive authorities of each institution and those at a provincial level. The report also proposes that the minister in consultation with the DFSC will appoint a panel of local and international experts to advise on lessons learnt and best practice in the field of development and development finance. However, to date there has been a lack of progress in establishing the DFSC. Specifically the report recommends that the DBSA should remain a “high focused infrastructure development institution and its SADC mandate should concentrate on economic infrastructure”. The report criticises the Bank for not keeping pace with best development practice. Whilst the Bank’s balanced scorecard emphasises the volume of inputs, that is the total number and value of projects funded, it does not evaluate its development impact. The report also notes that whilst the DBSA’s governance structure is based on the states’ requirements for state-owned enterprises and in line with good practice in the private sector, the conclusion is that these arrangements do not emphasise the institutions role and commitment to “development as its primary goal”. The review therefore recommends the establishment of a board “development effectiveness committee” to provide leadership to meeting the Bank’s development objectives, to define its key development indicators and to use these in monitoring and evaluation. In the current DBSA governance structure there is no dedicated sub-committee established to date. This is an issue worth pursuing with the current leadership of the Bank. There have been further developments at a government policy level that will shape the medium to long term strategy of the Bank. The adoption of the New Growth Path in 2011 (NGP) sets out an ambitious framework for job creation in priority sectors and emphasises infrastructure development as a key driver for creating new jobs and addressing rural development. It sets a target of 5 million new jobs by 2020. At a continental level the policy states that support for regional growth “is both an act of solidarity and a way to enhance economic opportunities”. It proposes that SA be a driving force behind the development of energy, transport and ICT infrastructure and work with DFI’s to address backlogs. Key priorities include improvements in the road, rail and ports system serving central and southern Africa and strengthening the Southern African Power Pool. A new bill, the Infrastructure Development Bill, will be tabled in parliament before the end of the year. The main purpose of this bill is to provide for the facilitation and co-ordination of public infrastructure development, to ensure that infrastructure development is given priority in planning, approval and implementation and to ensure that that the development goals of the State are promoted through infrastructure development. Final Draft 7|P a g e In addition to the NGP, another important policy framework is the adoption in 2011 by the government of the National Development Plan 2030 – Our Future Make it Work, and which was subsequently adopted by the ANC at its national conference in 2012. Again the plan emphasises infrastructure development in South. Whilst the Plan is SA-centric , it also contains a chapter titled “Positioning South Africa in the World” and by linking domestic growth to regional growth, calls for SA to “play a more pivotal role in regional development” and encourages SA firms to participate in regional infrastructure projects and supply chains to promote industrialisation. The Trade Law Centre calls on SA to “show sensitivity to the plight of its neighbours” and calls for constructive and active engagement with countries in the region. Anything less will “again see accusations of South Africa being a bullying boy of regional integration arrangements”. A further important policy framework currently under discussion is the restructuring of state owned enterprises (SOEs). The last review of SOEs was undertaken in 2000. A report released by the Presidential Review Committee in 2012 identifies the need for a framework to govern a new round of restructuring to address the needs of a development state and calls on government to “initiate a new and revised comprehensive policy that will guide and regulate restructuring of public enterprises”. It further recommends that an “appropriate consultation framework which genuinely considers the views and submissions of the public” must be developed. All options must be considered “on merit and there are no holy cows”. The PRC outlines a framework timeline for this large-scale restructuring exercise. diagram below: Final Draft See 8|P a g e 5. The DBSA Today Whilst the Bank has relative autonomy, the environment in which it operates is determined by the political, economic and social priorities of the government of the day. It could be argued that the DBSA has undergone a painful process of change but has successfully survived the democratic transition. Today, thirty years on, the Bank has grown its asset base to just under R54 billion and has recently undergone another restructuring process. The Bank, which has increasingly sourced loans from private capital markets, is not immune from the prolonged global financial crisis. The crisis has limited the ability of African states to expand their public investments in social infrastructure and as a result widened the gap between needs, expectations and delivery of social infrastructure projects. Increased private sector funding for local government and state-owned enterprises has also resulted in competition between private and public sector banks. The latter has seen its market share of loans reduced. In the 2011-2012 financial year the Bank reported a huge loss of almost R403- million largely due to “shoddy work” in making the wrong investment decisions, called “non-performing loans”. In the current financial the Bank records a net loss of R825,9-milion. It is understood that these were loans particularly to the private sector. As a result almost half of this had to be written down. In anticipation of continued poor financial performance in the 2012/2013 financial year, in June 2012 the government, as shareholder in consultation with the Board, reviewed the Bank’s strategy “in order to better focus the Bank’s activities to enhance its Final Draft 9|P a g e development impact, improve the efficiency of its operations and to increase the scale of the DBSA’s activities in order to expand the Bank’s developmental reach”. The African Union estimates spending in continental infrastructure to boost social development, trade and economic growth will need investments of approximately R93-billion per annum to clear the infrastructure backlog on the continent. In SADC countries the Bank had set a loan target of R20-billion. In South Africa the government had announced planned infrastructure spending of R850-billion between 2013-2015 and a total of R4-trilion over 15 years. Given the importance of the Bank as a development finance institution and the large infrastructure project spending planned it was vital for the government to ensure the Bank stays afloat and play a leading role and increase its lending within the country and on the continent. In late 2012 the DBSA Board, in return for a R7.9-billion three-year 2013-2016 recapitalisation facility, adopted a new strategy for the Bank. In return for this lifeline, government expectations were that the Bank would remain effective, efficient and financially sustainable. As the result the first casualty was staff following a decision to announce a cut back from 870 in 2012 to about 450 by May 2013. The plan is to grow development finance assets from R47.1 billion to R91 billion by 2016/17 with annual disbursements increasing from the current levels of around R9 billion to around R19 billion by 2016/17. At a regional level the Bank wants to increase its loan distribution to around R20bn by 2017, expanding beyond SADC and focusing on commercially viable projects in priority sectors such as energy, transport and bulk water as well as on fasttracking priority projects to improve connectivity and trade. As a result of the latest round of restructuring an important phase of the evolution of the Bank has started and the core structure of the Bank significantly changed. According to the 2013 Annual Report, the Bank “will accelerate its infrastructure to municipalities, stateowned enterprises, regional partners and public-private partnerships”. More importantly, the Bank has set itself a strategic financial and operational goal of “sustainability with the objective of generating and sustaining inflation-linked growth”. 6. Straddling the Tension between the “D” and the “B”? It would appear that the balance between the development and the financial goals of the Bank are now in favour of the latter. In the context of addressing the massive backlog in quality social infrastructure at local level, the logic of the market economy and profit maximisation would prevail in the Bank’s personnel, performance, organisational culture and operations. This should sound the alarms bells in those sectors of society that are keenly interested in the Bank’s catchy headline slogan of “development activism through development finance”. Given decades of skewed apartheid styled development in the country, the context of a democratic dispensation, good development practice involves the right of all people to access basic goods and services in order for them to attain a decent standard of living and to be able to meaningfully participate in policy development and decision making processes that affect their lives. Final Draft 10 | P a g e In the Bank’s stakeholder engagement strategy in addition to organs of the state, financial institutions, clients and partners, employees, the category of community is included. From a “development activism” perspective, the community is the central and most critical stakeholder in the assessment of needs and the design, planning, implementation, monitoring and evaluation of projects. From a development impact perspective, this aspect of stakeholder involvement is critical. Whilst the Bank may have built a reputation with its peers and shareholders, it is not clear how the Bank engages in meaningful consultations with the “community” as its end beneficiary and if and where it does, to what end. In the context of its municipal infrastructure support, it would be vital to undertake further research into the role of the community in the Bank’s projects within municipalities in South Africa and assess how and whether these have been able to contribute to the active involvement of community organisations on the one hand and the delivery of quality public services on the other. It would be necessary to further investigate the link, if any, between Bank funding and “service delivery protests” by residents in municipalities. In the context of the aspirations of the government to build a “democratic developmental state” to address the developmental challenges facing the country, achieving this goal requires effective public institutions at every level to achieve equity and social development for the poor. 7. The Development Context Since the formation of the Organisation of African Unity (OAU) in 1963 and with its successor the Africa Union (AU), the pan-African dream of continental integration has been on the table. In January 2013, at one of many celebrations of the 50th Anniversary of the founding of the OAU, AU commission chairperson, Dr Dlamini-Zuma noted that the AU and the African Development Bank (AfDB) together with the support from the UN’s Economic Commission for Africa (ECA) undertook to “cooperate on the development of a transformation agenda for the continent for the next fifty years”. Based on figures on sustained GDP growth and steady progress in good governance, a key issue she raised was the immense challenges the continent faced in terms of “structural underdevelopment and dependency, huge backlogs in infrastructure, basic services and human resource development and the need to build people-centred, inclusive and developmental public and private cultures and institutions”. She pointed out that Africa has a “window of opportunity” to set sail for the next 50 years towards integration, prosperity and peace by mobilising sources of funding including “tapping into Africa’s own resources” and those available globally. This window of opportunity is reinforced by “continental endowments (a youthful and growing population, the potential unleashed by women’s empowerment, urbanization) and natural resources (land, minerals, energy and marine resources), which if harnessed in the interest of Africa’s people, bodes well for the future.” On 1 February 2013 the UN High Level Panel released the preliminary Post 2015 Development Agenda, a new vision and action plan around a set of goals and targets that will replace the Millennium Development Goals adopted in 2000. In the words of the Eminent Panel the Post 2015 Agenda is not “business as usual and is not an option”. This is a very bold statement and hopefully marks a turning point in which the UN family, nation states, civil Final Draft 11 | P a g e society, corporations and citizens interact with each other. Serious civil society commentators have criticised the report as being big on rhetoric but weak on detail and based on previous promises will deliver little yet again. The report articulates the need for the agenda to be driven by “five, big transformative shifts” viz. “ leave no one behind, put sustainable development at the core, transform economies for jobs and inclusive growth, build peace and effective open and accountable institutions for all and forge a new global partnership”. The panel believes that these five shifts can end the “inequality of opportunity” suffered by billions of people and bring together social, economic and environmental issues in a coherent, effective and sustainable way that can build a new generation not only to believe in but also act collectively in different ways to build a better world that “leaves no one behind”. The African Economic Conference hosted by the AfDB, the UNECA and the UNDP, in South Africa will take place under the theme of “Regional Integration – Key to Transformation and Development”. In a press release issued before the conference the three organisers noted that whilst Africa is experiencing high levels of (economic) growth, there has been limited impact on ordinary people. They note that “weaknesses persist in the quality of institutions; infrastructure, macroeconomic policies, education and adoption of new technologies, while there are big gaps between its highest and lowest ranked economies”. They go on to state that “… this great gathering should do more than restate the case for regional integration: it must examine how to push the African continent to the next level, to become a global growth pole in its own right,” In addition, they state that “because of its focus on capital-intensive, commodity-based industries, Africa has seen limited economic transformation” and therefore job creation for the youth to “build better futures has lagged behind.” The conference looked at how integration could be achieved by harmonising laws and standards, common approaches to macro-economic policy and job creation and effective management of natural resources for sustainable poverty reduction and structural economic transformation. They urge “greater political will and vision” to address this problem. The hunger and thirst for Africa’s natural resources driven by the mineral commodity boom in Asia and the global food shortage crisis have been the prime drivers of export-led growth in many countries in Africa. Narratives on “Africa Rising” are been written by both governments and the global finance industry. One of the key barriers to further growth listed by these institutions is the lack of transport and energy infrastructure – roads, bridges, larger ports and power generation and distribution plants. These kinds of projects are long-term, high risk and low-returns from an investment perspective and therefore not particularly attractive for the private sector. Under colonialism the political economies of SADC countries were primarily commodity producers of minerals and agricultural products for export. The majority of the people remained poor and lived in under-developed rural areas without access to basic public services and social infrastructure. When global commodity prices dropped, countries were forced to adopt economic structural adjustment programmes in return for bail out loans from the World Bank and the International Monetary Fund leading to major cuts in public Final Draft 12 | P a g e expenditure for basic goods and services e.g. education, health and welfare and reduced state investments and involvement in strategic sectors and the privatisation of state owned enterprises in energy, water, housing and agriculture. The impact of these policies not only reduced the capacity of states to meet basic needs of the poor majority but also the growing indebtedness through servicing loans to these finance institutions. This created increased poverty, unemployment and the through deindustrialisation, the collapse of local indigenous industry and growth of informal unregulated sectors in the economy particularly in fast moving consumer goods. Following almost three decades of IMF-World Bank policies and the poor overall performance in achieving targets under the Millennium Development Goals, countries are working on new long term plans to drive socio-economic development and regional integration. Given the relative stages of development between states and within states, one of the most important challenges facing SADC is the creation of a regional framework to promote inter-generational social, economic and environmental development that is sustainable. Within the region, efforts have been made to advance a civic movement to come together to advance a people-centred development strategy. The Southern Africa Civil Society Forum (CSF) is an alliance of faith based organisations under the Fellowship of Christian Councils in Southern Africa, and national trade union federations affiliated to the Southern African Trade Union Co-ordinating Committee and non-governmental organisations affiliated to the SADC Council of NGO’s. One of the most important reasons for the alliance is to bring the “collective experiences, knowledge, strengths and capacities to work together” towards people-centred regional integration and development. In 2008, the SADC Council of NGO’s initiated a regional wide study into poverty and a consultative process to develop a basis for a common analysis and the causes of poverty, and to develop a position on regional integration and development within SADC that is sustainable and people-centred. The purpose of the study was to lay the basis for an agenda for engagement by civil society in SADC’s Regional Indicative Strategy and Development Plan. In a process involving over 1800 civil society organisations through direct and representative participation over a two-year period, the organisation developed and adopted at a regional assembly a “Southern Africa Civil Society Poverty and Development Charter” aimed at building a consensus on the vision, the necessary steps, partnerships and structures to implement the provisions of the charter. Another outcome of the study was proposals for the establishment of a Regional Poverty Observatory The charter notes that “poverty is not a natural phenomenon as often there is a paradox of abundant natural resources co-existing with widespread poverty. In this regard, poverty is socially constructed globally and locally, and can be deconstructed”. In the region poverty is “fuelled by deindustrialisation under neo-liberal economic reforms” which promote primary export of mineral and agricultural products without value-added manufacturing and in the process perpetuates the historical “colonial dual economies” (in which women which comprise the majority of the population) remain marginalised. Final Draft 13 | P a g e The charter describes the “SADC we wish to live in” as “people-centred, free from poverty within the context of pro-poor, high and sustainable economic growth and development and dynamic economies underpinned by equitable distribution of productive assets and income. Such a region “guarantees the rights to dignity, economic and social justice for all”. The charter proposes five areas of policy dialogue and engagement for poverty eradication in the region viz., pro-poor economic policies; social and human development; agriculture, food security and natural resources, governance and accountability, and infrastructure for regional integration. The latter pillar specifically highlights the transport, energy, water, sanitation and ICT sectors. According to the organisation, there are approximately 35 legal instruments and protocols which bind SADC to poverty eradication and the “full implementation of these will go a long way to eradicating poverty in the region”. As regards financing, the charter notes that resource mobilisation at national and regional levels is a priority but calls for “effective, transparent, and regular monitoring and evaluation. At the annual meeting of the CSF in 2012, delegates met under the theme “The SADC We Want” which expressed the ‘desire for a SADC that is characterised by a people-centred development paradigm; which guarantees rights and dignity of every citizen of being free from poverty; gender discrimination; with stable economies underpinned by equitable and sustainable development, fair and just trade, and redistribution of wealth and productive assets; which respects rule of law and upholds democratic values and human rights.” Delegates also decried the structural problems in the political economy of the region that perpetuates high levels of poverty and inequality based on “increasing economic growth through trade liberalisation, foreign direct investment and export driven policies at the expense of the needs of the people of SADC.” Citing weak leadership and a lack of political will to implement SADC protocols, they resolved to embark on a campaign to take “The SADC We Want” to all countries and review the work done at the 2013 annual meeting. 8. The DBSA beyond South Africa The DBSA is regarded as a key player in “development” infrastructure in South Africa and beyond its borders. Within Southern Africa and increasingly within Sub-Saharan Africa, it is both a “financier of infrastructure, a manager of project preparation facilities, a catalyst for partnership among neighbouring countries, a capacity builder and a knowledge broker”. The work of the Bank is undertaken through the International Financing Division. The DBSA and the African Development Bank are the two main indigenous state-owned public development finance institutions based in Africa. According to the Bank’s 2013 Integrated Annual Report, the main role of this division is to “leverage infrastructure development opportunities and stimulate economic growth” in Southern Africa, beyond South Africa. In 2012, SADC adopted 15-year Regional Infrastructure Development Master Plan (RIDMP), which provides a framework for cooperation amongst member states in energy, transport, information and communications, water and tourism projects. Current estimates of the overall plan are in the region of US$500-billion. Final Draft 14 | P a g e At an investor’s conference in Maputo last year, a short term action plan, estimated at US$63-billion, and key factors to guide the implementation of the RIDMP was agreed. These included issues such as project preparation, financing and implementation, building institutional capacity and the importance of coordination. A committee of SADC finance ministers has been established to discuss mechanisms to oversee project financing and institutional mechanisms. Once such mechanism put in place is the Project Preparation and Development Facility (PPDF). Seed capital of just $US1.2-billion is provided but way below the projected budget. SADC governments are committed as the primary funders of the RIDMP through the offering of international bonds. The DBSA is currently involved in several infrastructure projects in the region. In the 20112012 financial year, disbursements amounted to R3,2 billion. For the 2012-2013 financial year, in what the Bank describes as a “challenging trading environment”, loan approvals totalled R5.6-billion but actual disbursements amounted to R665-million. Net profit grew year on year from just over R18-million to just over R294-million. Within SADC, the international development agencies of countries as Japan, China, India, the UK and Germany are already involved with other multi-lateral agencies such as the World Bank and the African Development Bank. The DBSA has loans committed mainly in the transportation, energy, mining, ICT, health, financial services and manufacturing in Angola, Lesotho, Mozambique, Tanzania, Zambia, Zimbabwe and small multi-country projects. A key project towards regional integration is the agreement by the regional economic communities – SADC, Common Market for Eastern and Southern Africa (COMESA) and the East African Community (EAC) – to develop the NorthSouth Corridor by upgrading the road, rail and port infrastructure and the concept of “onestop border posts” in the countries involved. This agreement is known as the “Tripartite Agreement” and endorsed by the African Union through its Presidential Infrastructure Champions Initiative which SA President, Jacob G Zuma, chairs. As part of its new mandate emphasising project preparation, the Bank has focused on project origination as an “important element for generating business and improving development impact”. According to the Bank this enables the international financing division to “play a proactive role in shaping projects” whilst supporting the development of “infrastructure solutions for the region”. This is a shift from the Bank approving funds for externally designed projects. Final Draft 15 | P a g e Currently one such large scale project appraisal in the energy sector is the Ruzizi 3 Hydro Project on the border between the DRC and Rwanda which will generate electricity for the two countries and Burundi. Another is the Zizabona Energy Interconnector covering Namibia, Botswana and Zambia to power generation sources in Zimbabwe. From a SADC perspective a key issue is the character and governance of the DBSA. On the one hand, it is an institution created by an act of parliament in South Africa and is owned and accountable to its shareholder which is the South African government. Yet on the other hand, its development finance mandate extends to Southern Africa and beyond. This has created tensions within the region, particularly within civil society, and questions are posed as to whether in name it could truly live up to its name as a “Southern African development bank”, given its limited funding, its mandate and shareholder accountability. 9. Gearing for the Future – DBSA, BRICS and International Relations According to DBSA estimates, average forecasted growth across Africa is expected to be between 4 and 5 per cent. Foreign direct investments are projected to increase to approximately US$54-billion in 2015 for infrastructure particularly roads, rail, ports, airports and in sanitation, water and energy. Based on these forecasts the DBSA believes it is “well positioned” to increase its footprint on the continent by investing in core sectors viz., energy, water and transport and bring about “immense strategic benefits to both South Africa and the rest of the continent”. The key issue is whether the DBSA will be able to compete with the finance and investment institutions in the US and Europe which combined hold the largest share of projects on the continent. According to Deloitte’s latest research report on the construction industry, of the total $222-billion in infrastructure projects currently underway in Africa, thirty seven per cent are worked on by US and European companies, 12 per cent by Chinese companies and the rest are undertaken by contractors from Korea, Brazil, Japan, Australia and South Africa. One way of reducing the costs and risk exposure is to work with international partners outside of the region. The DBSA, together with institutions such as the European Investment Bank, the French Agency for Development, the UK’s Department for International Development, the German Credit Agency for Reconstruction and the UN’s Office for Project Services, has led technical and grant assistance facilities to support regional integration. Recently the European Union (EU), under the terms of the South Africa-EU Infrastructure Investment Programme approved a facility of GBP 100-million to be managed by the DBSA on behalf of the SA government. In addition, the Bank seeks to “leverage its relationships” with leading institutions from Asia and the BRIC nations to secure co-financing for regional projects. The fifth meeting of the BRICS countries was held for the first time South Africa in March 2013 under the theme “BRICS and Africa – partnerships for integration and industrialisation”. Over the last few years trade and foreign direct investment between Africa and the countries in this new economic bloc has surged. Trade between China and Africa increased from US $10 billion in 2000 to US $190 billion in 2012. India, Brazil and Russia have been active in promoting small- and medium-scale enterprises, mining and energy projects on the Final Draft 16 | P a g e continent. As a result the BRICS bloc is now Africa’s largest trading partners with trade expected to reach more than US $500 billion by 2015, with 60 per cent from China alone. As stated earlier, their presence and involvement is largely based on their domestic demand for the abundant minerals and land on the continent as well opportunities to tap into the rising middle class estimated at about one third of Africa’s one billion population. According to UNCTAD, as a result of the large demand for infrastructure in the resources sector, the most significant area of trade between BRICS and Africa is in the manufacturing and telecommunication, financial and retail services sectors. Boosting growth in food production in particular and the agricultural sector in general is vital for African countries. Brazil, which in recent years has emerged as a leading global player in agricultural production particularly in sugar, coffee, soybeans, ethanol, poultry and beef, wants to support Africa in this area and reduce the impact of food insecurity. However there are serious concerns over the takeover of land in Africa by many countries including those in BRICS to produce for their own domestic markets. The problem of “land grabs” has been well documented by civil society organisations in Africa and elsewhere. This, however, will also form part of another ActionAid study. It is common knowledge that South Africa is the smallest BRICS country both in terms of population as well as in the size of its economy. However, because South Africa currently accounts for one third of Sub-Saharan African economy, it is regarded as strategic from a geo-political view and a “gateway” for BRICS into Africa, and especially its abundant natural resources. As the BRICS are consolidating their positions in Africa through massive investments, by the time of the Durban conference, negotiations were at an advanced for the establishment of a new funding model to finance BRICS projects, to enhance their global funding role, and to foster south-south cooperation. During the conference, agreement was reached and the leaders announced their intentions to launch their own “development bank”. According to South African International Relations Minister Nkoana-Mashabane, the decision was made “as a result of the need to change the way business is conducted in international finance institutions”. Prior to becoming a formal member of the BRICS bloc, South Africa was a founding member of the India-Brazil-SA (IBSA) group of countries. The DBSA will be the government’s lead agency in the BRICS discussions on the new development bank and it is likely that at the next BRICS meeting in Brazil in 2014 more light will be shed on the details of the Bank. This places South Africa in a position in which it has to manage its political, social and economic relations with African countries with mutuality, care and respect. Already, as the so-called gateway, it has to manage perceptions of playing “gatekeeper” and in the case of the G20, the role of “interlocutor”. There’s also the position of “big brother”. SA’s commitment to promoting regional interests whilst also advancing national interests will place it between a rock and a hard place. As the same time SA plays a key role in a range of multi-lateral institutions trying very hard to balance national policy and interests with those of Africa and allies in the global north and south. Coordinating this work, whilst balancing the different interests and managing bilateral agreements in pursuit of a “better world”, is a huge responsibility. There are times when the Final Draft 17 | P a g e country gets it right and there are others when it goes wrong. Given the country’s recent history in overthrowing apartheid and replacing it with a progressive rights-based constitution, there are valid expectations that in everything it does, it is guided by a progressive vision, principles and values for a just, sustainable and peaceful world. In the course of this work, the country and especially its citizens must remain vigilant against any repetition of old systems and practices of colonial thinking and imperial designs. DIRCO’s Strategic Plan 2013-2018 sets out a vision and strategy for how SA will conduct it’s relationships with other countries. According to Minister Maite Nkoana-Mashabane, “Our struggle for a better life in South Africa is intertwined with our pursuit for a better Africa in a better world. Our destiny is inextricably linked to that of the Southern Africa Region. Regional and continental integration is the foundation of Africa’s socio-economic development and political unity, and essential for our own prosperity and security”. To this end, the plan articulates a role for SA in the AU and the UN systems to find “just and lasting solutions to “outstanding issues of self-determination and decolonisation” on the continent. In supporting socio-economic development the government will continue to disburse funding through the African Renaissance and International Cooperation Fund. In this period, DIRCO also plans to replace this fund with the establishment of the South African Development Partnership Agency to “manage all outgoing development cooperation programmes. One of the key challenges with the cabinet will be the ability to effectively coordinate policy and policy implementation across departments – finance, trade and industry, DIRCO, economic development and the presidency amongst others - beyond the country’s borders. A similar challenge exists within South African civil society with many organisations working separately on different issues such as migration, trade, worker rights and foreign policy. The recently formed South African Forum for International Solidarity provides a networking space to for these organisations to share their work and collaborate in monitoring government plans and action. In the context of the current global financial architecture, development financing has been dominated by the Bretton Woods institutions established to finance post-World War II reconstruction in Europe. The countries from the BRICS bloc have accused the World Bank and IMF of representing the interests of powerful northern countries and slow in transforming to meet the development financing needs of fast growing countries such as Brazil, India and China. Together the five BRICS countries account for 40% of the world’s population and a 25% of global gross domestic product (GDP) and together have currency reserves of over $4-trillion. Whilst the Durban Summit announced the formation of a development bank with seed capital of $10-billion from each country, the exact details regarding the role, structure, location and operations of the Bank are still in the development phase. The mere establishment of BRICS, still in its infancy stage, has generated new debate about the political economy of a multipolar world. New donor funding, policy think tanks, private sector research institutions, business to business councils, academic cooperation, development finance cooperation committees and new government departments amongst others have been established as result. Regular meetings, conferences, seminars are Final Draft 18 | P a g e funded to exchange knowledge and strategy. Within civil society debate rages as to whether the new bloc will constitute a “potential radical shift from the prevailing global political economic framework” or merely a “relocation of power” to the elites in the global south. In an article published in Pambazuka, the director of ActionAid South Africa, Fatima Shabodien, cautions against the proposed BRICS development bank “becoming an ‘emerging economies’ version of the World Bank”. She goes on to say that the “ideology represented by the World Bank has not worked for us, and has been largely inimical to the needs and aspirations of the poor, and of African women in particular”. The focus on infrastructure development in Africa, whilst important and necessary, must have a “defined redistributive mechanism” to ensure that “the poor have access to water, electricity, decent housing and quality education for children”. She warns that countries in BRICS must go beyond their own narrow national interest. South Africa in particular, must ensure that our membership of BRICS represents not only the business interest of SA, but that of the continent more broadly in this formation. BRICS members have to ensure that development in their respective regions happens in a manner as inclusive as possible. 10. Conclusions and Recommendations for ActionAid and progressive civil society more broadly In the ANC’s 2012 national conference the role of state-owned institutions was discussed in a policy paper presented by the National Executive Committee. The paper noted the “absence of a common comprehensive policy framework” that guides DFIs. An important point made in the paper that such institutions are not created to “maximise profits or incur losses” but for the dual mandate of achieving a “balance between the required level of selffunding and undertaking development projects that the private sector would ordinarily not”. The purpose of DFIs was to operate as “powerful instruments of economic transformation and remain firmly within the control of the state in order to have the capacity that is capable of responding effectively and efficiently to the developmental agenda of the ANC government”. The policy proposes that “Government as shareholder managers must build relationships with likeminded shareholder managers from around the world, with a particular emphasis on the BRICS alliance, so as to enable knowledge sharing and international collaboration between SOEs and DFIs to achieve mutual strategic objectives. BRICS partners are of necessity in terms of seeking to advance their own national interests. In this context the position is that the South African government must be “well coordinated with respect to its own SOEs and DFIs in these interactions.” In the context of the role of the DBSA these policy pronouncements together with the new mandate requires astute political management if it is to meet its development finance role as a publically owned institution competing with private sector banks in the in the country and in the region. Whilst the DBSA has only a 20% target for projects outside South Africa, the institutional expertise and knowledge developed within bank over the years is regarded as Final Draft 19 | P a g e an important asset to be constructively used by amongst others NEPAD, BRICS DFIs and the Pan-African Parliament. The Bank houses the Pan-African Development Facility. The agreement to house the EU-SA Infrastructure Investment Programme was preceded by stringent tests which the DBSA successfully passed. The Bank is seen by its peers in the region, on the continent and globally as an important player in the field of development finance and has established a set of strategic institutional learning partnerships for example, together with the Industrial Development Corporation (IDC), the DBSA also supports and hosts the SADC Development Finance Resource Centre, which provides support to similar agencies in the region. In addition that bank is part of a network, the African Association of Development Finance Institutions (AADFI) which provides information, training and policy development advice for African bankers, finance officers and other DFI’s. The Bank also works with the UN Environment Programme Finance Initiative, a network of over 200 financial institutions to promote linkages between sustainability and financial performance. There have been a few studies by the for example the World Bank, the AfDB and by the Bank itself to address institutional and project weaknesses in development financing. At a global level, following the financial crisis and the resultant economic climate, the financial sector is now under greater scrutiny by citizens across the globe. Globally there are several progressive reputable civil society organisations working on issues of development and on development finance institutions that have a long history of engagement and institutional knowledge to promote better engagement. On the back of the global financial crisis, the main weakness has been the lack of shared information, insights and strategies on the DFIs could be transformed to achieve global socio-economic and environmental equity and sustainable development goals. Organisations such as ActionAid International are well positioned to initiate a more collaborative approach to dealing with this gap within global civil society. One of the challenges facing SA civil society is to build a critical group of key activist “experts” on development finance and to collaborate, share knowledge and build a strategy for proactive engagement with the SA-based DFIs particularly on good development practice. In the course of this report, several discussions were help with current and former senior leadership and board members. There is a unanimous view that the tension between the development mandate and financial sustainability is an on-going and dynamic one. There is a willingness to engage. ActionAid should consider taking forward an agreement reached in principle on the proposal of a civil society –bank executive roundtable discussion. In SA, there is no civil society watchdog dedicated to monitoring and evaluating the country’s DFI’s. In Brazil, the Brazilian Institute for Social and Economic Analyses (IBASE) has secured state funding for independent research into the role and impact of the country’s largest development finance institution, BNDES. Given future growth and expansion plans for SA DFIs in terms of domestic policy and international agreements, the conceptualisation and establishment of a similar institution in SA is necessary and timely. This will enhance the building of capacity inside and across organisations and with Final Draft 20 | P a g e the constituencies they serve and represent. In this way we could build a network of community based activists keen on engaging the issue of development finance locally and globally. In the 2013 Integrated Annual Report, the DBSA annexes a Sustainability Report based on the Global Reporting Initiative (GRI). The three broad categories (there are over a hundred sub indictors) are institutional, social and environmental. In introducing this annexure the CEO is “proud to announce” and publish its third sustainability report as reviewed by its Internal Audit Department. It is noted that the report is not externally reviewed but important to note that it is published as part of its annual report. The process of stakeholder input as part of the report is regarded as good practice. This is over and above the AAA scores benchmarked against models used rating agencies such as Moody’s and Standard and Poor. The DBSA Appraisal Guidelines have recently undergone an internal revision and at the time of writing there were not available. It is necessary for ActionAid and civil society organisations to study the revised guidelines when available and assess whether these are useful and suggest any improvements based on comparable instruments available in other civil society allies. In the sustainability report the overwhelming result for the respective indictors – over hundred and ten including sub-indicators - are “fully” met whilst in only three the result is “partially” met. An area that will need further investigation is monitoring and evaluations at the coal face the actual development impact of the DBSA for each project. A critical issue here is the role of “beneficiaries” described as the “poor” and the extent to which their lives and areas in which they live have changed for the better. It is possible that NGOs in such communities have their own policies and instruments by which good development projects and practice is measured. If not then, if requested, ActionAid, with its knowledge, skills and experience could assist them develop their own. In the context of SADC, SA civil society has strong connections with the SADC-NGO Council which is based in Botswana. It is suggested that ActionAid in partnership with the South Africa Forum for International Solidarity (SAFIS), explore the possibilities of a joint conversation and or study on the experiences and development impact of DFI’s in general and the DBSA in particular in the region and what the lessons were and what could from the basis of a future policy intervention in the region. Beyond SADC, ActionAid has already begun work on DFIs in BRICS countries. It is understood that globally the organisation is working towards developing a strategy for engagement in the event a BRICS Development Bank is established. At the continental level the AfDB has developed a Framework for Engagement with Civil Society. A copy of this policy is available on the website of the AfDB. SA civil society could learn from the process and outcomes of the AfDB approach by engaging with our counterparts on the continent. Similar work has been undertaken by EU NGOs such as Concord, Eurodad and Climate Action Network for EU development finance institutions. Final Draft 21 | P a g e Given sustained average growth in member countries and the view that African countries can finance their own growth through revenues whether from increased taxes, inward remittances and investment, the AfDB believes that this requires an effective governance framework to manage these in order to meet the demands and expectations of citizens. The Bank recently launched an online public consultation on its new Governance Strategic Framework and Action Plan (2014 – 2018). The main purpose of this plan according to the Bank is to strengthen transparency and accountability in the use of state resources and to promote an enabling environment which supports Africa’s socio-economic transformation, job creation and financial inclusion. In the words of Donald Kaberuka, the AfDB President, quoted in the Bank’s magazine, the African Banker (Issue No. 24, second quarter 2013): “We will need leadership and I mean leadership at all levels – political leadership, business leadership and civil society leadership to all pull in one direction, the direction which gets Africa to the next level, which is economic transformation. This is vital”. To this end, it is worth exploring within civil society networks how to effectively and positively engage so that peoples’ voices are amplified within institutions such as the AfDB, the Pan African Parliament, the AU and NEPAD to achieve these democratic development goals at a Pan-African level. Another example of consultations on transparency and accountability is that of the InterAmerican Development Bank (IDB), which operates in Latin America and the Caribbean countries. Two months ago the IDB launched a public consultation process to review their Independent Consultation and Investigation Mechanism (ICIM) Policy and its operation. The Bank’s board mandates this review in order to increase transparency and accountability and to strengthen its mission, accessibility, independence and responsiveness. In conclusion, there is an ambitious continent wide vision and plans for infrastructure development as a necessary pillar to drive socio-economic growth for the decades to come. With the DBSA, a relatively young and influential global player undergoing its own evolutionary phases within its structure and strategy, it is an opportune time to set the basis now for a medium to long term civil society engagement strategy with the Bank on its domestic, regional and continental policies and practices. A successful engagement strategy will ensure that citizens in general and their organisations will play an active role in ensuring development needs are planned, designed, implemented and monitored effectively this contribution to the principles of active citizenship, effective institutions and accountability on the continent. If we do preferably take a long-term view, we might want to explore the possibility of creating a more permanent mechanism as a resource for building civil society’s capacity to engage effectively with the DBSA and other DFIs on the continent and globally. Final Draft 22 | P a g e References: DBSA, The Evolution of the Development Bank of South Africa, 2010. Midrand, DBSA. DBSA, Integrated Annual Report, 2013. Midrand, DBSA. SADC Council of NGO’s, Poverty Eradication in Southern Africa, April 2011. SADC-CNGO, Gaborone. SADC-CNGO, Concept Note – 9th Southern Africa Civil Society Forum, 2013. Botswana. Zarenda, H. South Africa’s National Development Plan and its implications for regional development, June 2013. Tralac, Stellenbosch. DBSA, The role of South Africa FDI’s in regional infrastructure development in Africa, March 2011. Midrand, DBSA. NEPAD, African Heads of State to be held accountable for regional infrastructure projects, July 2013. www.nepad.org. Hall,R. The Many Faces of Investor Rush in Southern Africa: Towards a Typology of Commercial Land Deals, February 2011. PLAAS, University of Western Cape, Cape Town. AU Commission, Statement of the Chairman to the Roundtable on financing Africa’s transformation, July 2013. Tunis. Omotola, A.H., What the BRICS Development means for Africa, August 2013. Johannesburg. Economy Watch. DBSA, Perspectives of DBSA on Infrastructure Investments in the SADC Region, March 2011. Japan, DBSA. Mwanza, W., Operationalising the SADC Regional Infrastructure Development Master Plan, July 2013. Stellenbosch, Tralac. DIRCO, Strategic Plan 2013-2018, 2012. Dirco, Pretoria. Bond, P., Is post-apartheid South Africa still “sub imperialist”? BRICS banking and frustrated global development finance reform, September 2013. Durban. CONCORD, Financing for development negotiations – what should the EU bring to the table, August 2013. Brussels. Final Draft 23 | P a g e ActionAid South Africa Physical Address 16th Floor Edura House 41 Fox Street Johannesburg Postal Address Postnet Suite 235 Private Bag X30500 Houghton 2041 Tel: +27 (0) 11 731 4560 Fax: +27 (0) 86 543 2557 http://www.actionaid.org/south-africa www.twitter.com/actionaid_sa www.facebook.com/actionaidsafrica Final Draft 24 | P a g e