107 Adminstrative Au.. - CHILD SUPPORT DIRECTORS

advertisement

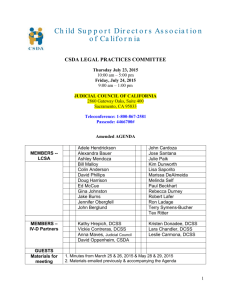

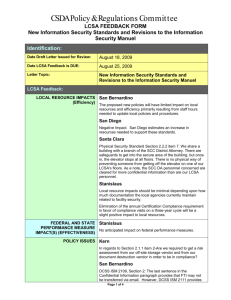

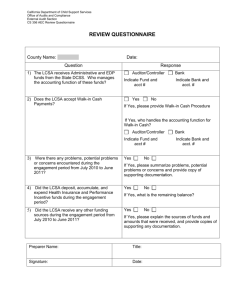

Child Support Director’s Association 2007 Training Conference Administrative Audits Presentation #107 September 18, 2007 Facilitator Lynn Titialii Deputy Director Administration San Diego DCSS Lynn.Titialii@sdcounty.ca.gov 619-578-6130 Presenters Linda Dippel Director Contra Costa County DCSS Bill Davis Assistant Director Sacramento DCSS ldippel@dcss.cccounty.us 925-957-7300 davisbi@saccounty.net 916-875-7848 Scott Limpach Chief, Office of Audits and Compliance California DCSS scott.limpach@dcss.ca.gov 916-464-3296 Presentation Outline Authority and References Pre-Audit Process On Site Activity Post Audit Process Most Common Findings Authority and References Federal Office of Management and Budget OMB Circular A-87 OMB Circular A-133 All Circulars available at www.whitehouse.gov/OMB/circulars/index.html 45 CFR 302.10 and 302.14 Requires adequate accounting systems to support claims for federal funds. Requires periodic evaluations of local operations. LCSA Letter 05-09 – Agreed Upon Procedures of Local Child Support Agency Administrative Costs Agreed Upon Procedures – February 15, 2005 Materiality Standard in consideration CSS Letter 04-20 Clarification of Child Support Administrative Claiming and Financial Policies CSS Letter 05-05 Clarification of Non-Electronic Data Processing Automation Requests and Cost Threshold for Equipment Inventories Criteria Used for Fiscal Audits Pre-Audit Process DCSS Planning Audit Selection Criteria Risk Assessment Various input Regional Administrators consulted Audit Plan Timing Workload balance Final Selection Regional Administrators consulted Balance against project schedules Pre-Audit Process Engagement Planning Audit Manager calls LCSA Director Schedule an agreeable entrance date Discuss space needs Confirm by Engagement letter Confirms first day on site Attachment defines documentation required On Site Activity Entrance Conference Meet the Team First day on site Introductions Scope of audit – see Agreed Upon Procedures Designation of LCSA contact Facility tour Access to space, phone, etc. Use of copy machine Receipt of documentation requested in letter Rules of Engagement Whom and how to contact Confidentiality On Site Activity Audit Work Interviews of key staff Documentation access and review Communication with LCSA contact Weekly updates Discussions of possible findings “Walk Away” meeting On Site Activity Exit Conference Scheduled weeks after walk away Discussion of draft findings Outline of draft findings, discussion only Discussion of further information needed Management Representation Letter requested Explain the report process Provide estimated date for draft report Post Audit Process Report Preparation Draft report provided to LCSA 10 days to respond – often extended Response can: Identify further information to refute findings Dispute findings Accept findings This is the time to raise issues! LCSA response is attached to final report Report is made final and distributed Post Audit Process Report Response Demand letter From County Allocation Office Will describe each finding and process for resolution May require payment May require Federal report revision May be a process change LCSA Responsibilities Respond in a timely manner Post-Audit Process Corrective Action LCSA has an obligation to resolve findings identified in final report State will verify compliance after reasonable time Most Common Findings Cash v. accrual basis Programs receiving federal funds are required to operate on a cash accounting basis. Cash claiming requires that expenditures be reported in the quarter in which they are purchased. No carry-forward of unobligated funds. Unabated Interest Interest earned on child support funds and child support collections must be abated on the CS 356 report. Controls over Inventory of Equipment Physical inventory performed at least once every two years. Property Ledger to record equipment information as follows: Acquisition date. Equipment description. Serial Number, model number, or other Id. number. Funding Source. Equipment cost or other basis of valuation. Who holds title. Percent of federal, state and county participation in the cost of the property. Location. Disposition data, including the date of disposal and sales price. Unallowable Costs – as defined in A-133 and A-87 Cost must be necessary and reasonable for proper and efficient performance and administration of federal awards. Costs of goods or services for personal use of the government unit’s employees are unallowable regardless of whether the cost is reported as taxable income to the employees.