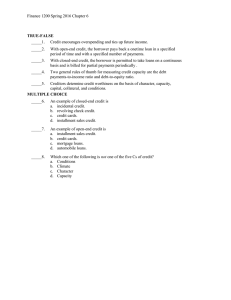

Savings, Investment and the Financial System

advertisement

Savings, Investment and the Financial System The SavingsInvestment Spending Identity Let’s go over this together… The Financial System Let’s go over this together… Types of Financial Assets • There are officially only four, but I want to address loan-backed securities (with loans) – as these played an important role in the 2008 recession Types of Financial Assets 1. Loans are an agreement between a lender and borrower. They create funding for the borrower (who is a seller in this transaction) and income for the lender (buyer). The buyer gives the seller the right to use the money, which is repaid with interest. These provide funds that fit the borrower’s needs and ability to repay, but are not ideal for large borrowers. Types of Financial Assets • Loan-backed securities are pools of individual loans sold as shares. Their intent was to reduce risk for lenders, since it was less likely that all (or most) of the borrowers would default. These securities were sold on the financial market as bundles of debt divided into small pieces and sold as an investment. Buyers were buying interest on the loan, not the loan itself. These were intended to be well-diversified to reduce risk, since the underlying loans have a variety of different risks (mortgages, credit cards, student loans, etc.), but proved risky because the quality and quantity of risk was hidden. Types of Financial Assets 2. Stocks are shares of ownership in a publicly-traded company. Their purpose is to reduce risk for the business owner, as they do not have to finance business needs from their own savings. Stocks are sold to finance business expansion, with shareholders (buyers) profiting in two ways: They receive shares of business profit (called dividends) as well as benefiting from growing resale value on the stock market. Stocks tend to have a higher rate of return than other investments, and they have high liquidity – but owning stock is riskier than many other investments, as these are not debts that companies have to pay if they fail. Types of Financial Assets 3. Bonds are a debt/promise to pay that is sold on the bond market. Like loans, they create funding for the borrower (seller) and income for the lender (buyer). The seller promises to repay a fixed amount of interest each year and to repay the principal on a set date. To raise needed money, a seller issues a number of bonds with a given interest rate and maturity date. Seller also benefits from growing resale value on the bond market. Bond-rating agencies assess risk, which helps to set the interest rate. Bonds are also very liquid, but they have a lower rate of return than some other investments. Types of Financial Assets 4. Bank deposits are a transaction in which money deposited is, in fact, a loan to a bank in exchange for a record of that deposit that allows you to draw on that money in the future. Bank deposits provide the funds for banks to lend. The depositor has the right to access funds at any time, but banks can use this money to finance loans. These are the most liquid of financial assets, and they are insured by the federal government to $250,000 – but they also have the lowest rate of return. Types of Financial Intermediaries 1. Mutual funds are diversified stock portfolios sold as shares. Mutual funds allow small investors to hold stock in a variety of companies. Mutual fund companies purchase a large stock portfolio and sell shares of the portfolio (with specialized options). These allow buyers to avoid transaction fees for each purchase, benefit from the expertise of fund managers, and better assess risk. Overall, mutual funds have a lower rate of return than stocks and can charge high management fees. Types of Financial Intermediaries 2. Pension funds are nonprofit organizations that collect savings of members and invest them. Pension funds provide retirement income for members. Pension funds purchase a large stock portfolio and divide it among members based on their savings. These have the same advantages/disadvantages as mutual funds. Types of Financial Intermediaries 3. Life insurance companies collect premiums (payments) and invest them. Buyers who pay premiums are guaranteed that the insurance company will provide an income to their beneficiaries. Premiums received are invested to provide profit for the insurance company. Life insurance is considered a safe investment, but you have little liquidity (very limited access to your money) during your lifetime – and there is a very low rate of return. Types of Financial Intermediaries 4. Banks provide assets to borrowers and depositors. See notes on bank deposits