AC113: Accounting for Non Accounting Majors

advertisement

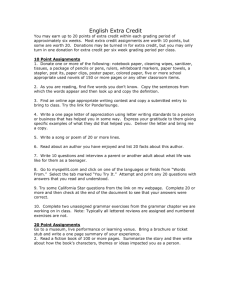

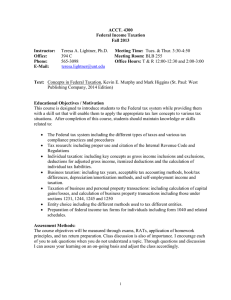

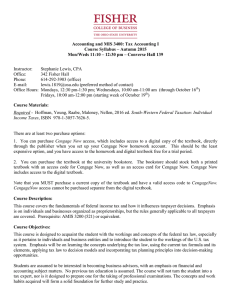

AC256: Federal Income Taxes Dr. Linda Leatherbury_____ Unit 1 Seminar Course Description • . • This course introduces students to the procedures to decipher tax information on an individual federal tax basis. Basic concepts in federal income taxation are explored, including gross income, exclusions, adjusted gross income, deductions, exemptions, and credits. Introductory tax concepts including cash and accrual methods, like-kind exchanges, and passive loss rules are covered. Additionally, students will familiarize themselves with a tax software package and will explore the tax software's use in generating a tax return. Course Objectives • By the end of this course, you should be able to: • Use the IRS website and other tax-related internet sites for tax research • Use tax tables to calculate individual tax deductions • Apply tax concepts to real world examples • Analyze proposed tax legislation • Prepare an individual Federal Tax return using a tax software package • General Education Outcomes: In addition, the following General Education outcomes are assessed during this course: • 1. Demonstrate college-level communication through the composition of original materials in Standard American English • 2. Apply ethical reasoning to ethical issues in tax reporting Textbook • Textbook Information • Title: Prentice Hall’s Federal Taxation Author(s): Thomas R. Pope ISBN: 13-978-0-13-213857-4 Grading Scale Total Points Letter Grade Percentage 930-1000 A 93-100% 900-929 A- 90-92% 870-899 B+ 87-89% 830-869 B 83-86% 800-829 B- 80-82% 770-799 C+ 77-79% 730-769 C 73-76% 700-729 C- 70-72% 670-699 D+ 67-69% 600-669 D 60-66% 0-599 F 0-59% Course Activities • • • • Discussion Boards Homework Assignments Quizzes Final Exam Discussion Grading Criteria The Discussion Board Requirement: • Students are to post a minimum of three posts per unit. One initial response and two replies to their classmates • Posting on a minimum of three different days, for example: Wednesday, Friday and Monday • The first post must be made by Saturday. Online Communication Guidelines A Few Rules of Thumb • Never post a message that is in all capital letters - it comes across to the reader as SHOUTING! • Always practice good grammar, punctuation, and composition. This shows that you've taken the time to craft your response and that you respect your classmates' work. • Be respectful and treat everyone as you would want to be treated yourself. • Use spell check! Homework Assignments • Homework assignments are due on Tuesday at the end of each unit. • Excel homework templates are located in doc sharing for your convenience. Instructor Contact Information • • • • Professor Linda Leatherbury Ph.D Email: lleatherbury@kaplan.edu AIM Screen Name:lphdstudent Office Hours: Questions???