The IRS Audit of Tax Return Preparer:

advertisement

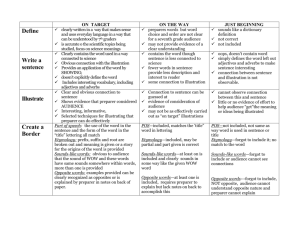

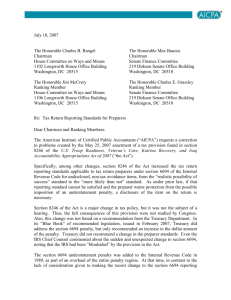

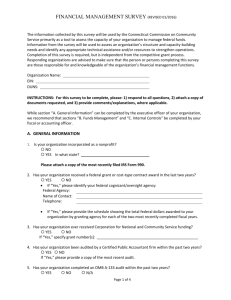

1 IRS AUDIT OF TAX RETURN PREPARERS: The Good, The Bad and The Ugly 2 Objectives • What is the Return Preparer Visitation Project? • How did the RPVP come about? • What is the RPVP’s Objectives? • What will be examined during an IRS visit? • What do you need to be concerned with? • What is the future of the project? 3 Origins – The Good • IRS Strategic Plan (FY 2009 -2013) • Strengthen partnerships with tax practitioners, paid preparers, and other third parties in order to ensure effective tax administration • Ensure that all tax practitioners, paid preparers, and other third parties in the tax system adhere to professional standards and follow the law • Tax Return Preparer Review – December 2009 • Six-month comprehensive study of paid preparer industry • Intended to be an open discussion of the issues within the paid preparer community • IRS concluded that implementing higher standards would: • significantly enhance protections and service for taxpayers, • increase confidence in the tax system, and • result in greater taxpayer compliance with tax laws. 4 Beginnings – The Good • On January 7, 2010 • Service announced the development of the Return Preparer Visitation Project (RPVP). • First steps to improve the accuracy and quality of filed tax returns as well as to heighten awareness of paid preparer responsibilities. • The initial rollout of the RPVP occurred during FY 2010, with the intention that the RPVPs will be conducted on an annual basis. 5 Selection for RPVP – The Bad • FY 2010 – practitioner prepared more than 25 tax returns with schedules commonly containing errors: Schedules A, C and E • FY 2011 – inspection of tax returns, relevant supporting documents and records of clients to ensure compliance with Section 6695 • FY 2012 – preparers of a large volume of returns with Schedules A, C and E in order to confirm compliance with return preparer requirements 6 Target Goals - The Bad • Target Goals for letters and visits: • FY 2010 • 10,000 Information Letters • 2,500 Visits • FY 2011 • 10,000 Information Letters • 2,500 Visits • FY 2012 • 21,000 Information Letters • 2,100 Visits 7 Duties of Tax Return Preparers Section 6695 • Failure to • furnish copy of tax return to taxpayer • sign tax return • furnish identifying number • retain copy or list of tax returns prepared • file correct information return (Sec. 6060) • Amount of penalty • $50 per return • $25,000 maximum per year • Reasonable cause exception 8 Duties of Tax Return Preparers Section 6695 • Negotiation of Refund Check • Amount of penalty • $500 per event • Failure to determine Earned Income Credit eligibility • Amount of penalty • $100 per failure • Due Diligence exception 9 Understatement of Taxpayer’s Liability by Tax Return Preparer - Section 6694(a) • A preparer may only agree to the filing of a tax return if it contains a reasonable postion • A position taken by a preparer is reasonable if there is substantial authority for the position • If position is reasonable, then no penalty will apply • “Substantial Authority” has the same meaning as in Treas. Reg § 1.6662-4(d)(2) • Even if substantial authority does not exist, penalty can be avoided through adequate disclosure • Position cannot be frivolous 10 Substantial Authority Standard Section 6694(a) • Applies to all returns and information documents • Standard aligns preparers with their clients • Applies to preparers who were primarily responsible for the position • Includes signing and non-signing preparers • Excludes non-signing preparers who spent less 5% of aggregate time on the position • Applies to position that is a substantial portion of the return 11 Understatement of Taxpayer’s Liability by Tax Return Preparer - Section 6694(a) • Section 6694(a) Penalty Amount • The greater of $1,000 or • 50% of the income derived (or to be derived) by the tax return preparer from the preparation of a return or claim with respect to which the penalty was imposed. 12 Understatement of Taxpayer’s Liability by Tax Return Preparer - Section 6694(a) • Exception for Tax Shelters and Reportable Transactions • Penalty applicable unless preparer has • A reasonable belief that the position would more likely than not be sustained on its merits • No exception for disclosure • Reasonable Cause and Good Faith exception applies 13 Understatement of Taxpayer’s Liability by Tax Return Preparer - Section 6694(b) • §6694(b) – Willful or Reckless Conduct • Standard • Disregards information furnished by the taxpayer or other persons or fabricates items or amounts on the return in an attempt to wrongfully reduce the tax liability of the taxpayer • Defenses • Adequate Disclosure • Reliance on taxpayer 14 Understatement of Taxpayer’s Liability by Tax Return Preparer - Section 6694(b) • Section 6694(b) Penalty Amount • The greater of $5,000 or • 50% of the income derived (or to be derived) by the tax return preparer from the preparation of a return or claim with respect to which the penalty was imposed 15 AICPA Response – The Bad • AICPA Comment Letters to Service dated: • October 29, 2010 • December 22, 2010 • Concerns • Visits occur during the busiest time of the year • Client Confidentiality • Review of filed tax returns • Review of client files • Possibility of assertion of penalties 16 FATP – Section 7525 • Section 7525 – Federally Authorized Tax Practitioner’s Privilege • With respect to tax advice, the same common law protections of confidentiality which apply to a communication between a taxpayer and an attorney shall also apply to a communication between a taxpayer and any federally authorized tax practitioner to the extent the communication would be considered a privileged communication if it were between a taxpayer and an attorney 17 FATP – Section 7525 • Purpose: level the playing field among practitioners • Requirements • Applies only to the Federal tax matters • Same principle and requirements as the attorney-client privilege • Must be between taxpayer and federally authorized tax practitioner • Must be tax advice • Must not be intended to be revealed • Does not exist for criminal tax proceedings • Does not apply to certain written communications regarding tax shelters 18 FATP – Section 7525 • Effective Date • Effective for communications made on or after July 22, 1998. 19 TIGTA Report – The Ugly • June 29, 2012 • Treasury Inspector General for Tax Administration (TIGTA) issued their report on the RPVP for its FY 2010 and FY 2011 filing seasons • Implementation of the Return Preparer Visitation Project was Successful, but Improvement are Needed to Increase Its Effectiveness • Report was favorable in that Service fulfilled its objectives for the project 20 IRS Visit Results • The results for FY 2010 and FY 2010 21 TIGTA Report – The Ugly • Recommendations: • Service should use data-driven selection criteria to specifically identify paid preparers who filed tax returns with errors to make certain the most egregious paid preparers are receiving educational and enforcement visitations. • Service should develop specific performance measures and that internal controls that can be used to assess the impact of the RPVP on the paid preparer community. • Should include a process to monitor and track the behavior of paid preparers visited to determine whether the quality and accuracy of tax returns improved. 22 TIGTA Report – The Ugly • Service Response: • Agreed with both recommendations and has already begun implementation 23 Future of the RPVP? • A continuing effort to ensure the highest standards of quality and compliance • Maintenance of paid preparer lists regarding conduct? 24 IRS Audit of Tax Return Preparers • The Good, The Bad and The Ugly •Finis