GMAC v Daniels summary

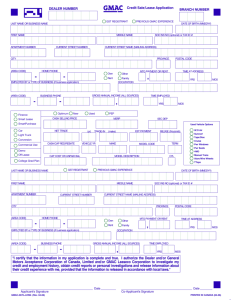

advertisement

GENERAL MOTORS ACCEPTANCE CORP. v. DANIELS Court of Appeals of Maryland, 1985. 303 Md. 254, 492 A.2d 1306. BACKGROUND AND FACTS In June 1981, John Daniels agreed to purchase a used car from Lindsay Cadillac Company. Because John had a poor credit rating, his brother, Seymoure, agreed to cosign the installment sales contract. Seymoure signed the contract on the line designated “Buyer,” and John signed on the line designated “Co-Buyer.” Lindsay then assigned the contract to General Motors Acceptance Corporation (GMAC). In May 1982, GMAC declared the contract in default. After attempting to locate the car for several months, GMAC finally found it in a condition of total loss. GMAC brought an action for damages, but because service of process was never effected on John, the action proceeded only against Seymoure. The trial court found that Seymoure was a guarantor of the contract between John and GMAC and held that GMAC would have to attempt to bring suit first against John before it could proceed against Seymoure. GMAC appealed the ruling. COLE, Judge. **** A suretyship and guaranty are contractual agreements. * * * It is well settled that Maryland follows the objective law of contracts. A court construing an agreement under this test must first determine from the language of the agreement itself what a reasonable person in the position of the parties would have meant at the time it was effectuated. In addition, when the language of the contract is plain and unambiguous there is no room for construction, and a court must presume that the parties meant what they expressed. In these circumstances, the true test of what is meant is not what the parties to the contract intended it to mean, but what a reasonable person in the position of the parties would have thought it meant. * * * **** Our review of the evidence in this case convinces us that the District Court erred in finding that Seymoure was a guarantor rather than a surety with respect to the installment contract. * * * * * * Seymoure agreed to purchase the subject automobile by affixing the signature to the installment sales contract on the line designated “Buyer.” The contract clearly stated that all buyers agreed to be jointly and severally [individually] liable for the purchase of that vehicle. Therefore, under the objective law of contracts, a reasonable person knew or should have known that he was subjecting himself to primary liability for the purchase of the automobile. In short, although uncompensated sureties are favorites of the law, Seymoure’s careless indifference does not insulate him from primary liability on that agreement. Seymoure executed the same contract as his brother, thereby making himself a party to the original contract. There is no evidence that Seymoure executed an agreement collateral to and independent of this contract. This fact, standing alone, ordinarily negates the existence of a guaranty. * * * Both Seymoure and John signed the contract at the same time. * * * [T]his fact tends to establish the existence of a contract of suretyship rather than a contract — Page 627 — of guaranty. Furthermore, there are no competent facts indicating that Seymoure expressly agreed to pay for the automobile only upon the default of John. DECISION AND REMEDY The appellate court reversed the lower court’s ruling. Full text of case ¾¾¨¾¾