File - 2013 Business 1B 3059 Group Project Group4

advertisement

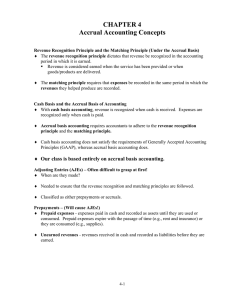

Cash Basis Accrual Basis 2 principles Profit Rich& Cash Poor Extra $100 $100 $100 $100 $100 $200 $200 $200 $200 $200 $300 $300 $300 $300 $300 $400 $400 $400 $400 $400 $500 $500 $500 $500 $500 The practice of summarizing operating results in terms of cash receipts and cash payments, rather than revenue earned or expenses incurred. What is “Cash Basis Accounting”? Back to Board Short-term, highly liquid investments, such as money market funds, commercial paper, and Treasury bills that will mature within 90 days from the acquisition date. What is “Cash equivalents”? Back to Board Concept under which cash receipts must be recorded as soon as all restrictions related to the receipt have ended. What is “Constructive Receipt”? Back to Board Measures taken by management to make the company appear as strong as possible in its financial statements. What is “Window Dressing”? Back to Board This type of corporation refers to any corporation that, under United States federal income tax law, is taxed separately from its owners. This type of corporation is distinguished from an S corporation, which generally is not taxed separately. What is “C Corporation”? Back to Board Assets representing advance payment of the expenses of future accounting periods. As time passes, adjusting entries are made to transfer the related costs from the asset account to an expense account. What is “Prepaid Expenses” (or Deferred Expenses) Back to Board An obligation to deliver goods or render services in the future, stemming from the receipt of advance payment. What is “Unearned revenue” (or Deferred Revenue)? Back to Board Money owed to a business by its clients (customers or debtors) and shown on its balance sheet as an asset. What is “Account Receivable”? Back to Board This account is never touched during adjusting entries. What is “Cash account”? Back to Board The only Accounting Method accepted by GAAP. “What is Acrual Based Accounting? Back to Board The generally accepted accounting principle that determines when expenses should be recorded in the accounting records. The revenue earned during an accounting period is matched (offset) with the expenses incurred in generating that revenue. What is “matching principle”? Back to Board The general accepted accounting principle that determines when revenue should be recorded in the accounting records. Revenue is realized when services are rendered to customers or when goods sold are delivered to customers. What is “realization principle”? Back to Board Accounting principle which plays a major role in making of adjusting entries. What is “materiality”? Back to Board Entries made at the end of the accounting period for the purpose of recognizing revenue and expenses that are not properly measured as a result of journalizing transactions as they occur. What is “adjusting entries”? Back to Board The accounting treatment accorded to this items is of little or no consequence to decision makers. What is “immaterial items”? Back to Board A financial statement summarizing the results of operations of a business by matching its revenue and related expenses for a particular accounting period. Shows the net income or net loss. What is “income statement”? Back to Board An increase in owners’ equity resulting from profitable operations. Also, the excess of revenue earned over the related expenses for a given period. What is “net income”? Back to Board Assets that have been pledged to secure specific liabilities. Creditors with secured claims can foreclose on (seize the title to) these assets if the borrower defaults. What is “collateral”? Back to Board A book written by Dr.Howard Schilit which talks about seven primary ways in which corporate management manipulates the financial statements of a company. What is “Financial Shenanigans?” Back to Board Income coming from interest payments, dividends, capital gains collected upon the sale of a security or other assets, and any other profit that is made through an investment vehicle of any kind. What is “investment income”? Back to Board The interest that a debtor pays before the first scheduled debt repayment. What is “Prepaid Interest’? Back to Board A type of account in the current liabilities section of a company's balance sheet. This account is comprised of taxes that must be paid to the government within one year. What is “Income Tax Payable”? Back to Board Income that a company receives from its normal business activities, usually from the sale of goods and services to customers. What is “revenue”? Back to Board Outflow of money to another person or group to pay for an item or service, or for a category of costs What is “expense”? Back to Board Jeopardy + Bingo = ? What is “Jeopardingo”? Back to Board