Chapter 3 - Social Security Taxes

advertisement

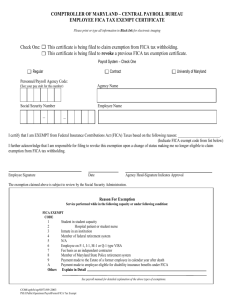

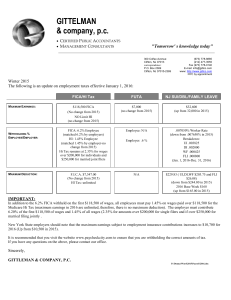

CHAPTER 3 SOCIAL SECURITY TAXES Developed by Lisa Swallow, CPA CMA MS Social Security Taxes FICA (1935) Federal Insurance Contribution Act for employees and employers 6.2% OASDI plus 1.45% HI SECA (1951) Self Employed Contribution Act Tax upon net earnings of self-employed 6.2% + 6.2% = 12.4% OASDI plus 1.45% + 1.45% = 2.9% HI 3 issues: Are you an EE or independent contractor? Is compensation considered taxable wages? Calculating FICA and SECA under varying situations http://www.ssa.gov/employer Determination of Independent Contractor (SECA) vs. Employee (FICA) IRS uses 20-point test to determine “common law relationship” - examples from list include How many companies does person work for Control work/schedule/where performed Who provides tools Can person incur profit or loss 3 Categories of evidence Behavioral Control Financial Control Type of Relationship Can file SS-8 with IRS if uncertain what to do!! Access http://www.irs.ustreas.gov/prod/forms-pubs/pubs/p15a02.htm Specifically Covered (in addition to common law) Life insurance salespeople Traveling salespeople Agent- and commission-drivers of food/beverages Not-for-profit EE (except ministers): minister can irrevocably elect FICA coverage Federal employees (only HI if hired prior to 1984) Military on basic pay (no FICA on excess pay) More Specific Situations Temporary employees – considered EE of temporary agency Household employees If they make $1300+/year ER must pay FICA – reports on 1040 (still paid by both) Unless already files 941 - then report on this form Doesn’t apply to minor unless that’s their occupation Must pay if he/she under your control (gardener/nanny/cook) Corporation Officers are EE Board of director members are not EE Partnership Partners are not EE Employment Specifically Exempt from FICA Children under 18 employed by parent’s business, if either a sole proprietorship or partnership (but not corp) Farm workers if all workers annual compensation < $2500 or each worker earned < $150/year Employees covered under RRTA (Railroad Retirement Tax Act) Ambassadors/diplomats Newspaper carrier less than 18 years old *this is not an exhaustive list* What are Taxable Wages? Cash Wages and salaries Bonuses and commissions FMV of noncash compensation Gifts (over certain amounts) Stock options Fringe benefits like personal use of corporate car Prizes Premiums on group term life insurance > $50,000 Taxable Wages (Continued) Tips greater than $20 or more per month EE must file form 4070 by 10th of following month with ER 50% penalty imposed on EE for not reporting ER calculates FICA on tips and withholds from regular paycheck on these reported tips ER must match but they receive a business tax credit roughly equivalent to the ER paid FICA on tips “Large employers” (11+ EE) must allocate [(Gross receipts x .08) – reported tips] Don’t have to withhold FICA on allocated tips, only reported tips Have to show allocated tip income on W-2 ER can petition IRS to reduce tip allocation to as low as 2% Employer must file Form 8027 at year end with IRS Specifically Exempt Wages Meals/lodging for ER convenience (for example, paramedic) Sick pay after 6 consecutive months off (personal injury – not permanent disability – payments) Sick pay by 3rd party (insurance company/trustee) ER SEP* (up to 15% of first $170,000) SEP contributions through salary reduction must have FICA withheld ER-provided nondiscriminatory education assistance (must have written plan) up to $5,250 Education must maintain/improve skills required by employment *Simplified Employee Pension FICA Taxable Wage Base OASDI caps at $89,700 for 2003 (estimated) HI never caps Facts: Earn $95,000/year - paid semimonthly on the 15th and 30th; the calculations for 12/15 payroll are: First must find prior payroll YTD gross $95,000/24 = 3,958.33 3,958.33 x 22 = 87,083.26 How much will be taxed for OASDI? 89,700.00 – 87,083.26 = 2,616.74 OASDI tax is 2,616.74 x 6.2% = 162.24 HI tax is 3,958.33 x 1.45% = 57.40 Total FICA is 162.24 + 57.40 = $219.64 Is this EE withholding or ER payroll tax expense? Answer - both!! Example #2 to Calculate FICA Earns $178,000/year; paid first of every month; determine FICA for 7/1/03 payroll What do we calculate first? 178,000/12 = $14,833.33 per paycheck YTD gross prior to current payroll = 14,833.33 x 6 = 88,999.98 89,700.00 - 88,999.98 = 700.02 taxed for OASDI 700.02 x 6.2% = 43.40 OASDI tax 14,833.33 x 1.45% = 215.08 HI tax (remember - no cap!) Total FICA = 43.40 + 215.08 = 258.48 Remember - the ER has withheld $258.48 from the employee’s paycheck and must match this amount SECA - Independent Contractor is both EE & ER EE and ER portion of FICA if net income exceeds $400 Net Income = Revenue – Expense Partnerships – distributive share of partnership net income subject to FICA If you own more than one business - offset losses and income and calculate FICA based on combined net income Can have W-2 and self employment income Example: W-2 = $92,768 and self employment income = $14,500; how much FICA on $14,500? Answer: No OASDI because capped on W-2 and HI = 2.9% x 14,500 = $420.50 Example: W-2 = $78,000 and self employment income = $21,000; how much is FICA on $21,000? Answer: (89,700 - 78,000) = 11,700 OASDI wages x 12.4% = $1450.80 + 21,000 x 2.9% = $609.00 Total FICA = ($1450.80 + 609.00 = $2059.80) How to Get Set Up with SSA One FEIN per employer File Form SS-4 with IRS office where tax returns will be filed. TELE-TIN to obtain Federal Employer Identification Number (FEIN) immediately (1-866-816-2065). When purchasing an existing business, the new owner needs a new FEIN. SS-5 for everyone > one year old To apply for social security number Required under SSA W-7 for ITIN (aliens who must file a tax return, but are ineligible for SS number) Deposit Requirements for FICA and FIT (always go together) Each November, based upon a look back period, IRS tells ER what type of depositor he/she is 1. Monthly depositor - pay FICA and FIT by 15th of following month 2. Semiweekly depositor If payroll was W-F, deposit by next Wednesday If payroll was S-T, deposit by next Friday Exceptions If really big ($100,000+ of federal payroll tax liability), taxpayer has until close of next banking day If really small (quarterly owe less than $2,500), wait and pay when 941 report is filed How to Deposit FIT/FICA Fill out a Form 8109 coupon These are sent to you when apply for FEIN. Take to an authorized financial institution (depository for federal government) Or can use EFTPS (Electronic Federal Tax Payment System) must use if total deposits exceed $200,000 for a year complete Form 9779, EFTPS Business Enrollment Form to utilize online capabilities, enroll at www.eftps.gov If mailing, must postmark at least 2 days before due date Penalties for late deposits How to Report FIT/FICA File Form 941 (Employer’s Quarterly Federal Tax Return) Download at www.irs.ustreas.gov Due on last day of month following close of quarter: 1/31 4/30 7/30 10/31 941E-file are for Reporting Agents who file 10+ returns per quarter 941 TeleFile are for certain depositors sent TeleFile kits Types of Penalties Failure-to-comply penalties will be added to tax and interest charges; negligence can also result in fines/imprisonment Imposed for following: not filing employment tax returns on time not paying taxes when due not making timely deposits not furnishing W-2s not filing/providing information returns not supplying proper Taxpayer Identification Numbers (TINs)