Decision Analysis

advertisement

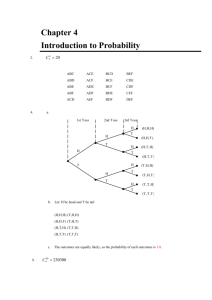

Decision Analysis EMBA 8150 Dr. Satish Nargundkar Basic Terms Decision Alternatives (eg. Production quantities) States of Nature (eg. Condition of economy) Payoffs ($ outcome of a choice assuming a state of nature) Criteria (eg. Expected Value) What kinds of problems? Mutually Exclusive vs. Mix of alternatives Single vs. Multiple criteria Assumptions Alternatives known States of Nature and their probabilities are known. Payoffs computable under different possible scenarios Decision Environments Ignorance – Probabilities of the states of nature are unknown, hence assumed equal Risk/Uncertainty – Probabilities of states of nature are known Certainty – It is known with certainty which state of nature will occur. Trivial problem. Example – Decisions under Risk Assume the following payoffs in $ thousand for 3 alternatives – building 10, 20, or 40 condos. The payoffs depend on how many are sold, which depends on the economy. Three states of nature are considered - a Poor, Average, or Good economy at the time the condos are completed. Probabilities of the states of nature are known, as shown below. A1 (10 units) A2 (20 units) A3 (40 units) Probabilities S1 (Poor) S2 (Avg) S3 (Good) 300 -100 350 600 400 700 -1000 0.30 -200 0.60 1200 0.10 Expected Values When probabilities are known, compute a weighed average of payoffs, called the Expected Value, for each alternative and choose the maximum value. Payoff Table S1 A1 300 -100 A2 -1000 A3 Probabilities 0.30 S2 S3 EV 350 600 -200 0.60 400 700 1200 0.10 340 400 -300 The best alternative under this criterion is A2, with a maximum EV of 400, which is better than the other two EVs. Expected Opportunity Loss (EOL) Compute the weighted average of the opportunity losses for each alternative to yield the EOL. Opportunity Loss (Regret) Table S1 A1 A2 A3 Probabilities S2 S3 0 250 800 400 0 500 1300 800 0 0.30 0.60 0.10 EOL 230 170 870 The best alternative under this criterion is A2, with a minimum EOL of 170, which is better than the other two EOLs. Note that EV + EOL is constant for each alternative! Why? EVUPI: EV with Perfect Information If you knew everytime with certainty which state of nature was going to occur, you would choose the best alternative for each state of nature every time. Thus the EV would be the weighted average of the best value for each state. Take the best times the probability, and add them all. A1 (10 units) A2 (20 units) A3 (40 units) Probabilities S1 (Poor) S2 (Avg) S3 (Good) 300 -100 350 600 400 700 -1000 0.30 -200 0.60 1200 0.10 300*0.3 = 90 600*0.6 = 360 1200*0.1 = 120 _____________ Sum = 570 Thus EVUPI = 570 EVPI: Value of Perfect Information If someone offered you perfect information about which state of nature was going to occur, how much is that information worth to you in this decision context? Since EVUPI is 570, and you could have made 400 in the long run (best EV without perfect information), the value of this additional information is 570 - 400 = 170. Thus, EVPI = EVUPI – Evmax = EOLmin Decision Tree 0.3 340 0.6 0.1 A1 0.3 0.6 A2 A2 400 400 A3 0.1 | 300 | 350 | 400 | -100 | 600 | 700 0.3 0.6 | -1000 0.1 | 1200 -300 | -200 Sequential Decisions Would you hire a consultant (or a psychic) to get more info about states of nature? How would additional information cause you to revise your probabilities of states of nature occurring? Draw a new tree depicting the complete problem. Consultant’s Track Record Instances of actual occurrence of states of nature Previous Economic Forecasts Favorable Unfavorable S1 20 80 100 S2 60 40 100 S3 70 30 100 Probabilities P(F/S1) = 0.2 P(U/S1) = 0.8 P(F/S2) = 0.6 P(U/S2) = 0.4 P(F/S3) = 0.7 P(U/S3) = 0.3 F= Favorable U=Unfavorable Joint Probabilities S1 S2 S3 Total Favorable 0.06 0.36 0.07 0.49 Unfavorable 0.24 0.24 0.03 0.51 Prior Probabilities 0.30 0.60 0.10 1.00 Posterior Probabilities P(S1/F) = 0.06/0.49 = 0.122 P(S2/F) = 0.36/0.49 = 0.735 P(S3/F) = 0.07/0.49 = 0.143 P(S1/U) = 0.24/0.51 = 0.47 P(S2/U) = 0.24/0.51 = 0.47 P(S3/U) = 0.03/0.51 = 0.06 Solution Solve the decision tree using the posterior probabilities just computed.