Name:______KEY_________________________ Date: : ______

Name:______KEY_________________________ Date: _____________________ Block: ______

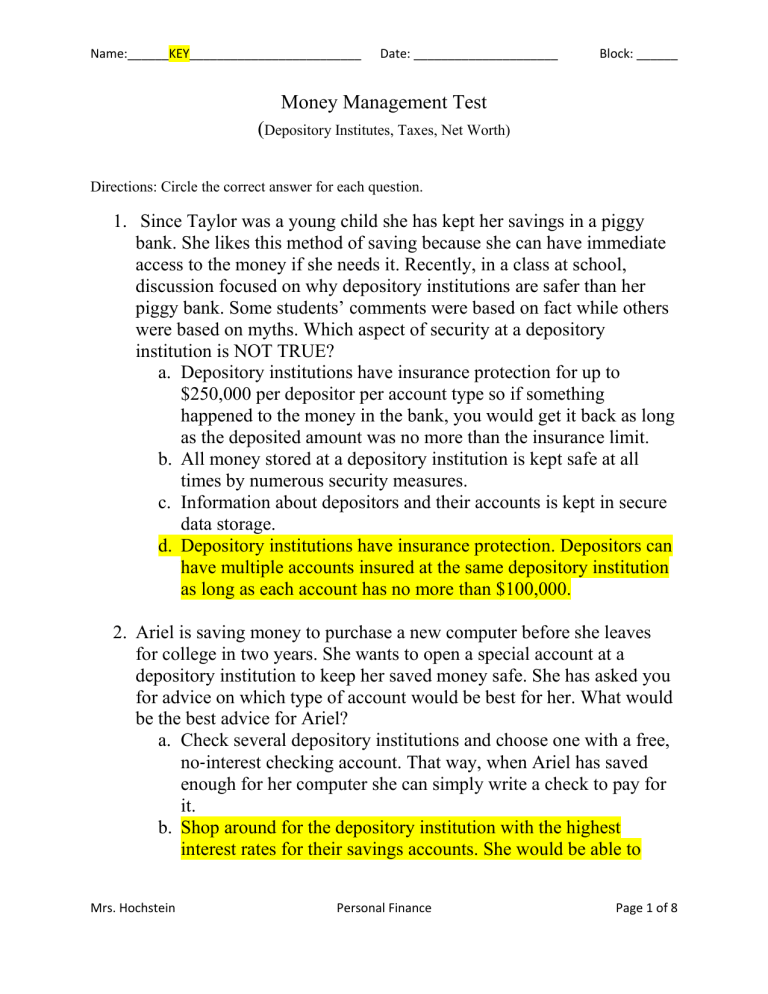

Money Management Test

(

Depository Institutes, Taxes, Net Worth)

Directions: Circle the correct answer for each question.

1.

Since Taylor was a young child she has kept her savings in a piggy bank. She likes this method of saving because she can have immediate access to the money if she needs it. Recently, in a class at school, discussion focused on why depository institutions are safer than her piggy bank. Some students’ comments were based on fact while others were based on myths. Which aspect of security at a depository institution is NOT TRUE? a.

Depository institutions have insurance protection for up to

$250,000 per depositor per account type so if something happened to the money in the bank, you would get it back as long as the deposited amount was no more than the insurance limit. b.

All money stored at a depository institution is kept safe at all times by numerous security measures. c.

Information about depositors and their accounts is kept in secure data storage. d.

Depository institutions have insurance protection. Depositors can have multiple accounts insured at the same depository institution as long as each account has no more than $100,000.

2.

Ariel is saving money to purchase a new computer before she leaves for college in two years. She wants to open a special account at a depository institution to keep her saved money safe. She has asked you for advice on which type of account would be best for her. What would be the best advice for Ariel? a.

Check several depository institutions and choose one with a free, no ‐ interest checking account. That way, when Ariel has saved enough for her computer she can simply write a check to pay for it. b.

Shop around for the depository institution with the highest interest rates for their savings accounts. She would be able to

Mrs. Hochstein Personal Finance Page 1 of 8

Name:______KEY_________________________ Date: _____________________ Block: ______ make regular savings deposits and earn interest while she is saving up for the computer. c.

Look for a Credit Union that offers share draft accounts. These secure accounts are designed especially for saving for long ‐ term financial goals. d.

Shop around for a depository institution that offers safe deposit boxes. These accounts offer extra security for deposits and can be set up to allow her to withdraw her money when she needs it.

3.

Ryan will be traveling to China this summer on a school ‐ sponsored cultural exchange program. He has been told that his debit card will not work in the area of the country they are traveling to and that he should not carry large amounts of cash for safety reasons. To determine if his bank offers services that can help him access his money while in China, he should ask his bank about: a.

Safe Deposit Boxes b.

Checking Accounts c.

Savings Accounts d.

Special Needs Payment Instruments

4.

Jacob received an email from his depository institution describing a new service being offered where he can access his account, transfer funds, and pay bills from his smartphone or tablet. This new service is best described as: a.

Contactless Banking b.

Online Banking c.

Mobile Banking d.

ATM Banking

5.

Samantha wants to be able to use funds in her checking account but finds going to the bank to withdraw cash to be inconvenient. She would like a more effective way to access her checking account funds. What would you suggest she do? a.

Apply for mobile banking. That way she can access her money with her smartphone to pay for the things she needs. The amount she spends would automatically be deducted from her savings account.

Mrs. Hochstein Personal Finance Page 2 of 8

Name:______KEY_________________________ Date: _____________________ Block: ______ b.

Apply for a debit card. That way she can use the card instead of cash to purchase the things she needs and the amount spent is immediately deducted from her account. c.

Apply for a credit card. That way she can use the card to purchase the things she needs and pay for it when the credit card statement comes from her checking account. d.

Request a cashier’s check from her depository institution. That way she can spend money from her checking account without risk of an overdraft fee.

6.

David made a mistake in his checking account recordkeeping and spent

$10 more than he had deposited in his account. As a result, he can expect to be charged a(n): a.

ATM Fee b.

Contact Fee c.

Safe Deposit Fee d.

Overdraft Fee

Directions: Read the following statements and determine which type of tax the statement describes by putting the corresponding letter in the blank. Note some of the words are used more than once.

7.

__B___ Funds the Social Security and Medicare

Programs

8.

__C___ The fee to license a car is this type of tax

9.

__A___ A tax on earned and unearned income.

10.

__E___ The tax on airline tickets and gasoline

11.

__B___ This tax is determined by a set percentage of earned income

12.

__D___ A tax that is added to the original price of an item purchased in a retail store

13.

__A___ The specific amount paid for this tax depends on many factors but increase as income increases.

Directions: Answer the following questions with complete sentences. a) Income Tax b) Payroll Tax c) Property Tax d) Sales Tax e) Excise Tax

Mrs. Hochstein Personal Finance Page 3 of 8

Name:______KEY_________________________ Date: _____________________ Block: ______

14.

How do taxes relate to the principle “you are better off being in a community than by yourself?”

Taxes are a way that members of a community can provide for the care and protection of each other in a variety of ways. Taxes help fund the creation of roads, public schools, libraries, police and fire departments, military for national security, government safety net programs, recreation

(such as parks and trails), and much more. Without taxes, it would be difficult for you to individually create many of the benefits provided by being part of a community.

15.

As a person living in the United States you are a taxpayer. What are two benefits you receive from the taxes you pay?

Answers will vary: roads, public schools, libraries, police and fire departments, military for national security, government safety net programs, recreation (such as parks and trails),

16.

What is the difference between earned and unearned income? Provide at least one example of each type of income.

Earned Income: Money earned from working for pay

Unearned Income: Income received from sources other than

17.

employment federal income tax helps pay for?

What are two items or services that

Answers will vary: Operations of federal government, Government

Programs live Education, Defense of the nation, Disaster Relief

18.

What is the Social Security System?

Social Security is a federal government program that helps citizens fund retirement, as well as helps people who have experienced profound disability, the premature death of a parent (if under the age of 18), or the premature death of a spouse in a family with children.

Mrs. Hochstein Personal Finance Page 4 of 8

Name:______KEY_________________________ Date: _____________________ Block: ______

Income for Retirees, People with profound disability, children who have lost a parent, and/or a person with children who has experienced the death of a spouse

19.

What is the Medicare Program?

Medicare payroll tax helps fund the Medicare program, which is a federal program with the main purpose to help pay for health care for senior citizens in the U.S.

Helps pay for health care for Senior Citizens

20.

If an employee owes $250 for payroll taxes, how much will the employer need to pay for payroll taxes?

Employers match their employees’ tax contribution.

21.

What is one difference between income and payroll tax?

Answers will vary: 1)Income tax: paid on both earned and unearned income; payroll tax: paid on only earned income. 2) Income Tax: amount paid depends on many different factors but increase as income increase; payroll tax: a set percentage of earned income is paid. 3)

Income tas: funds many different operations and programs of the federal government; payroll tax: funds the Social Security and Medicare programs.

22.

What are two pieces of property besides an automobile that property taxes may be paid on?

Answers will vary: land, buildings, houses, automobiles, boats, motorcycles, trailers

23.

What is one difference between sales tax and excise tax?

Excise tax is included in the price of an item and sales tax is added to the price of an item. Excise taxes are charged on consumption items

(such as gasoline, hotel rooms, alcohol, ciragrettes, and airline tickets – varies by state, city, or county. Sales tax is a tax on items purchased in retail stores and varies bys tate or even by city or county.

Directions: Match the word with its definition.

Mrs. Hochstein Personal Finance Page 5 of 8

Name:______KEY_________________________ Date: _____________________ Block: ______

24.

__C___ Liabilities

25.

__B___

26.

__A___

Assets

Net Worth a.

The amount of money left when b.

c.

liabilities are subtracted from assets

Everything a person owns with monetary value.

What is owed to others

Directions: Help Mindy understand her Statement of Financial Position by answering her questions below. Make sure to provide an explanation to each answer to help Mindy learn more about the Statement of Financial Position.

27.

Mindy still owes $25,000 on her home loan. However, she called her loan provider and they informed her that if she were to pay her home loan off today, she would pay $18,500 because she wouldn’t have to pay interest for the remainder of the loan. What amount should be recorded in the liabilities section of her Statement of Financial

Position?

Mindy would record $18,500 in the liabilities section because when recording the amount for a liability, you record what you would pay if you were to pay the loan off in full today. Financial Statements describe an individual or family’s financial condition on a specified date.

28.

Mindy signed a contract with her Internet provider and will be paying $75 per month for her Internet service for a minimum of one year. Since she is required to pay this monthly payment for a year, should Mindy’s monthly Internet service fee be recorded as a liability on her Statement of Financial Position?

Mindy’s monthly Internet Service is an expense (money spent) and not a liability; therefore, it should not be recorded on the financial statement.

29.

Mindy purchased a computer last year for $800. However, after looking through the newspaper classifieds and an Internet selling site,

Mrs. Hochstein Personal Finance Page 6 of 8

Name:______KEY_________________________ Date: _____________________ Block: ______ she sees that similar computers are only selling for $300. What amount should be recorded in the asset section of her Statement of Financial

Position?

Mindy should record the market value of her computer, $300, on the

Financial Statement not the purchase price.

30.

Mindy is grateful to have an employer-sponsored retirement account that is worth $10,000. She knows this is an asset, but doesn’t know if it should be recorded as a monetary, tangible, or investment asset. How should she record this asset?

An employer-sponsored retirement account is an investment asset – the sole purpose of the asset is to make more money .

31.

After completing her Statement of Financial Position, Mindy finds that she has a net worth of $40,000. She doesn’t quite understand how she can have a net worth of $40,000 if she earns $50,000 per year at her job. Help Mindy understand the difference between net worth and income.

Net worth is a measurement of how much a person or household owns once all debts have been paid. Net worth is different than income. Income is money received such as wages earned from working for pay. A person can have a high income and low net worth and vice versa. If a person spends all money received and does not save and/or invest any money, they may have low net worth (no matter how high their income is).

Directions: Answer the following questions with complete sentences.

32.

What is the purpose of a Statement of Financial Position?

The financial statement is a tool that tells you your Net Worth which is an objective measure of wealth. Therefore net worth is like your personal financial thermometer, because it provides a number that can measure your “financial temperature”. Only you can decide what you want your financial temperature to be – the amount of wealth desired varies for everyone. When you know your net worth, you can make better financial decisions. If you are thinking of purchasing a car, your net worth gives you information to make a better decision on whether or not you can take on more liabilities

(debt).

33.

Describe the difference between monetary assts and tangible assets.

Monetary assets are assets that can be quickly and easily converted to cash like cash on hand and money in a checking and savings account. Tangible assets are personal property that were purchased to create a lifestyle or improve your life such as a home,

Mrs. Hochstein Personal Finance Page 7 of 8

Name:______KEY_________________________ Date: _____________________ Block: ______ automobile, electronics, furniture and any other personal property such as clothing, jewelry, and sporting goods.

34.

Why is the market value, instead of the purchase value, of assets listed on the Statement of Financial Position?

Market Value is what you could realistically sell that asset for today and the Statement of

Financial Position is created for a specified date in time. The purchase price is what the item cost when it was bought, not what it is worth today. The value of tangible assets can change, often decreasing, over time so the market value is listed on the financial statement, not the purchase value.

35.

How can you increase your net worth?

You can increase your net worth by decreasing your liabilities, increasing your assets, or a combination of both. Increasing assets and/or decreasing liabilities will require you to evaluate how you manage your money .

Mrs. Hochstein Personal Finance Page 8 of 8