Opening Statement - Department of Finance (9 July 2014)

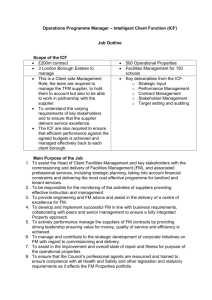

advertisement

Joint Committee on Finance, Public Expenditure and Reform

Wednesday 9th July 2014

Matters relating to the collapse of Setanta Insurance

Opening remarks

I wish to thank the Joint Committee for the invitation to brief it on the collapse

of Setanta Insurance and, in particular, to provide you with information on the

role and the operation of the Insurance Compensation Fund and how this Fund

may be used to assist those policyholders affected by the closure of Setanta.

I am accompanied by my colleagues Antoine MacDonncha, Bríd Kemple and

Aideen Morrissey from the Department.

I propose to address the four specific matters which you have raised in your

letter.

Insurance Compensation Fund

The Fund was established under the Insurance Act, 1964 ('the 1964 Act') to

make arrangements to meet certain liabilities of insolvent insurers, to provide

for the Minister to make advances to the Fund and to provide for contributions

to the Fund by insurers.

The Fund is maintained and administered under the control of the President of

the High Court. Amounts are paid from the Fund, with the approval of the

High Court, to a person in relation to an insurer in liquidation or

1

administration, in respect of claims under policies issued by the insolvent

insurer in circumstances where it is unlikely that the claims can be met

otherwise than from the fund.

The Accountant of the High Court ('the Accountant') provides annual accounts

of the Fund to the Department of Finance and the Central Bank and these are

laid before the Houses of the Oireachtas.

In the period since the early 1980s, the Fund has advanced monies to Primor

plc (formerly PMPA Insurance Company) and Icarom plc (formerly Insurance

Corporation of Ireland) and since 2011, QIL (Quinn Insurance Limited.

Currently, there is a balance of €48m in the Fund.

Funding by the State

In accordance with section 5 of the 1964 Act, in the event that the Fund does

not have sufficient funds to meet a payment approved by the High Court, the

Minister for Finance may, on the recommendation of the Central Bank,

advance Central Fund monies to the Fund to enable payments out of the Fund

to be made promptly, and on the terms and conditions that he decides to be

appropriate.

Contribution to the Fund by insurers

The Fund is, ultimately, funded by contributions from insurers. Prior to 2011,

the act provided for charges to be levied on insurers in respect of policies

issued regardless of the location of the insured risks. Following advice from

the Attorney General, that charges could not be levied on insurance companies

in respect of risks outside the State, an amendment was made to the 1964 Act

through the Insurance (Amendment) Act 2011 ('the amendment Act'). The

amendment Act

2

provides that the Fund shall be funded by contributions from insurers

who issue policies in respect of risks in the State, whether the insurers

are based in Ireland or in another member State, and

changed the scope of the Fund, from one that covers the risks of

policyholders of Irish authorised insurance companies, to one which

covers all insured risk in the State, except for specific excluded risks.

Under the Act, the Central Bank has responsibility for determining whether the

Fund requires financial support and the level of contribution to be paid to the

Fund by insurers. The contribution may not exceed 2 per cent of aggregate of

the gross premiums paid to each insurer for policies issued in respect of risks in

the State.

A levy in accordance with Section 6 of the Act (as substituted by Section 7 of

the Insurance (Amendment) Act 2011) came into effect on 1 January

2012. The Central Bank set the levy at the maximum 2% of aggregate of the

gross premiums paid. The Department of Finance estimates that the levy will

generate approximately €65 million per annum. (In 2013 the levy generated

€64.6m.) The levy is payable quarterly in arrears to the Revenue

Commissioners, who have responsibility for its collection, and they transfer the

proceeds of the levy to the ICF account.

Liquidation of an insurance company

The Committee will be aware that the liquidation of an insurance company is a

legally complex and time-consuming process. In general terms, under the

Statute of Limitations, claimants are given two years following an accident to

make an initial claim. However, it could take several years for a particular case

to be settled. Protracted legal challenges also add years, and often additional

costs, to the claims process. These are factors that the Liquidator is currently

examining in order to get an estimate of the cost of claims in the Setanta

liquidation.

3

Committee members will be aware that the liquidation of Setanta insurance is

still at an early stage. The Liquidator has advised us that claims and "Incurred

But Not Reported" amounts (IBNR) are likely to be considerably greater than in

the Statement of Affairs as prepared by the Directors at the time of

liquidation. The Liquidator has appointed Towers Watson to conduct an

assessment of the adequacy of the claims reserves quoted in the Statement of

Affairs. To date he has only received preliminary information from Towers

Watson on claims and INBR reserve amounts as part of a detailed examination

of the insurance claims against the company. The Liquidator has emphasised

that any information on claims is subject to change as more information is

received and that this may have a material impact on the overall estimate of

the likely maximum dividend that will be payable from the liquidation.

How claims may be paid out

The main factors in relation to the ICF payments of claims as set out in the ICF

legislation is as follows;

A payment may only be made if it appears unlikely that the

claim can be met otherwise than from the Fund. This means that

it is necessary to clarify,

o how much is available from the Liquidator to go towards the claim

o whether or not MIBI is in a position to pay the claim or a portion

of the claim

The ICF only pays out on claims where an individual is involved. The

Act provides that claims by bodies' corporate or unincorporated bodies

are not covered by the Fund except where there is a liability to or by an

individual. While the Liquidator has informed us that Setanta had a

significant number of "commercial" policies, he is not in a position to

clarify the exact amount at this stage. He has indicated that 'It doesn't

necessarily follow that most claims would not be covered by the Fund.

While we have not detailed breakdowns, we expect that the majority of

4

claims will relate to liability to individuals and would therefore be

covered'.

In a liquidation situation, the ICF only pays out 65% of the total claim

or €825,000, whichever is the lesser.

The ICF does not refund unearned premiums.

The Motor Insurance Bureau of Ireland

The Motor Insurance Bureau of Ireland (MIBI) is a non-profit-making

organisation registered in Ireland, which was established by Agreement

between the Government and those companies underwriting motor insurance

in Ireland, in accordance with EU Motor Insurance Directives.

All insurance companies underwriting motor insurance in this country must, by

law, be members of MIBI and contribute to funding claims in proportion to

their market share. The principal role of MIBI is to compensate innocent

victims of accidents caused by uninsured and unidentified vehicles. This is

regulated under the terms of a 2009 Agreement between MIBI and the

Minister for Transport, Tourism and Sport.

MIBI does not operate a fund. Claims are received and issued to one of four

major insurers which handle the claims on behalf of MIBI. When claims are

settled, MIBI member motor insurance companies are levied to make up the

amount due. This means that MIBI is funded entirely by premiums paid by

insured policyholders and it has a responsibility to ensure that all its payments

are appropriate and fair.

The arrangements put in place by MIBI for dealing with the Setanta claims is a

matter for MIBI itself under the terms of the Agreement and as such it falls

5

outside the remit of the Minister for Finance to issue instructions to MIBI. The

situation of Setanta Insurance, where an insurance company has gone into

liquidation, is believed to be unprecedented. Given this fact and its potential

impact, MIBI is taking legal advice as regards its role and responsibilities. The

MIBI board will be meeting in the coming days after which further clarifications

are expected.

The question of the Liquidator accessing the ICF.

The question as to how the ICF can assist those policyholders affected by the

Setanta closure, the role of the MIBI and the work of the liquidator continues

to be examined by the Department. The process to be followed and the formal

procedures for making applications will be set out once clarification is reached

on a number of issues.

It goes without saying that payments made by the relevant parties must be

entirely in compliance with laws and agreements under which they operate. In

the case of Setanta, it is necessary for all the parties to obtain clarity on the

legal position. Furthermore, for the Liquidator, each case is subject the terms

of the individual insurance policy itself.

According to Section 3B of the 1964 act, as amended, where a person who

performs the functions of a Liquidator has been appointed to an insolvent

insurer in another Member State, then the Accountant to the High Court may

apply to the High Court for approval for amounts due to claimants subject to

the limitations set out in the legislation.

The Office of the High Court Accountant will liaise with the Central Bank of

Ireland and Department of Finance on the state of the ICF and its ability to

meet claims. The ICF is expected to be adequately funded to meet all claims

but the Minister for Finance may advance monies to the ICF to meet any

shortfall if necessary.

6

Closing remarks

Committee members will be aware of the Ministers strong desire that matters

relating to the liquidation of Setanta be progressed and concluded in an

orderly fashion. This is important for the claimants as well as former policyholders of Setanta Insurance. It is also important for the insurance sector as a

whole.

In summary then, Setanta claimants should continue to contact the Liquidator

in relation to their claims until otherwise advised. The Liquidator is continuing

his work on providing clarity to the extent he can on the full extent of claims

and the likely dividend from the liquidation. Once further information

becomes available, and the outcome of MIBI's consideration of its legal advice

has been taken into account, the Department will further examine how the ICF

can assist those policyholders affected by the Setanta closure.

The Department and the Central Bank continue to work with the Liquidator to

assist in that regard.

I am happy to take any questions or clarifications to assist the Committee.

Thank you

7

![FORM NO. 157 [See rule 331] COMPANIES ACT. 1956 Members](http://s3.studylib.net/store/data/008659599_1-2c9a22f370f2c285423bce1fc3cf3305-300x300.png)