General Report

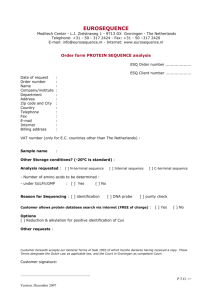

advertisement

General Report Host institution and exact dates of semester abroad: Wirtschaft Universität Wien, from the 1st of September till January 31st . The actual semester started in the beginning of October, but there was a pre-semester language course and a cultural program in September. I strongly recommend you to participate in this, since you’ll meet so many fun people during this program. Furthermore it was much fun to have some tours through museums, public buildings etc. At last, the language course is a great opportunity to improve your German! Contact with home faculty, preparation and journey: The contact with both faculties went pretty smooth. After my admission for the WU, I received some information from the RUG about the things I had to arrange. Just make sure that you store the documents you receive from both faculties, so that you can easily obtain it when needed. As a preparation I would recommend you to arrange all the documents on time. Things to think about: Registration at WU after receiving the nomination letter, Erasmus (health insurances) and Learning agreement, residence and the course registration in August (make sure you are logged in before the registration opens, otherwise the webpage could be full!!). Furthermore it might be useful to take a credit card, since you often need this when you are travelling or booking any stuff. On the first of September my dad drove me to Vienna, so I could take extra stuff with me. It’s about 1250 km from Groningen, so that’s a lot more than the ski regions for instance. If you take a flight there are basically two options: - Fly to Vienna from Rotterdam/The Hague. Or depart from Eelde and fly to Salzburg. From there you can take a three hour train to Vienna. If you do this I recommend you to take the Vorteilscard Jugendlich at ÖBB (train organization) This card costs 19 euro, it’s valid for 1 year and gives you 50% discount on all domestic train tickets! Residence abroad I chose for a residence at the OEAD, which is the main supplier of student residences in Vienna. Most of the exchange students chose to do this, which means that you will meet a lot of people at your dorm! It’s also possible to find an accommodation privately via local websites. The advantage of those residences is that you get more space for the same price. In general, the rent is a little more expensive than in Groningen. I paid 376 per month for everything included. My bedroom was 10/11 m2 and there was a common room/kitchen of 12 m2 which you share with 2 other students. Besides, we had 2 bathrooms! After your arrival in Vienna, you should get your temporary residence permit within three days after your arrival! The OEAD gives you the information necessary to arrange it when you arrive, so that you know where to go. If you stay longer than three months, like I did, you need a confirmation of permanent residence. This has to be done within four months after your arrival in Austria. Keep in mind that this is a bureaucratic process, which can take like 5 hours. You need to bring all your documents to the office (Meldenszettel, nomination letter, Erasmus agreement, Passport, Insurance valid in Europe, Student ID, letter of acceptance) otherwise they’ll not help you. The fee is about 30 euros. Grant – Amount – Expenses The Erasmus grant was €1250 in total (€250 per month). I received €950 in September and I will receive the remaining amount when I get back in Groningen. Besides I received grant of €100 per month for not using my public transport card. Living expenses are 10 to 20 percent higher than in Groningen. Especially in the beginning I had some start-up costs because I bought the metro semester ticket (€150), Vorteilscard, EBN membership, EBN trips and deposits, OEAD deposit, etc. So the first month is quite expensive, although you can see it as costs, not expenses! Do to all my trips to surrounding cities and countries I spent almost €1000 euro per month, but it is definitely worth it, since you’re having the time of your life!!! The big advantage of Vienna is its central location in Europe, which makes traveling cheap and easy! Cities and places I recommend you to visit are Budapest, Prague, Bled (Slovenia), Hallstatt, Belgrade and the coastline of Croatia! You can easily organize trips with a small group by renting a car or going by bus. For hostels you should check www.hostelworld.com or www.airbnb.com. These sites gave us for instance a hostel at the main square in Sarajevo for €7,50 per night including breakfast! Study (general) I took 6 courses in total, which all counted for 6 ETCS. Compared to Groningen, the workload was quite low. The schedule of the courses differed a lot, so that I never had the same schedule from one week to the other. The first course that I took, IFM II, was done in two days, both days from 9 to 6! After that, we had a 2 hour session in which we did a test exam. The last session was 1 hour in which we took the exam. Another course had 6 sessions consisting of 4 hours each. The exam was during the end of the last session, which made the total contact hours 24. This is in general the amount per course. Besides our contact hours, I didn’t have to do much for homework. Most courses required one small presentation or a group assignment, which could all be done in a couple of hours. It was relatively easy to obtain a good grade. Some courses even offered between 10 and 30 percent for an active posture during the tutorials! Furthermore, the assessment for the presentations were quite mild. Overall, the workload was ideal to do a lot of fun things during the semester. The campus is brand new and was opened last year. All the buildings look beautiful and offer a broad amount of facilities. The printing system is the only thing which didn’t work very convenient. The library has a great location and also offers some spots to hang out. Basically, the campus has enough facilities to spent your whole day there, with some restaurants, a Spar, some bars etc. The best thing is the Glühwein stands on campus which are opened from mid-November till February! Summary impression of the study period abroad The last semester has certainly been the best period of my life! I haven’t regretted going to Vienna for a single moment, since it was so much fun from the beginning to the end! The city is beautiful and offers a lot of architecture, cultural activities and a good nightlife. Besides the location of Vienna is ideally to travel through central- and eastern Europe. Last but not least, it is all the great people who make the amazing experience! There is a big diversity in people in the city and among the students, so that you learn a lot about foreign cultures, habits, food, languages etc. All in all, I strongly recommend future students to spend their exchange in Vienna! Specific Report Corporate finance 1. Lectures and literature The course dealt with investment project; weather it should be taken or not. We discussed different techniques to assess this. Furthermore, time value of money problems, equity-debt values, capital structures, leverage, etc. were involved. There was no textbook required 2. Overview of lecture program 3. Contents Day Date Time Goals of corporate finance Tuesday 10/14/14 01:30 PM - 05:00 PM Types of financial markets Time value of money (discounting and compounding), annuities, Tuesday 10/21/14 11:00 AM - 02:30 PM perpetuities Equity vs. debt finance, capital Tuesday 10/28/14 01:00 PM - 04:30 PM structure and financial leverage Weighted average cost of capital (WACC) Tuesday 11/18/14 01:00 PM - 04:30 PM Equity Finance for quoted and unquoted firms, preferred stock, Wednesday 11/19/14 01:00 PM - 04:30 PM privileged subscription Bonds and their feature, type of bonds Tuesday 12/02/14 01:00 PM - 04:30 PM Debt finance and substitutes: bank term loans, trade credits, terms of Tuesday 12/09/14 01:00 PM - 04:30 PM payment, stretching accounts payable, line of credit, factoring Relationship between risk and Wednesday 12/10/14 12:00 PM - 02:00 PM return Relevant cash flows of investment projects Capital budgeting techniques and investment: payback period, net present value, internal rate of return Room TC.3.09 D3.0.222 D4.0.039 D4.0.127 TC.3.10 EA.5.030 D4.0.039 TC.2.02 Ernst & Young 4. Lecture-related activities Case study about three different companies would had to take an investment project. The case studies had to be presented by the groups. 5. Relevance to Groningen study program This course was quite similar to Asset Pricing and Capital Budgeting in Groningen. Capital Structure and Financial Planning also gave me a good background knowledge. Therefore, the first part of the course was a bit straightforward. Fortunately I learned some new insights on the relationship between risk and return. Besides the case study was very useful and dealt with a broad amount of ‘practical matters’ in which it was not fully clear how to incorporate them in the cash flows. We also discussed some new capital budgeting techniques. 6. Study load Case study: 5 hours Lectures: 24 hours Preparation midterm & final exam: 10 hours 7. Assessment in Groningen 6 ECTS Assessment done by Dr. Christian Kreidl International finance 1. Lectures and literature The course discussed how financial- and money markets work. How arbitrages could be exploited. How risk can be diversified or dissolved by options and futures/forwards. All in all a very interesting course, I gained a lot from it! There was no textbook required, the slides were sufficient Day Date Time Room 2. Overview of lecture program 3. Contents The objective of the course is to provide an understanding of both the key features of foreign exchange markets and the actual problems of multinational corporation within an environment of free flows of foreign capital and floating exchange rates. Our attention will be especially focused on: Wednesday 10/22/14 04:30 PM - 08:30 PM D2.0.382 Thursday 10/23/14 02:00 PM - 06:00 PM TC.4.18 Friday 10/24/14 02:30 PM - 06:30 PM TC.2.03 Wednesday 11/26/14 02:00 PM - 06:00 PM TC.3.10 Thursday 11/27/14 02:00 PM - 06:00 PM TC.3.06 the architecture of foreign exchange markets Friday 11/28/14 02:00 PM - 06:00 PM TC.3.07 the motivation of participants in foreign exchange markets (arbitrage, speculation, hedging) the role of conventions in exchange rates quotation and trading in foreign exchange markets the type of foreign exchange operations (spot, forward, currency swaps, futures and option) the factors that influence the price of currency derivatives (forward rate, swap points, interest rates, futures price, option premium) the nature of foreign exchange exposure and risk and its management the relationship between the changes of exchange rates and the dynamics of fundamental economic factors (balance of payments, inflation, interest rates, expectations) the changes of foreign currency regime since the crash of Bretton Woods regime of fixed exchange rates the structure of the balance of payments and main relations between economic transaction in the balance of payments 4. Lecture-related activities Presentation about a financial related topic, we chose the financial crisis in Southeast Asia 5. Relevance to Groningen study program I found this course very interesting and highly relevant for my bachelor program. The arbitrages and how to exploit them were quite new for me, while the foreign exchange operations were partly dealt with in Capital Structure and Financial Planning in Groningen. The fun thing about this course is that it has some practical interpretations which will be relevant for my future career. The assessment was a bit mild I think and the presentations were to heavy weighted since it didn’t cost a lot of effort. 6. Study load Presentation: 8 hours Lectures: 24 hours Preparation exam: 10 hours 7. Assessment in Groningen 6 ECTS Assessment done by Josef Tauser P.h.D. International financial management I 1. Lectures and literature The course was based on financial markets, stock portfolios, risk diversification, covariances, investment projects, Beta’s, NPV, etc. I found it very interesting, since you can imagine the practical value from studying these topics. Day Date Time Room 2. Overview of lecture program 3. Contents Wednesday 10/08/14 02:00 PM - 06:00 Basic Concepts (Cost of Capital, Valuation and Valuation Shortcuts, YTM of Bonds, EXCEL Solver, Basic Concepts Wednesday 10/15/14 02:00 PM - 06:00 of Uncertainty) Expected Portfolio Return and Portfolio Wednesday 10/22/14 02:00 PM - 06:00 Risk Implementation in Practice (Scenariobased implementation, Implementation Wednesday 10/29/14 02:00 PM - 06:00 based on historical data) Market Risk, Unique Risk and Wednesday 11/05/14 02:00 PM - 06:00 Diversification Beta Efficient Portfolios Portfolio Management without Risk-Free Borrowing/Lending Wednesday 11/12/14 02:00 PM - 06:00 Portfolio Management with Risk-Free Borrowing/Lending Sharpe Ratio Wednesday 11/19/14 02:00 PM - 06:00 Capital Asset Pricing Model (CAPM) Deriving the Cost of Capital from a RiskThursday 12/04/14 05:00 PM - 07:00 Return Relationship (Capital Market Line, Security Market Line, Implementation in Practice) Capital Structure and Cost of Capital Weighted Average Cost of Capital Use of Cost of Capital (Stock Valuation, Capital Budgeting, Business Valuation)) PM TC.3.05 PM TC.3.05 PM TC.3.05 PM TC.3.05 PM TC.3.05 PM TC.3.05 PM TC.3.05 PM TC.0.10 Audimax 4. Lecture-related activities Four homework documents which were graded Case study 5. Relevance to Groningen study program The practical value of the course was valuable. The professor still works part time in the banking sector, so he focusses on the topics which are actually useful in real life. We learned how to diversify the risk of a portfolio by means of covariances. Besides, the process of unlevering Betas to a levered Beta by working with a benchmark firm was new for me. This was the hardest course I took. 6. Study load Homework exercises: 8 hours Case study: 10 hours Lectures: 24 hours Preparation exam: 10 hours Day Date Time Room 7. Assessment in Groningen 6 ECTS – Assessment done by Dr. Manuel Friday 10/03/14 09:00 AM - 07:00 PM D4.0.127 Lingo. International Financial Management II 1. Lectures and literature This course dealt with money- and financial market. Besides it discusses currency forwards, futures, options and how to price them. 2. Overview of lecture program Saturday 10/04/14 08:00 AM - 05:30 PM D4.0.133 Friday 10/31/14 09:00 AM - 11:00 AM TC.5.01 Friday 11/14/14 11:00 AM - 01:00 PM TC.1.01 OeNB 3. Contents International Finance: why do you need to understand international finance? Spot markets for foreign exchange Understanding forward rates for foreign exchanges Using forward rates The market for currency futures Currency options 4. Lecture-related activities A homework document consisting of 10 open questions. It counted for 20 percent of the grade. Besides there was a quiz at the end of every tutorial for 10 percent of the grade. 5. Relevance to Groningen study program This course overlapped a little bit with International finance. Besides, International Economics in Groningen was useful for understanding this course. I learned a lot about how to exploit different arbitrages in financial markets by hedging and using the money market. Furthermore I learned how to value a call/put option based on different models, this was challenging but exciting as well! 6. Study load Homework exercises: 10 hours Lectures/tutorials: 24 hours Exam preparation: 10 hours 7. Assessment in Groningen 6 ECTS Assessment done by P.h.D. Dr. Margarethe Rammerstorfer Monetary Policy in the US and the EU – with a special focus on the Financial Crisis and the Great Recession. Day 1. Lectures and literature The course is about the measures taken in different coutries, e.g. USA, UK, EU and Japan. Besides we discussed different regimes, strategies and the development of central banking through time. 2. Overview of lecture program 3. Contents Date Time Room Wednesday 01/07/15 02:00 PM - 07:00 PM D3.0.229 Thursday 01/08/15 02:00 PM - 07:00 PM TC.3.07 Friday 01/09/15 02:00 PM - 07:00 PM TC.3.21 Monday 01/12/15 02:30 PM - 07:30 PM TC.4.12 This undergraduate course will introduce you to the challenges of central banking during the dramatic Tuesday 01/13/15 02:15 PM - 07:15 PM TC.3.11 period following the financial crisis and the “Great Recession.” The primary emphasis of the course will be on the importance of monetary policy to the health of the economy. We will examine the role of central bank independence, decision making, and transparency in the process of making monetary policy. We will focus on the key roles of the Federal Reserve System and the European Central Bank in their respective economies, with special emphasis on the their actions during the 2007-2009 financial crisis, the serious recession that followed, and the long and slow economic recovery. 4. Lecture-related activities Presentation about the measures being taken by the ECB in 2014. 5. Relevance to Groningen study program It was a very interesting and relevant course, since it focusses on the practical matters of central banking, instead of the mathematical mechanisms. The lecturer had over 40 years of working experience at the FED, San Francisco, so he knew where he was talking about! It helped me a lot to examine how policies work in real life, because you also discuss the outcome. 6. Study load Lectures/Tutorials: 24 hours Case study/presentation: 15 hours Exam preparation: 10 hours 7. Assessment in Groningen 6 ECTS Assessment done by Prof. Gary C. Zimmerman, MA,BA Wirtschaftskommunikation Deutsch 1.Lectures and literature Day Date Time Room Monday 10/06/14 05:00 PM - 08:15 PM D1.1.074 Monday 10/13/14 05:00 PM - 08:15 PM D1.1.074 Monday 10/20/14 05:00 PM - 08:15 PM D1.1.074 Monday 10/27/14 05:00 PM - 08:15 PM D1.1.074 Monday 11/03/14 05:00 PM - 08:15 PM D1.1.074 Monday 11/10/14 05:00 PM - 08:15 PM D1.1.074 Dates 2. Overview of lecture program 3. Contents Thematisch im Vordergrund stehen verschiedene wirtschaftliche und unternehmensrelevante Bereiche wie Tourismus, Europäische Union, Bewerbungstraining, Werbung, Neue Medien, Banken und Finanzen, Personalmanagement, etc., wobei Aktualität und Österreich-Bezug besonderes Augenmerk gilt. By fulfilling this course, students will have speaking-communicative competences at B2 level. Wednesday 11/12/14 05:00 PM - 08:15 PM D3.0.222 Monday 11/17/14 05:00 PM - 08:15 PM D1.1.074 Monday 11/24/14 05:00 PM - 08:15 PM D1.1.074 Monday 12/01/14 05:00 PM - 08:15 PM D1.1.074 4. Lecture-related activities Monday 12/15/14 05:00 PM - 08:15 PM D1.1.074 A visitation to the Wirtschaftsmusuem in Vienna. A German presentation about an economic related topic. 5. Relevance to Groningen study program The ability to speak German is not directly applicable for my study program in Groningen, but it will be useful in the near future. For decennia, Germany has been the most important trading partner for the Netherlands , so I find relevant to speak/understand and write it. This course enhanced my Business German abilities a lot, and I am glad that I took it! 6. Study load Homework exercises: 5 hours Presentation: 5 hours Lectures/Tutorials: 35 hours Preparation exam: 5 hours 7. Assessment in Groningen 6 ECTS Assessment done by Mag. Kristina Reich