Gifts & Home Furnishings

advertisement

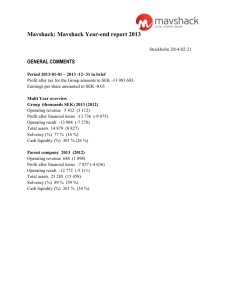

Interim report Q2 April – June 2013 This is New Wave Group New Wave Group is a growth company. We design, acquire and develop brands and products in the corporate promotion, gifts and home furnishings sectors. Our three operating segments are: Corporate Promo; promowear, promotional gifts and workwear, Sports & Leisure and Gifts & Home Furnishings. We are active in two sales channels; the promo market and the retail market. By being active in both markets the Group achieves good risk diversification. We also achieve great synergy advantages since major parts of our product range can be used in both sales channels. New Wave Group’s strengths are design, purchasing, logistics and marketing of our brands. The products are mainly produced in Asia and to a certain, lesser extent in Europe. New Wave Group has since the start had strong growth and good margins. Our brands Corporate Promo Operating segments and markets New Wave Group distributes more than 40 different brands, 4 of which are licensed brands. The rest are fully owned. Sport & Leisure Each brand is categorised according to which of our three operating segments it belongs to; Corporate Promo, Sports & Leisure or Gifts & Home Furnishings. The brands are distributed in both the promo market and the retail market to achieve good risk diversification. Gifts & Home Furnishings New Wave Group covers all three corporate promo segments; promowear, promotional gifts and workwear. Corporate Promo Corporate Promo is divided into three additional segments; promowear, promotional gifts and workwear. The segment’s domestic market is the Nordic countries which also answer for most of the sales. The segment had 39 % of the Group’s sales in 2012. The brands in the Corporate Promo operating segment are sold primarily in the promo sales channel, but some brands are sold in the retail sales channel as well. Corporate Promo promowear New Wave Group offers clothes adapted for printing and embroidery which, in addition to price and quality, also cover all application areas and sizes – from favourably priced basic garments to detailed garments made of exclusive textiles, leisure, work and sports clothes, clothes in classic and trend colours, in sizes from XS to XXXL. Harvest promowear to create team-spirit Jingham basic high-volume garments in classic company colours Clique high-quality basic garments and accessories in a wide range of colours and sizes New Wave exclusive and refined promowear Printer simple designs at great prices Grizzly good quality sporty promowear for active people Texas Bull basic garments perfect for large-volume activities Mac One wide range of classic garments for internal and external corporate marketing DAD maritime promowear for ambitious companies Hurricane strong basic textiles Corporate Promo promotional gifts The promotional gifts concept is broad and the segment covers a multitude of products and price classes. New Wave Group can offer everything from pens, USB flash drives and digital picture frames to handbags, bed linen and towels. Lord Nelson Queen Anne Wilson Staff Toppoint Nightingale Cottover Philips d-vice Lord Nelson classic high-quality bed, bath and kitchen textiles bed, bath and home furnishing products at great value for money reasonably priced high-performance golf balls suitable for profiling (licensed brand) giveaways such as pens and USB drives used to enhance corporate identity textile products at unbeatable prices high-quality terry and fleece promo products a selection of Philips products available in the promo market (licensed brand) innovative latest technology gadgets and devices top of the line bed and bath textiles There is a vast need for personal protection in some work areas. In Sweden, the issue is intensely promoted by trade unions. Corporate Promo workwear New Wave Group can offer workwear for such professional categories as construction and installation, painters and plasterers, transport and service, and hotel and restaurant. The collection is all-inclusive, ranging from underwear to outer garments for all seasons and weather conditions, retro-reflexive clothing, shoes, gloves, carrying systems and accessories. All garments and products are ergonomic and durable and come in sizes for both women and men. Jobman workwear for construction workers, painters and ProJob transport businesses complete workwear line, including safety shoes, highvisibility clothing and flame retardant garments Promowear brand James Harvest Sportswear helps companies create a winning team-spirit. Corporate Promo vision The vision for the Corporate Promo operating segment is to become the leading supplier in Europe and one of the leading suppliers in the USA of promotional products by offering retailers a broad product range, strong brands, advanced expertise and service, and a superior allinclusive concept. Sports & Leisure Sports & Leisure consists of 14 different brands. Two licensed brands – Speedo and Umbro – are sold alongside the company’s own brands. Sports & Leisure answered for 46 % of the Group’s sales in 2012. Most of the sales relate to the retail market (sports retail sector) but some sales also stem from the promo market. Speedo world-leading competition swimwear (licensed brand) Clique Retail basic garments for active people Umbro ground-breaking iconic football gear (licensed brand) Craft top of the line x-country, running, cycling and alpine skiing sportswear technically knitted socks and hats Seger Cutter & Buck impeccable classic golf wear ANNIKA Cutter & Buck’s exclusive golf wear collection designed for Annika Sörenstam high-quality comfortable women’s shoes Sköna Marie Kate Lord sophisticated and fun women’s golf wear Auclair one of Canada’s largest suppliers of gloves for men, women and children AHEAD golf caps, men’s golf wear and accessories PAX Paris Glove Laurentide top quality children’s shoes gloves for men, women and children work gloves, protective gloves, protective clothing and rain gear Sports & Leisure vision The vision for the Sports & Leisure operating segment involves establishing the wholly owned brands Craft and Seger as international functional sportswear brands, and making Cutter & Buck a world-leading golf apparel brand. The vision also entails strengthening Umbro in the Swedish market and Speedo also in the Norwegian and Danish markets. With regards to our most recent acquisitions, we want to launch AHEAD in Europe and in time achieve the same market position as in the USA. The brand Auclair should take a leading position in Europe and we will also use Paris Glove’s strong distribution platform to launch the Group’s other brands in Canada. All in all, we want to become the leading sports supplier in both Sweden and the other European countries, as well as in the USA. Gifts & Home Furnishings The Gifts & Home Furnishings operating segment includes 11 strong brands. In total, the segment’s brands are established in 15 countries. Gifts & Home Furnishings was responsible for 15 % of the Group’s sales figures in 2012. While the brands are mainly sold in the retail market, some sales also occur in the promo market. Kosta Boda handmade glass in bold shapes and striking colours SEA Glasbruk colourful and functional glass for everyday use Joyful Giftcard select your own gift Kosta Förlag publishing house Orrefors classic and elegant handmade glass Sagaform joyful and innovative gifts Kosta Linnewäfveri home textiles for the design-conscious Orrefors Jernverk Swedish designed kitchenware Kosta Outlet 20 000 m2 shopping Kosta Boda Art Hotel glass hotel, spa and conference centre Linnéa Art Rest. gourmet restaurant led by chef Edin Dzemat Joyful and innovative gifts from Sagaform, here represented by ‘Happy Days’ by Matz Borgström. Gifts & Home Furnishings vision The vision for the Gifts & Home Furnishings operating segment area is to make Orrefors and Kosta Boda worldleading glass and crystal suppliers. Part of the vision also involves utilising innovative and playful design to make Sagaform a prominent player in Northern Europe in both the promo and retail markets. The Group’s ambition is to become a prominent supplier in the North American promo market through its presence in the USA and Canada. Financial information April – June 2013 Sales amounted to SEK 995 million (SEK 1 075 million), -7% of which currency effect SEK 30 million (3 %). Operating result amounted to SEK 70.2 million (SEK 58.7 million) Result after tax amounted to SEK 38.9 million (SEK 33.3 million) Cash flow from operations amounted to SEK 41.8 million (SEK 132.8 million). April – June 2013 Sales -7%, SEK 995 million (SEK 1 075 million) Sales in local currencies -4%. Corporate Promo -6%, Sport & Leisure -7%, Gifts & Home -14%. Weak market conditions Sales weak in both sales channels Operating segments Corporate Promo -6% to SEK 421 million (SEK 448 million) - Sports & Leisure -7% to SEK 442 million (SEK 473 million) - Decrease primarily in Sweden, Oth. Nordic countries and Europe. Weak market primarily in Sweden, Oth. Nordic countries and Europe Gifts & Home -14% to SEK 133 million (SEK 155 million) - Primarily lower in the promo sales channel and in the export markets. April – June 2013 Sales per region Sweden USA Nordic countries excl Sweden Central Europe South Europe Other countries Total APR-JUN 2013 272 278 155 156 80 54 995 Part of turnover 27% 28% 16% 16% 8% 5% 100% APR-JUN 2012 314 280 176 166 86 53 1 075 Part of Change turnover MSEK 29% -42 26% -2 16% -21 16% -10 8% -6 5% 1 100% -81 % -13 -1 -12 -6 -7 2 -7 April – June 2013 Income statement SEK Million Income Goods for resale Gross profit Other operating income External costs Personnel costs Depreciation/amortization Other operating costs Associated companies Operating profit Financial income Financial costs Net financial items Result before tax Tax on profit for the period Result for the period Result per share 3 months Apr-Jun 2013 995.3 -529.1 466.2 46.8% 7.7 -209.7 -177.9 -14.6 -1.9 0.4 70.2 7.1% 3 months Apr-Jun 2012 1 074.9 -580.0 494.9 46,0% 9.5 -238.3 -189.2 -13.0 -5.9 0.7 58.7 1.4 -16.1 -14.7 0.5 -13.0 -12.5 55.5 46.2 -16.6 38.9 -12.9 33.3 0.60 0.50 5.5% April – June 2013 EBITDA per operating segment Corporate promo amounted to SEK 48.7 million (SEK 56.9 million) Lower sales, savings Sports & Leisure amounted to SEK 27.7 million (SEK 23.8 million) Lower turnover but higher gross profit margin and savings. Gifts & Home amounted to SEK 8.4 million (SEK -9.0 million) Lower sales but higher gross profit margin and savings Sales Result before tax April - June 2013 Cash flow 3 months Apr-Jun 2013 3 months Apr-Jun 2012 55.3 43.8 Changes in working capital -13.5 89.0 Cash flow from operations 41.8 132.8 Investing activitites -8.9 -15.1 Cash flow after investing activities 32.9 117.7 -42.0 -71.4 -9.1 46.3 SEK Million Cash flow from operating act. before changes in working capital Financial activities Cash flow for the period CEO summary – Q2 Market conditions and sales Still tough market situation. No change in Europe or Nordic countries. USA stable Stock to low in some basic promo articles Result Good cost control and savings Focus on improvements. Structural changes and reorganizations may be required Cash flow and working capital Good control Will increase the stock within corporate promo the coming quarters Future Continued tough in Q3 and maybe throughout the year. Will increase sales and marketing activities January – June 2013 Sales amounted to SEK 1 873 million (SEK 2 050 million), -9% of which currency effect SEK 58 million (3 %). Operating result amounted to SEK 86.3 million (SEK 61.3 million) Result after tax amounted to SEK 39.0 million (SEK 25.1 million) Cash flow from operations amounted to SEK 147.9 million (SEK 177.8 million). January – June 2013 Sales -9%, SEK 1 873 million (SEK 2 050 million) Sales in local currencies -6%. Corporate Promo -8%, Sport & Leisure -8%, Gifts & Home -15%. Weak market conditions Sales weak in both sales channels Operating segments Corporate Promo -8% to SEK 766 million (SEK 831 million) - Decrease primarily in Sweden, Oth. Nordic countries and Europe Sports & Leisure -8% to SEK 867 million (SEK 938 million) - Weak market in Sweden, Oth. Nordic countries and Europe - USA has a weak growth Gifts & Home -15% to SEK 240 million (SEK 281 million) - Primarily lower in the promo sales channel and in the export markets. January – June 2013 Sales per region Sweden USA Nordic countries excl Sweden Central Europe South Europe Other countries Total JAN-JUN 2013 485 501 294 334 158 100 1 872 Part of turnover 26% 27% 16% 18% 8% 5% 100% JAN-JUN 2012 558 524 323 365 178 102 2 050 Part of turnover 27% 25% 16% 18% 9% 5% 100% Change MSEK -73 -23 -29 -31 -20 -2 -178 % -13 -4 -9 -8 -11 -2 -9 January – June 2013 Income statement SEK Million Income Goods for resale Gross profit Other operating income External costs Personnel costs Depreciation/amortization Other operating costs Associated companies Operating profit Financial income Financial costs Net financial items Result before tax Tax on profit for the period Result for the period Result per share 6 months Jan-Jun 2013 1 872.6 -985.9 886.7 47.4% 16.3 -432.7 -352.6 -26.3 -5.7 0.6 86.3 4,6% 6 months Jan-Jun 2012 2 050.3 -1 111.2 939.1 45,8% 18.0 -485.5 -375.5 -24.9 -9.7 -0.2 61.3 3.2 -33.9 -30.7 1.9 -28.4 -26.5 55.6 34.8 -16.6 39.0 -9.7 25.1 0.60 0.38 3,0% Promowear brand James Harvest Sportswear helps companies create a winning team-spirit. January – June 2013 EBITDA per operating segment Corporate promo amounted to SEK 57.6 million (SEK 69.8 million) Lower sales, savings Sports & Leisure amounted to SEK 53.0 million (SEK 51.7 million) Lower turnover but higher gross profit margin and savings. Gifts & Home amounted to SEK 2.0 million (SEK -35.3 million) Lower sales but higher gross profit margin and savings January - June 2013 Cash flow 6 mths Jan-Jun 2013 6 mths Jan-Jun 2012 36.6 31.0 Changes in working capital 111.3 146.8 Cash flow from operating activities 147.9 177.8 Investing activitites -18.6 -25.9 Cash flow after investing activities 129.3 151.9 -198.4 -150.4 -69.1 1.5 SEK Million Cash flow from operating act. before changes in working capital Financial activities Cash flow for the period Financal highlights - summary 6 months 6 months Jan-Jun Jan-Jun 2012 2013 12 months 12 months 12 months 12 months 12 months Jan-Dec Jan-Dec Jan-Dec Jan-Dec Jan-Dec 2008 2009 2010 2011 2012 -8.7 2 222 5.2 2 423 1.0 2 258 -0.2 2 470 3.8 2 196 -11.2 2 203 9.8 2 562 47.3 6.0 4.6 3.0 45.8 4.2 3.0 1.7 43.6 3.8 1.7 0.3 47.7 8.9 7.7 6.5 47.1 9.1 7.7 7.1 46.5 5.9 4.2 3.1 48.5 9.4 8.0 5.1 4.0 5.0 2.5 3.2 0.4 2.0 9.9 8.9 12.1 9.4 4.9 4.3 9.2 9,0 46.0 73.3 76.9 1 429.3 1.2 43.4 83.4 79.0 1 710.0 1.1 44.1 77.5 77.3 1 516.7 1.3 43.5 85.9 78.6 1 797.3 1.2 44.8 72.8 75.3 1 406.6 1.4 41.0 96.3 87.7 1 740.8 1.1 34.1 140.5 94.3 2 576.3 1.2 Cash flow before investments, SEK million Net investments, SEK million Cash flow after investments, SEK million 147.9 -18.6 129.3 177.8 -25.9 151.9 341.1 -50.4 290.7 66.0 -326.5 -260.5 343.6 -57.6 286.0 806.3 -23.0 783.3 -268.0 -65.2 -333.2 Shareholders’ equity per share, SEK 29.38 30.89 29.51 31.54 29.14 27.24 27.64 Sales growth, % Number of employees Gross profit margin, % Operating margin before depreciation, % Operating margin, % Profit margin, % Return on shareholders’ equity, % Return on capital employed, % Equity ratio, % Net debt - Equity ratio, % Net debt - working capital ratio, % Net debt, SEK million Stock turnover, times Orrefors har ett klassiskt formspråk, med rena linjer som framhäver glasets form och karaktär. Post balance sheet events Craft Sportswear North America As of July1 New Wave Group, through its wholly owned subsidiary New Wave USA Inc, acquired the distribution of CRAFT products on the North American market. Operating transfer, initial purchase price is USD 3 million with an additional contingent consideration that cannot exceed USD 4.75 million. Pro-forma sales 2012 amounted to appr. USD 6.9 million and New Wave Group expects it will add some USD 0.7 million additionally in annual operating profit. New structure will provide a good basis for further expansion of the CRAFT brand in the USA and Canada. Final words We strive to make everyone who buys our products a happy customer. If you choose to invest in New Wave Group we want you to know that we promise to take care of your investment in the best possible way we can — through long-term thinking, growth, stability and hard work!