US Canada Trade

advertisement

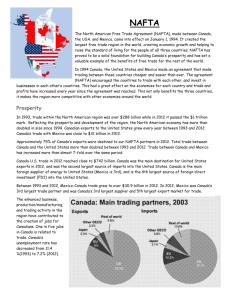

U.S. – Canada Trade: Opportunities Through NAFTA and Beyond Andrew I. Rudman Office of NAFTA & Inter-American Affairs International Trade Administration U.S. DEPARTMENT OF COMMERCE Northern Networks Trade Conference Duluth, MN October 18, 2006 TOP 10 U.S. TRADING PARTNERS 2005 $600 $400 287.9 $300 170.2 $200 243.5 138.1 S. K or ea . U .K m an y G er Ja pa n in a Ch ic o M ex na da 33.8 22 22.4 27.7 $0 EXPORTS 34.8 IMPORTS 33.7 10.4 M al ay si a 38.6 nc e 34.1 43.8 Fr a 41.8 55.4 51.1 an 84.8 120.0 iw $100 Ta 211.3 Ca BILLION DOLLARS $500 Source: U.S. Bureau of Census U.S. EXPORTS TO NORTH AMERICA EXCEEDING THOSE TO OTHER REGIONS 2005 NAFTA 36.7% EU 20.6% Canada 23.4% Other 10.1% Other West Hem 7.9% Pacific Rim 24.6% Mexico 13.3% Source: U.S. Bureau of Census U.S. TRADE IN PERSPECTIVE 2005 $800 $700 BILLION DOLLARS $600 458.1 $500 $400 308.8 $300 $200 331.4 243.5 $100 138.1 186.3 $0 NAFTA EU(25) EXPORTS 41.8 55.4 China Japan IMPORTS Source: U.S. Bureau of Census U.S. – NAFTA TOTAL TRADE 1990-2005 800 657.1 700 612.3 602.1 789.5 713.0 627.0 BILLION DOLLARS 561.9 600 503.3 477.3 500 421.2 380.6 343.2 400 293.2 265.0 300 240.6 233.5 200 100 0 90 991 992 993 994 995 996 997 998 999 000 001 002 003 004 005 9 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 Source: U.S. Census Bureau NAFTA TRADE IN PERSPECTIVE Most comprehensive Regional Trade Agreement signed by the United States Exports to NAFTA are outpacing rest of world NAFTA trade has increased by over $496 billion since 1993 to $789.5 billion in 2005 Combined trade is $2.2 billion a day between NAFTA partners, that’s $1.5 million a minute U.S. two-way merchandise trade with Canada and Mexico more than exceeds U.S. two-way merchandise trade with the European Union (25) and Japan combined U.S. exports to Mexico are greater than U.S. exports to Mercosur and the Andean region combined. U.S. – CANADA TRADE $300 287.9 256.4 230.8 216.3 $200 198.7 221.6 209.1 $150 163.4 160.9 2002 155.9 145.3 151.8 134.2 127.2 166.6 158.8 143.9 2001 168.2 211.3 189.9 178.9 169.9 114.4 $100 100.4 111.2 128.4 EXPORTS IMPORTS 2005 2004 2003 2000 1999 1998 1997 1996 1995 $0 1994 $50 1993 BILLION DOLLARS $250 Source: U.S. Bureau of Census CANADA & TRADE SHARE OF CANADIAN IMPORTS 2005 SHARE OF CANADIAN EXPORTS 2005 CHINA 1.6% REST OF WORLD 22.6% MEXICO 0.8% UNITED KINGDOM 1.9% GERMANY 2.7% JAPAN 2.1% UNITED KINGDOM 2.7% JAPAN 3.9% GERMANY 0.7% REST OF WORLD 9.0% UNITED STATES 56.5% UNITED STATES 83.9% MEXICO 3.8% CHINA 7.8% Source: World Trade Atlas CANADA & ENERGY In 2005, Canada had a reported 178.8 billion barrels of proven oil reserves, second only to Saudi Arabia. However, the bulk of these reserves (over 95%) are oil sands deposits in Alberta. Nevertheless, during January-November 2005, the top supplier in the world of crude oil to the United States was Canada (1.6 million bbl/d). More than 80 percent of U.S. natural gas imports come from Canada, mainly from the western provinces of Alberta, British Columbia, and Saskatchewan. Canada enjoys a vigorous electricity trade with the U.S., and the electricity networks of the two countries are heavily integrated. Source: U.S. Department of Energy NAFTA SUCCESSES LEVELED THE PLAYING FIELD CANADA: Duty-free in 1998 MEXICO: Virtually duty-free; average Mexican tariff has fallen from 10% to 2% all tariffs to be eliminated by 2008 STIMULATED TRADE GROWTH U.S. exports to NAFTA partners have grown by 133% For Canada up 110% for Mexico up 188% MINNESOTA & TRADE MINNESOTA & TRADE NAFTA: Exports from Minnesota to Canada & Mexico reached $4.1 billion in 2005, an increase of 101% since 1993 when exports were $2.1 billion. NAFTA: Over 28% of Minnesota’s exports go to the NAFTA region. CANADA: Canada is Minnesota’s #1 export market 24.4 percent of its exports go to Canada. In 2005 it exported $3.6 billion. CAFTA-DR: Exports from Minnesota reached $81.4 million in 2005. U.S. Peru TPA: Exports from Minnesota reached $19.8 million in 2005. U.S.-Colombia TPA: Exports from Minnesota reached $38.9 million. SHARE OF MINNESOTA’S MERCHANDISE EXPORTS , 2005 28 PERCENT WENT TO NAFTA JAPAN 6.0% CHINA 5.0% IRELAND 9.3% REST OF WORLD 51.6% NAFTA 28.1% Source: U.S. Bureau of Census The SPP- What Is It? The Goal: ensure North America Best and safest place to live, work and do business Maintains NORTH AMERICAN ADVANTAGE in era of global sourcing Builds on the NAFTA, P4P, and border initiatives to: Better protect citizens from man-made and natural threats Promote safe and efficient movement of people and goods The SPP consists of an economic and a security component Based on the principle that our common prosperity depends on our mutual security Expands economic opportunities by reducing barriers and making our businesses more competitive in the global marketplace The SPP- What Is It? The SPP is meant to: Cut red tape, lower costs for manufacturers by eliminating unnecessary barriers Enhance our mutual efforts to: improve our quality of life, protect our environment, improve food safety and consumer choice, combat infectious diseases, and develop responses to cross-border man-made/natural disasters Economic (‘Prosperity’) Component Working Groups Manufactured Goods (DOC) Lower production costs for North American manufacturers by eliminating unnecessary regulatory barriers, ensuring compatibility of regulations and by eliminating redundant testing requirements Provide consumers with cheaper, safer, and more diversified and innovative products The Other Nine: E-Commerce and ICT (DOC) Energy (DOE) Movement of Goods (USTR) Transportation (DOT) Food and Agriculture (USDA) Business Facilitation (DOS) Financial Services (Treas.) Environment (DOS) Health (HHS) Security Component Working Groups (DHS) Secure North America from External Threats Traveler and Cargo Security, and Bio-protection Prevent and Respond to Threats within North America Aviation and maritime security, law enforcement, intelligence cooperation, and protection, prevention and response Further Streamline the Secure Movement of Low-Risk Traffic across our Shared Borders Develop and implement strategies to combat threats, such as terrorism, organized crime, migrant smuggling and trafficking Some Accomplishments to Date Uniform in-advance electronic exchange of cargo manifest data (maritime, railroad and motor carriers) 50% Reduction of Detroit/Windsor waits Consumer Product Safety Agreements Food Safety Coordinating Task Force Harmonizing risk assessment mechanisms, and establishing protocols to detect fraud and smuggling Ongoing R.O.O. liberalization- $30 bln in goods affected NASTC Strategy (steel) US-Canada PulseNet MOU Creation of avian/pandemic influenza coordinating body Mexico adoption of low-sulfur fuel standard 2006 Initiatives Five SPP ‘Cancun’ priorities: Smart, secure borders Energy security Emergency management Avian and Pandemic Influenza North American Competitiveness Council North American Competitiveness Council (NACC) Membership- 10 private sector representatives from each country U.S. Secretariat- Council of the Americas and U.S. Chamber of Commerce Organization varies in each country Purpose: provide recommendations on N. American competitiveness that could be addressed through the SPP Value of high-level private sector input Recommendations AND solutions to SPP Ministers Next Steps NACC priorities to Ministers SPP Ministers Meeting early 2007 Working groups to continue existing projects and identify new deliverables Why Canada First? • • • Common language • Culture • Canadians are very familiar with U.S. products and services • • Geographic proximity • • Congruent time zone • High standard of living • Supportive Government • Roaring Canadian Dollar •US$ 1.00 = C$ 1.1357 • Highly developed transportation infrastructure Sophisticated telecommunications infrastructure integrated with the U.S. Stable, mature financial markets No restrictions on the movement of funds into or out of the country Efficient Marketing Channels Understanding Canada Your key to making a loonie or a toonie north of the border • Realize the significance of the U.S.-Canada trading relationship • In 2005, two-way trade amounted to US $479 billion - up 12% from 2004 and is larger than the sum of 15 European Union countries • Look at regional differences in Canada • Canada and the U.S. are similar in many ways, but understanding what makes Canada different and unique is important for U.S. exporters • Look to the U.S. Commercial Service for assistance in understanding the Canadian market and selling your products or services in Canada 80% of Canada’s Population Understanding the Differences A relatively small and dispersed Canadian population Culture Metric system Labeling Taxes Best Prospects for U.S. Exports to Canada (2006) • • • • • • • • • • • • • Sector Automotive Parts & Services (APS) Electronic Power Systems (EPS) Building Products (BLD) Plastic Materials/Resins (PMR) Oil/Gas Field Machinery (OGM) Computers/Peripherals (CPT) Computer Software (CSF) Telecommunications Equipment (TEL) Medical Equipment (MED) Agricultural Machinery and Equipment (AGM) Water Resources Equipment/Services (WRE) Security/Safety Equipment (SEC) Sporting Goods/ Recreational Canadian Market Entry Strategies APPOINT AGENT APPOINT DISTRIBUTOR FORM STRATEGIC ALLIANCES ESTABLISH BRANCH OFFICE IN CANADA ITA Can Help Commercial Service Canada Products and Services • Gold Key Service • Market Research • International Partner Search • Single Company Promotion (SCP) • Platinum Key Service • Trade Missions, DealMakers • Business Service Provider (BSP) Upcoming Trade Schedule Trade Events scheduled from 2006 – 2008 include: • Industrial/Maritime Security Event • Canadian Solid Waste & Recycling Expo • Meet the Buyers Seminar • Plastics Executive Service Trade Mission • Smart Building Seminar For a complete listing of all trade events occurring from 2006 – 2008, please refer to our website. http://www.buyusa.gov/canada/en Why Monitor and Enforce Trade Agreements? Trade Agreements increase market access for U.S. exporters. Important to all stakeholders that existing trade agreements are being enforced. Create confidence and support for future trade opening agreements. What Kinds of Barriers do Firms Face? Tariff and Customs Barriers Rules of Origin, Certificates of Origin Import Licensing Standards, Testing, Labeling, or Certification Lack of Intellectual Property Rights Protection Government Procurement Contracts ITA COMPLIANCE ACTION What we do? Identify unfair treatment Form Compliance Team COUNTRY, INDUSTRY, AND AGREEMENT SPECIALISTS, GENERAL COUNSEL, FOREIGN POST, OTHER – NIST, PTO Apply FTA/WTO Analysis Craft Action Plan to Resolve Issue USEFUL LINKS • • • • • • • • COMMERCE NAFTA SITE – www.mac.doc.gov/nafta/index.htm SECURITY & PROSPERITY PARTNERSHIP – www.spp.gov US & FCS (Minnesota) - www.buyusa.gov/minnesota/ US & FCS (Canada) – www.buyusa.gov/canada/en TRADE STATISTICS BY STATE – tse.export.gov TRADE INFORMATION CENTER – www.trade.gov/td/tic/ NORTH AMERICAN DEVELOPMENT BANK - www.nadbank.org NORTH AMERICAN COMMISSION FOR ENVIRONMENTAL COOPERATION – www.cec.org • UNITED STATES TRADE REPRESENTATIVE –www.ustr.gov • EXPORT INFORMATION – www.export.gov • MARKET ACCESS OR COMPLIANCE PROBLEMS – www.tcc.mac.doc.gov Contact Information Phone: Fax: 202-482-6452 202-482-5865 Andrew_Rudman@ita.doc.gov NAFTA Website: www.mac.doc.gov/nafta/compliance