ACCT 101 Exam 2 Review Problem 1: The following balances are

advertisement

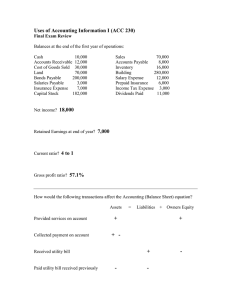

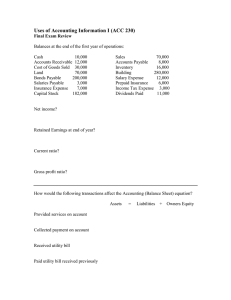

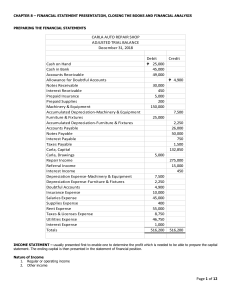

ACCT 101 Exam 2 Review Problem 1: The following balances are from Halloween Town, Inc. Cash Accounts Receivable ADA Prepaid Rent Prepaid Insurance Equipment Accumulated Depreciation Patent Accounts Payable Wages Payable Interest Payable Taxes Payable Note Payable Common Stock Retained Earnings Sales COGS Wage Expense Rent Expense Interest Expense Insurance Expense Depreciation Expense Income Tax Expense 20x11 46,400 50,000 10,000 6,000 2,400 210,000 70,000 6,000 40,000 10,000 0 3,000 50,000 80,000 47,800 100,000 30,000 10,000 24,000 4,000 2,000 10,000 6,000 20x10 30,000 65,000 5,000 3,000 3,600 190,000 60,000 0 50,000 0 5,000 4,000 70,000 50,000 37,600 During the year, Halloween Town exchanged 100 shares of Common stock worth $10,000 for a new piece of equipment worth that amount. The Note requires annual principal payments of $20,000. During 20x11, the company paid a dividend of __3,800______. No equipment was sold during the year. The tax rate is 30% and the 20x10 tax payable and ½ of 20x11 taxes were paid in 20x11. PREPARE A CASH FLOW STATEMENT AND ANSWER THE FOLLOWING QUESTIONS. ACCT 101 Exam 2 Review 1. The Total Assets at December 31, 2011 was: a. $200,800 b. $240,800 c. $240,000 d. $280,800 2. The Total Current Liabilities at December 31, 2011 was (be careful!) a. $53,000 b. $50,000 c. $73,000 d. $70,000 3. The Operating Income was a. $24,000 b. $25,500 c. $20,000 d. $22,000 4. The cash paid for wages in 2011 was: a. $10,000 b. $0 c. $11,000 d. $5,000 5. Cash flow from Operations was: a. $36,000 b. $35,200 c. $36,200 d. $26,200 6. Cash Flow from (Used by) Investing Activities was: a. ($16,000) b. ($10,000) c. ($20,000) d. $16,000 7. Cash Flow from (Used by) Financing Activities was: a. ($43,800) b. ($40,300) c. ($3,000) d. ($3,800) ACCT 101 Exam 2 Review 8. In the “Supplemental Cash Flow Information” section, the Cash Paid for Interest was: a. $9,000 b. $4,000 c. $13,000 d. $10,000 9. In the “Supplemental Cash Flow Information” section, the Cash Paid for Taxes was: a. $10,000 b. $7,000 c. $13,000 d. 0 10. Taxable Income for 2011 was: a. $14,000 b. $28,000 c. $20,000 d. $22,000 11. Net Fixed Assets at December 31, 2011 was: a. $210,000 b. $70,000 c. $280,000 d. $140,000 12. Financing Activities include: a. Issuance of Common Stock $30,000 b. Issuance of Common Stock ($20,000) c. New Borrowings ($20,000) d. Issuance of Common Stock $20,000 13. Investing activities include: a. Purchased Land ($100,000) b. Purchased Equipment ($20,000) c. Purchased Equipment ($10,000) d. Payment on Note ($20,000) 14. On November 19, Lauren’s Company made a $8,000 credit sale under the terms 2/10, n/30. If Lauren receives full payment of the account on November 26, the amount of cash received is: a. $ 8,160 b. $ 8,000 c. $ 7,840 d. $ 7,800 ACCT 101 Exam 2 Review 15. The accounts receivable turn measures: a. The ability of a company to turn sales into cash b. The ability of a company to pay its bills for the coming year c. How well a company uses its assets to create profits d. The amount of debt a company is carrying as a percentage of total assets 16. Which of the following would NEVER be an adjustment in arriving at net cash flow from operations on any Statement of Cash Flows? a. Add: Accumulated Depreciation b. Decrease in Net A/R c. Increase in Prepaids d. Increase Taxes Payable 17. Lucky Company had a beginning balance (12/31/2010) in Accounts Receivable of $300,000 and a beginning credit balance in ADA of $10,000. During 20x11, Lucky Co. sold $100,000 of goods on credit and collected $75,000. If Lucky Co. estimates that 4% of their ending accounts receivable will eventually not be collected, their adjusting journal entry for the bad debt expense will include a credit to ADA for: a. $13,000 b. $3,000 c. $10,000 d. $23,000 18. Still on Lucky Co. – if they had written off $6,000 of accounts receivable during 20x11, the debit to bad debt expense would have been: a. $8,760 b. $12,760 c. $6,000 d. $8,800 19. Lauren’s Lollipop Factory had a fire! She knows that last year she ended with $650,000 in inventory and after going through invoices she finds she had purchased $400,000 in inventory prior to the fire. Her average markup rate is 120% of the cost of the item. Her sales to date of the fire were $1,000,000. How much inventory did she lose in the fire? a. $595,454 b. $600,000 c. $365,000 d. $599,000 e. None of the above 20. You are buying a new Hummer. The cost is $70,000 with 10% down and the rest in 60 month payments which include interest at an annual rate of 6%. What are the monthly payments? a. $3,898.17 b. $1,159.97 c. $1,353.30 d. $1,217.97 e. None of the above REMEMBER TO STUDY YOUR RATIOS (A/R TURN, INVENTORY TURN, AVG COLLECTION PERIODS, AVG DAYS SALES IN INVENTORY, EPS