John Maynard Keynes

advertisement

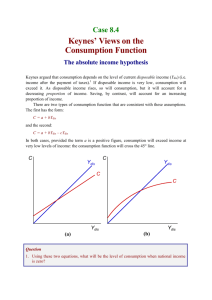

John Maynard Keynes, 1883 - 1946 • • • • • • Civil servant Pamphleteer Don, Kings College College Bursar Editor, Economic Jrl Company Chairman – National Insurance Co. • Patron of the Arts – Bloomsbury • Statesman – Spokesman – Advisor • • • • House of Lords Bank of England Lend Lease Bretton Woods Bloomsbury The Memoir Club (painting by Vanessa Bell) Clive Bell, Quentin Bell, Vanessa Bell, E.M. Forster, David Garnett, Duncan Grant, J.M. Keynes, Lydia Lopokova (Lady Keynes), Desmond MacCarthy, Mary MacCarthy, Leonard Wolff Duncan Grant, Keynes Bertram Russell, Keynes, Lytton Strachey Doing Economics: Math++ Professor Planck of Berlin, the famous originator of the Quantum Theory, once remarked to me that in early life he had thought of studying economics, but had found it too difficult! Professor Planck could easily master the whole corpus of mathematical economics in a few days. He did not mean that! But the amalgam of logic and intuition and the wide knowledge of facts, most of which are not precise, which is required for economic interpretation in its highest form, is, quite truly, overwhelmingly difficult … J. M. Keynes Alfred Marshall, 1842-1924 Economic Journal, September 1924 p. 333 fn. John Maynard Keynes (1883 – 1946): Major Works •Indian Currency and Finance , 1913. •The Economic Consequences of the Peace , 1919. •A Treatise on Probability, 1921. •Revision of the Treaty, 1922. •A Tract on Monetary Reform, 1923. •The Economic Consequences of Mr. Churchill, 1925. •"Am I a Liberal?", 1925, N&A •The End of Laissez-Faire, 1926 •"A Rejoinder to Ohlin's The Reparation Problem", 1929, EJ •Can Lloyd George Do It? with H.D. Henderson, 1929. •A Treatise on Money , two volumes, 1930. •"Economic Possibilities for Our Grandchildren", 1930, N&A and Saturday Evening Post. •Essays in Persuasion, 1931 •Essays in Biography, 1933 •The Means to Prosperity, 1933. •General Theory of Employment, Interest and Money , 1936. •"The General Theory of Employment", 1937, QJE "Alternative Theories of the Rate of Interest", 1937, EJ •"The Ex Ante Theory of the Rate of Interest", 1937, EJ •"The Theory of the Rate of Interest", 1937, in Lessons of Monetary Experience: In honor of Irving Fisher •How to Pay for the War: A radical plan for the Chancellor of the Exchequer, 1940. •"Proposals for an International Clearing Union" (Second Draft), 1941 “Europe Before the War” from Economic Consequences of the Peace • • • • What an extraordinary episode in the economic progress of man that age was which came to an end in August 1914! The greater part of the population, it is true, worked hard and lived at a low standard of comfort … But escape was possible, for any man of capacity or character at all exceeding the average, into the middle and upper classes, for whom life offered … conveniences, comforts, and amenities beyond the compass of the richest and most powerful monarchs of other ages. The inhabitant of London could order by telephone, sipping his morning tea in bed, the various products of the whole earth, in such quantity as he might see fit, and reasonably expect their early delivery upon his doorstep; he could at the same moment and by the same means adventure his wealth in the natural resources and new enterprises of any quarter of the world … ; or he could decide to couple the security of his fortunes with the good faith of the townspeople of any substantial municipality in any continent that fancy or information might recommend. Europe was so organised socially and economically as to secure the maximum accumulation of capital. While there was some continuous improvement in the daily conditions of life of the mass of the population, society was so framed as to throw a great part of the increased income into the control of the class least likely to consume it. … Herein lay, in fact, the main justification of the capitalist system … The immense accumulations of fixed capital which, to the great benefit of mankind, were built up during the half century before the war, could never have come about in a society where wealth was divided equitably. Thus this remarkable system depended for its growth on a double bluff or deception. On the one hand the labouring classes accepted from ignorance or powerlessness, or were compelled, persuaded, or cajoled by custom, convention, authority, and the well-established order of society into accepting, a situation in which they could call their own very little of the cake that they and nature and the capitalists were cooperating to produce. And on the other hand the capitalist classes were allowed to call the best part of the cake theirs and were theoretically free to consume it, on the tacit underlying condition that they consumed very little of it in practice. Now perhaps we have loosed him (Malthus’ devil) again. Keynes, A Skeptical Monetarist • … an arbitrary doubling of [the money stock], since this in itself is assumed not to affect [the velocity of money or the real volume of transactions] ... must have the effect of raising [the price level] to double what it would have been otherwise. The Quantity Theory is often stated in this, or a similar, form. Now "in the long run" this is probably true. But this long run is a misleading guide to current affairs. • In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons they can only tell us that when the storm is long past the ocean is flat again. • In actual experience, a change in [the money stock] is liable to have a reaction both on [the velocity of money] and on [the real volume of transactions]... John Maynard Keynes A Tract on Monetary Reform