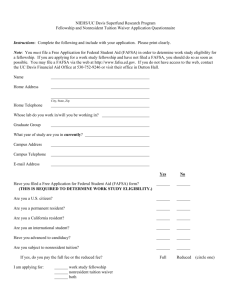

Applying for Financial Assistance

advertisement

2014-2015 Financial Assistance Information 1 http://www.studentaid.gov 2 • • • • • • Prepare for College Types of Aid Who Gets Aid FAFSA: Apply for Aid Loan Information Quick Links & Checklists 3 FAFSA: Apply for Aid • Quick Links: – How Aid is Calculated – The PIN – Filling Out the FAFSA 4 www.pin.ed.gov • • • • • • • PIN for student and parent Sign your FAFSA electronically Check status Review and correct answers Sign promissory notes electronically View info about federal loans & grants Reapply for financial aid in the future 5 How to Apply • Submit the Free Application for Federal Student Aid (FAFSA) beginning January 1st prior to every academic year • File on-line www.fafsa.gov – Use FAFSA On the Web Worksheet • .PDF FAFSA, print and mail 6 Web Advantage • Built-in edits to help prevent costly errors • Skip-logic allows student and/or parent to skip unnecessary questions • More timely submission of original application and any necessary corrections • More detailed instructions and “help” for common questions • Ability to check application status on-line • Simplified renewal application process 7 Organize Your Documents • • • • • • Social Security Numbers Driver’s License 2013 Income Tax Return (Estimate OK) 2013 W-2 Statements Asset information Investment records 8 IRS Data Sharing • IRS Data Retrieval Tool if taxes completed • Participation is voluntary • Use FAFSA on the Web to electronically view tax information • Tax information can also be securely transferred into the FAFSA 9 Meet Filing Deadlines • Meet FAFSA and priority dates / deadlines • College/University deadlines vary • You can use estimated information in order to meet financial aid application deadlines 10 Verification • The process of proving the accuracy of FAFSA information • About a third of all applications selected – Random selection, – Do not meet federal edits or – Chosen by the college/university 11 IRS Tax Transcript • If you do not use the IRS Data Retrieval Tool to provide tax information and your college requests a copy of your tax return or your parents’ tax return, you may be required to obtain an official tax transcript from the IRS. 12 General Eligibility Requirements • Must be enrolled or accepted for enrollment in an eligible program of study • Must be pursuing a degree, certificate, or other recognized credential • Must be a U.S. citizen or eligible non-citizen • Must be registered with Selective Service (if male and required to be) • May not have eligibility suspended or terminated due to a drug-related conviction while enrolled 13 Principles of Need Analysis • To the extent they are able, parents have primary responsibility to pay for their dependent children’s education • Students also have a responsibility to contribute to their educational costs • Families should be evaluated in their present financial condition • A family’s ability to pay for educational costs must be evaluated in an equitable and consistent manner, recognizing that special circumstances can and do affect its ability to pay 14 Unusual Circumstances • • • • Loss of employment Loss of benefits Death or divorce Other changes to family income, assets or student status 15 Who Completes the FAFSA? • Dependent student (for financial aid purposes) • Parents provide information • If parents are divorced or separated, – Parent with whom the student has lived the most in the last twelve months – If equal, parent who has provided the most financial support • If remarried, parent & stepparent information is used • Grandparent or guardian information is not used – This student may need to speak with the Financial Aid office to determine if they are Independent. 16 Evaluating Eligibility • • • • • Parent’s Income Family Assets (Savings, Investments, etc.) Student’s Income and Assets Family Size Number in College 17 Investments: Current value minus Debt • • • • • • • • • • • • Real Estate (Not your Home) Trust Funds Money Market Funds Mutual Funds Certificates of Deposit Stocks & Stock Options Bonds & Other Securities Coverdell Savings Accounts College Savings Plans Installment & Land Sale Contracts UGMA and UTMA accounts Etc. 18 Investments Do Not Include • • • • The home in which you live The value of life insurance Retirement plans UGMA and UTMA accounts for which you are the custodian but not the owner 19 Independent Student Definition (partial) • At least 24 years old by December 31st of the award year covered by the FAFSA; • Graduate or professional student; • Married; • Has legal dependents other than a spouse; • Orphan or ward of the court; • Veteran of the U.S. Armed Forces; or • Determined to be independent by the financial aid administrator 20 EFC Used for Need (Theoretical) Total Cost of Attendance minus EFC Federal Need 21 Need Varies Based on Cost 1 X 2 Y 3 Cost of Attendance (Variable) Z EFC EFC Expected Family Contribution Need (Variable) (Constant) 22 Costs of Attendance • • • • • Billed Costs Tuition Fees Room Meals • • • • • • • Indirect Costs Books Supplies Transportation Personal Expenses Child Care Ongoing Medical Needs 23 Bottom Line Estimated Billed Cost of Education… Tuition, Room & Board minus - Financial Aid (Grants & Loans) Billed Cost of Education 24 Types & Sources of Financial Aid • Gift Aid • Self-Help – Grants – Scholarships – Loans – Work – – – – Federal State Institutional Private / Other 25 Alternative Sources • • • • • • • Institutional Payment Plans Institutional Loans Employer Assistance Labor Unions Cooperative Education Programs Community/Service Organizations H.S. Guidance Office 26 Tax Benefits for Higher Education • • • • • Hope Scholarship Tax Credit Lifetime Learning Tax Credit Education IRAs Student Loan Interest Deduction Qualified State-Sponsored Tuition Plans (QSTP) • Employee Tuition Assistance 27 Resources • • • • • • • fafsa.gov finaid.org nasfaa.org oasfaa.org act.org collegeboard.com aie.org 28 NASFAA.org Cash for College • • • • • Paying for college Expected Family Contribution Comparing aid packages Where can I get more info? Financial aid checklist 29 FAFSA Help Ohio College Goal Sunday February 9, 2014 30 Questions? Otterbein University Financial Aid Office 614-823-1502 financialaid@otterbein.edu 31 Who is considered a Parent when completing the FAFSA? Changes for 2014-2015 Beginning with the 2014-2015 FAFSA, a dependent student will be required to include income and other information about both of the student’s legal parents (biological or adoptive) if the parents are living together, regardless of the parents’ marital status or gender. 33 Changes for 2014-2015 Because unmarried parents may be of the opposite sex or of the same sex, when the response to the parents’ marital status question is “Unmarried and both parents living together,” follow-up questions will refer to the parents as “Parent 1 (father/mother)” and “Parent 2 (father/mother)” or simply “parents.” 34 Who is a Parent? • Biological parents • Adoptive parents • Stepparents, if they are married to the student’s biological or adoptive parent and the student is included in their household size 35 Who is NOT a Parent? • Foster parents • Legal guardians who have not adopted the student • Relatives who have not adopted the student • Stepparents who have not adopted the student and who would be the ONLY person providing parental information 36 Comparison FY14 and FY15 Dependent Student’s Parents’ Household Comprised Of: Data from 1 or 2 Parents Collected? Data from 1 or 2 Parents Collected? 2013-2014 and Prior 2014-2015 and Forward 1 Parent Single legal parent 1 Parent Two legal parents who are husband and wife Legal parent and stepparent Two legal parents who are unmarried and living together (regardless of gender), or who are of the same sex and are married, as recognized by a State or foreign country 2 Parents 2 Parents 2 Parents 1 Parent 2 Parents 2 Parents Note: Only the opposite sex spouse of a legal parent is considered a stepparent for FAFSA purposes. However, if a same sex partner has become a legal parent by adopting the dependent student, information from each legal parent would be collected. 37