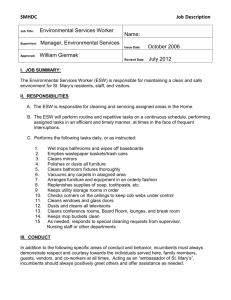

DOC - ESW Group

advertisement