Higher for Longer - AAII Washington D.C. Metro Chapter

advertisement

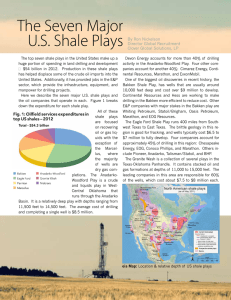

Higher for Longer: How to Profit from Sustained High Energy Prices Elliott H. Gue AAII DC Metro Chapter May 2012 The Big Picture Credit Spreads Seasonal Distortions A Few Additional Uncertainties • US and French elections. • Fiscal Cliff • Statistical distortions caused by autumn 2008 collapse in data. • Oil prices remain elevated, natural gas prices outside the US still high. • US housing market is bottoming but not booming and more foreclosures ahead. • Europe far from healed. US and ICE Natural Gas Prices Supply is Too Healthy Less Gas Drilling Won’t Help More Efficient Energy: Oil, LNG over US Gas Teekay LNG Partners (NYSE: TGP); 7% Yield • Teekay LNG owns: 20 liquefied natural gas (LNG) carriers, 5 liquefied petroleum gas (LPG) carriers and 11 oil tankers. • Long-Term Charters with an average remaining duration of 16 for LNG, 15 for LPG and 10 for tankers. • With charters fixed, TGP grows by increasing the size of its fleet. • Day-rates for LNG carriers at near record highs. • Surging international natural gas prices, growing demand from Asia and Europe Cheapest Gas is in Marcellus Inergy Midstream (NRGM); 7.5% Yield • 42 bcf of natural gas storage • 1.5 million barrels of natural gas liquids (NGLs) storage • 90% of storage booked under LT agreements • 2.1 mbbl new NGLs storage capacity due June ‘12 • MARC I Pipeline due July ‘12 Linn Energy (NSDQ: LINE) • Linn is an LLC, similar advantages to an MLP but no General Partner or IDRs. • Most important regions are MidContinent (KS, TX, OK; 65% of reserves), and Permian Basin (TX, NM; 18% of total reserves) • About 50% oil and NGLs, 50% natgas • Significant drilling upside in Granite Wash, Permian and Bakken • Growth via Acquisitions, benefit from low cost of capital. • Hedges covering 100% of natural gas production through 2015, 100% of oil through 2013. US Royalty Trusts: SandRidge Permian Basin Trust (PER) • Royalty Interest in 16,800 gross acres in Permian Basin of TX. • 87% oil and 9% NGLs. • 509 producing wells, 888 development wells before March 31, 2016 • 80% proceeds from existing wells, 70% from new wells. • Hedges and subordination structure insulate from commodity prices. • 12-Month forward yield: 12.5% to 14% • Buy Under $26. Other Royalty Trusts • SandRidge Miss. II (NYSE: SDR) owns wells in OK and KS Anadarko Basin 85% of expected revenues from oil. • 80% of proceeds 67 existing wells, 70% from 206 development wells. • 10.5% yield in 2012, 15% in 2013. • Pacific Coast Oil Trust (ROYT) 80% of proceeds from developed properties, 25% from remaining properties, 7.5% from Orcutt properties. • Plans to develop wells is shallow, porous Diatomite (fossilized algae) formation using cyclic steam injection. • Whiting USA Trust II (WHZ) 90% of net proceeds from 1,300 gross wells • Terminates 12/31/2021 or after 11.79 million bbl oil produced. • 72% crude oil. Deepwater Boom • • • • • • • • • Cobalt Energy (NYSE: CIE) announced Cameia – 1 Discovery in Angola, opens up new pre-salt field Gulf of Mexico deepwater drilling coming back sooner than expected. Brazil’s Petrobras ramping up deepwater BZ spending Shortage of ultra-deep rigs developing, sending rates >$600,000/day Rig signed at $648,000 per day in 2013 3 rigs due off contract in 2013 Yields around 8 to 9 percent Possible MLP listing to offer even more yield potential. Pacific Drilling (PACD) – 4 drillships under long-term contract, 2 new drillships for delivery in 2013. Pacific Drilling (PACD) The Bakken Shale A Few Shale Recommendations • EOG Resources (EOG) – Well-diversified producer with exposure to the Bakken Shale, EagleFord Shale, Barnett Combo and Niobrara • Oasis Petroleum (OAS) – 300,00 net acres in the Bakken Shale, produces about 11,500 bbl/day and will spend as much as $850 m drilling in 2012 US Silica (SLCA) Value in Services and Coal • US thermal coal prices to remain pressured by weak gas prices. • Met coal market more promising. • Peabody Energy (BTU) strong met and Australian exposure an advantage. • Long-term value in PRB. • Avoid US-focused services companies like HAL and BHI. • International business showing signs of picking up. • Benefits Schlumberger (SLB) and Weatherford (WFT).