Islamic University of Gaza Accounting Principles (2) ACTE 1302

advertisement

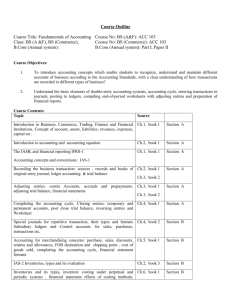

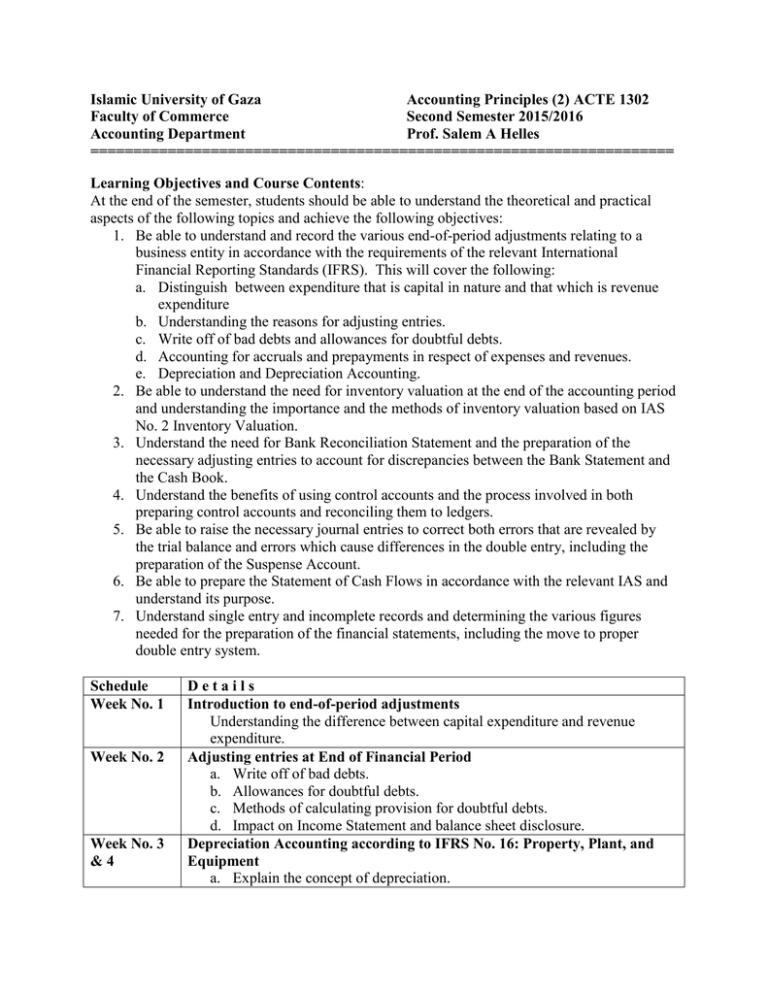

Islamic University of Gaza Accounting Principles (2) ACTE 1302 Faculty of Commerce Second Semester 2015/2016 Accounting Department Prof. Salem A Helles ==================================================================== Learning Objectives and Course Contents: At the end of the semester, students should be able to understand the theoretical and practical aspects of the following topics and achieve the following objectives: 1. Be able to understand and record the various end-of-period adjustments relating to a business entity in accordance with the requirements of the relevant International Financial Reporting Standards (IFRS). This will cover the following: a. Distinguish between expenditure that is capital in nature and that which is revenue expenditure b. Understanding the reasons for adjusting entries. c. Write off of bad debts and allowances for doubtful debts. d. Accounting for accruals and prepayments in respect of expenses and revenues. e. Depreciation and Depreciation Accounting. 2. Be able to understand the need for inventory valuation at the end of the accounting period and understanding the importance and the methods of inventory valuation based on IAS No. 2 Inventory Valuation. 3. Understand the need for Bank Reconciliation Statement and the preparation of the necessary adjusting entries to account for discrepancies between the Bank Statement and the Cash Book. 4. Understand the benefits of using control accounts and the process involved in both preparing control accounts and reconciling them to ledgers. 5. Be able to raise the necessary journal entries to correct both errors that are revealed by the trial balance and errors which cause differences in the double entry, including the preparation of the Suspense Account. 6. Be able to prepare the Statement of Cash Flows in accordance with the relevant IAS and understand its purpose. 7. Understand single entry and incomplete records and determining the various figures needed for the preparation of the financial statements, including the move to proper double entry system. Schedule Week No. 1 Week No. 2 Week No. 3 &4 Details Introduction to end-of-period adjustments Understanding the difference between capital expenditure and revenue expenditure. Adjusting entries at End of Financial Period a. Write off of bad debts. b. Allowances for doubtful debts. c. Methods of calculating provision for doubtful debts. d. Impact on Income Statement and balance sheet disclosure. Depreciation Accounting according to IFRS No. 16: Property, Plant, and Equipment a. Explain the concept of depreciation. Week No. 5 &6 Week No. 7 Week No. 8 Week No. 9 Week No. 10 Week No. 11 Week No. 12 & 13 Week No. 14 Week No. 15 b. Compute periodic depreciation using different methods. c. Accounting entries relating to depreciation. d. Disposal of plant assets. Inventories according to IAS No. 2, Inventories a. Describe the steps in determining inventory quantities. b. Explain the accounting for inventories and apply the inventory cost flow methods. c. Explain the lower-of-cost-or-market basis of accounting for inventories. d. Indicate the effects of inventory errors on the financial statements. Bank Reconciliation Statement a. Understanding the reasons for the discrepancies between the cash book and the bank statement. b. Preparation of the necessary adjusting entries resulting from the bank reconciliation statement. Control accounts a. Explain why control accounts can be useful. b. Reconcile the Purchase ledger and the Sales ledger with their respective control accounts. Mid- term Exam General Revision Correction of errors: a. Preparation of correcting entries in respect of errors not revealed by the trial balance; and b. Correction of errors affecting double entry and use of the suspense accounts. Single Entry and Incomplete Records a. Preparation of financial statements from incomplete records. b. Moving from single entry to double entry. Adjustments for Financial Statements a. Adjusting entries for accruals in respect of expenses and revenues; and b. Adjusting entries for prepayments in respect of expenses and revenues. Non- profit- oriented organizations a. Prepare receipts and payments accounts. b. Prepare statement of financial position for Non- profit- oriented organizations. Statement of Cash Flows according to IFRS No. 7 a. Understanding of cash flows. b. Classification of cash flows: operating, investing and financing activities. c. Purpose of the Statement of cash flows. d. Preparation of the Statement of cash flows. Final Exam Week No. 16 Text Book Frank Wood and Alan Sangster (2012), Business Accounting I, Part II, 12 Edition, prentice Hall. Examinations and Marks Mid-Term Exam: 30 Marks, Final Exam: 60 Marks, Course work: 10 Marks