03/02 - David Youngberg

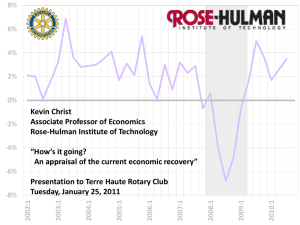

advertisement

David Youngberg ECON 201—Montgomery College LECTURE 13: RECESSIONS AND THE BUSINESS CYCLE I. II. The Business Cycle a. Recession—a significant, widespread decline in real income and employment i. National Bureau of Economic Research (NBER) defines it as two consecutive quarters of a decline in GDP, along with other considerations (e.g. two quarters of slightly negative growth doesn’t count, unless other indicators suggest otherwise). b. Whom the recession hits the most i. When a recession hits, sales of toilet paper and alcohol don’t change that much (though the type of alcohol people buy does change). What should change the most? ii. Things that people can put off buying, whether because they can stretch what they currently have or because they can do without one at all for a bit longer. These tend to be consumer durables and capital goods iii. Thus, an increase in private investment and consumer durables is a good sign of an economic recovery. c. The good news is the business cycle is a cycle. What goes down eventually comes up. It typically follows a four-phase pattern (the exact nature and names of each phase will vary between economists): i. Peak—a point of strong growth and low unemployment ii. Recession—the period when people start losing their jobs and production falls iii. Trough—the low point; when the recession has bottomed out iv. Recovery—the often rapid return to high productivity and low unemployment d. This pattern typically lasts anywhere from two or three years to fifteen years. i. That fifteen year span was the Great Depression Causes a. Classical (and later neoclassical) economists tend to believe recessions are caused by exogenous (or outside) shocks to the economic system. III. 1 i. These shocks include weather, technology, poor policy, regulation, monopolies (especially those achieved through political favor), and other forces. ii. There’s inevitability to the business cycle. $#&@ happens. iii. Say’s Law—there’s no such thing as a general glut; in other words, supply creates its own demand. Shocks are ultimately self-correcting and long-run recessions are impossible when the market functions properly. iv. This might seem strange given the current state of the economy but think of it like this. If so many people are looking for work, why don’t they just accept a lower wage? v. In different places in the United States, there’s a shortage of various kinds of labor.1 b. Keynesian economists argue that endogenous (or inside) considerations cause recessions. i. John Maynard Keynes launched Keynesian with his book The General Theory of Employment, Interest, and Money (1936). ii. He argued recessions are cause by a drop in consumption. If you increase consumption, you’ll get a recovery as more money goes to producers who then hire more workers. iii. This drop is complicated by the idea that human beings are not simply rational but also guided by emotions and instincts which Keynes termed animal spirits. iv. Among items guided by animal spirits is the confidence consumers have in the economy. When they are concerned about the future, they arrest their spending. That concern might easily be disproportionate to the actual problem, but it’s a prophecy that fulfills itself. If people think there’s a problem, they will cut their spending which, in turn, creates a problem. Seasonal Business Cycles a. We must adjust for the natural ebb and flow of the year i. If we look at retail sales throughout the year, there’s always a boom in November and December. Does that mean a recovery’s underway? ii. The seasonal business cycle follows short-term movements in economic productivity derived from predictable annual patterns. http://ismyjobinanotherstate.com/ iii. Normal variation does not imply the start or continuation of a recession nor a boom. b. The seasonal business cycle follows this basic pattern (actual months do not perfectly correspond to the seasons): i. Spring—big slump ii. Summer—small boom (vacation season and fishing/farming boom) iii. Fall—small slump iv. Winter—big boom (holiday shopping season) c. When GDP is seasonally adjusted, it’s adjusted for this natural cycle. When it’s adjusted in this way, we can tell if a Christmas shopping season was unusually good (hinting the recovery continued in the season) or not.