Chapter 7 Recommended End-of-Chapter Problems and Solutions

advertisement

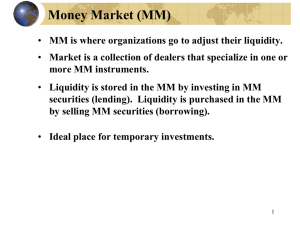

Chapter 7 Recommended End-of-Chapter Problems and Solutions 1. If a 180-day T-bill has a face value of $10,000, calculate its price if purchased at a discount “Asked” rate of 6%? Also, what is the T-bill’s bond equivalent yield? P n y P0 Pf f d 360 10000(180).06 10, 000 360 $9, 700 Knowing P0, the bond equivalent yield is computed using Pf P0 365 P0 n 10000 9700 365 9700 180 6.2715% ybe 8. Suppose Fargood Corporation engages in a repurchase agreement with The National Bank of Nebraska. In the agreement, Fargood sells $9,987,950 worth of Treasury securities to the bank and agrees to repurchase the securities in 30 days for $10,000,000. a. Is this transaction a loan, and if so, who is the borrower and who is the lender? The transaction is a reverse-repurchase agreement for the bank because it agrees to purchase securities under agreement to resell. The bank is buying the Treasuries owned to provide Fargood liquidity. Technically, this is not a loan, but a purchase with agreement to resell, but the effect is the same as a loan to a customer. b. Is the loan collateralized? What is the collateral? Who holds the collateral during the term of the agreement? The bank or an offsite depository would hold the securities (collateral) during the contract period. Although technically a purchase/sale, it is in effect a short-term collateralized loan. 1 c. What interest rate (or yield) is earned by the lender? On a bond equivalent yield basis, the yield Prepo P0 365 P0 n 10, 000, 000 9,987,950 365 9,987,950 30 1.4679% ybe 9. Suppose Fed Funds rate is quoted at 1.65%. What is this on a bond-equivalent yield basis? To compare yields in the fed funds market with those of other money market instruments, the fed funds rate must be converted into a bond equivalent yield. 365 ybe y ff 360 365 1.65% 360 1.6729% a. Consider the following data faced by the U.S. Treasury at the sale of its 182-day Tbill on xx/xx/xx. Specify the following items. 182-Day Bill Issue date xx/xx/xx Competitive $3.0 billion 4.975% Total Offering $18 billion $4.0 billion 4.980% $5.0 billion 4.985% Noncompetitive Tenders $1.4 billion $4.0 billion 4.990% Competitive Tenders? $36.0 billion $7.0 billion 4.995% $6.0 billion 5.000% Highest Accepted Rate? 4.995% $5.0 billion 5.005% Bid-to-Cover Ratio? 37.4/18 = 2.0778 $2.0 billion 5.010% 2 Tenders at High Rate Allocated? .6/7.0 = 8.5714% Price Per $100 for this issue? 100 – (.04995*182*100/360) = 97.474750 Investment Rate % for this issue? ((1000 – 974.7475)/974.7475)*(365/182) = 5.1956% Lowest Rate? 4.975% b. On slide 9 of Module 3.7, consider the 26-week (i.e., 182-day) T-bill whose Issue Date was 11-08-2012. Reconcile its Discount Rate % with its Price Per $100, and its Price Per $100 with its Discount Rate %. P n yd P0 Pf f 360 100(182).0015 100 360 99.924167 yd Pf P0 360 Pf n 100 99.924167 360 100 182 .0015 or 0.15% c. In the case of the 52-week T-bill of 10-18-2012, verify, with a Price Per $100 of 99.818000, that the 0.183 figure in the Investment Rate % column is correct. Pf P0 365 P0 n 100 99.818000 365 99.818000 364 .001828 or 0.183% (rounded) ybe 3 d. Suppose a bank wishes to purchase $400 million face value of 182-day T-bills but is only willing to spend $393 million maximum. What should be its Discount Rate % bid? 400 393 360 400 182 3.4615% yd Rounding using .005%, bank should bid 3.465%. Otherwise, if it bid 3.460% it would pay more than the maximum of $393 million. e. Suppose $18 million face value of 15-day commercial paper is being sold for $17,984,000. What bank discount rate pertains to this situation? 18 17.984 360 2.1333% 18 15 4