Payment Systems Assignment 14

advertisement

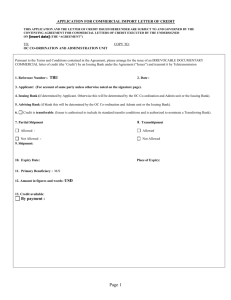

Payment Systems Letters of Credit Basic Concepts Basic Concepts Basic Concepts • UCC Article 5 US L/Cs and those that incorporate it. • Uniform Customs and Practices Act (UCP) incorporated by most international L/Cs The Actors • • • • • • Applicant Asks for L/C Beneficiary Makes demand Issuing Bank Issues L/C Advising Bank Informs of L/C Confirmer Agrees to honor Nominated Person Authorized to honor Basic Concepts • Documents must strictly comply • Issuing bank must pay if the documents comply • Issuing bank can only get reimbursed if it was permitted to pay Problem 9-1.1 • Jodi presented with an L/C stating it will provide payment for goods shipped ‘‘during the first half of February 2010.’’ • She received a draft this morning including an invoice for goods shipped on February 16, 2010. • She tells you that the letter of credit incorporates the UCP by reference. Can it be possible that the draft complies? UCP Article 3 • “the term first half and second half of a month shall be construed respectively as the 1st to the 15th and the 16th to the last day of the month, inclusive. “ Problem 9-1.2 • Cliff Janeway (your book-dealer friend is frustrated because he is having trouble collecting on L/C • The confirming bank (SecondBank) told him that it was not obligated to pay Cliff because the issuing bank (FirstBank) had closed. Thus, the officer explained to Cliff, SecondBank would not be able to obtain any reimbursement if it paid Cliff. SecondBank’s confirmation of Cliff’s letter of credit was unenforceable for lack of consideration. UCC 5-105 “Consideration is not required to issue, amend, transfer, or cancel a letter of credit, advice, or confirmation.” Problem 9-1.3 • Ben’s bank received a draft on January 5 but misfiled it and did nothing. • In early February the Beneficiary wrote demanding payment again. • Ben found L/C and draft and discovered L/C called for payment based on documents covering a shipment of 100 cases of Llano Estacado wine at a price of ‘‘around $140 per case.’’ The draft seeks payment of $120 per case. • Must Ben honor? Problem 9-1.3 • Ben found L/C and draft and discovered L/C called for Ben saw that the letter of credit called for payment based on documents covering a shipment of 100 cases of Llano Estacado wine at a price of ‘‘around $140 per case.’’ The draft seeks payment of $120 per case. • Does the Draft strictly comply? UCP Article 30 [a] The words “about” or “approximately”, used in connection with the amount of the Credit or the quantity or the unit price stated in the Credit are to be construed as allowing a difference not to exceed 10% more or 10% less than the amount or the quantity or the unit price to which they refer. Problem 9-1.3 • 10% of 140 = 14 • 140 – 14 = 126 • $120 > 10% less than $140 The Credit does not comply But can Ben raise this issue to refuse to honor? UCC 5-108 (b) An issuer has a reasonable time after presentation, but not beyond the end of the seventh business day of the issuer after the day of its receipt of documents: (1) to honor, (2) if the letter of credit provides for honor to be completed more than seven business days after presentation, to accept a draft or incur a deferred obligation, or (3) to give notice to the presenter of discrepancies in the presentation. (c) Except as otherwise provided in subsection (d), an issuer is precluded from asserting as a basis for dishonor any discrepancy if timely notice is not given, or any discrepancy not stated in the notice if timely notice is given. UCP 14.b • Provides a window of five banking days to decide if a presentment complies. Problem 9-1.3 • The Credit does not comply • But can Ben raise this issue to refuse to honor? Problem 9-1.4. • FSB received initially by an authenticated electronic-mail message from Portland State Bank requesting FSB advise the beneficiary of the issuance of the credit and, if willing, also serve as a confirming bank. • The message satisfied FSB’s security procedure for transmissions from PSB. • Ben printed out the letter of credit, added an indication that FSB confirmed the letter of credit, and had the original confirmed letter of credit delivered to the beneficiary. Problem 9-1.4. • Last week Ben honored a draft on the letter of credit in the amount of $500,000 (the stated face amount of the credit that Ben delivered). • When Ben sought reimbursement from PSB, Ben learned that the letter of credit should have been for $50,000. The $500,000 figure was a typo. • Ben received a written copy of the letter of credit with the correct $50,000 amount in the mail the day after Ben delivered the letter of credit to the beneficiary. UCC 5-107 (a) A confirmer is directly obligated on a letter of credit and has the rights and obligations of an issuer to the extent of its confirmation. The confirmer also has rights against and obligations to the issuer as if the issuer were an applicant and the confirmer had issued the letter of credit at the request and for the account of the issuer. UCC 5-108(a) (i) An issuer that has honored a presentation as permitted or required by this article: (1) is entitled to be reimbursed by the applicant in immediately available funds not later than the date of its payment of funds; UCC 5-106 (a) A letter of credit is issued and becomes enforceable according to its terms against the issuer when the issuer sends or otherwise transmits it to the person requested to advise or to the beneficiary. A letter of credit is revocable only if it so provides. (b) After a letter of credit is issued, rights and obligations of a beneficiary, applicant, confirmer, and issuer are not affected by an amendment or cancellation to which that person has not consented . . . . UCP 11 An authenticated teletransmission of a credit . . . will be deemed to be the operative credit . . . and any subsequent mail transmission shall be disregarded. Problem 9-1.5 • Jane Halley from Boatmen’s Bank has a customer, Toy Importing Company (TIC), for whom she has issued a letter of credit in the form set forth in Figure 9.1. • TheL/C was to pay for a shipment of toys from Toy Manufacturing Company (TMC) in Hong Kong. Because TIC is dissatisfied with the toys, TIC wants Boatmen’s to reject the draft. Problem 9-1.5 • TMC on September 21, 1996, submitted a draft with the appropriate documents to its main bank, Bank of Hong Kong. Bank of Hong Kong processed those documents, paid TMC on the letter of credit, and submitted the draft to Boatmen’s on September 24, 1996. Jane wants to know if she can reject the draft because it was presented to her after the letter of credit had expired. Problem 9-1.5 • She could understand if she was obligated to accept a draft presented to Hang Seng Bank (the advising bank) in a timely manner, but how can she possibly be obligated to respect a draft presented to some bank with which she has not had any prior dealings? Problem 9-1.5 • What must TMC due by expiration date? • To whom must they present? 5-102 Comment 7 Unless the letter of credit provides otherwise, the beneficiary need not present the documents to the issuer before the letter of credit expires; it need only present those documents to the nominated person. UCP 7 a. Provided that the stipulated documents are presented to the nominated bank or the issuing bank and that they constitute a complying presentation, the issuing bank must honor c. An issuing bank undertakes to reimburse a nominated bank that has honoured . . . a complying presentation. Problem 9-1.5 • What must TMC due by expiration date? • To whom must they present? • Is BHK a “nominated person”? It is not mentioned in the Credit. § 5-102(a)(11) Defines nominated person as a party that the issuer has “undertake[n] by agreement or custom and practice to reimburse.” UCP Article 2 In a Credit “available with any bank,” any bank is a Nominated Bank. UCC 5-102 Comment 7 Under the UCP any bank is a nominated bank where the letter of credit is ‘freely negotiable.” [Example of a “freely negotiable credit is one] “available with any bank by negotiation.” 5-102 Comment 7 “a nominated person that gives value in good faith has a right to payment from the issuer despite fraud,” UCC § 5-108 comment 1 “[A] nominated person that has honored a demand or otherwise given value before expiration will have a right to reimbursement from the issuer even though presentation to the issuer is made after the expiration of the letter of credit.” § 5-108 comment 1 “[A] nominated person that has honored a demand or otherwise given value before expiration will have a right to reimbursement from the issuer even though presentation to the issuer is made after the expiration of the letter of credit.” Problem 9-1.6 • The April Company and Boatmen’s established special procedures for drafts submitted under L/Cs issued to some of April’s regular suppliers. April and Boatmen’s agreed that Boatmen’s would provide same-day service on drafts for less than $25,000 submitted on designated “Express Draft” letters of credit. Problem 9-1.6 • April agreed that Boatmen’s would not be obligated to review any of the documents submitted with such drafts, and Boatmen’s agreed to reduce its normal processing fees by 50 percent for those drafts. • Jane’s problem comes from a $20,000 draft submitted last week on an “Express Draft.” • Jane’s department honored the draft in a few hours, without even looking at the underlying documents. Problem 9-1.6 • When the documents got to April, April noticed that the documents did not include the bill of lading called for by the L/C. • April has discovered that the supplier/beneficiary (a small Indonesian company) in fact did not ship the goods in question; indeed, that company has become insolvent and stopped operations. Problem 9-1.6 • April’s shipping clerk called Jane yesterday and said that under the circumstances April did not want to reimburse Boatmen’s for that draft. • Jane wants to know whether she has a right to payment from April. What do you say? UCC 5-108 (i) An issuer that has honored a presentation as permitted or required by this article: (1) is entitled to be reimbursed by the applicant in immediately available funds not later than the date of its payment of funds; UCC 5-103 • (c) With the exception of this subsection, subsections (a) and (d), Sections 5102(a)(9) and (10), 5-106(d), and 5114(d), and except to the extent prohibited in Sections 1-102(3) 1-302 and 5-117(d), the effect of this article may be varied by agreement or by a provision stated or incorporated by reference in an undertaking. UCC 5-103 Comment 2 • Neither the obligation of an issuer under Section 5-108 nor that of an adviser under Section 5-107 is an obligation of the kind that is invariable under Section 1-102(3). Section 5-103(c) and Comment 1 to Section 5-108 make it clear that the applicant and the issuer may agree to almost any provision establishing the obligations of the issuer to the applicant. UCC 5-108 Comment 1 “In some circumstances standards may be established between the issuer and the applicant by agreement or by custom that would free the issuer from liability that it might otherwise have. For example, an applicant might agree that the issuer would have no duty whatsoever to examine documents on certain presentations (e.g., those below a certain dollar amount). UCC 5-108 Comment 1 Where the transaction depended upon the issuer's payment in a very short time period (e.g., on the same day or within a few hours of presentation), the issuer and the applicant might agree to reduce the issuer's responsibility for failure to discover discrepancies. . . . Neither those agreements nor others like them explicitly made by issuers and applicants violate the terms of Section 5-108(a) or (b) or Section 5103(c).” To prevent paying forgeries banks • Require the person presenting the draft be a specified person known to them. • Require funds to be paid to accounts known to belong to the beneficiary.