EU regulation in the financial services sector

advertisement

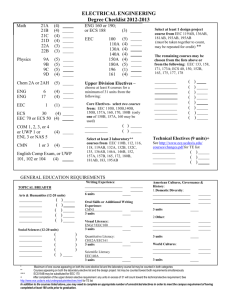

DRAFT EU Financial Services Legislation – enlargement and regulatory convergence UNECE WORKSHOP Athens 7-8 November 2003 Dr. Alexander Spachis Adviser on Enlargement Financial Institutions Internal Market Directorate General European Commission Fax : +32-2-295 39 54 E-mail : markt-f-enlargement@cec.eu.int http://europa.eu.int/comm/internal_market/en/index.htm 1 Financial Services a typical “Single Market” subject The 4 Freedoms: in particular establishment, services and capital: which is which? What are restrictions? What are discriminations? 2 Freedom of establishment / Freedom to provide services Community law framework Establishment & services at Treaty Level Freedom of establishment Arts. 43-48 EC (ex 52-58) Freedom to provide services Arts. 49-55 EC (ex 59-66) 3 Freedom of establishment / Freedom to provide services Community law framework Personal scope of application nationals of EU Member States and EEA companies / firms set up under national law of an EU Member State registered office / head office / principal place of business 4 Freedom of establishment / Freedom to provide services Community law framework The notion of ‘establishment’ economic activity fixed infrastructure indefinite duration how : agency, branch, subsidiary (secondary establishment) 5 Freedom of establishment / Freedom to provide services Community law framework The notion of ‘services’ Art. 50 EC : subsidiary notion economic realities three types of provision of services service provider moves to other MS to provide service (Art. 50) service receiver moves to other MS to receive service (Court of Justice, application Art. 49) no movement of persons, only service crosses borders (Court of Justice, application Art. 49) 6 Role of the European Commission What does EU Commission do? Researches and drafts legislation Negotiates directives in Council and EP Checks Member States follow EU rules (infringements) 7 Financial Services Directives Home country control = supervision by the authorities of the MS of origin Close co-operation host State and home State authorities Minimum harmonisation - key measures of prudential supervision Mutual recognition : the European passport only for ‘branching’ and ‘provision’ of services 8 Financial Services Directives Banking Codified Banking (2000/12/EC) contains 1st and 2nd coordination , solvency ratios, own funds, large exposures, consolidated supervision Capital Adequacy - CAD (93/6/EEC, amended by 98/31/EC) Bank Accounts (86/635/EEC) Branch Accounts (89/117/EEC) Deposit Guarantee (94/19/EC) E-money (2000/49/EC) Financial conglomerates 9 Financial Services Directives Insurance Insurance on Life - 3 directives (79/267/EEC,90/619/EEC and 92/96/EEC) Insurance on Non-Life - 4 directives (73/239/EEC, 88/537/EEC, 92/49/EEC, 87/344/EEC) Insurance Accounts (91/674/EC) Insurance on Motor Vehicles - 4 directives (72/166/EEC, 84/5/EEC, 90/232/EC and 2000/26/EC) Pension funds Intermediaries 10 Financial Services Directives Securities Investment Services - ISD (93/22/EEC) Insider Trading (89/592/EEC) Listing Particulars (80/390/EC) Regular Reporting (82/121/EC) Prospectus (89/298/EEC) Public Offer (90/211/EEC) Admission to Trading (79/279/EC) Major Holdings (88/627EEC) UCITS (85/611/EEC) (subsequently replaced) Investor Compensation (97/9/EC) 11 Financial Services Directives Payment Systems Cross-border Credit Transfer (97/5/EC) Settlement Finality (98/26/EC) Electronic Payment Instruments (REC 97/489/EC) 12 Money Laundering New rule : identify your customer (no anonymous account) Every bank must have an officer responsible for detecting and reporting suspicious operations from criminal activities exceeding € 15 000 Keep records for 5 years Enhanced administrative co-operation Second Money Laundering Directive Obligations on lawyers, accountants, ... Know also the final beneficiary owner 13 Fundamental economic objective Lisbon European Council 23/24 March 2000 “To become the most competitive and dynamic knowledge-based economy in the world, capable of sustainable growth and with more and better jobs” 14 A single market of 25 in financial services What is its aim? To ensure smooth operation of single financial services market Banking Insurance Investment and trading Asset management Consumers and operators can take full advantage 15 Integration of Financial Markets crucial: Link companies looking for finance with investors wanting to make most of savings through efficient exchanges Huge economic benefits: • • • • Microeconomic Macroeconomic Social Financial Stability 16 Not there yet Markets remain fragmented • The cost of financial products 3 times higher in one Member State than in another • stock market capitalisation in US is 179% of GDP compared to 90% in EU • expensive clearing and settlement • Retail markets vs B2B Obstacles • • • • remain Heavy handed laws Gaps in scope Failure to implement Directives adequately And more… 17 Important unfinished business: ISD Revision Single passport for investment firms • Harmonised high levels of investor protection • Functional approach to ATS • Common regulatory principles for regulated markets • 18 Need to integrate now Introduction of Euro Enlargement ‘post-Enron’ confidence issues Technological breakthroughs Market pressures 19 Two wider issues for regulatory convergence and financial services 1. Creating a more efficient regulatory system: the Lamfalussy process 2. Ensuring that EU Enlargement takes place successfully 20 The Lamfalussy approach Level 1: Broad Framework Principles in Directive/Regulation Level 2: Implementing Rules delegated to Commission, assisted by ESC and CESR Level 3: Strengthened Co-operation between Regulators to Improve Implementation (and achieve converging practices) Level 4: Strengthened Enforcement of Community Law 21 Enlarge the EU: why and how The obligation and the benefits The conditions for success Acceding countries must fulfil criteria Union needs to prepare itself adequately The agreements and Treaty :The case of financial services and insurance No permanent derogations; only limited transition periods for some banking and securities issues but none for insurance. 22 Ensuring successful Enlargement of a single market in financial services Five processes : • Transposition checks • Peer Reviews with recommendations • Action plans • Monitoring and safeguard measures • Other preparations 23 Key messages in the EU Commission's Comprehensive Monitoring Reports of 5 November 2003 Most countries advanced in reforming and strengthening judicial system Progress in fight against corruption, fraud and economic crime, but some concerns remain Financial intermediation has strengthened All ACs now have a more stable and efficient banking sector 24 Key messages (continued) Domestic bank lending still low Liberalisation of capital movements in line with acquis is now complete in most countries Attention needs to be paid to proper implementation of money laundering directives and financial services legislation, in particular the independence of supervisory authorities 25 Between now and 1 May 2004 Next step : assess the urgent needs identified in the Comprehensive Monitoring Reports of the the 10 countries , published on 5 November 2003 , and the regular reports on 2+1 countries Comprehensive monitoring and possibility of imposing safeguard clause for Internal Market Transposition control : legislation of Acceding Countries checked by Commission services (in translation), comments sent and draft corrections received 26 ACs Compliance with Community law Although good progress in transposition, more needs to be done in the next 6 months: Banking : successfully implemented but non-codified directives less advanced (e.g. Capital Adequacy) Insurance : not bad, but work still needed in order to be fully in-line, especially on motor insurance Securities : some concerns about correct implementation Payment Systems : steadily proceedingprogressing Money laundering: laws in place 27 Effective Implementation and Enforcement Peer reviews and implementing capability Supervision: some EU legislation and direct relevance of international voluntary standards, especially the Basel Committee CORE PRINCIPLES IAIS Insurance Core Principles, see their website: www.iaisweb.org IOSCO core principles for securities 28 Supervisory Authorities : progress but more to be done to achieve internationally accepted standards Most advanced : Banking supervision Less experienced : Insurance and Securities Implementation of out-of-court redress schemes (FIN-NET) has just started: settlement of disputes between service providers and customers, including insurance. 29 Anti-Money Laundering Defences Legislation generally positive (first directive implemented, second underway) but certain technical problems (e.g. systematic reporting of all transactions above a low threshold) Good progress in implementation but situation to be kept under close scrutiny (e.g.: off-shore centre with links to high-risk countries) Third EU directive in preparation Insurance sector to be more careful 30 FSAP – What next? Take stock what worked what less successful impact State of integretation of EU financial markets(Are markets fragmented? Is this a problem?) 31 How? (see press release of 27 Oct. 2003) Assessment by market practioners 4 Sectoral Expert Groups: banking, insurance, investment and trading(of financial instrumnts), asset management Case for any further EU action Start soon: 4 groups of experts meet early december Report summer 2004 32 A single market of 25 in financial services: challenges and opportunities ACs made good progress in financial sectors. Strong presence of foreign companies, often via large local enterprises. Privatisations resulted in strategic investments, bringing local market knowledge together with access to capital and know-how of the foreign financial institution. 33 Challenges and opportunities(continued) financial market for large companies is relatively developed. Enormous long term potential for developing the middle market. Increased business will depend, in addition to stability, on progress in rule of law and reform of judiciary systems. pension savings reform will generate further opportunities for insurance and securities markets (and fund management). Supervision of supplementary pension funds : an obligation as from 2005 Challenge to supervisory authorities: large amounts of funds may also attract all sorts of "interests". 34 Challenge in financial services is to deepen legal framework and institutions that underpin financial stability harmonisation of legislation transparent accounting and auditing, comprehensive supervision, effective bankruptcy mechanisms and adequate collateral registration and recovery mechanisms. new EU committee structure ( level 3 committees of regulators(=supervisors)) will contribute to better supervision practices and efficiency, also in the acceding countries. restructuring of sector, finished in some cases and well under way in others, needs to be completed. 35