Example annotated bibliography (click to download)

advertisement

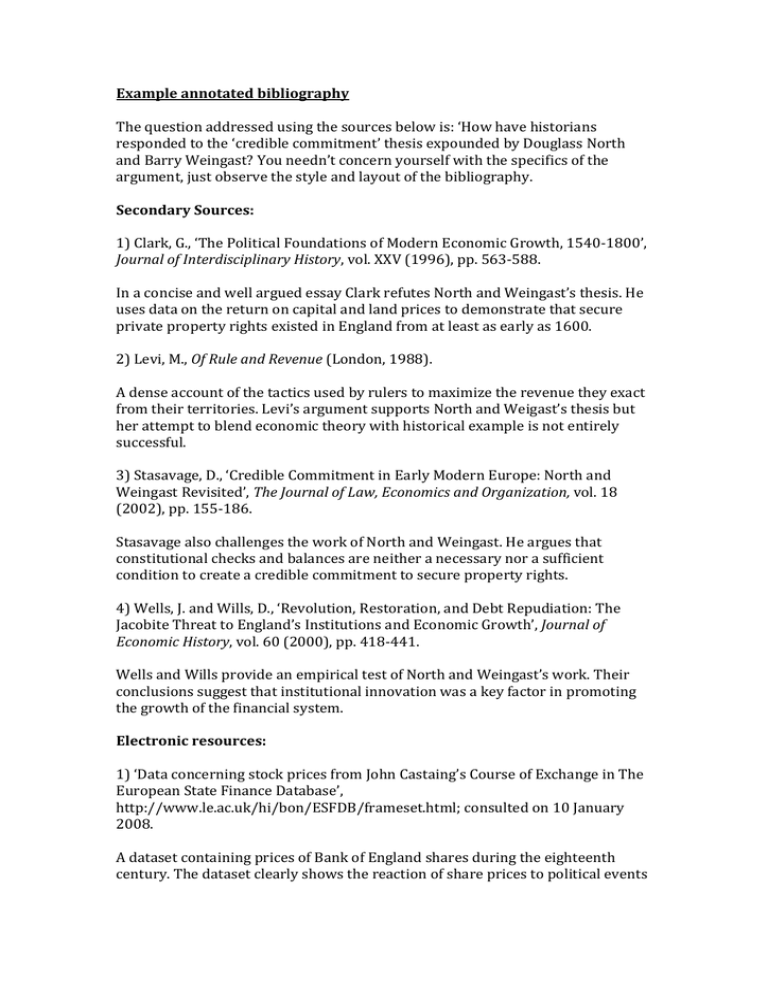

Example annotated bibliography The question addressed using the sources below is: ‘How have historians responded to the ‘credible commitment’ thesis expounded by Douglass North and Barry Weingast? You needn’t concern yourself with the specifics of the argument, just observe the style and layout of the bibliography. Secondary Sources: 1) Clark, G., ‘The Political Foundations of Modern Economic Growth, 1540-1800’, Journal of Interdisciplinary History, vol. XXV (1996), pp. 563-588. In a concise and well argued essay Clark refutes North and Weingast’s thesis. He uses data on the return on capital and land prices to demonstrate that secure private property rights existed in England from at least as early as 1600. 2) Levi, M., Of Rule and Revenue (London, 1988). A dense account of the tactics used by rulers to maximize the revenue they exact from their territories. Levi’s argument supports North and Weigast’s thesis but her attempt to blend economic theory with historical example is not entirely successful. 3) Stasavage, D., ‘Credible Commitment in Early Modern Europe: North and Weingast Revisited’, The Journal of Law, Economics and Organization, vol. 18 (2002), pp. 155-186. Stasavage also challenges the work of North and Weingast. He argues that constitutional checks and balances are neither a necessary nor a sufficient condition to create a credible commitment to secure property rights. 4) Wells, J. and Wills, D., ‘Revolution, Restoration, and Debt Repudiation: The Jacobite Threat to England’s Institutions and Economic Growth’, Journal of Economic History, vol. 60 (2000), pp. 418-441. Wells and Wills provide an empirical test of North and Weingast’s work. Their conclusions suggest that institutional innovation was a key factor in promoting the growth of the financial system. Electronic resources: 1) ‘Data concerning stock prices from John Castaing’s Course of Exchange in The European State Finance Database’, http://www.le.ac.uk/hi/bon/ESFDB/frameset.html; consulted on 10 January 2008. A dataset containing prices of Bank of England shares during the eighteenth century. The dataset clearly shows the reaction of share prices to political events and military setbacks and successes thus providing the basis for a test of North and Weingast’s theories. Primary Sources: 1) Grascome, S., An Account of the Proceedings in the House of Commons in Relation to the Recoining the Clipp’d Money (London, 1696). Grascombe’s polemical account details the English public’s anger at Parliament’s financial incompetence. It shows that North and Weingast were wrong to argue that Parliament was regarded as a credible debtor.