Gifts and benefits procedure

advertisement

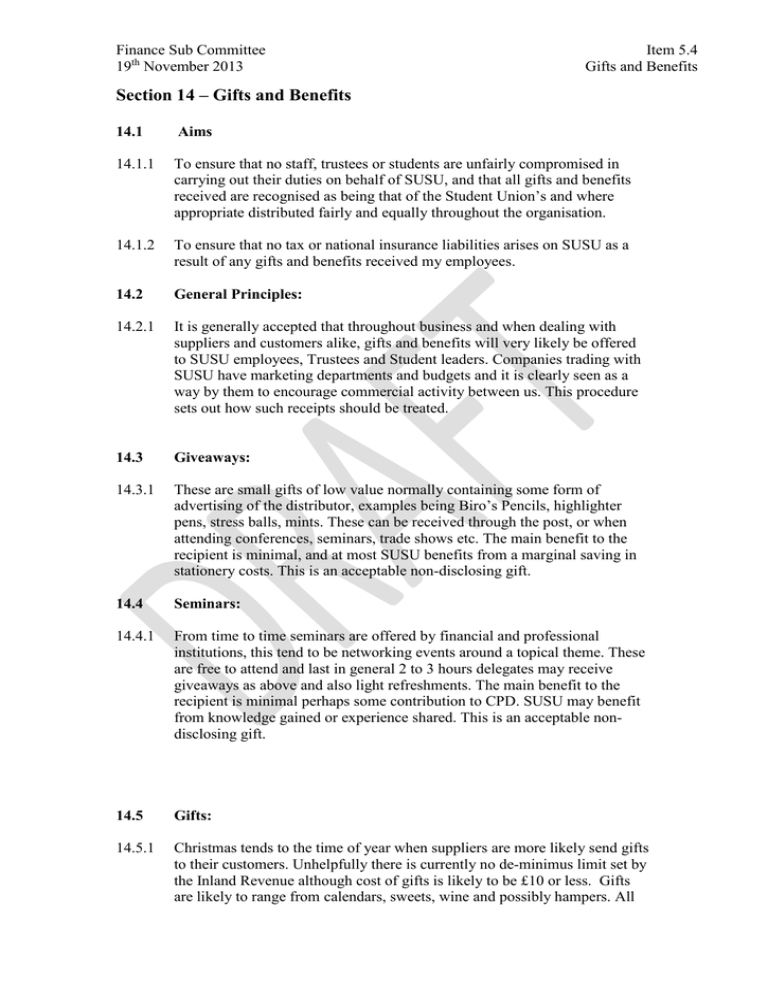

Finance Sub Committee 19th November 2013 Item 5.4 Gifts and Benefits Section 14 – Gifts and Benefits 14.1 Aims 14.1.1 To ensure that no staff, trustees or students are unfairly compromised in carrying out their duties on behalf of SUSU, and that all gifts and benefits received are recognised as being that of the Student Union’s and where appropriate distributed fairly and equally throughout the organisation. 14.1.2 To ensure that no tax or national insurance liabilities arises on SUSU as a result of any gifts and benefits received my employees. 14.2 General Principles: 14.2.1 It is generally accepted that throughout business and when dealing with suppliers and customers alike, gifts and benefits will very likely be offered to SUSU employees, Trustees and Student leaders. Companies trading with SUSU have marketing departments and budgets and it is clearly seen as a way by them to encourage commercial activity between us. This procedure sets out how such receipts should be treated. 14.3 Giveaways: 14.3.1 These are small gifts of low value normally containing some form of advertising of the distributor, examples being Biro’s Pencils, highlighter pens, stress balls, mints. These can be received through the post, or when attending conferences, seminars, trade shows etc. The main benefit to the recipient is minimal, and at most SUSU benefits from a marginal saving in stationery costs. This is an acceptable non-disclosing gift. 14.4 Seminars: 14.4.1 From time to time seminars are offered by financial and professional institutions, this tend to be networking events around a topical theme. These are free to attend and last in general 2 to 3 hours delegates may receive giveaways as above and also light refreshments. The main benefit to the recipient is minimal perhaps some contribution to CPD. SUSU may benefit from knowledge gained or experience shared. This is an acceptable nondisclosing gift. 14.5 Gifts: 14.5.1 Christmas tends to the time of year when suppliers are more likely send gifts to their customers. Unhelpfully there is currently no de-minimus limit set by the Inland Revenue although cost of gifts is likely to be £10 or less. Gifts are likely to range from calendars, sweets, wine and possibly hampers. All Finance Sub Committee 19th November 2013 Item 5.4 Gifts and Benefits gifts that are received at SUSU are the property of SUSU as contracts with suppliers are with the organisation, however it is the department manager that is likely to be the initial recipient of the gift. 14.5.2 Christmas gifts received should be pooled and distributed fairly amongst all SUSU staff, it is suggested that this is completed by a free raffle at the end of the first term. 14.5.3 Should any member of staff receive a gift or inducement which has a face value or estimated value in excess of £25 then this should be reported to their line manager together with an explanation of the circumstances leading up to the receiving of that gift or inducement.. 14.6 Gifts used as an Inducement: 14.6.1 As a marketing tool suppliers may offer inducements to managers in order to secure an increase in volume. This is where being in bulk will lead to either free supply of further product or different products or to the supply of a nonattributable gift. In either case the additional supplies / gift belong to SUSU. 14.6.2 Product which is supplied FOC improves profit margin and therefore should be encouraged provided sell by dates and storage allow. Gifts which are not perishable should be treated like Christmas gifts in 14.5.2. otherwise made available to all staff. 14.7 Promotional Gifts Prizes: 14.7.1 From time to time SUSU maybe party to some promotional activities by suppliers that will involve rewarding SUSU staff / volunteers by the supplier for achieving sales targets. In these incidents a contract is formed between the employee and the supplier and therefore the reward is not the property of SUSU. Departmental managers may however need to carefully manage these activities to ensure fairness and equality across the staff involved 14.8 Benefits used as an inducement: 14.8.1 During the course of carrying out your duties, from time to time hospitality maybe received. This could involve food or alcohol tasting. This can be viewed as essential to the decision making ability of the staff involved on which SUSU should ultimately benefit. There is no discernible benefit to the employee 14.8.2 In the course of carrying out their duties some hospitality however will result in preferential treatment, this is particularly relevant to student leaders and relationships with night clubs. Finance Sub Committee 19th November 2013 Item 5.4 Gifts and Benefits Such preferential treatment can extend beyond free entry and use of the VIP area, and encompass free drinks. Student leaders receiving such inducement should declare this as a conflict of interest at the relevant committee meeting and recorded on the conflict of interest register. Student leaders should also consider the code of conduct. 14.8.3 As part of organising trips, student leaders / volunteers may be entitled to receiving free places at certain levels of participation or even be rewarded for signing up members to attend events. Students in this situation should acknowledge this benefit and reduce the overall costs of the trip for all attending alternatively they will be undertaking a role on the trip 14.9 Tendering Inducements: 14.9.1 Where SUSU is taking part in a tender process for services and the lead member of staff for that tender receives an inducement form a tenderer then the following steps should be taken. 1. The tender document should state that any gifts / inducements received will be noted in the final recommendations report to the Trustees 2. Any Gifts / Inducements received will be formally acknowledged with the supplier and other tenderers notified of the inducement. 3. The Trustees will receive as part of the recommendation report details of all gifts and inducements received and then consider whether it is a conflict of interest and unduly influenced the recommendation. 14.10 Bribes 14.10.1 It is the duty the Trustees of the charity to report to police authorities and the charities commission any and all incidents of proven or alleged bribery. This may consist of receiving money as a Trustee to influence the Trustee board or for the charity to receive a “tainted” donation. The board may be required to also seek professional advice to ensure that they properly carryout their duties of a Trustee. 14.11 Tainted Donations 14.11.1 A tainted donation occurs when a charity and a donor enter into a connected arrangement when a donation is made, the purpose of which is for the donor or a related person to the donor receives an advantage from the charity. These rules fall under tax evasion rules for the donor and exempt income rules for the charity. Donations should be reviewed, and any other contractual arrangements made at arm’s length. ………………………………………………. Finance Sub Committee 19th November 2013 Item 5.4 Gifts and Benefits