Criminal Cartel Investigation - Association of Corporate Counsel

advertisement

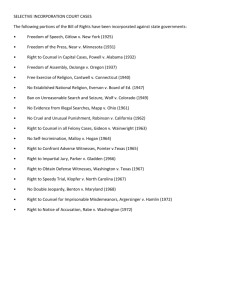

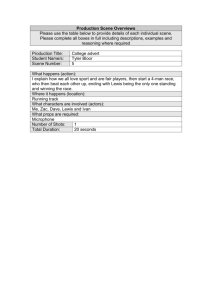

COMPETITION LAW LIVE! CRITICAL LESSONS THROUGH THE LIFECYCLE OF A CRIMINAL CARTEL INVESTIGATION Wednesday, September 16th, 2015 8:00 a.m. - 8:30 a.m. - Registration and Breakfast 8:30 a.m. - 12:00 p.m. - Workshop (with break) Osler Conference Centre - 63rd Floor, First Canadian Place, 100 King Street West, Toronto Overview of the Hypothetical : Products & Parties 4D-LCD is a display technology used in flat-panel computer monitors, notebook computers, smartphones, tablets and other devices. The panels are produced and then sent to electronics manufacturers to be incorporated into finished goods destined for consumers around the world. They are the single most expensive component in most electronic products. There are three major manufacturers of 4D-LCD panels, together holding 80% of the global market for 4D-LCD screens: KorEa, a vertically-integrated Korean electronics corporation that produces 4D-LCD panels as well as many other electronic products. CanLCD, a Canadian company that focuses on the design and manufacturing of LCD Panels. US-LCD, an American company that is the worldwide market leader in sales of 4D-LCD panels with a 40% share of global 4DLCD sales. Contracts with private sector customers are negotiated twice a year and state-owned firms award contracts annually pursuant to a RFP process. 2 Overview of the Hypothetical: Conduct Senior sales executives from KorEa, CanLCD and US-LCD began cooperating with each other in 2009 to attempt to control global prices of 4D-LCD panels. Through frequent meetings and communications, they would determine specific price points for the various standard sizes of 4D-LCD panels and provide those set prices as quotes for their customers. In addition, they would coordinate their respective bids in response to the annual RFPs issued by state-owned enterprises. The three manufacturers were able to use this strategy for over 4 years, and increased prices for 4D-LCD panels by more than 20% which, in turn, led to a significant increase in downstream prices for computer monitors, notebook computers and other devices into which the panels are incorporated. The strategy led to consumers of electronic products that incorporate 4D-LCD panels being overcharged by an estimated $2 billion globally over the 4 year time period. 3 Overview of the Hypothetical: Investigation and Government Proceedings After attending a mandatory competition law compliance training session led by CanLCD’s external counsel, Jane Cansale, the VP of Global Sales for CanLCD, informed CanLCD’s General Counsel about her dealings on behalf of the company with KorEa and US-LCD. This starts a chain of events that results in CanLCD seeking immunity from competition law enforcement authorities in various jurisdictions, including Canada and the U.S. Based on information provided by CanLCD, competition enforcers in Canada, the U.S., Europe, Japan, Korea and Australia conduct coordinated raids (i.e. search and seizures) at the offices of US-LCD and KorEa. Competition enforcers also conduct raids on CanLCD’s offices around the world to avoid speculation and protect CanLCD’s identity as an immunity applicant. US-LCD ultimately decides to cooperate with authorities and seek leniency under various leniency programs. KorEa, whose General Counsel, after reviewing the emails on the company’s servers, found no documentary evidence of its wrongdoing, decides not to cooperate with authorities and fight the allegations. 4 Overview of the Hypothetical: The Civil Litigation Literally minutes after the Wall Street Journal and the Globe & Mail break the news about the raids, Overcharge & Justice LLP in Canada and Action & Sue LLP in the U.S., respectively file class actions for both direct and indirect damages suffered by direct purchasers of 4D-LCD panels (i.e., electronics manufacturers and state-owned enterprises) and by the public who purchased electronic products into which such panels had been incorporated. 5 Scene 1: Hatching the Agreement Ms. Jane Cansale was hired as the VP of Global Sales for CanLCD in January of 2009. Ms. Cansale is aware that CanLCD was under tremendous pressure from its most important customers to materially reduce prices. In her first negotiations with Microsung, she was forced to provide them with a 2% discount, reducing not only CanLCD’s margins but also her compensation, which was tied to CanLCD’s profits. In February of 2009, just after Ms. Cansale’s negotiations with Microsung, Ms Cansale attends the annual Global Electronics Tradeshow in Tokyo’s Capitol Hotel. In going from booth-to-booth she introduces herself to others participants at the show. Following a dinner sponsored by Microsung, a number of conference attendees went to the hotel’s lobby bar for a drink. With the Microsung negotiations fresh in her mind and eager to obtain competitive intelligence as well as the views of others on the state of the 4D-LCD panel industry, Ms. Cansale asks Mr. Huang Korsale, Director of Sales for KorEa, to join her for a drink. They were sharing their thoughts on how business was doing when Ms. Elizabeth Usale, VP of Global Sales for USLCD walked by and they invited her to join as well. 6 Scene 1 Hatching the Agreement 7 Scene 2: In-House Counsel Makes A Discovery Following an antitrust compliance training session, General Counsel for CanLCD, Mitchell West gets a visit from a nervous Jane Cansale, Vice President, Global Sales for CanLCD. Jane tells her General Counsel about an arrangement she has had with KorEa and US-LCD, their biggest competitors, about pricing and customer contracts for 4D-LCD panels. While Mitchell and Jane are talking, they are joined by CanLCD’s external legal counsel, Chris Naudie, who has dropped by to debrief Mitchell on the compliance session. Mitchell introduces Jane and tells counsel what she has learned. 8 Scene 2 In-House Counsel Makes a Discovery 9 Scene 3: An Emergency Meeting of the Board: Should the Company Seek Immunity? The General Counsel for CanLCD convenes an urgent meeting of the Board of Directors. The Board consists of the nonexecutive Chair, the CEO, and two outside directors. The General Counsel and external counsel from Canada, the U.S., Korea and EU advise on the potential exposure to the company based on the conduct that has been discovered. Each counsel underscores the potential opportunity to mitigate the fine/imprisonment exposure through the various immunity policies in place in these jurisdictions and outlines the basic elements required to obtain immunity. 10 Scene 3: An Emergency Meeting of the Board: Should the Company Seek Immunity? The Board raises questions on a number of issues, including: potential violations of competition and foreign corruption laws; fines & imprisonment civil litigation exposure debarment exposure management issues, including disciplinary actions against culpable executives governance and disclosure issues the potential downsides of applying for immunity alternatives to applying for immunity the impact on reputation and customer relationships. The General Counsel seeks authorization to pursue immunity from the Canadian Competition Bureau, U.S. Department of Justice, Korea, the European Commission. In this scenario we focus on Canada. 11 Scene 3: Immediate Steps in the Internal Investigation Continuing to interview Jane and are reviewing all of her email. Have asked Jane to make her home computer and personal email accounts accessible to our team, and she has voluntarily complied. In the process of interviewing all sales staff that might have communications with KorEa and US LCD. Have imaged their company computers and iphones, and have instructed all relevant staff to preserve their documents. Have told Jane not to communicate directly with KorEa and US LCD, and to report any “inbound” communications from her counterparts at those companies to our attention. Have told Jane to put her participation a trade conference coming up next week in Banff on hold. Have collected a large amount of data, and team reviewing to identify any information relating to Jane’s statements. 12 Scene 3: Conspiracy –Section 45 Strictly prohibits price-fixing, market or customer allocation, and production limitations The criminal prohibition is directed at “agreements” between actual or potential competitors The offence is the agreement itself not necessary for the agreement to be implemented not necessary for the agreement to have an anticompetitive effect 13 Scene 3: Bidding Rigging- Section 46 Criminal offence for a participant in a bid and tender process to agree: not to submit a bid withdraw a bid about the content of the bid 14 Scene 3: Penalties and Consequences Statutory fines: up to $25M per count for s. 45; no statutory maximum for 47 Imprisonment: up to 14 years Civil liability: private actions (on an individual or class basis) for damages in the $millions damage awards often significantly greater than fines; in the US damages awards can be trebled (3x)!!! Debarment for Federal contracts for 10 years Costs of litigation, business disruption and reputational damage 15 Scene 3: Requirements of the Immunity Program Available to both organizations and individuals. Time is of the essence as immunity is only available to the first applicant satisfying the eligibility criteria. Creates a “race” to the Bureau. The difference between “first-in” and “second-in” may be a criminal conviction & $millions in fines & prison Immunity not available if the applicant coerced others to participate in the illegal activity or if the Bureau is already aware of the offence. Applicants must: terminate their participation in the illegal activity maintain confidentiality; provide complete, timely and ongoing cooperation— very onerous obligationkeep the Bureau apprised of the status of any related criminal or civil proceedings 16 Scene 3: Requirements of the Immunity Program Grants of immunity and the decision of whether to commence criminal prosecutions, are the sole responsibility of the Public Prosecution Service of Canada. The identity of an immunity applicant will typically remain confidential until charges are laid against other participants to the offence, and disclosure of the Crown’s case to the accused is required. 17 Scene 3: UpJohn Warning At the beginning of each interview, we have advised the employee that: Osler is counsel to the Company and is not counsel to you personally. We are interviewing you and others in order that we may gather facts in order to provide legal advice to the Company. As such, this means that our conversation with you is protected by privilege. While our communications are protected by privilege, the privilege belongs solely to the Company, not you. The privilege is controlled by the Company, and the Company may decide to share any information it learns through this interview with third parties, including the government, without your permission or notice. In order for this discussion to be subject to the privilege, it must be kept in confidence. In other words, with the exception of your own lawyer, you may not disclose the substance of this interview to any third party, including other employees or anyone outside of the Company. 18 Scene 4: Marker Request The Board instructs its General Counsel to make request for immunity from the competition law enforcers for various jurisdictions asap. This scenario focusses on CanLCD’s immunity marker request in Canada. 19 Scene 4 Marker Request 20 Scene 5: Dawn Raids /Search & Seizures CanLCD has successfully established itself as “first-in” for immunity with the Canadian Competition Bureau, the United States Department of Justice (U.S. DOJ), the Japan Fair Trade Commission (JFTC), the Korea Fair Trade Commission (KFTC), and the European Commission (EC). The antitrust enforcers for all six jurisdictions investigating the case are cooperating with each and have collectively determined the strategy and timing of dawn raids or surprise search and seizure on the offices of KorEa and US-LCD around the world and staged raids of the offices of the immunity applicant, CanLCD This scene focusses on the Competition Bureau execution of its search warrant on US-LCD’s office in Canada 21 Scene 5 Dawn Raids 22 Scene 6: Negotiating the Guilty Plea and Sentencing Recommendation under the Leniency Program Since the raid on their offices around the world, US-LCD has been working intensively with external counsel to determine the scope of its legal risk and implement measures to reduce its exposure. Following external counsel’s interview of US-LCD’s Vice- President, Global Sales, Elizabeth Usale, and counsel’s review of Ms. Usale’s emails, text messages since 2009, USLCD’s General Counsel recommended to the Board that USLCD admit guilt in return for a substantially-reduced fine in accordance with the Competition Bureau’s Leniency Program. US-LCD’s Board has approved the recommendation but imposed some challenging asks on its external counsel, Mahmud Jamal, including avoiding carve-outs for individuals. 23 Scene 6: Negotiating the Guilty Plea and Sentencing Recommendation under the Leniency Program At the same time, the Competition Bureau armed with an enormous volume of information from CanLCD, and in particular, Jane Cansale, as well as the documents (terabytes of emails) seized during the raid, is building a compelling criminal case against US-LCD and KorEa under both section 45 (conspiracy) and section 47 (bid-rigging) of the Competition Act. Senior legal counsel of the Department of Public Prosecutions is outraged by the duration of criminal activity uncovered, particularly in light of the fact that all three companies tout their antitrust compliance programs on their websites. He believes this is the case where individual liability must attach. It is in this context that Senior Counsel of the DPP and US-LCD’s external counsel meet to negotiate the terms and conditions of US-LCD’s leniency application. 24 Scene 6 Negotiating the Guilty Plea 25