Stages of Excellence - Gillespie's Guide to Travel+Procurement

advertisement

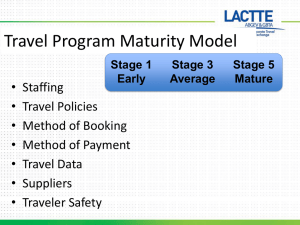

Stages of Travel Management Excellence Strategies for Advancing Your Travel Programme Presented by Scott Gillespie, CEO TRAVEL ANALYTICS INC Today’s Agenda • • • • • Credentials The Stages of Excellence Framework Application and Limitations Elements and Criteria Discussion Scott Gillespie’s Background • Founded Travel Analytics in 1999 – Developed TANGO™ and BRAVO™ for airline sourcing projects – Analyzed in excess of $10 Billion of annual air spend – Recipient of ACTE’s Industry Professionalism and Distinguished Fellow honors – Named by Business Travel News as one of the travel industry’s most influential executives • A.T. Kearney’s expert in strategic sourcing of travel suppliers from 1994 -1999 • MBA, University of Chicago Past and Current Clients – – – – – – – – – – – AXA Capital One Coca-Cola Chevron Compaq DaimlerChrysler Dell Computer John Deere Ernst & Young ExxonMobil Ford – – – – – – – – – – – Hewlett-Packard Hoffman LaRoche Invensys International Monetary Fund Lockheed Martin Microsoft Lucent Technologies Proctor & Gamble Nortel Networks PricewaterhouseCoopers Saint Gobain Stages of Excellence For Travel Management The Framework How Many Good Travel Programmes Are Out There? 50%? 25%? 20%? 5%? Poor Fair Good Great How Do Travel Programs Evolve? By taking a series of prioritized and often difficult steps Stage 2 Stage 1 No real travel program; mostly fighting fires Stage 3 Advanced travel program; good support Basic travel program; limited support Right…What are those steps, exactly? Stage 4 World class program; Great support, Excellent results The Answers Are Not Clear…But The Method Is • The travel/procurement team must agree on a basic strategy and key goals – What is realistically achievable? – What does our company expect? • Requires a rigorous assessment of current program, practices, processes and stakeholders • Managers must prioritize costs and benefits of each potential improvement Managers need a useful framework Stages of Excellence Framework Dimensions Stage 1 Stage 2 Stage 3 Illustrative Stage 4 Travel manager None or parttime Full-time Category specialists Functional specialists Travel policies None or ad hoc Written, low to moderate enforcement Moderate to strong enforcement Regular business case reviews Occasional bursts of involvement Predictable support Engaged and supportive Keep the noise down Operational excellence Support the Business Keep making promises Focus only on price Strategic sourcing Criteria Vocal but Senior management uninvolved Major goals Respond to problems Procurement None or ad hoc strategy Better 14 Major Dimensions • • • • • • • Senior Management Travel Strategy Goals Travel Policy Feedback Controls Procurement • • • • • • • Suppliers Transient Management Group Management Data Travelers Demand Management Travel Organization Organized Into Four Quadrants Roadmap Senior Management Travel Strategy Goals Steering Wheel Travel Policy Feedback Controls Engine Procurement Suppliers Transient Management Groups Management Data Drivers Travelers Demand Management Travel Organization Similar to a Balanced Scorecard Three Levels of Analysis Dimensions Criteria Senior Management Travel Strategy Goals Elements No goals Goals are hard to measure Goals are easy to measure Goals are meaningful and aggressive Traveler Satisfaction 1 2 3 4 Agency Operations 1 2 3 4 Stage 1 Better Stage 4 Each Element and Dimension Is Scored Stage 1 Criteria Dimension Goals Stage 4 Elements No goals Traveler Satisfaction 1 Agency Operations 1 Goals are hard to measure 2 2 Average Goal Score: 2.0 Goals are easy to measure 3 3 Goals are meaningful and aggressive 4 Can score 2.5 or 3.3 etc. 4 Stages of Excellence For Travel Management Application and Limitations Weak Points Can Be Addressed Stage 1 Is this a priority? Will it clearly helpElements us? Goals No goals Stage 4 Goals are Goals are hard to easy to measure What goals measure Goals are meaningful and aggressive should we use? Traveler Satisfaction Agency Operations 1 1 are we How going to measure them? 2 3 4 2 3 4 Scores Can Be Summarized Roadmap 2.5 Engine Procurement 2.0 Senior Management 1.8 Suppliers 1.6 Travel Strategy 3.4 Transient Management 1.2 Goals 1.0 Groups Management 2.7 Data Average: 2.3 Average: 1.6 Steering Wheel 2.4 Travel Policy Drivers 2.6 Travelers 2.8 Feedback 1.4 Demand Management 3.1 Controls 3.6 Travel Organization Average: 2.8 Average: 2.5 Priorities Can Be Set Roadmap 4 3 2 1 Priority 2 Priority 1 4 3 2 1 Steering Wheel 4 3 2 1 Engine Drivers 4 3 2 1 Entire Programs Can Be Compared Stage 4 Stage 3 Stage 2 Stage 1 A B C D E Company Codes F G And More Importantly – Improved! Goal Today Stage 4 Stage 3 Stage 2 Stage 1 A B C D Company Codes E F G How Is This Different From Benchmarking? • Most benchmarking statistics are descriptive – “Our average ticket price is $375 vs. peer group’s $344” – “Our travel agency configuration is a single reservation center; 63% of our peers use on-site agencies” • Descriptive statistics are not often prescriptive – Should your average ticket price be lower? – Should you use on-site agencies? Stages of Excellence are designed to be prescriptive Limitations to Stages Of Excellence • The Dimensions, Elements and Criteria were developed by Travel Analytics – There are many other possible views • Requires honest self-assessment • Scoring depends on assigned weights • The path to improvement is not always obvious – Must often ask “What do we need to do to improve this score?” Stages of Excellence is a rigorous and objective – but not perfect – diagnostic tool Stages of Excellence for Travel Management Elements and Criteria Roadmap Senior Management (4) Travel Strategy (6) Goals (8) Steering Wheel Travel Policy Feedback Controls ( ) = Number of Elements Engine Procurement Suppliers Transient Management Groups Management Data Drivers Travelers Demand Management Travel Organization Senior Management Stage 1 Stage 2 Stage 3 Stage 4 Solid understanding of most key issues; views Travel strategically SM1. Understanding of Travel Management Little or no understanding of the basic issues Basic understanding, but struggles with making decisions Basic understanding; makes good decisions SM2. Ownership of Travel Management Nobody owns Travel Ownership is not very clear Ownership is fairly Ownership is very clear clear SM3. Support and Enforcement Little or no support or enforcement Support and enforcement is fairly weak and inconsistent Consistent but moderate support and enforcement Strong and consistent support and enforcement SM4. Utilization of a Travel Council No Travel Council Limited use; not very effective Moderate use; fairly effective Significant use; very effective Travel Strategy, part 1 Stage 1 Stage 2 Stage 3 Stage 4 TS1. Travel viewed as a factor for business success Not at all Slightly Moderately Significantly TS2. Travel viewed as a factor in employee retention and productivity Not at all Slightly Moderately Significantly TS3. Travel viewed as a controllable cost Not at all Slightly Moderately Significantly Travel Strategy, part 2 Stage 1 Stage 2 Stage 3 Stage 4 TS4. Success at budgeting travel costs Little or none Somewhat limited Generally good Excellent TS5. Success at tracking and reporting travel cost savings Little or none Somewhat limited Generally good Excellent TS6. Success at getting major travel management initiatives approved Little or none Somewhat limited Generally good Excellent Goals, part 1 Stage 1 Stage 2 Stage 3 Stage 4 G1. Traveler satisfaction No goals Exist, but hard to measure Fairly easy to measure Meaningful; aggressive but achievable G2. Senior management satisfaction No goals Exist, but hard to measure Fairly easy to measure Meaningful; aggressive but achievable G3. Policy compliance No goals Exist, but hard to measure Fairly easy to measure Meaningful; aggressive but achievable G4. Agency performance No goals Exist, but hard to measure Fairly easy to measure Meaningful; aggressive but achievable Goals, part 2 Stage 1 Stage 2 Stage 3 Stage 4 G5. Self-booking adoption No goals Exist, but hard to measure Fairly easy to measure Meaningful; aggressive but achievable G6. Contract compliance No goals Exist, but hard to measure Fairly easy to measure Meaningful; aggressive but achievable G7. Supplier performance No goals Exist, but hard to measure Fairly easy to measure Meaningful; aggressive but achievable G8. Financial performance No goals Exist, but hard to measure Fairly easy to measure Meaningful; aggressive but achievable Roadmap Senior Management (4) Travel Strategy (6) Goals (8) Steering Wheel Travel Policy (3) Feedback (8) Controls (4) ( ) = Number of Elements Engine Procurement Suppliers Transient Management Groups Management Data Drivers Travelers Demand Management Travel Organization Travel Policy Stage 1 Stage 2 Stage 3 Stage 4 TP1. Quality of travel to be purchased Little or no guidelines General guidelines Fairly specific Very specific TP2. Processes to be used for purchasing travel Little or no guidelines General guidelines Fairly specific Very specific TP3. Typical consequences of not complying with a key travel policy Little or no consequences Minor consequences Moderate consequences Strong consequences Feedback, part 1 Stage 1 Stage 2 Stage 3 Stage 4 F1. Traveler satisfaction Little or none sought Obtained irregularly Obtained regularly Clearly drives future actions F2. Senior management satisfaction Little or none sought Obtained irregularly Obtained regularly Clearly drives future actions F3. Policy compliance Little or none sought Obtained irregularly Obtained regularly Clearly drives future actions F4. Agency performance Little or none sought Obtained irregularly Obtained regularly Clearly drives future actions Feedback, part 2 Stage 1 Stage 2 Stage 3 Stage 4 F5. Self-booking adoption Little or none sought Obtained irregularly Obtained regularly Clearly drives future actions F6. Contract compliance Little or none sought Obtained irregularly Obtained regularly Clearly drives future actions F7. Supplier performance Little or none sought Obtained irregularly Obtained regularly Clearly drives future actions F8. Financial performance Little or none sought Obtained irregularly Obtained regularly Clearly drives future actions Controls Stage 1 Stage 2 Stage 3 Stage 4 C1. Exceptions to travel policies Easy to obtain; not tracked or reported Fairly easy to obtain; tracked and reported Fairly hard to obtain; tracked and reported Very hard to obtain; reported to senior management C2. Supplier preferencing at point of sale Little or none Agents are expected to sell preferred suppliers Preferred suppliers identified automatically at Point of Sale Preferred suppliers automatically prioritized based on contract needs C3. Ability to move business away from key suppliers Little or no ability Fairly limited ability Moderate ability Significant ability C4. Ability to pass travel costs onto business units Little or no ability Fairly limited ability Moderate ability Significant ability Roadmap Senior Management (4) Travel Strategy (6) Goals (8) Steering Wheel Travel Policy (3) Feedback (8) Controls (4) ( ) = Number of Elements Engine Procurement (7) Suppliers (4) Transient Management (5) Groups Management (4) Data (5) Drivers Travelers Demand Management Travel Organization Procurement, part 1 Stage 1 Stage 2 Stage 3 Stage 4 P1. Tender or RFP process Very informal Require proposals; but have rolling contracts Formal sourcing process Strategic sourcing process; directed by senior management P2. Analysis of pricing Informal; back of the envelope Benchmarking of key rates, city pairs, etc. Detailed comparisons of bids and current contracts Use sophisticated cost/pricing models P3. Analysis of quality No analysis Limited analysis; mostly rely upon supplier’s reputation Fairly detailed analysis of RFP/tender responses Use of quality scoring models and traveler feedback P4. Analysis of risk (implementation, contract cancellation, traveler dissatisfaction No real analysis Limited analysis; primarily based on judgment Fairly detailed analysis combined with judgment Significant analysis; tied clearly to procurement decisions Procurement, part 2 Stage 1 Stage 2 Stage 3 Stage 4 Significant integration P5. Travel’s integration with Procurement No integration Minimal integration Moderate integration P6. Basis for awarding contracts Primarily based on relationships Primarily based on price Suppliers evaluated Decision rules established prior to on total cost, receiving bids quality and risk P7. Legal department’s input None Minimal review of contracts and bids Moderate to significant input, but timeconsuming Moderate to significant input; issues resolved quickly Suppliers Stage 1 Stage 2 Stage 3 Stage 4 S1. Delivery of expected level of service Very or mostly dissatisfied Fairly satisfied Very satisfied Delighted S2. Resolution of traveler complaints and other operational issues Very or mostly dissatisfied Fairly satisfied Very satisfied Delighted S3. Quality of people assigned to your account Very or mostly dissatisfied Fairly satisfied Very satisfied Delighted S4. Current pricing Very or mostly dissatisfied Fairly satisfied Very satisfied Delighted Transient Management Stage 1 Stage 2 Stage 3 Stage 4 Some consolidation; mostly in major countries Counselors trained to sell preferred suppliers, but are fairly passive Mostly consolidated at country level Mostly consolidated at regional level TM1. Agency consolidation Very little consolidation TM2. Ability to control the point of sale Little or none TM3. Agency service quality Poor or very inconsistent Fairly satisfied Very satisfied Delighted TM4. Agency productivity Not measured or getting worse Fairly stable Some recent improvements Significant and sustained improvements TM5. Agency as a trusted advisor or consultant Not used in this capacity Use is limited mostly to agency operational issues Provides practical advice on a range of issues Trusted as an objective and proactive source of excellent advice Counselors actively Able to easily control preferred sell preferred supplier market suppliers share Group Management (GM) Stage 1 Stage 2 Stage 3 Stage 4 GM1. Ability to measure GM spend Unable; difficult for even major events Very basic ability for most large events Fairly easy for most large events Fairly easy for most large and medium events GM2. Communication between internal GM planners Little or none Fairly fragmented; not well organized Well organized network; effective communications GM planners have very strong communication network GM3. Centralized visibility of GM events Little or none Limited to major events Fairly good for most large and medium events Very good for most events of all sizes GM4. Processes for planning, sourcing and managing GM events No or few standardized processes Standardized processes only for large events Standardized processes for most large and medium events Standardized processes for most all events; very effective Data / Information Stage 1 Stage 2 Stage 3 Stage 4 Very easy and fast; good data quality D1. Ability to consolidate enterprise-wide travel spending Very difficult; poor data quality Fairly difficult; data quality questionable Fairly easy; good data quality D2. Airline data Very limited; long delays Basic reports; moderate delays Excellent reports Good reports; fairly timely; useful and analyses D3. Hotel data Mostly limited to agency bookings; 40+% missing Mostly limited to agency bookings; 20-40% missing Visibility of 80+% room nights by property D4. Agency data None or limited Basic monthly or quarterly reports Informative reports Daily dashboard reports on all key available weekly metrics Fairly satisfied Very satisfied D5. Other Very or fairly information needed dissatisfied for managing travel Visibility of 90+% room nights by property Delighted Roadmap Senior Management (4) Travel Strategy (6) Goals (8) Steering Wheel Travel Policy (3) Feedback (8) Controls (4) ( ) = Number of Elements Engine Procurement (7) Suppliers (4) Transient Management (5) Groups Management (4) Data (5) Drivers Travelers (4) Demand Management (4) Travel Organization (4) Travelers Stage 1 Stage 2 Stage 3 Stage 4 T1. Awareness of travel policies and preferred suppliers Little or no awareness Moderate awareness Good awareness Strong awareness T2. Compliance with key travel policies Low; less than 65% Moderate; between 65 and 80% Good; between 80 and 95% Strong; over 95% T3. Input on travel policies and suppliers Generally not solicited Limited input sought Moderate input sought Moderate or significant input sought; clearly effective T4. Opinion of Travel department Low opinion No opinion, or somewhat mixed Generally favorable Fairly high opinion; clearly respected Demand Management Stage 1 Stage 2 Stage 3 Stage 4 DM1. Ability to eliminate unnecessary trips before they are taken Very difficult Somewhat difficult Fairly easy Very easy DM2. Guidelines for evaluating the need for a trip None Basic, such as use good judgment Fairly useful guidelines Specific criteria suited to job DM3. System for evaluating a trip’s value None Post-trip evaluation or report Pre-trip authorization Pre-trip authorization and post-trip evaluation DM4. Promotion of non-travel alternatives None; not in scope Limited efforts Moderate efforts Significant efforts or cooperation with other departments Travel Organization Stage 1 Stage 2 Stage 3 Stage 4 TO1. Ability to execute major new policies, projects and initiatives Very difficult Somewhat difficult Fairly easy Very easy TO2. Staffing Staffed mostly by fairly ineffective people Staffed mostly by fairly effective people Staffed mostly by effective people Staffed mostly by very effective people TO3. Recruiting Fairly difficult to recruit effective people Fairly easy to recruit effective people Very easy to recruit Very easy to recruit highly effective effective people people TO4. Career Advancement Travel department viewed as unattractive Limited advancement opportunities Regular advancement opportunities Travel department viewed as a desirable career stepping stone Where Do We Go From Here? • Score your program – Should generate deep discussions and frank assessments – Many companies will not like their scores • Organize confidential comparisons – Travel management companies or consultants can lead these efforts • Develop specific goals and priorities for your program • Measure results year to year We Can Go From Here… 50%? 25%? 20%? 5%? Poor Fair Good Great …To Here! 50% 25% 20% 5% Stage1 Stage 2 Stage 3 Stage 4 Thank You! For a copy of this presentation and the accompanying scoring tool, please visit our Free Tools page at www.travelanalytics.com Or send an e-mail to: Scott.Gillespie@travelanalytics.com