Council for Research Excellence Video Consumer Mapping Study

advertisement

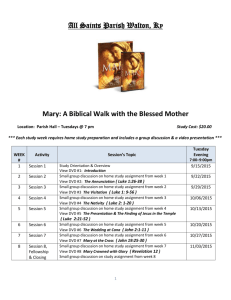

Council for Research Excellence Video Consumer Mapping Study Mike Bloxham, Director Michael Holmes, Assoc Director Insight & Research, Center for Media Design CABA CH-RC Digital Home Ecosystem Forum, April 2009 Agenda • • • • The Key Players Involved The Video Consumer Mapping Study The Method Applied Selected Findings 2 The Key Players • The Nielsen Company – Creator and supporter of the Council’s work • Council for Research Excellence – A client-led group that operates independently from Nielsen • The Media Consumption and Engagement Committee – Selected and guided the Video Consumer Mapping Study • Sequent Partners – A brand and media metrics consultancy • BSU Center for Media Design – A consumer-centric media insight and R&D facility 3 Council for Research Excellence Active Membership Brad Adgate, Horizon Media Shari Anne Brill, Carat* Joanne Burns, 20th Television, Fox* Michele Buslik , AAAA Media Research Committee; TargetCast TCM Michael Nathanson, Sanford C. Bernstein and Co. Michael Orgera, Warner Brothers* Jessica Pantanini, Bromley Communications Mike Pardee, Scripps Networks* David Poltrack, CBS Alex Corteselli , Telerep Beth Rockwood, Discovery Communications Laura Cowan, Rick Johnson & Co. Greg Ross, Procter & Gamble Susan Cuccinello, TVB Matt Ross, Hearst-Argyle Television Paul Donato, The Nielsen Company Lyle Schwartz, Mediaedge: CIA Colleen Fahey-Rush, MTV Networks Ceril Shagrin, Univision Nancy Gallagher, NBC Universal Mike Hess, Carat George Ivie, Media Ratings Council Tina Silvestri, NBC Universal Noreen Simmons, Unilever* Barbara Singer, Kraft* Bob Ivins, Comcast Spotlight Mark Kaline, Kimberly Clark Kate Sirkin, Starcom MediaVest Group Steve Sternberg, Magna* Michael Link, The Nielsen Company Pat Liguori, ABC Owned Television Stations Billy McDowell, Raycom Media* Ira Sussman, CAB Beth Uyenco, Microsoft Advertising* Jack Wakshlag, Turner Broadcasting* Dan Murphy, Univision* Richard Zackon, Facilitator *Media Consumption and Engagement Committee Members. The MCE Committee members also include • • • Tim Brooks, Consultant Jane Clarke, Time Warner Horst Stipp, NBC Universal 4 Principal Investigators • Mike Bloxham Director • Michael Holmes Associate Director • Bill Moult founding partner • Jim Spaeth founding partner 5 Agenda • • • • The Key Players Involved The Video Consumer Mapping Study The Method Applied Selected Findings 6 Video Consumer Mapping Study Objectives Dimension current consumption of media—focusing on television and video—and how it is changing over time in order to Guide video media audience measurement… … by generating a comprehensive map of the current media ecosystem 7 Measuring Video Is Becoming A Multi-Platform, Multi-Place Challenge TV Video cell phone DVR Video iPod Video on laptop DVD Instore TV Portable DVD 8 Agenda • • • • The Key Players Involved The Video Consumer Mapping Study The Method Applied Selected Findings 9 CRE VCM Study Who? • Primarily former Nielsen panelists (e.g. from FTO), recruited with Nielsen’s assistance What? • Full waking day observation of media exposure, life activities and location When? • Observed twice, in Spring and Fall 2008 Where? • Six regionally dispersed DMAs How? • Computer-assisted observation How many? • A final sample of 952 observed days: Over ¾ million minutes of observation, at 10-second resolution 10 CRE VCM Study DMAs • A final sample of 952 observed days: – N=376 individuals in the Core sample, observed twice, yielding 752 observed days – Plus 100-person media Acceleration sample, yielding 200 observed days Seattle, WA Philadelphia, PA Chicago, IL Core DMAs in yellow; Indianapolis, IN Atlanta, GA Dallas, TX Acceleration DMA in red Image from Google Earth™ 11 12 The Observational Method 12 Computer-Assisted Observation Danatm smart keyboards equipped with a custom Media Collector™ program Observers categorize location, life activities and media exposure via touch screen & keyboard Data are logged to file every 10 seconds Image © 2008 Neo Direct 13 Locations and Activities Locations Life Activities • • • • • • • • • • • • • • • • • • Own home Other’s home Car Public Transportation Work School Other • • • • Media only Work Meal preparation Meal eating Traveling or commuting Personal needs Household activities or chores Care of another Personal/household services Education Religion (includes church organizations) Organizations (civic, govt., community) Social activities (socializing) Exercise/sports/hobbies Other 14 Media Categories TV • News program • Sports program • Entertainment/info program • Ad/Program promotion • Surfing • Navigation (e.g., program guide) Video Playback • Videotape • DVD • TiVo/DVR • Other Radio Web • Search (Yahoo, Google, Ask, etc.) • Social network (MySpace, etc.) • Online gaming • Media browsing (YouTube, iTunes) • Other Email Instant Msg Software • Office/writing/work • Offline PC Game • Online PC Game (non-web) • Media (photo/imaging/video/sound) • Other (Programming, CAD) Computer Media • CD on Computer (includes SACD) • DVD on Computer (inc. music DVD) • Digital Music Stored (on hard drive) • Digital Music Streaming (real-time) • Digital Video Stored • Digital Video Streaming • Other Phone • Landline • Mobile Talk • Mobile Texting/SMS • Mobile Camera • Mobile Video • Mobile Audio (MP3) • Mobile Games (any built-in game) • Mobile Web (includes online game) • Other Print • Newspaper • Magazine • Book • Other Games • Console Online • Console Offline • Portable (PSP, Gameboy, etc) • Other (arcade, DVD extra, etc) Digital Transfer • Download audio • Download video • Upload audio • Upload video Portable Video Other • Portable DVD • Non-DVD (iPod, PSP, PDA, etc.) • Other • Cinema • Other (walkie talkie or other 2-way radio, etc.) Music • Apparent primary attention is noted in concurrent media exposures • Supplemental flags are used to tag social/solitary viewing, altered speed, indoor/outdoor • Portable Music (iPod, other MP3) • Home/Office Stereo or boom box • Other (e.g., music in retail setting) 15 Observers Were Trained Extensively Telephone and computer while working, at work Television while exercising out of home Game console while socializing, at home Training videos show typical behavior in context while animating the steps to log the exposure in the Media Collector software 16 Day in the Life Map 7am markers 8am Hour 12pm 1pm 2pm 3pm 10am First part of the day map Legend 11am 9am 4pm 5pm 6pm Second part of the day map Note: Map has been horizontally compressed to fit on this slide 7pm 8pm 9pm 10 pm African-American woman, 43 7am 8am 9am 10am Audio Print Radio Video Computer Television Activity Location 11am 12pm 1pm 2pm 3pm 4pm 5pm Audio Print Radio Video Computer Television Activity Location Note: The map has been horizontally compressed to fit on this slide 6pm 7pm 8pm 9pm 10 pm Agenda • The Key Players Involved • The Video Consumer Mapping Study • The Method Applied Selected findings 20 Four-Screen Categorization 2nd 1st TV Screen Live TV DVD/VCR DVR Playback Game Console 3rd Mobile Screen Talk Text Web Mobile Other (e.g. camera) Mobile Video • • • • • • • • • • • • • Text Message Computer Screen Web Email IM Software Computer Video 4th All Other Screens • Environmental • GPS Navigation • In-Cinema Movie • 21 The Composition of Consumers’ Screen Media Time Varied Across Age Groups, but Total Screen Time was Strikingly Similar Except Among Those 45-54, Whose Screen Time was Highest. • Averaging 8½ hours total when including concurrent media exposure, for all age groups except for the 45-54 group (at 9½ hrs) Confirmation of earlier research or beliefs New information But with substantial additional detail now available in a “video consumer map” from a media-neutral source Confirms the direction expected, particularly for digital media… This is the first known information source documenting what could be considered a share competition for media consumers’ time across various screen media. 22 How Consumers How Consumers Accumulated Accumulated Their Their Screen Screen Time Time Average Daily Minutes, Core Sample, N=752 observed days, Spring and Fall 2008 Except for those 45-54, 4-screen totals all add Average Daily Minutes, Core Sample, N=752 observed days, Spring and Fall 2008 All participants, including non-users of various media, including concurrent media exposure to 8½ hrs +/-2% All participants, including non-users of various media, including concurrent media exposure By age By age group group 65+ 421 7 11 19 11 16 8½ hrs 8hrs 18mins – 2% It is widely recognized that those 65+ are heavy users of Live TV 55-64 346 9 14 42 38 36 12 8½ hrs 8hrs 32mins Among those 55+ time with email declines substantially and IM disappears 45-54 336 19 21 DVR playback is highest among those under 55 35-44 230 46 51 15 52 18 9hrshrs 9½ + 1% 34mins Those 45-54 use TV like those older but computer like those younger 17 27 74 47 15 62 25 8½ hrs 8hrs 33mins + 1% Web use is highest for those under 45 256 16 DVD use is highest among those18-34 the 18-34 18-24 210 35 14 56 45 17 34 26 67 20 15 1st screen Live TV: 309min Playback via DVR: 15min DVD or VCR: 23min Console games: 7min Total 1st screen: 353min 180 240 Web: 49min Email: 37min IM: 8min Software: 46min 62 nd 2 2nd screen screen 300 3rd screen 120 2st screen 60 19 8½ hrs 8hrs 31mins Computer and environmental video small and mainly among those under 25 st 1 1st screen screen 0 50 Computer video: 2min Total 2nd screen: 143min 360 420 Mobile talk: 17min Mobile text: 2min 29 9 rd 3 3rd th 4 4th 480 4th screen 25-34 Mobile web: 1min Mobile other (e.g. camera, etc): 0.5min Mobile video: 0.1min Total 3rd screen: 20min 8½ hrs 8hrs 30mins 540 600 Environmental /Other video: 4min In-Cinema movie: 2min GPS navigation: 2min Total 4th screen: 8min Mobile is mostly about talking, but with 12 mins texting for those 18-24 Complete Ranking Of Minutes for 17 Screen Media, by Age Group Using a 10 minute average as a cut off Rank 1 2 3 4 5 Email 11 65+ Live TV 421min Web 19 Software 16 DVD or VCR 11 55-64 Live TV 346min Web 42 Email 38 Software 36 DVD or VCR 14 45-54 Live TV 336min Software 52 Email 51 Web 46 DVD or VCR 21 35-44 Live TV 230min Web 74 Software 62 Email 47 DVD or VCR 27 25-34 Live TV 256min Web 56 Software 51 Email 45 DVD or VCR 35 18-24 Live TV 210min Web 67 Software 62 DVD or VCR 34 Mobile Talk 29 6 7 8 9 10 11 12 13 14 15 16 17 Environm ental/ Mobile In-Cinema Console Computer Mobile Mobile Mobile Mobile IM Other Talk movie games Video Text Other Web Video 0.3 video 3 2 0.3 0.2 0.06 0.05 0 0 4 Environm Mobile Playback ental/ GPS In-Cinema Mobile Computer Console Mobile Mobile Mobile IM Talk via DVR Other Navigation movie Web Video games Text Other Video 0 12 9 video 4 3 1.3 1.2 1.2 0.4 0.2 0 4 Environm Playback Mobile ental/ Console GPS Computer Mobile Mobile In-Cinema Mobile Mobile IM via DVR Talk Other games Navigation Video Text Web movie Other Video 15 19 18 video 3 3 2 1.3 0.7 0.6 0.5 0.13 5 Environm Mobile Playback Console In-Cinema Computer ental/ Mobile Mobile Mobile GPS Mobile IM Talk via DVR games movie Video Other Text Other Web Navigation Video 15 25 17 5 3 3 video 2 0.6 0.6 0.3 0.06 3 Environm Mobile Playback Console ental/ Computer Mobile Mobile In-Cinema GPS Mobile Mobile IM Talk via DVR games Other Video Web Text movie Navigation Other Video 3 19 16 14 video 4 2 2 2 1.2 0.6 0.02 5 Environm Console Playback Mobile ental/ Computer In-Cinema Mobile Mobile Mobile GPS Email IM games via DVR Text Other Video movie Other Web Video Navigation 20 15 26 17 12 video 6 1.2 1.1 0.8 0.1 0 9 Playback GPS via DVR Navigation 7 4 Those 18-24 are exposed to twice as many screen media 10+ mins as those 65+ (10 vs. 5); greater media diversity 25 Live TV Led All Video Time by a Large Margin, Followed By DVDs, with DVRs Third. 4 • • Live TV continued to dominate other media. This was true not only in total minutes across all adults, but also in daily reach (94%) and average daily duration (5½ hours) for users. Total TV’s #1 position among media held across all age groups (though total audio time matched live TV time for those 18-24). Confirmation of earlier research or beliefs New information This may confirm Nielsen TV viewership data… But disputes a common perception that TV is not the major medium for those in younger age groups Confirms that DVR playback is a significant component of total TV time, though much smaller than live TV Demonstrates that DVD time (rarely discussed) is larger than DVR playback (often discussed) 26 Daily Reach: % of observed days 100 Example: Total Daily Reach and Duration for Live TV Users: Daily reach Live TV Daily reach: 94% Avg. daily duration: 331 mins 80 60 40 Total Usage = Daily reach X Daily duration 94% X 331= 311 avg. mins per ALL Core participants including non-users spent with Live Television 20 Usage per User: Average daily duration 0 0 60 120 180 240 Daily Duration: Average Minutes per User 300 360 27 Live TV Continued To Dominate Other Media Daily Reach: % of observed days 100 Daily Reach and Average Daily Duration for All Major Media Core Sample N=752 observed days, Spring and Fall 2008 Any Phone Live TV Any Audio Landline Broadcast radio 80 Any Computing Mobile Any Print Live TV continued to dominate other media both in daily reach (94%) and average daily duration (5hr 31min) for users. Any Internet Web Media Categories 60 Email Software Video 40 Newspapers Magazines 20 Gaming IM Any audio: • Broadcast radio • MP3s, CDs, etc. (not shown separately) Any computing: • Any Internet • Web • Email • IM • Software Video includes DVDs and DVRs primarily and other video hierarchy media (shown on next chart) Any print includes newspapers, magazines, books (not shown separately) Any phone includes landline and mobile Other media 0 0 60 120 180 Daily Duration: Average Minutes per User 240 300 28 DVDs Followed by DVR Playback Were by Far the #2 And #3 Sources of Video After Live TV Daily Reach: % of Participants Total Daily Reach and Duration for Video Media Core sample, N=752 total observed days, Spring '08 and Fall '08 100 Total TV & Video Live TV represented the overwhelming majority (88%) of total TV & video time 80 Live TV Total TV (Live + Playback) Adding DVR playback did not increase daily reach of TV; it increased daily duration, and video increased both. 60 Total TV & Video TV Non Total TV Video Computer Video Non Total TV Video 40 Mobile Video DVD/VCR 20 DVD/VCR players matched DVR on duration, but were higher on daily reach. Computer Video Playback via DVR Digital video streaming to computer Environmental/Other video Mobile Digital video stored on Video computer Video on Demand/PPV DVD on computer (Fall '08 only) 0 Portable DVD 0 120 180 240 Video on personal 60 devices Video on (iPods, etc.) Daily Duration: Average Minutes per User mobile phone 300 360 29 Media Acceleration Process™ • Previously piloted by PepsiCo, P&G and Time Warner • Targets devices/services in early adoption phase • Designed to avoid “early adopter” trap • Provided steep discount (50%) to participants who bought from catalog of selected items, to accelerate adoption by “early majority” consumers • For a minimum of $1400 and maximum of $4000 in purchases (i.e., $700 to $2000 cost per participant) • N=100 individuals observed before and after acceleration purchases Acceleration Learning Was Dominated By HDTV Effect, But Also Led To DVR Analysis Device available Purchase Category included count in tables HDTV 79 HDTV Nintendo Wii 41 Nintendo Wii PS3 31 PS3 Laptop computer 21 Laptop computer DVD player 18 DVD player iPod 16 Portable audio player iTouch 14 Portable video player Xbox 360 12 Xbox 360 Desktop computer 7 Desktop computer Apple TV 5 iPhone 5 iPhone Zune 4 Portable audio player Kindle 1 Archos Wifi 1 Portable video player DirectTV receiver (new service) 1 Satellite TV Cable/Satellite upgrade 0 Slingbox 0 Smartphone 0 Tivo 0 This sample did not need acceleration to try DVR (17 participants naturally adopted DVRs) Accelerated categories analyzed Video Games Purchase count 84 PS3 + Xbox 360 43 Nintendo Wii 41 HDTV 79 Portable audio/video player 35 Laptop computer 21 DVD player 18 iPhone 5 DVR/Tivo 0 • The outlined 2 acceleration categories analyzed • Other devices were all purchased by 5 or fewer participants each Media Acceleration Findings • The evidence suggests that a new HDTV increases TV viewership: – 1st HDTV (in both Core and Accelerated samples) – 2nd HDTV (which was only possible to observe in the Accelerated sample) – Particular increase in Live TV and Sports • However, the decline in TV viewership among early HDTV owners in Core suggests that some portion of the HDTV-based increase in TV viewing is temporary • Game Consoles – Game Console Accelerators spent more time with Live TV and Gaming – Less time with computer applications – particularly computer video For more information The study report, summary PowerPoint deck, additional analyses and technical appendices are available for download from the client’s site: www.researchexcellence.com Thank you 33