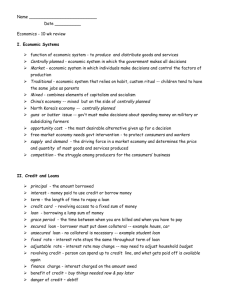

Supplemental Income Generation Opportunites Using

advertisement

DRAFT Supplemental Income Generation Opportunities Using the Term Asset-Backed Securities Loan Facility (“TALF”) March 3, 2009 Executive Summary Consideration of using TALF to generate supplemental treasury returns Subsidized leveraged limited liability investment in stranded consumer asset related ABS Issues Positives • Limited downside given high quality assets • Alternative returns high double digit ROE • Intermediate Term 6 – 18 month • Modest Investment •Limited Mark to Market Consideration • Liquidity • ALM • More expensive than deposit funding (100 -125 BPs) 2 Term Asset-Backed Securities Loan Facility Summary Summary Information Facility Structure First-Loss Protection: U.S. Treasury Loan Terms New York Federal Reserve (NY Fed) will make up to $1 trillion of non-recourse loans to Eligible Borrowers, secured by Eligible ABS. TALF will begin lending in March 2009 and continue through December 31, 2009, unless the program is extended. US Treasury will provide $20 billion of first-loss protection to NY Fed under the TALF in the event of collateral default. Borrowers will access TALF through Primary Dealers, who will act as agent and deliver Eligible ABS to a Custodian Bank. (See Exhibit D for list of Primary Dealers). All settlements have to clear through the Depository Trust Company (“DTC”). NY Fed will establish an SPV that will purchase any Eligible ABS collateral the NY Fed receives if a borrower under a TALF loan puts the collateral to the NY Fed in satisfaction of the loan. US Treasury will provide the first $20 billion of funding to that SPV, in the form of a subordinated note purchase. NY Fed will make a senior loan to the SPV to fund any purchases of Eligible ABS above the $20 billion provided by the US Treasury. All cash flows on SPV assets will repay the NY Fed's senior loan first, and the US Treasury's subordinated notes will absorb first losses on any ABS collateral owned by the SPV. 3 Term Asset-Backed Securities Loan Facility Summary (cont’d) Loan Terms Loans offered on a fixed day each month. Eligible Borrowers may request one or more loans by indicating for each loan (a) Eligible ABS (prescreened for eligibility by Primary Dealer), (b) loan amount, and (c) fixed or floating interest rate. NY Fed reserves the right to accept/reject requests at its discretion and/or identify higher risk ABS for additional scrutiny. Upon receipt of eligible collateral at the NY Fed’s Custodian Banks, loan proceeds are dispersed to the Borrower. 3 year loan terms. Eligible auto loan ABS and credit card ABS must have a maximum 5-year expected life. NY Fed will require a 5 bps non-recourse loan fee at the inception of each loan transaction. Borrower may elect either a fixed or floating (spread to LIBOR) interest rate for each loan requested. Interest rate set in advance of each monthly subscription date; Fixed interest rate at 3-year swap rate + 100 bps; Floating interest rate at 1-month LIBOR + 100 bps; Rate level to be set at a level to incent Borrowers to purchase newly issued Eligible ABS at yield spreads that are both higher than normal market conditions but lower than spreads in highly illiquid market conditions. Interest paid monthly. All principal collections are required to apply towards repayment of principal of the related TALF loans (no limit on prepayments), while excess interest passes through to the Borrower. Maximum loan amount: market value of the Eligible ABS less a haircut (subject to additional restrictions based on asset class). Minimum Loan Amount: $10 million. Collateral Haircuts will be determined by the NY Fed and announced monthly prior to each monthly loan subscription date; the haircuts will vary by asset class, collateral composition, and ABS tenor. A set of preliminary collateral haircuts can be found in Exhibit A. For comparative purposes, Exhibit B outlines Fed discount window collateral haircuts. Please note that these may or may not be similar to the eventual haircuts established for TALF. No ongoing collateral MTM/Margining requirements. Collateral Substitution is not allowed during the loan term. 4 Term Asset-Backed Securities Loan Facility Summary (cont’d) Loan Terms (cont’d) US$ denominated cash ABS backed by auto loans (includes retail and leases relating to cars, light trucks or motorcycles and auto dealer floorplan loans), student loans (FFELP consolidation and nonconsolidation and private student loans), credit cards (including corporate cards) or SBA loans (including loans guaranteed by the government). May be expanded to include CMBS, non-Agency RMBS or other asset classes. All/substantially all of assets in pools must be new or recent originations to US-domiciled obligors. Collateral underlying ABS may NOT be originated by the Eligible Borrower or its affiliates. Collateral underlying ABS may NOT be itself cash or synthetic ABS. Except for SBA Pool Certificates or Development Company Participation Certificates, eligible ABS must be issued on or after January 1, 2009. Eligible ABS If auto loan ABS, auto loans must have been originated on or after October 1, 2007. If SBA loan ABS, SBA loans must have been originated on or after January 1, 2008. If student loan ABS, student loans must have a first disbursement date on or after May 1, 2007. If credit card ABS, must be for refinancing of existing credit card ABS maturing in 2009 and in maximum size equal to maturing ABS. ABS must be rated AAA/Aaa by at least two NRSROs(2) and may not have a rating below AAA/Aaa by any major NRSRO. Eligible ABS need not be issued on the same day of borrowing from TALF 5 Term Asset-Backed Securities Loan Facility Summary (cont’d) U.S. persons (including business organizations organized in the U.S.), including U.S. subsidiaries of non-U.S. parent companies and U.S. branches/agencies of foreign banks. Must have account relationship with a Primary Dealer. Expected Borrowers/Investors: Eligible Borrowers Hedge Funds who often operate with leverage. Primary Dealers are expected to take-down securities for spread income. Originator Restrictions Originators of securitized assets must agree to comply with executive compensation limits consistent with TARP Capital Purchase Program executive compensation guidelines as outlined in the Emergency Economic Stabilization Act of 2008. 6 Preliminary Collateral Haircuts Sector Auto Auto Auto Auto Auto Bank Card Bank Card Retail Card Retail Card Student Loan Student Loan Small Business Subsector Prime retail lease Prime retail loan Subprime retail loan Floorplan RV/motorcycle Prime Subprime Prime Subprime Private Gov’t guaranteed SBA loans 0-1 10% 6% 9% 12% 7% 5% 6% 6% 7% 8% 5% 5% 1-2 11% 7% 10% 13% 8% 5% 7% 7% 8% 9% 5% 5% ABS Expected Life (years) 2-3 3-4 4-5 12% 13% 14% 8% 9% 10% 11% 12% 13% 14% 15% 16% 9% 10% 11% 6% 7% 8% 8% 9% 10% 8% 9% 10% 9% 10% 11% 10% 11% 12% 5% 6% 7% 5% 5% 6% 5-6 N/A N/A N/A N/A N/A N/A N/A N/A N/A 13% 8% 7% 6-7 N/A N/A N/A N/A N/A N/A N/A N/A N/A 14% 9% 8% For ABS with expected lives beyond seven years, haircuts will increase by 1% for each additional year of expected life beyond seven years 7 Fed Discount Window Collateral Haircuts Collateral Category Federal Reserve System Discount and PSR Collateral Margins Table* Effective: September 22, 2006 Changes can be viewed in the 'Change History' worksheet tab Lendable Value for Securities or Lendable Value for Instruments with Market Prices /1 Securities or (% of Market Value) Instruments if Duration Buckets Market Price Not Lendable Lendable Value Value for for Loans Not Loans Individually Individually Deposited at Deposited at Available FRS/8 FRS/7 (% of Par or (% of Outstanding (% of Market Outstanding Balance) Balance) Value) 0 to 5 >5 to 10 >10 98% 98% 97% 95% 93% 90% 90% 97% 96% 96% 94% 92% 89% 85% 97% 92% 94% 95% 90% 97% 92% 97% 95% 90% 92% 92% 87% 95% 90% 95% 93% 85% 86% 88% 83% 90% 85% 90% 80% Foreign Government Agencies - AAA - Foreign Denominated/2 92% 90% 85% Municipal Bonds - US Dollar Denominated Municipal Bonds - AAA - Foreign Denominated /2 Corporate Bonds -US Dollar Denominated Corporate Bonds - AAA -Foreign Denominated /2 97% 90% 97% 92% 95% 85% 95% 90% 92% 80% 93% 85% 75% German Jumbo Pfandbriefe - AAA - US Dollar Denominated 96% 92% 90% 60% German Jumbo Pfandbriefe - AAA - Foreign Denominated/2 92% 90% 85% U.S. Treasuries and Fully Guaranteed Agencies: Bills, Notes, Bonds, Inflation Indexes Zero Coupons, STRIPS Government Sponsored Enterprises: Bills, Notes, Bonds, Inflation Indexes Zero Coupons, STRIPS International Agencies: Bills, Notes, Bonds - US Dollar Denominated Bills, Notes, Bonds - AAA - Foreign Denominated /2 Zero Coupons, STRIPs Brady Bonds- US Dollar Denominated Brady Bonds - Foreign Denominated /2 Foreign Governments - US Dollar Denominated Foreign Governments - Foreign Denominated /2 Foreign Government Agencies - US Dollar Denominated 8 60% 75% 75% 80% Fed Discount Window Collateral Haircuts Asset-Backed Securities - AAA (includes Collateralized Loan and Debt Obligations) 98% 96% 93% 85% Asset-Backed Securities - non AAA (excludes Collateralized Loan and Debt Obligations) 97% 95% 92% 80% 97% 95% 92% 80% 98% 96% 93% 90% 97% 95% 92% 80% 94% 92% 90% 90% 70% Commercial Mortgage-Backed Securities - AAA Mortgage Backed Securities (includes agency and private label) Collateralized Mortgage Obligations - AAA (includes agency and private label) Trust Preferred Securities Mutual Funds (tcuux, tcudx, tcuxx) /5 /6 87% Government Sponsored Enterprise Stock (FNMA, FHLM) /6 Bankers Acceptances, Certificates of Deposit, and Commercial Paper Commercial and Agricultural Loans: Minimal Risk Rated /3 Normal Risk Rated /4 Agency Guaranteed Loans Commercial Real Estate Loans Construction Real Estate Loans 1-4 Family Residential Mortgages Home Equity Consumer Loans- Autos, Private Banking, Installment, Etc. Consumer Loans- Credit Card Receivables, Student Loans Consumer Loans - SubPrime Credit Card Receivables 97% 95% 90% 87% 93% 87% 87% 91% 89% 87% * This document is for informational purposes only and subject to change without notice. It is not binding on the Federal Reserve System in any particular transaction. /1 New issues are valued at 90 percent of par value until they are priced by the Federal Reserve System's pricing vendor(s). /2 Contact your local Reserve Bank for a list of the foreign denominations currently acceptable. /3 Minimal Risk is defined as investment grade. /4 Normal Risk is defined as below investment grade but still a "pass-credit" from a regulatory standpoint. /5 Margin only for Credit Union Mutual Funds. Margin must be developed on a fund by fund basis. /6 The duration buckets do not apply to the mutual fund or GSE stock margins. /7 Pledged loan data received using electronic files formatted according to FRS's specifications (Automated Loan Deposit - ALD) and certain loans held in FRS Vaults. (Note: Information on Automated Loan Deposit (ALD) is available at www.FRBDiscountWindow.org/ald.cfm) /8 Pledged loan data received using paper reports or electronic files in a format determined by pledging institution. Source: http://www.frbdiscountwindow.org 9 80% 75% 90% 75% 75% 85% 85% 80% 75% 60% Indicative Returns 2-3 Year Auto Loans 2-3 Year Credit Card ABS TALF Margin: 100 bps; Upfront Fee: 5 bps; Ppt: 1.7 ABS Haircut ##### 150 200 250 300 350 400 450 500 550 6.00% 8.00% 9.00% 11.57% 21.17% 31.53% 42.69% 54.71% 67.64% 81.57% 96.54% 112.64% 9.36% 16.38% 23.80% 31.66% 39.97% 48.76% 58.05% 67.87% 78.24% 8.64% 14.82% 21.32% 28.15% 35.34% 42.90% 50.84% 59.18% 67.94% Bond Spreads (bps) Bond Spreads (bps) TALF Margin: 100 bps; Upfront Fee: 5 bps Haircut 10 37.4% 150 200 250 300 350 400 450 500 550 8.00% 11.00% 6.11% 9.26% 12.59% 16.12% 19.87% 23.86% 28.10% 32.61% 37.43% 5.31% 7.59% 9.97% 12.45% 15.04% 17.73% 20.55% 23.49% 26.57% Primary Dealers List of the Primary Government Securities Dealers Reporting to the Government Securities Dealers Statistics Unit of the Federal Reserve Bank of New York: Primary Dealers BNP Paribas Securities Corp. Banc of America Securities LLC Barclays Capital Inc Cantor Fitzgerald & Co. Citigroup Global Markets Inc. Credit Suisse Securities (USA) LLC Daiwa Securities America Inc. Deutsche Bank Securities Inc. Dresdner Kleinwort Securities LLC Goldman, Sachs & Co. Greenwich Capital Markets, Inc. HSBC Securities (USA) Inc. J. P. Morgan Securities Inc. Mizuho Securities USA Inc. Morgan Stanley & Co. Incorporated UBS Securities LLC. Source: http://www.newyorkfed.org/markets/pridealers_current.html 11