Tom Casten Presentation - Back-up/standby

advertisement

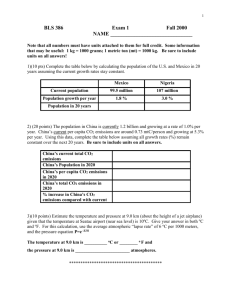

Assessing Market Barriers to Distributed Generation Backup Rates and other Misleading Questions Thomas R. Casten Chairman World Alliance For Decentralized Energy 630-371-0505, tcasten@privatepower.net March 28, 2003 Presentation Outline The essential question – What is optimal way to provide expected electrical load growth? Describe expected results of meeting load growth with100% new GG, 100% new DG, and various mixtures of CG and DG Meeting all load growth with DG reduces capital expenditures, power costs, emissions, CO2 and vulnerability Explore why power markets don’t optimize Explore locational benefits and costs, how new rules could reward incumbent utilities for encouraging optimal path of DG? What are “Correct” Standby rates is a misleading question Question assumes DG has a net cost to society Assumes no load growth, or no cost to meet expected load growth with new central generation Assumes transmission is adequate for load growth, Assumes central generation is efficient and clean Assumes CG and transmission is cheaper than DG Assumes what is good for DISCO’s is good for society, or stated another way, Assumes regulatory rules reward DISCO behavior that is beneficial to society Each Assumption is False DOE projected 20 year load growth: US = 44% New England 28% US transmission is badly congested Likely mix of new DG is more fossil efficient and less polluting than likely mix of new CG Capital Cost, CG versus DG Item NEW CG NEW DG Average cost per kW $700 $1200 Average trans. cost per kW $1200 None Total Capital cost per kW $1800 $1200 Is DISCO and Society Benefit the Same? Perspective on Govt. Rules “A history of American government limited to those laws which sprang pure from the brains of the nation’s politicians with no special interests as their objects would be a very short history indeed.” Jonathan R. T. Hughes, The Government Habit, Basic Books Inc., 1977 Incumbents vastly better financed to promote protective rules than insurgent companies blocked by current rules Regulation always flawed, filled with unintended consequences Perspective on Electric Regulation Ninety year history, sub-optimal regulations reward capital investment, create throughput bias, ignore or penalize efficiency gains and block DG worldwide Utility efficiency stagnant at 33% for 42 years and counting Looming problems of CO2 and criteria pollution, fossil fuel dependency, balance of payments, and vulnerability all exacerbated by bad regulation that promotes CG What are Societies Goals for the Heat & Power System? Consensus goals are to minimize: Capital expenditures Cost per kWh to users Criteria pollutant emissions Fossil derived CO2 emissions Vulnerability to storms and terrorists Power failures The Process We modeled each generation technology – capital cost, performance, emissions We checked impact on each of societies goals from meeting all load growth with new CG, with all new DG, and with various mixtures We summed up all societal benefits and costs for each approach to satisfying load growth Inputs included: Baseline data for existing generation Average line losses for CG power – 9% Load factors for each technology Line losses at peak load – 15% Progress expected on cost and performance for each technology DOE projected 44% load growth through 2020 Nine mixtures of CG and DG Results – Optimizing Generation of Incremental Heat and Power DG as % of Total US Generation Impact of Generating 2020 Load Growth with Central or Decentralized Generation 100% CG 100% DG Savings % Change $853 $562 $291 34% $149 $97 $52 35% 8.89 5.78 3.11 35% PM10 255 175 155 80 16 146 175 159 9 68% 91% 5% Million Metric Tonnes CO2 720 387 332 46% Total Capital Cost (Capacity + T&D) Billions of Dollars 2020 Incremental Power Cost Billions of Dollars 2020 Incremental Power Cost Cents / KWh Emissions from New Load Thousand Metric Tonnes NOx SO2 Capital Cost to Supply 2020 Electric Load Growth 900 800 $ Billions 700 600 500 400 300 200 100 0 6.11% 8% 10% 15% 20% 25% 30% 35% 39.38% % DG of Total US Generation Inv. In New Cent. Gen. Inv. In new Dist. Gen. Inv. In T&D Total Costs for Incremental Electricity Purchases in 2020 160 140 $ Billions 120 100 80 60 40 20 0 6.11% 8% 10% 15% 20% 25% 30% 35% 39.38% % DG of Total US Generation O&M Fuel Capital Amorization + Profit T&D Amorization Retail Costs per KWh for Incremental 2020 Load Cents / KWh 10 8 Average 2000 Retail Price- 6.9 cents / KWh 6 4 2 0 6.11% 8% 10% 15% 20% 25% 30% 35% % DG of Total US Generation O&M of New Capacity Capital Amorization + Profit On New Capacity Fuel T&D Amorization on New T&D 39.38% Added Annual Fossil Fuel Use for Incremental 2020 Load Quads of Fossil Fuel / Yr 12 10 8 6 4 2 0 6.11% 8% 10% 15% 20% 25% 30% % DG of Total US Generation Total "New" Distributed Generation Fuel Use Total "New" Central Generation Fuel Use 35% 39.38% Emissions from Generating Incremental 2020 Electric Load Thousand Metric Tonnes / Year 700 600 500 400 300 200 100 0 6.11% 8% 10% 15% 20% 25% 30% 35% % DG of Total US Generation SO2 Emissions NOx Emissions PM10 Emissions 39.38% Added Annual CO2 Emissions for Incremental 2020 Load Million Metric Tonnes / Year 800 700 600 500 400 300 200 100 0 6.11% 8% 10% 15% 20% 25% 30% 35% 39.38% % DG of Total US Generation CO2 emitted for added Cent Gen. CO2 emitted for added Dist. Gen. Why Don’t Markets Move to Optimal Solutions? Power is not a free market Optimization requires on-site generation to utilize waste heat 90 year old laws and regulations are barriers to efficiency DISCO’s are rewarded for capital investment, penalized for loss of throughput, given no rewards for improving efficiency or cutting costs to consumers Observations on Locational Benefits/Costs of DG? Net of costs and benefits dramatically favors using DG to meet future load growth Need 13,000 MW of new generation every year for US, 282 MW every year for New England If CG, must build 118% more generation and 118% of load growth in new T&D Emissions and vulnerability concerns favor DG as well What are True Standby Costs Typical DG has 96% availability, i.e., 4% probability of outage. 1000 DG units of 1 MW average capacity have actuarial need for 40 MW backup, if all were fully utilized at peak hour. Utilities have been unable to invest in adequate T&D, congestion increasing T&D is aging, book value is shrinking DG saves new T&D and holds down costs of future power Impact of Standby Charges Any standby charge serves to discourage DG, and will thus raise future costs of electric power and pollution associated with that generation Future generation will not be optimal unless locational value of generation is recognized and rewarded, i.e. a DG payment. Other Rule Changes Needed Reward DISCO’s for encouraging DG and avoiding more CG and more T&D Allow wires utilities to invest in DG, providing they give equal treatment to third party DG Increase DISCO allowed rates of return based on T&D avoided, line losses, and efficiency gains Refuse to authorize T&D investment until DG opportunities have been exhausted Conclusions DG has significant net benefits in economics, emissions and vulnerability DG should receive significant locational benefits for net value it provides to other users Utilities are rewarded for blocking DG, even though more DG will dramatically benefit society Any backup charges will make the future cost of heat and power higher Thanks for Listening For more detail, go to www.privatepower.net or to www.localpower.org