Final Expenses

advertisement

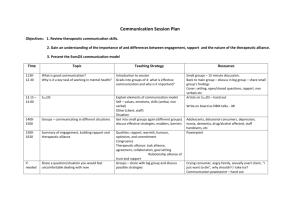

Needs Based Sales Presentation LIBERTY NATIONAL LIFE INSURANCE COMPANY 2013 LNL2422I2 0213 Needs Based Sales Needs Based Sales The chief function of life insurance is to pay for a person’s final expenses. Some of the money paid to a beneficiary normally is used to meet current financial obligations created by the insured’s death. The remainder of the money may also be used to meet future needs of the insured’s beneficiary or beneficiaries. Totaling the amounts required to pay for current and future expenses is often referred to as the “total needs approach” to determine how much life insurance a person should carry. Four Obligations at Death 1: Final Expenses Funerals cost money. So do doctors; the ambulance; and the hospital, where a stay before death could cause a bill. Income taxes, estate and inheritance taxes, (because they resulted from death) make up what could be called “Death Taxes.” Four Obligations at Death When a breadwinner dies, dependent family members may still have other financial needs for: 2: Income Replacement Replacing the breadwinner’s income 3: Mortgage Protection Taking care of the outstanding mortgage loan on the house (if any) 4: College Education Protection Today, almost everyone recognizes the necessity of a good college education for their kids, if they hope to attain success in the business or professional world. Many conscientious parents consider it their duty – an obligation – to establish a fund for their children’s education. Need for Life Insurance No matter how many of these obligations an individual leaves behind, there’s only one thing that will satisfy them…money! For this reason, a person who wants to relieve the family of obligations when he or she dies will plan to leave them with an estate – money – that is sufficient to cover all needs. Needs Based Example Jim died. He was the breadwinner. The family suffers the loss of his income plus the responsibility of these expenses: Final Expenses $30,000 Income replacement (5 yrs) $175,000 Mortgage remaining $155,000 College costs (2 children) $200,000 TOTAL $560,000 The Needs Approach Obligations Assets Final Expenses: $30,000 Whole Life: $0.00 Income: $175,000 Term & Work: $200,000 Mortgage: $155,000 Mortgage Ins: $0.00 College: $200,000 College Funds: $0.00 Total: $560,000 Total: $200,000 Additional Total Need for Insurance: $360,000 Need for Whole Life: $30,000 Need for Term Life: $330,000 The Sales Process Three Components of Success Rapport Transitions and Tie Downs Needs Based Closing Rapport Building FIRST COMPONENT OF SUCCESS The Balance Between the Human Element and Technology Clients buy products based on advertising messages, word of mouth, reputation, etc. Clients buy LNL products because they like and trust the Agent. The Laptop Sales Presentation is key to show professionalism and uncover the client’s needs. But that’s only part of the sales process. The other key is human interaction, which is represented in the rapport and close. When you break down the sales process, the amount of time spent on each step is: Rapport – 40%; Need – 30%; Presentation 20%; Close 10% Therefore, the balance between the technology and the human element must be 50-50. RAPPORT=40% NEED=30% PRESENTATION LAPTOP =20% AGENT CLOSE =10% Balance between Human Element & Technology is 50/50 The Art of Establishing Rapport Consumers today are more professional and better educated because they are bombarded with sales pitches over the radio and TV. A professional agent can break through all of this resistance by playing up to each customer as if that person is the first and the last client he/she will ever sell to. Make that customer want to do business with you. People buy from Agents they Trust Customers may feel threatened by an Agent coming into their home. Therefore, everything an Agent will do or say in the home will either produce tension or trust. Don’t start closing from the moment you walk in the home. This will build walls and not trust. Go slow, create trust, and then move into your presentation. People buy from Agents they Respect Respect the customer’s time. Don’t spend more time than you need to make a sale presentation. Respect the customer’s territory. You are a guest, so ask for permission to move around the room or come closer to show a brochure. Respect your customer’s intelligence by being up front. Rapport Building: The Warm Up When you walk into a house, find a place where you can sit comfortably and face the customers. Put your hands on the table, relax, and establish rapport. People buy from you because they like you and they trust you. They buy you first, then the Company, and the products after. Find something in common with your customers and go from there. Avoid politics and religion. This should not last more than 15 minutes. Balance Between Agent and the Laptop Interaction with videos • Be excited to watch the videos like it’s your first time every time! • Client is half as excited as you are. Be an insurance professional • People buy from Agents they trust • People buy from Agents they respect Strong warm- up • Shows you are a professional • Shows you care about them • Use FOR (Family, Occupation, Recreation) Transitions and Tie Downs SECOND COMPONENT OF SUCCESS Less is More Remember the Laptop demonstrates the need for the product. Your job is to transition into those videos, re-emphasize, and tie down the importance of the need and the product to the client. To do this effectively, use the LNL Laptop Presentation Script Introductory Offers Collect More Referrals Establish Cause and Effect Sales Cause and Effect Sales • Use the videos to ask for referrals • Use the script to keep it simple • More referrals come from using the Laptop in the Introductory Offers section • Problem, solution • Problem: Every 4 minutes someone dies from an accident* • Solution: $3,000 Accidental Death Plan • Is used in sales universally • Happens up to 4 separate times in the Introductory Offers section • Is the same structure from the Survey to Close *National Safety Council 2012 Asking for Referrals (Sponsors) “We are trying to extend introductory offers to the people in your circle of influence who you know can use it.” “Who would you like to sponsor FIRST?” Get your first sponsorship and ask “Who would you like to sponsor NEXT?” Referral Collection Tips “Who’s first …” is much better than “Can you think of anyone …” Always ask “Who’s next?” Even if they say they can’t think of anyone else, bring up another option, a sibling, relative, neighbor, or coworker and they will think of another, then say, “who’s next?” Be suggestive. “Most people just look through their phone to think of people.” Use competition, “Most people sponsor 10, but the most I’ve seen someone sponsor is 27 if you want to try and set the record!” Overcome an objection, “Whenever the Company sends out a claim check, the family receiving it never sends the check back, they always cash it. Who do you want to help first?” Needs Analysis The Needs Analysis has a three part process to follow to ensure the strongest effect: I–R–T Intro Recap Tie Down Elevate the Need Higher the Need Less Objection to Buying Introduce and Play the Video Recap the Benefit Tie Down “I’m sure you can see how important it is to have this protection in place when something happens, yes?” Needs Based Closing THIRD COMPONENT OF SUCCESS Sell the Concept Needs Based Closing Do: Sell the Concept • Final Expenses covered • Income protected • Mortgage completely protected • Kid’s college expense protected • Your needs are protected so you don’t have to worry about this again. Don’t: Sell Dollar Amounts • Don’t sell face amounts • Don’t say the premiums • Buying based on premium or face amount is short lived People Keep What They Know They Need Downclosing Procedures Downclosing Basics First, understand the objection isn’t always related to the price. Before downclosing: Listen to what the client is telling you. Identify what the actual objection is. Overcome the objection, and re-ask the closing question Option 1 vs. Option 2 $15,000 WL to $10,000 WL $10,000 WL to $7,500 WL Income replacement reduced 1 level Ex 2 years to 1 year