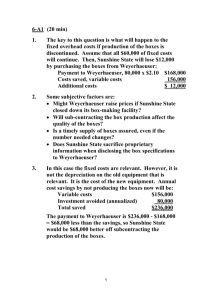

Chapter 9

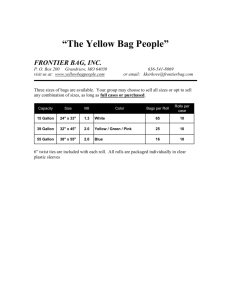

advertisement

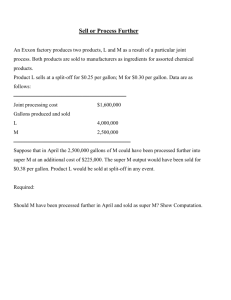

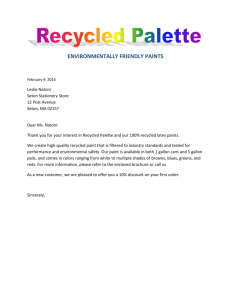

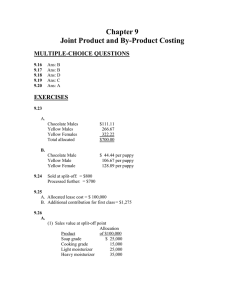

Chapter 9 Joint Product and By-Product Costing Key Topics: – Joint processes and common costs • Main products and byproducts – Allocation methods – Choosing a method – Using joint cost allocation information • Decisions to process further • Choosing a method • Uses of joint costing information Joint Processes and Common Costs • Jointly produce more than one product • Joint (common) costs cannot be traced to individual products • Joint production ends at the split-off point • Individual products might or might not be processed beyond the split-off point Main Products and Byproducts Allocation Methods • • • • Physical output Sales at split-off point Net realizable value Constant gross margin NRV Physical Output Method • Allocate joint costs in proportion to the physical output for each main product • Examples of physical measures: meters, pounds, gallons • All main products must be expressed in the same physical measure Sales at Split-Off Method • Allocate joint costs in proportion to the sales value for each main product at the point where joint production ends • Not always possible to measure sales value at the split-off point Net Realizable Value Method • Allocate joint costs in proportion to the net realizable value for each main product, taking into account the final selling price and separable costs • Same as the sales value at split-off method if there is no additional production beyond the split-off point Constant Gross Margin NRV Method • Allocate joint costs so that the gross margin for all main products is the same – First, calculate combined gross margin for all main products – Second, calculate joint cost allocation that will result in the same gross margin for all main products, taking into account the final selling price and separable costs Allocating Joint Costs The Paint Palette Company produces two products: premium and regular paint. Joint costs are $10,000 per batch of 1,000 gallons, 30% premium and 70% regular. If Paint Pallet sold the products at split-off, it would receive $10.00 per gallon for premium and $5.00 per gallon for regular. When the paint is processed further, the separable cost per gallon for premium is $4.00 and for regular is $1.00. Price per gallon after further processing for premium is $20.00 per gallon and for regular is $10.00 per gallon. Allocating Joint Costs •Allocate the joint costs using the following methods: –Physical units –Sales at split off –NRV –Constant gross margin Decisions About Processing Further Regular paint can be processed further into a paint that dries extremely quickly. The new selling price is $22 per gallon and separable costs increase to $12 per gallon. • What is the contribution of the new product? • Should regular paint be processed further? Choosing a Method Major Goal Avoid distortion of individual main product values Uses of Joint Cost Information • Financial statements • Income tax returns • Government regulatory reports • Other external reports Estimations (Uncertainties) in Allocations • • • • Physical quantities Sales value at split-off point Sales prices if processed further Separable costs • Joint costs are irrelevant for many types of decisions