Technology Transfer in Developing countries

advertisement

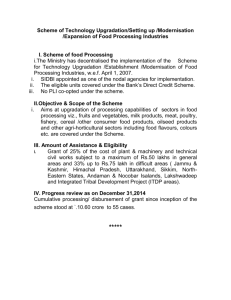

Roundtable II Cooperation in Technology Transfer Tuesday, 29 November 2005 Vienna, Austria Structure of the Presentation Technology Transfer - Insight Technology Competitiveness in Developing countries - Factors Technology Upgradation - Hindsight Technology Development – Challenges India – Case studies Technology Transfer – Way Ahead Technology Transfer - Insight Technology Transfer Phases Technology acquisition Technology Transfer Skill Development Know How Forms Knowledge Management Patents & Licenses Technology adaptation Dissemination Increases production efficiency - Long Term competitiveness of SMEs Technology Transfer - Process Technology Creation Technology Sourcing Knowledge Innovation Development Testing Identification Verification Design Modification Testing Evaluation Awareness Decision Making Application Brokering Technology Transfer is the suite of processes encompassing all dimensions of the origins and uptake of know-how, experience and equipment amongst, across and within countries, organizations and institutions. Technology Transfer – Main Issues Slow uptake of technologies that support sustainable development, despite many initiatives for increased and effective transfer of technologies. Need to emphasize on specific and practical methodologies and tools for promoting the adoption and use of latest technologies. Absence of ubiquitous approach. Need to prioritize initiatives for developing countries depending on their needs and status. Technology Competitiveness in Developing countries - Factors Technology Competitiveness in Developing countries - Factors Technology imports • Small number of developed countries provide most of technological innovations. Most of the developing countries are neither innovating nor adopting. <Technology innovating economies..> • Lacks capability to create globally competitive technologies • Lack of access to information on new technologies and innovations Technology infrastructure • R&D institutes and testing facilities in developing countries fall short of quality when compared to industrialized countries • Lack of collaborative research • Isolation of universities and R&D from Industry Technology Competitiveness in Developing countries - Factors Pace of technological change • SMEs lack the capability to constantly upgrade technologies in view of rapidly changing technologies in developed countries • Easier in Process industries Technology acquisition • Unit level technology absorption is low • Lack of incentive, direction and capability to update existing technologies • Lack of ready access to capital • Relatively high transaction cost Technology Competitiveness in Developing countries - Factors Unit Level Interventions • Smaller firms find difficult to finance and coordinate the requisite level of technological activity • Low participation in network of organizations and institutions involved in diffusing information on technologies. (specially SMEs) Availability of Skilled Manpower • Shortage of trained personnel • Lack of continuous capability development of manpower in technical dimensions • New technologies are not adopted due to lack of skilled people thus widening the technology gap. Technology Upgradation - Hindsight Knowledge Drivers of the 21st Century NANOTECH NETWORKS ATOMS NEURONS BIOTECH GENES Building Blocks & Knowledge tools of 21ST Century COMPUTERS BITS & BYTES Technology Foresight Process Summary Demography Define the question(s) Economics ‘Global’ Trends Environment Society Government technology Business Vectors Technology Dynamics Growth Opportunities Organization’s Power Assets Emerging Growth Opportunities ©L Carlson Consulting Technology Interaction Matrix Pacer, Gating 2nd order effect Exponential Software Micro-elec. Med. Dev. H/M Int. Sensors Photonics Wireless Biotech Nanotech Adv. Mat. Enabling Power Application Needs ICT Support to Design RDCS: Robust Design Computation System ICT Support to Product Design OIS: Design – Manufacturing – Customer Feedback : Integrated Model ICT Support to Manufacturing Customer Relationship Management (CRM) Customer Relationship Management (CRM) Systems that allow you to manage relationship Strategy that puts the customer first, it's getting intimate with the customer - solidifying loyalty Understanding and tracking customer habits Links data together from all parts of the business Warehouse of all the info of your customer Maximizer, ACT!, Salesforce.com, Pivotal Nanotechnology Applications Building blocks Coatings and surfaces Environmental, energy, health & safety systems Consolidates and composites Biochemical Dispersions & structures Biodevices and systems NSEC Processing and integration System architectures NanoTechnology Research MRSECs, STCs, ERCs, IUCRCs NNUN PhotonicsOptics Electronic-magnetic systems Modeling tools and instruments Management of applications matter ! Technology Development – Challenges Technology Development - Challenges Can be met through innovations management To be able to invest in technology creation at the risk of failing Adequate infrastructure required for technology creation IPR issues Adequate information relevant to strategic planning and market development Developing countries have already lost precious time Creation of useful and usable technologies is a major factor in ensuring that there is opportunity to make informed and confident choices in technology investment projects Technology Creation should be best left for developed countries. Developing countries should focus on adapting, learning and dissemination. India – Case Studies Machine Tools sector in India A holistic programme implemented by UNIDO-ICAMT (International Centre for Advancement of Manufacturing Technology). Emphasis on Technology dissemination through sensitization workshops, unit level interventions, participation in International fairs, Technology missions, skill upgration and market development activities. Growth in 2004-05 was 47% Annual growth of over 90% in the number of CNC machines production in the last two years. 50% increase in production of components and accessories. 101% increase in export of target group of machine tools – from USD 6.6 million to USD 13.3 million While the Technology innovation is still low, the sector has done extremely well due to Technology dissemination, Skill upgradation, Unit level interventions & market development activities. Auto Components sector in India Indian auto component industry has grown from US $ 3.9 Billion to US $ 6.7 Billion in 3 years Exports have increased from US $ 578 Million in 2001-02 to US $ 1000 Million in 2003-04. India has become the 2nd largest two wheeler manufacturers in the world Increased competitiveness is due to increased capability of latest technologies for continuous improvement when compared to other countries. Emphasis on process engineering skills, product engineering and continuous improvement capability. While the Research & Development activities are still at low level, the sector has witnessed phenomenal growth due to application of ICT tools, Technology dissemination, Skill upgradation, Knowledge management in the area of Engineering Design. Indian Software: Global Brand By Verticals: 25,000 21,500 USD Million Manufacturin g 13% 20,000 15,900 15,000 12,450 10,100 10,000 8,470 Domestic Exports Total 12,500 9,870 Telecom Equipment 6% BFIS 37% 6,300 5,000 2,170 2,580 3,400 4,500 By Geography: 0 2000/01 2001/02 2002/03 2003/04 2004/05 Year Software & Services Grow over 30 % Others 25% 17,000 7,680 2,420 Retail 6% Telecom Service 7% Health Care 6% North America 68% W. Europe 21% Japan 2% Latin America & Asia Pac ROW 3% 6% ~ 80% of Fortune 500 outsource their IT from India Source: NASSCOM India: Fast Growing Market … India Hardware Industry projected at US $ 69 billion by 2008 4 million PC Shipments – 2004 65 million mobile subscribers 2.5 million broadband in 2004 - 2004 10 million broadband in 2008 14 Mil PC Shipments - 2008 200 M Mobile subscribers by 1 million Set Top Box – 2004 15 million Set Top Box - 2008 2007 • More than 3 million cell phone subscribers added every month • Sub $ 40 Mobile Phone • Sub $ 225 PC ‘s would increase PC penetration. 9.25 million TV Sets – 2004 16 million TV Sets – 2008 Indian IT Industry Industry Turnover (2004-05) Hardware Domestic: Hardware Exports: Software Exports: Software Domestic: Industry Turnover by 2008: US $ 27.75 billion US $ 5 billion US $ 1.25 billion US $ 17 billion US $ 4.5 billion More than US $ 100 Billion While the Research & Development activities have been low, the sector has witnessed boom due to knowledge workers, Skill upgradation & capability development. Indian Telecom Sector From To Monopoly service providers Competitive regime with multiple players (public & private sector) across service segments Peak long distance tariff from Delhi to Mumbai of Rs.30/minute ($ 0.65/minute) Rs.2-3 per minute ($ 0.04-0.07/minute) Rs.1-2 per minute ($ 0.02-0.04/minute) 48 mn fixed line subscribers including FWT and Limited mobility CDMA 56 mn mobile subscribers Competition Tariffs Peak cellular outgoing tariff of Rs.16/minute ($ 0.35/minute) 18 mn fixed line subscribers in March 1998 <1 mn cellular subscribers in March 1998 Subscribers Total industry revenue of US$ 4 bn in FY98 ~ US$ 18 bn for FY05 <2% telephony penetration in March 1998 9.37% penetration No regulator Independent and active regulator (TRAI) and appellate tribunal (TDSAT) Industry Size Penetration Regulator TRAI: Telecom Regulatory Authority of India; TDSAT : Telecom Disputes Settlement and Appellate Tribunal Indian Telecom Sector - Latest Technology at Affordable Prices National policy is technology neutral but encourages global state of the art technologies All leading equipment and handset vendors have established significant presence in India They have been instrumental in making mass wireless service viable Capex / sub has dropped from US$300-400/sub to US$70-80/sub Entry handset prices have dropped from US$400-500 to US$50 Coexistence of dual wireless technology – CDMA and GSM Growth at the rate of 30% Leapfrogging in Technology Adaptation has attributed to Telecom boom. PAN-African Network 53 PAN-African countries to be connected as one network through Satellite and Fiber Optics Network to provide: • • • • • • • Tele-education Tele-medicine VVIP communication network Internet Videoconferencing VOIP services Support e-governance, e-commerce, infotainment, resource mapping and metrological services PAN-African Network To connect 5 universities to 53 learning centers, 10 Super specialty hospitals to 53 Remote hospitals in rural areas Indian Institutions to only make the programme running till the expertise is passed on to PAN-African countries PAN-African network will be established, maintained and managed within a period of 3 years. Handholding training will be imparted to the users and handed over by the end of 3 years Novel way for sharing of knowledge & technology Technology Transfer – Way Ahead Technology Transfer in Developing countries – Road Map Establishment of International Technology Centres Adopt demand-driven approach Focus on specific industrial sectors Establish Technology Trackers in leading industrialized countries Encourage application of technologies at the enterprise level through rapid build up of awareness of need, diagnosis of economical requirements, technology transfer management etc Emphasis on capability development Establishment of cooperative and collaborative partnerships between key stakeholders Technology Transfer in Developing countries – Road Map Implementation of technology driven programmes Focus on technology areas of core competence and with cross sectoral impact demand of developing countries, thus increasing the international activities. Design and implementation of technology transfer plans and specific actions Dissemination of technology information – access to reliable and relevant information Skill development activities Provide outreach programmes for SMEs for effective dissemination. A system that minimizes contractual and other legal risks. Access to Decision Support Tools. Technology Upgradation – Key Focus Areas Key Drivers Others Technology Innovations/R&D Global Benchmarking of Quality Market access ICT Applications to Technology & Management Processes Technology Dissemination Capacity building Skill upgradation Thank You Technology Innovating Economies US-Patents per million population USA 314.43 Japan Taiwan 260.99 239.78 Switzerland Sweden Israel 195.65 195.65 163.32 Finland Germany Canada 140.21 135.73 115.80 Denmark 89.55 Back