File - Financial Accounting at Sias

advertisement

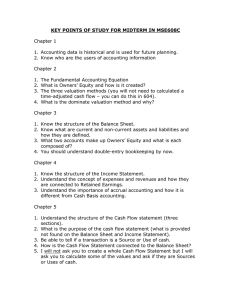

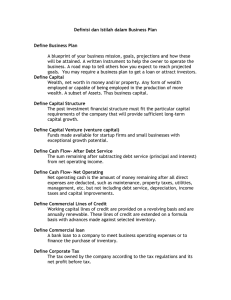

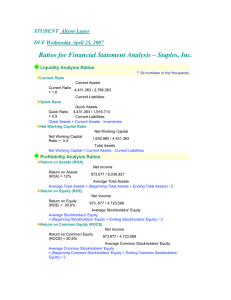

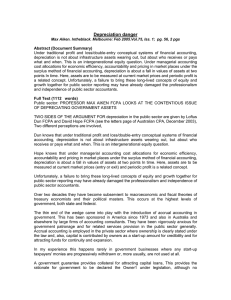

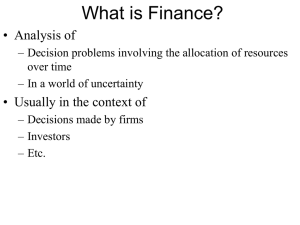

Financial Accounting Midterm Exam Study Guide Sias International University: Fall 2012 Mr. Ashton Converse www.accountingsias.weebly.com Directions for Exam: Take your time and read each question carefully. Please use only your thoughts and not your classmates thoughts, refrain from looking at others’ exams, do not cheat, no using notes, cellphones are not allowed, and answer all questions. Take a deep breath, choose only one answer, and try your best. Choose the best answers. What to Review PowerPoint Slides Notes from Class Mid-Chapter Summary Problems Review PPT Slides Textbook and Practice Problems Homework Accounting Coach The Website Exam Layout Multiple Choice: 20 Questions Fill in the Blank: 5 Questions Short Response: 5 Questions Essay: 1 Question Transaction/Journal: 1 Question Financial Statement: 1 Question Topics on Exam Chapter 1: Financial Statements and Introduction Know Financial Accounting The Financial Statements Shareholders Partnership Stock PPE All types of assets Proprietorship Forms of Business Revenue and Net Income Liabilities, Assets, Balance Sheet, Owners’ Equity Difference between Financial Accounting and Managerial Accounting Affects of Turmoil in a Country Key to Accounting Entity and GAAP The Principles and Concepts of Chapter 1 Inflation, Deflation, and the Accounting Equation Managerial Decision Guidelines Chapter 2: The different assets Inventory Accounts Payable and Receivable Notes Payable and Receivable Long-term Debt Stockholders’ Equity Common Stock Retained Earnings, Dividends 5 Necessities for Every Financial Statement Report Parts to an account Transaction, account, cash, prepaid expenses Assets and Liabilities and Stockholders’ Equity Single-Entry vs. Double-Entry Accounting Debit vs. Credit Transaction Accounts Expansion of the Accounting Equation T-accounts, journal, ledger, posting, trial balance Flow of Accounting Your Holiday Project (interview) Chapter 3: www.accountingcoach.com Why companies spend millions of dollars on research? Why accounting is important? How to keep employees motivated Accrual vs. Cash-basis accounting Accrual Accounting Cash Flows Time Period Concept Matching Principle Revenue Principle Accounting Period Fiscal year Deferral, Depreciation, Accrual Accumulated Depreciation Book Value Accrued Revenue, Accrued Expense, Unearned Revenue Closing the Book and Entries Liquidity, Operating Cycle, Report Format, and Account format Single-step Income Statement, and Mult-step Current Ratio and Debt Ratio Chapter 4: What happens if a company fails to supervise its employees some Internal Control Sarbanes-Oxley Act Components of Designing Internal Control Controller and Audit All documents and records must be kept safe Firewall and Encryption Check, Bank Statement, Electronic Fund Transfer Bank Reconciliation Items for Reconciliation Controlling/Managing Cash: Physical Receipts and Mail Recipts Check and Review Petty Cash and Budget Ethics and Accounting Being Ethical Managerial Decision Guidelines Chapter 5: Creditor vs. Debtor Debt Instrument Equity Security Maturity and Term Short-Term Investments Trading Investments Transactions Journal and Ledger Entries Gain vs. unrealized gain Impact on Balance Sheet and Income Statement Financial Statements Receivables Security/collateral Uncollectable Receivables Principal and Interest