CNY Derivatives and Market Risk Management in China

advertisement

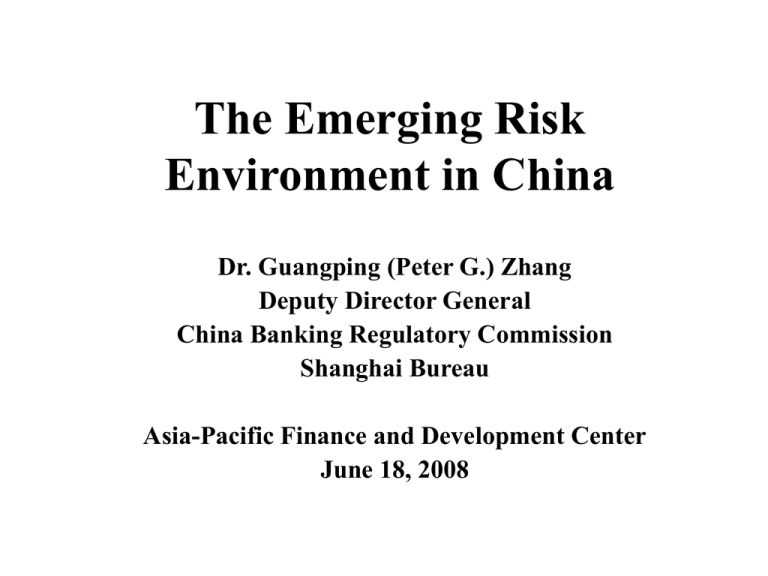

The Emerging Risk Environment in China Dr. Guangping (Peter G.) Zhang Deputy Director General China Banking Regulatory Commission Shanghai Bureau Asia-Pacific Finance and Development Center June 18, 2008 Major Contents Risk Management Instruments in China On-shore Products FX Forwards (Merchant & Inter-bank), FX Swaps, Bond Forwards, IRS, Stock Warrants Off-shore Products Foreign CNY Derivatives Non-deliverable Forwards (NDF), Non-deliverable Options (NDO), Non-deliverable IRS (NIRS),H share stocks, Index futures and Options Risk Management Supervision & Related Issues BASEL II Implementation Difficulties for Risk Management Practices in China Lack of Options Market and Implied Volatilities Low Liquidities of OTC Products Product Design & Pricing CNY Forwards (Merchant) PBOC: “The Tentative Administrative Methods for RMB Forward Settlement” January 18, 1997 BOC: April 1st , 1997 CCB: April, 2003 ICBC: April, 2003 ABC : April, 2003 China Foreign Exchange Trade Center (CFETCS) China Foreign Exchange Trade Center (CFETCS) was authorized to trade CNY forwards on August 15, 2005 CNY/USD CNY/JPY CNY/HKD CNY/Euro China Foreign Exchange Trade Center (CFETCS) Trading has not been active at CFETCS,Trading turnover in 1Q2006 RMB3420 million (430 million USD); 2Q2006 RMB7210 million (900 million USD) 3Q2006 RMB31.5 billion (3.98 biillion USD) 4Q2006 8.75 billion USD 1Q2007 5.323 billion USD 2Q2007 5.347 billion USD 3Q2007 4.323 billion USD 4Q2007 7.391 billion USD 2006 $14.06 billion; 2007 $22.384 billion Liquidity of CNY Forwards (Merchant) BIS 2007: Daily Average FX Trading in April 2007 $9 billion (spot, forwards and swaps 61.4%, 31.3% and 7.4%), thus Total forwards 9*31.3% = $2.817 billion daily average in April 2007, $59.157 billion in April 2007; April 2007 Forwards Inter-bank = $1.996; thus April 2007 forwards merchant trading 59.157-1.996 = $57.161 billion in April 2007; total forwards merchant around $680 billion for 2007, total forwards including inter-bank about $703 billion for 2007, or about 32.3% of total trade value of $2.175 trillion in 2007, compared to international ratio around 150% Foreign Exchange Swaps Trading 3Q2006 15.6 billion USD 4Q2006 31.4 billion USD 2006 50.9 billion USD 1Q2007 55.7 billion USD 2Q2007 77.7 billion USD 3Q2007 100.6 billion USD 4Q2007 81.58 billion USD 2007 total $315.58 billion Merely 17.6% of daily FX swaps trading in April 2007 Other CNY Derivatives in China • Interest Rate Swaps – SHIBOR Swaps • Bond Forwards Wealth Management Products Deposits with embedded options Deposits linked to Libor, commodity indexes, stock indexes, etc. IRS Trading CNY (billion) 1Q2007 2Q2007 3Q2007 4Q2007 2007 39.364 63.902 62.253 53.171 218.69 $ billion 5.18 8.41 8.19 6.99 28.77 Offshore CNY Derivative Products Non-deliverable Forwards NDF Non-deliverable Options NDO Non-deliverable Forward Options NDFO Non-deliverable CNY Swaps NDS Non-deliverable FX Swaps Non-deliverable IRS Structured Notes Deposits with embedded Options NIRS CNY NDF-most Popular Product offshore Came into existence in 1996 before Asian financial crisis, yet liquidity was extremely low Liquidity began to pick up late in 2002 Trading turnover estimated around US$150180 billion in 2003 & 2004! around US$250 billion in 2005 around US$300 billion in 2006 around US$360 billion in 2007 2008-4-2 2007-12-2 2007-8-2 2007-4-2 2006-12-2 2006-8-2 2006-4-2 2005-12-2 2005-8-2 2005-4-2 2004-12-2 2004-8-2 2004-4-2 2003-12-2 2003-8-2 2003-4-2 2002-12-2 Revaluation Pips (1000) (2000) (3000) (4000) (5000) (6000) (7000) (8000) (9000) 04-2-6 03-11-6 03-8-6 03-5-6 03-2-6 02-11-6 02-8-6 02-5-6 02-2-6 01-11-6 01-8-6 01-5-6 01-2-6 CNY/USD Historical Volatilities 0.20 0.18 0.16 0.14 0.12 0.10 0.08 0.06 0.04 0.02 0.00 2008-5-5 2008-2-5 2007-11-5 2007-8-5 2007-5-5 2007-2-5 2006-11-5 2006-8-5 2006-5-5 2006-2-5 2005-11-5 2005-8-5 CNY/USD Historical Volatilities 5.0% 4.5% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% 2005-8-5 2005-10-5 2005-12-5 2006-2-5 2006-4-5 2006-6-5 2006-8-5 2006-10-5 2006-12-5 2007-2-5 2007-4-5 2007-6-5 2007-8-5 2007-10-5 2007-12-5 2008-2-5 2008-4-5 2008-6-5 CNY/USD Historical Volatilities Compared to Euro & Yen Vols 80% 70% 60% 50% 40% 30% 20% 10% 0% 2008-4-1 2008-2-1 2007-12-1 2007-10-1 2007-8-1 2007-6-1 2007-4-1 2007-2-1 2006-12-1 2006-10-1 2006-8-1 2006-6-1 2006-4-1 2006-2-1 2005-12-1 2005-10-1 2005-8-1 Appreciation and Further Expectation for RMB 30% 28% 26% 24% 22% 20% 18% 16% 14% 12% 10% 8% 6% 4% 2% 2003-4-1 2003-7-10 2003-10-22 2004-2-5 2004-5-19 2004-8-24 2004-12-6 2005-3-21 2005-7-1 2005-10-12 2006-1-18 2006-4-25 2006-7-31 2006-11-13 2007-2-28 2007-6-14 2007-9-19 Onshore CNY Forward Rates vs. Offshore CNY NDF Rates 500 -500 -1500 -2500 -3500 -4500 -5500 -6500 BASEL II Implementation in China Major Chinese Banks are Required to Implement BASEL II by 2010 Market Risk Management Credit Risk Management Future Market Demand Hedging CNY FX Risk -Steady Growth of Foreign Trade -Expansion of QDIIs -International Investments -Foreign Participation of Domestic Capital Market, Banking Industry Need to Develop the Options Market Challenges for Market Risk Management in China • • • • Construction of reliable Yield Curve Interest Rate Liberalization Structuring and Pricing Capacity Market Risk Management Models (VaR) Challenges for Market Risk Management in China • Lack of Exchange Trade Options • No Implied Volatilities • Low Liquidity of Existing Products Comparisons with Indian Rupee Derivatives Markets Average Daily Trading Value of Foreign Exchange in China & India Foreign Exchange Trading ($billion) Spots Outright Forwards Foreign Exchange Swaps China 9 5.53 2.82 0.67 India 34 14.48 9.35 10.13 China 61.4% 31.3% 7.4% India 42.6% 27.5% 29.8% 32.6% 11.7% 55.6% Word 3210 Average Daily IR derivatives in April $ 1 billion in 2004 and $ 3 billion in 2007, India, ---in China “Exotic Options” 1997(1st),1998(2nd), 2008(3rd) “Chinese Yuan Derivative Products”(English,400p) World Scientific October 2004 (Peter G. Zhang) Chinese Yuan Derivative Products China Financial Press (in Chinese,900p), May 2006; 2nd Edition (around 1300p), April 2008 Thank You!