ACCT 140 01 SANDS-WESTHOFF SP 13

advertisement

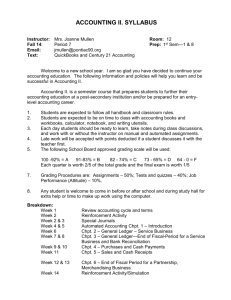

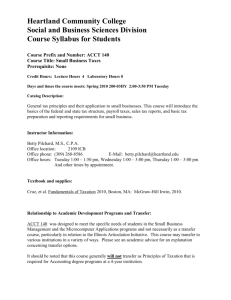

1 Heartland Community College Social and Business Sciences Division Course Syllabus for Students Course Prefix and Number: ACCT 140 Course Title: Small Business Taxes Prerequisite: None Credit Hours: Lecture Hours 4 Laboratory Hours 0 Days and times the course meets: ACCT 140.01 Wednesday 6:00 – 8:50 pm Catalog Description: This course will introduce the fundamentals of federal and state income tax preparation and reporting requirements for individuals and various types of small businesses. In addition, payroll tax and sales tax reporting will also be introduced. Instructor Information: Lynn Sands Westhoff, CPA, MS Cell phone: (309) 261-1430 E-Mail: Lynn.Sands@heartland.edu Office hours: Before and after class and by appointment Textbook and supplies: Cruz, et al. Fundamentals of Taxation 2012, Boston, MA: McGraw-Hill Irwin, 2012. Relationship to Academic Development Programs and Transfer: ACCT 140 was designed to meet the specific needs of an Associate of Applied Science degree or certificate programs and not necessarily as a transfer course, particularly in relation to the Illinois Articulation Initiative. This course may transfer to various institutions in a variety of ways. Please see an academic advisor for an explanation concerning transfer options. It should be noted that this course generally will not transfer as Principles of Taxation that is required for Accounting degree programs at a 4-year institution. 2 COURSE OUTCOMES General Program Education Outcomes Outcomes Accounting Foundations* Analyze how the federal and state tax Throughout Throughout structure affects tax reporting for the the semester, the semester various forms of business ownership. students will students will achieve the achieve the Analyze personal and business tax following following reporting scenarios and apply the Gen Ed Accounting appropriate federal tax laws and outcomes: Foundations regulations to determine: program filing status, personal exemptions, outcomes dependency exemptions, and the CO 1 standard deduction for tax reporting; PS 1 AF 3 income that must be included in the PS 2 AF6 computation of taxable gross income on CT 1 a 1040; CT 2 adjustments to income allowing in the computation of adjusted gross income on a 1040; personal expenditures that are allowed to be treated as itemized deductions reported on a 1040 Schedule A; business income and maximize business expenses including depreciation reported on a 1040 Schedule C for self-employed business owners; the computation, classification, and reporting of gains or losses from the sale of personal-use assets, trade or business assets, or investment assets reported on a 1040 Schedule D; the reporting of income from rental properties, royalties, and flow-through entities such as partnerships, S corporations and LLCs on a 1040 Schedule E; the requirements for a partnership to report income or losses and other required informational items on a 1065 and related Schedule K-1; the requirements for a Subchapter S Corporation to report income or losses and other required information items on a 1120S and related Schedule K-1. Course Outcomes 1. 2. a. b. c. d. e. f. g. h. i. 3. Apply appropriate state and federal tax laws and regulations for payroll tax withholding, reporting, and payment responsibilities for employers. Range of Assessment Methods Throughout the semester, the following assessment methods will be used to measure the course, program, and Gen Ed learning outcomes: Homework, Exams, Quizzes, Cases and other activities as determined by the instructor. 3 4. Utilize income tax software to prepare tax returns. * Accounting Foundations Outcomes: AF 3 Prepare accounting records and documentation necessary to prepare sales, payroll, and income tax returns. AF6 Possess proficiency in using computer software, including MS Word, MS Excel, computerized accounting software, and computerized income tax software. Course Outline: 1. Sources of Tax Authority and Tax Law 2. Form 1040EZ 3. 1040 and 1040A Basic Concepts 4. Gross Income 5. Adjustments for Gross Income 6. Itemized deductions (Schedule A) 7. Self-Employed Business Income (Schedule C) 8. Capital Gains and Sales of Business Property (Schedule D & Form 4797) 9. Rental Properties & Special Property Transactions (Schedule E) 10. Partnership Taxation 11. Sub Chapter S Corporate Taxation 12. Employer Payroll Taxes 13. Illinois Income Taxes EDUCATIONAL BELIEFS Beliefs about the Academic Discipline: Every business professionals and individual taxpayer can benefit from a basic understanding of tax laws. This understanding will help them prepare the facts needed to accurately prepare their tax returns. Understanding the tax laws can help in recognizing potential problems before taxable events take place. Through proper planning, taxpayers may be able to structure business transactions to reduce their overall tax liability. 4 Beliefs about Teaching and Learning: My philosophy of teaching and learning evolves around the belief that the ultimate responsibility for learning belongs to the student while it is the teacher’s responsibility direct the learning process by providing a classroom environment that encourages the student to reach for their fullest individual potential. As the teacher, I have a responsibility to direct the learning process by providing: a classroom environment that is respectful and supportive of the student while encouraging student success an appropriate mix of course materials and activities to help the student learn the subject matter assistance with understanding the basic theories and principles of accounting and tax law that correlate to the course materials opportunities for students to assess their learning before they are evaluated for grades an introduction to the basic principles, strategies or decision making tools that will provide the foundation needed for the students’ future studies in accounting and business as well as for their lives/jobs. As the student, you have a responsibility to: be prepared for class be willing to actively participate in all course related activities be respectful of the instructor and the other students in the classroom assess your own learning so you can communicate effectively when you encounter difficulties with course materials apply what you learn in class to future studies in accounting and business as well in your life/job. I believe there is definitely a reciprocal relationship between my responsibilities as the teacher and your responsibilities as a student. Over the years I have found that if I live up to my responsibilities as the instructor, you will find your responsibilities much easier, and vice versa. I have also found that if I live up to my responsibilities, you are much more likely to take you responsibilities more seriously and that is when you will begin to see your true individual potential. COURSE POLICIES Grading System: Total points accumulated during the semester will determine course grades. Points will be assigned as follows: Online Quizzes (top 8) 80 points Text Tax Return Problems (15) 150 points Comprehensive Tax Return Projects (2) 80 points Payroll Tax Return Project 40 points Hourly Exams (2) 200 points Final Exam 100 points Total points possible 650 points Grading Scale: The grading scale used to determine the course grade will be: A = 585 to 650 points D = 390 to 454 points B = 520 to 584 points F = Less than 390 points C = 455 to 519 points 5 Policies on Assignments/Tests/Make-ups: Students will be required to complete several tax returns throughout the course utilizing the tax software that is provided with the text and/or blank tax forms. Approximately 20 tax return problems will be assigned, however, only the scores of the top 15 will be counted towards the final grade for the course. You must complete at least one problem from each chapter that we cover. There will be three required tax return projects assigned throughout the course that will count towards the final grade for the course. In addition, the projects will require you to address questions from the taxpayer related to their tax returns. Students will be allowed to use calculators during quizzes and examinations. Students are responsible for completing quizzes/exams within the allotted time period in case of calculator failure. No calculators on cell phones, iPads, or other multifunctional electronic devices may be used on quizzes/exams Online quizzes will be taken after we have completed coverage of that topic in class. You have two chances to complete each 10 point quiz and only the top score will we counted for that quiz. There will be at least 10 online quizzes available and only the top 8 scores will be used in the determination of your course grade. Deadlines for the quizzes will be posted in Blackboard. MAKE UP QUIZZES OR DEADLINE EXTENTIONS WILL NOT BE GIVEN FOR ONLINE ACTIVITIES. The exams may consist of problems, as well as multiple choice, true false, and/or essay questions which are included to test your conceptual understanding of the material. The final exam for the course will be taken during the final exam time assigned to this class. MAKEUP EXAMS WILL BE GIVEN ONLY IF ARRANGED IN ADVANCE UNLESS EXTENUATING CIRCUMSTANCES CAN BE DOCUMENTED. Anyone who removes an exam, in part or in total, from the classroom at anytime will be given a grade of "F" for the course. Reproduction of the contents of the exam by any process will result in your receiving a grade of "F" for the course. 6 Attendance Policy: All students are expected to attend class on a regular basis. Consistent class attendance and participation is critical in the learning process since accounting knowledge tends to be cumulative in nature. Class attendance and participation in class activities may be evaluated by the instructor and may be considered as part of determining your final course grade. Notice of Cancelled Class Sessions Cancelled class sessions, for all HCC classes, will be listed under Cancelled Class Meetings announcements at www.myheartland.edu. The list will show you the classes have been cancelled for that day and the upcoming week. Be sure to check the last column, which might contain a message from the instructor. Required Writing and Reading: The text was selected to provide the basis of the information needed for this course. In additional, supplementary materials will be made available from time to time for student usage in certain sections of the course. We will not necessarily discuss all of the information contained in the reading assignments; however, students will be responsible for all information presented in assigned readings. Students will be required to complete two comprehensive tax return projects during the semester. Those projects will include some written discussion of the tax return as well as tax planning strategies the taxpayer may want to consider in future years. Academic Integrity: Academic integrity is a fundamental principle of academic life at Heartland Community College and is essential to the credibility of the College’s educational programs. Moreover, because grading may be competitive, students who misrepresent their academic work violate the right of their fellow students. The College, therefore, views any act of academic dishonest as a serious offense requiring disciplinary measures, including course failure, suspension, and even expulsion from the College. In addition, an act of academic dishonesty may have unforeseen effects far beyond any officially imposed penalties. Violations of academic integrity include, but are not limited to cheating, aiding or suborning cheating or other acts of academic dishonesty, plagiarism, misrepresentation of data, falsification of academic records or documents and unauthorized access to computerized academic or administrative records or systems. Definitions of these violations may be found in the college catalog. 7 SUPPORT CENTER SERVICES Library The Library, located in the Student Commons Buildings at the Raab Road campus, provides Heartland students with a full range of resources including books, online journal databases, videos, newspapers, periodicals, reserves, and interlibrary loan. Librarians are available to assist in locating information. For more information, please call the Library (309) 268-8200 or (309) 268-8292 Tutoring Services Heartland Community College offers tutoring in various forms at no cost to Heartland students at the Tutoring and Testing Center in Normal and at the Pontiac and Lincoln Centers. Tutors are available at convenient times throughout the week. Study groups are also available by request. For more information about services available at each location, please call the Tutoring and Testing Center in Normal (309) at 268-8231, the Pontiac Center at (815) 842-6777, or the Lincoln Center at (217) 735-1731. Testing Services The Tutoring and Testing Center provides a secure testing environment for students who are enrolled in online, hybrid, and other distance learning courses; have a documented disability; or need to take a make-up exam. Testing accommodations for students having documented disabilities must be arranged by the student through the Office of Disability Services, and Testing Services will only administer make-up exams at the request of the instructor. Contact Testing Services at (309) 268-8231 for more information. Open Computing Lab The Open Computing Lab provides free computing for HCC students at convenient times throughout the week. The computer lab is staffed by trained Lab Assistants and offers the use of approximately 70 computers, a scanner, a laser printer, and an electric typewriter. Hours for Support Services Hours that the various support services are available are posted online at www.heartland.edu . Please be advised that hours around holidays and over school breaks may be limited. 8 ACCOUNTING 140 - CLASS SCHEDULE (Spring 2013 W) DATE Chpt Topic of Discussion Homework to be discussed 1/16 Course Introduction & Intro to1040EZ Chpt1: TRP1 to be completed in class 1/23 1&2 Form 1040EZ, 1040, 1040A Chpt 1:3-5, 23, 24, 31-34, 43, 50 Chpt 2: 18-30, 33, 36-9, 4-5 1/29 Q1 Quiz Chapters 1 & 2 1/30 3 Gross Income Chpt 3:1-3, 22-5, 28-33,35-7, 39,42-3 Chpt 1:TRP 2 & 3 Chpt 2:TRP 2 & 3 2/5 Q2 Quiz Chapter 3 2/6 4&5 For AGI deductions & Itemized deductions Chp 4: 29-42, 43, 47-8, 50, 55 Chpt 5: 32-40, 44-45, Chpt 3:TRP 2 & 3 2/12 Q3 Quiz Chapter 4 2/13 5 Itemized deductions (Schedule A) Chpt 5: 44-45, 48-59, 62-3 Chpt4: TRP 2 & 3 Chpt 5: TRP 2 & 3 2/19 Q4 2/20 2/27 6 Quiz Chapter 5 Exam 1 Self-Employed Business Income & Depreciation (Schedule C) 3/5 3/6 Quiz Chapter 6 Capital Gains (Schedule D & Form 4797) Q5 7 3/13 3/19 Q6 3/20 8 & 12 Spring Break Quiz Chapter 7 Rental Properties (LO 1 & 4) Property Transactions (LO 1 through 3) 3/26 Q7 3/27 11 Quiz Chapters 8 & 12 Retirement and Tax Deferred Plans 4/3 Exam 2 Chpt 6: 19-27, 30-42, 54-56 Chpt 7: Chpt 6: TRP 1 & 3 Chpt 8: 18-21, 31-4, 40, 43 Chpt 12: 23-38, 45, 47, 56 Chpt 7: TRP 1 & 2 TBA Chpt 8: TRP 1 & 3 9 4/10 14 Partnership Taxation Chpt 14: 26-47, 50, 52,54-5, 58, 60-1 4/16 Q8 4/17 15 Quiz Chapter 14 Corporate Taxation Chpt 15: 25-44 Chpt 14: TRP 1 & 2 4/23 Q9 4/24 10 Quiz Chapter 15 Employer Payroll Taxes 5/1 Illinois Sales Taxes Chpt 10: 26-48, 55-7 Chpt 15: TRP 1 & Handout TBA 5/7 5/8 Quiz Chapter 10 Illinois Income Tax TBA Exam 3 5/15