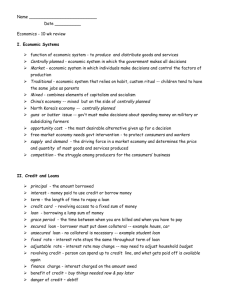

Open-ended credit

advertisement

Chapter 16.2 Open-ended credit – An agreement to lend the borrower an amount up to a stated limit and to allow borrowing up to that limit again, whenever the balance falls below the limit. Borrower is to repay amount borrowed within 30 days? (open 30 day accounts) Borrower is to repay amount borrowed over a period of months or years?(revolving credit) Open 30 –day accounts Revolving Credit Must pay full balance each month when bill is received Consumer has option of paying in full or making payments at least as high as the stated minimum Most all-purpose credit cards like visa/Master Card and department store cards(Penny’s) OPEN-END CREDIT Loan is a reflection of varying types of charges made by borrower Allows continuous borrowing and varying repayment amounts Example: Credit cards that allow continuous charging like “Visa” CLOSE-END CREDIT Loan is for a specific amount and must be repaid in full by a stated due date Repayments are fixed amounts(installments) that include principal plus interest Example: Buying a refrigerator using credit or buying a car OPEN-ENDED CREDIT No down payments required SERVICE CREDIT Having a service done now and paying for it later Example: telephone and utility services which usually offer budget plans resulting in lower monthly payments CLOSE-ENDED CREDIT Usually a down payment is required The product purchased with loan becomes collateral for the loan Often referred as an installment loan Retail Stores (department stores, restaurants, and most service businesses) Often offer their own credit cards and also accept the major credit cards. Often give discounts or incentives to use their own credit card Major Credit Card Companies(master card/visa) Often has cash advance option and access checks Banks and Credit Unions (offer credit cards and installment loans) Two Types of small loan finance companies Consumer Finance Company Sales Finance Company Usually charge higher interest rates for the use of their money. Why? They are willing to take higher risks that banks and credit unions are not willing to take If someone is unable to get a loan at a bank or credit union, they can often get one at a small loan company. Consumer Finance Company Makes mostly consumer loans to customers buying consumer durables (items expected to last several years…car,refigerator) Sales Finance Company Makes loans through authorized representatives. For example, GMAC finances General Motors automobile dealers and their customers. Beware of these lenders They are unlicensed They charge illegally high interest rate They just may break your legs if you don’t pay the money back! Legal lenders that make high-interest loans based on value of personal possession pledged as collateral Loan amount is usually set at a value considerably less than the value of item pledged. Some Pawn shops give only 10 to 25% of value of article pledged. Most give no more than 50% to 60%. Most common source of cash loans. Includes parents, other relatives, friends, etc. May or may not charge interest. LIFE INSURANCE POLICY Policy holders can borrow at low interest rates against the value of their policy Loan does not have to be repaid Amount of loan will reduce value of policy CERTIFICATE OF DEPOSIT Certificate used as collateral Interest charged is usually only 2 to 5 % above the interest rate received oncertificate Certificate retains full value