So Many Changes - Tax Help for Older People

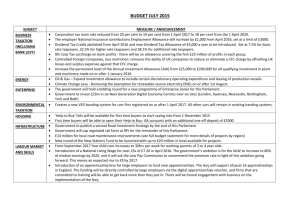

advertisement

So many changes… The most recent budget announced some interesting changes; combine them with those announced earlier in the year and also in 2014, and we can all be forgiven for becoming confused. Here, we look at the ones that affect most of us, not exhaustive, along with the dates they come into force. Personal allowances - The basic allowance, currently £10,600, is what most people are allowed before paying tax, if born after 5th April 1938. Those born on or before this date receive the slightly higher allowance of £10,660 (but if their income is over £27,700 it is reduced down to the basic amount). The basic allowance is being increased to £11,000 in April 2016. The higher allowance will no longer be available. Higher rate tax band – The threshold for paying higher rate tax is currently £42,385 and will increase to £43,000 in April 2016. 0% Savings rate – This came into effect on the 6th April 2015 and allows people on lower incomes to receive up to £5,000 of savings income free of tax. It can be difficult to understand the rules, but as a guide those people with a total income under £15,600 will not pay any tax on their savings. Personal savings allowance – This comes into force on the 6th April 2016 and as far as we are aware, will run alongside the 0% savings rate. People who pay tax at the basic rate will be eligible to receive up to £1,000 of their savings income free of tax and those who pay tax at the higher rate will have a reduced allowance of £500. Banks and building societies will no longer remove tax before paying you your interest. Those who still need to pay tax will find it their responsibility to inform HMRC. Dividend tax allowance – From April 2016 the dividend tax credit is abolished and dividend income will become taxable. However, there will be a £5,000 tax allowance and anything received over this amount will be taxed at 7.5% for basic rate tax payers, 32.5% for higher rate taxpayers and 38.1% for additional rate taxpayers. Rent a Room relief – Is increasing from £4250 to £7500 from 6th April 2016. This equates to £144 per week if you decide to rent out a room in your home. As always though, there are rules to follow, so check first. Making ISAs more flexible – Starting on 6th April 2016 it will be possible to withdraw and replace money from ISA accounts (cash and stocks & shares) without this replacement counting towards the annual ISA subscription limit. Taxation of pensions at death – Again, starting on 6th April 2016 the tax rate applied to pension lump sums paid from the pension of someone who dies aged 75 and over will be reduced to the marginal rate of the recipient. This means that it is added to any other income of the recipient and taxed accordingly. IHT, Transferable nil rate band – This one doesn’t apply until 6th April 2017 and allows for a new transferable nil rate band when a main residence is passed on death to a direct descendant such as a child or grandchild. It is added to the existing nil rate band of £325,000. In 2017/18 the new nil rate band will be £100,000 increasing to £125k in 2018/19 £150k in 2019/20 and £175k in 2020/21. Secondary market for annuities – Delayed – Following consultation the government has decided to delay implementation until 2017. More information should be available later in the year. And lastly a reminder. If you have £1,060 of unused personal allowance and as a couple don’t claim the married couple’s allowance, you can register for the Marriage Allowance. It is worth up to £212 a year. Register on GOV.UK or if struggling with technology write to HM Revenue and Customs, BX9 1AS, United Kingdom. This article is provided by Tax Help for Older People registered charity no 1102276, offering free tax advice to older people on incomes below £20,000 a year. The Helpline number is 0845 601 3321 or geographical 01308 488066