2-1 - combsbusiness

advertisement

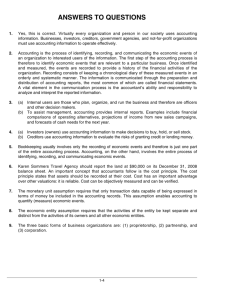

How Transactions Change Owner’s Equity in an Accounting Equation The changes that typically effect the day to day activities within a business. Vocabulary • Revenue • Sale on Account • Expense • Withdrawals Revenue Transactions Received Cash from Sales Transactions for the sale of Goods and Services results in an increase in owner’s equity. Sold Services on Account The customer is allowed to pay the business by a later specified date. REVENUE TRANSACTIONS Transaction 6 August 12. Received cash from sales, $325.00. Transaction 7 August 12. Sold services on account to Kids Time, $200.00. Lesson 2-1, page 26 Paid Cash for Expenses A transaction to pay for Goods or Services needed to operate the business results as a decrease in Owner’s Equity. PAID CASH FOR EXPENSES Transaction 8 August 12. Paid cash for rent, $250.00. –45 (expense) Transaction 9 August 12. Paid cash for telephone bill, $45.00. Lesson 2-1, page 27 Other Transactions Received Cash on Account This transaction increases Cash, and decreases Accounts Receivable They receives cash from a customer for a prior sale. Paid Cash to Owner for Personal Use This transaction typically decreases Owner’s Equity, and decreases Cash This is also know as a withdrawal. Summary of Changes in Owner’s Equity By adding each transaction effecting Owner’s Equity, the owner can see the total affect they had on the Owner’s Equity, positively or negatively. OTHER TRANSACTIONS Transaction 10 August 12. Received cash on account from Kids Time, $100.00. –100 (withdrawal) Transaction 11 August 12. Paid cash to owner for personal use, $100.00. Lesson 2-1, page 28 SUMMARY OF CHANGES IN OWNER’S EQUITY Transaction Number 6 7 8 9 11 Change in Kind of Transaction Owner’s Equity Revenue (cash) Revenue (on account) Expense (rent) Expense (telephone) Withdrawal +325.00 +200.00 –250.00 –45.00 –100.00 Net change in owner’s equity +130.00 Lesson 2-1, page 28