Lecture 6

advertisement

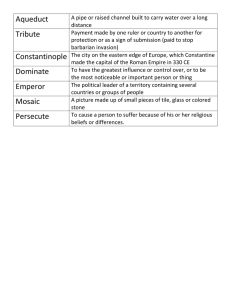

PA 546 Constantine Hadjilambrinos Income Taxes Lecture 6 October 3, 2005 PA 546 Constantine Hadjilambrinos History of the Income Tax First applied in 1862 to finance civil war— expired in 1872. Constitutional requirement for apportionment of direct taxes prevented income tax from being applied until 1913. Then, ratification of 16th amendment made income tax possible. Until end of WW II, very few people earned enough income to be eligible to pay tax. PA 546 Constantine Hadjilambrinos Advantages Equity: Measures ability to pay Equity: Adjustable for individual circumstances Broad base—possibly less resource distortions, (if low rate) efficiency and equity advantages Yield: Significant revenue at socially acceptable rates; rate base self-adjusting with economic growth Disadvantages Transparency and compliance: Too complex Administration and compliance: Too expensive to collect Adverse economic effects Economic distortions Equity: Too progressive, too many loopholes Overuse: Too burdensome when rates too high PA 546 Constantine Hadjilambrinos Defining Income Economic Income (Haig-Simmons): Consumption + increase in net wealth (would include increase in stock values, imputed income, gifts) Adjusted Gross Income (AGI): IRS-defined income—Excludes many types of income: Imputed income (too difficult to calculate) Income from activities government wants to promote Income from state and municipal bonds PA 546 Constantine Hadjilambrinos Personal Deductions: What is the rationale? Expenses outside control of household Medical expenses, “casualty” losses, etc. Areas where Fed. Gov. wants to encourage spending Charitable contributions, home mortgage interest, etc. Adjusting gross income to net income Moving expenses, business expenses, etc. PA 546 Constantine Hadjilambrinos Narrow definition of taxable income: Many deductions, exclusions, & exemptions Higher rates to generate needed revenue Very high marginal rates (always higher than average rates) contribute little revenue but can have serious adverse effects on tax system PA 546 Constantine Hadjilambrinos Preferential rates for some activities— it all represents a violation of normal principles Complicates tax system Distorts tax system Increases uncertainty Decreases transparency PA 546 Constantine Hadjilambrinos Graduated tax structures Income separated into brackets ($0 - $10,000 and $1001-$10,000). Each bracket subject to different tax rate ($0 $10,000 at 3% and $1001-$10,000 at 5%). Tax rate of highest bracket is the marginal tax rate. Not all income is taxed at the same rate Introduces distortions and inefficiencies. PA 546 Constantine Hadjilambrinos Average Tax Rate ATR = Tax / Taxable Income Taxable Income = Adjusted Gross Income – Exemptions Tax = (SBracket Income x Bracket Tax Rate) – Tax Credits PA 546 Constantine Hadjilambrinos Effective Tax Rate ETR = Tax / Adjusted Gross Income Taxable Income = Adjusted Gross Income – Exemptions Tax = (SBracket Income x Bracket Tax Rate) – Tax Credits PA 546 Constantine Hadjilambrinos Bracket creep: Movement into higher tax bracket during high inflation. Accelerates collection and provides macroeconomic tax brake. Slows collection during recession— macroeconomic stimulus. Indexation: Adjusts tax brackets, exemptions, standard deductions, etc. to account for inflation. PA 546 Constantine Hadjilambrinos Corporate Income Tax Tax on profits (Earnings – expenses) Multinational firms can avoid it: Non–US branches can charge US branches high prices for goods and services, artificially lowering US profits State taxes—Issue of apportionment. Dual taxation: Taxing both corporate profits and individual dividend income taxes same income twice. PA 546 Constantine Hadjilambrinos Payroll Tax Narrow tax, only applied to certain kinds of income (wages and salaries). Collected from employers, so easier to enforce. Exclusion of income from interest, dividends, capital gains, etc., creates both vertical and horizontal equity issues.