By: Rick Ribar Finance 1050 11/24/2015 Rich Dad Poor Dad, What

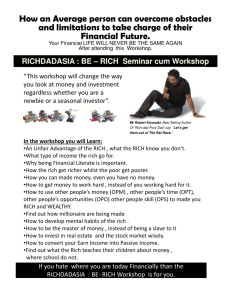

advertisement

By: Rick Ribar Finance 1050 11/24/2015 Rich Dad Poor Dad, What the Rich Teach Their Kids About Money and the Poor and Middle Class Do Not! By: Robert Kiyosaki This book attempts to distinguish between the way rich people teach their children about money and what most middle class people teach their kids about money. The author, Mr. Kiyosaki was fortunate in that he had, what he calls, two dads while he was growing up. Each dad was highly educated, although his rich dad never finished the 8th grade. His poor dad (biological dad) was educated in the collegiate sense and had attained multiple prestigious degrees. Each dad had a very different perspective of how money is made and how to prepare for a career. The author, Mr. Kiyosaki, chose at the age of nine to listen to the advice of both dads and make a choice in which advice he would pursue in his own life. His poor dad had the philosophy that a college education would be most beneficial in preparing him for a high paying job at a good company. In contrast his rich dad believed that he should learn how money works so that he could purchase the good company. The poor dad wanted Robert to work for money. The rich dad wanted Robert to learn how to have money work for him. He ultimately chose to listen to his rich dad’s approach in his pursuit to make money and become financially independent. The book begins with two boys at the age of nine who agree to form a partnership to make money. Robert and his friend Mike had decided that they wanted to make money. They collected used lead toothpaste tubes and used them and plaster of Paris molds to cast their own coins. To their surprise they learned that their actions were illegal and the business venture was over. Roberts’ dad suggested that the two boys learn how to make money from Mikes’ dad, who was said to be amassing an empire and would soon be a very rich man. The two boys met with Mikes’ dad to ask for help learning to make money. Mikes’ dad agreed and through a series of life lessons began to teach the boys why the rich become rich and how they think differently than poorer people do. The first lesson he taught the boys was to not accept a job as a means of making money. He did this by having the boys work in one of his stores for 3 hours each Saturday for .10 cents per hour. The boys agreed to do the work and give up softball and other pleasant childhood experiences for the opportunity to learn how to make money. After several weeks of frustrating work Mikes’ dad (Rich dad) finally explained that many people fall into a trap of working for money and that people cling to these jobs because of two powerful emotions fear and desire. Fear of not having money pushes people out the door in the morning and desire keeps them at the job. Rich dad explains that this is the trap that most people get caught in which he calls “the rat race”. He discusses with the boys that they should not be ruled by emotional decisions and that a job is only a short term solution to a long term problem. This By: Rick Ribar Finance 1050 11/24/2015 point is repeated and re-stated many times in the book. At first I thought the repetition was solely to fill pages, but I believe the repetition is intended to be for emphasis. The next important concept (Lesson 2) that is relayed through the authors’ life experiences was the concept that rich people buy assets and poor people buy liabilities. Robert explains that his rich dad taught him the simple definitions of asset and of liability. In his perspective an asset adds money to your pocket and a liability takes money out of your pocket. This concept is presented to the reader the same way it was presented to nine year old boys. Robert gives an example of how his two dads thought differently about assets and liabilities. His example shows that his poor dad viewed his house as his largest asset. His rich dad felt the opposite because, a mortgage payment, mortgage interest, taxes, maintenance, utilities, furnishings and many other expenses take a significant amount of money out of our pockets. More important is the idea that this money spent on a home, would be money that could grow when used to purchase true assets thus is viewed by rich dad as lost opportunity. This concept, along with, “Do not get trapped in the rat race”, are two of the main emphasis points of the book. They are repeated many times throughout the book “Do not get trapped in the rat race” and “know the difference between an asset and a liability, buy assets”. In my opinion these first two lessons are the primary focus of the book. The author continues on with 5 subsequent lessons that are related to how the rich think about money. Lesson 3 – Mind Your Own Business, this lesson Mr. Kiyosaki encourages the reader to mind their business which he explains is the readers’ asset column. He continues his explanation stating that most people are concerned with their income statement or paycheck that they receive from working for someone else. Mr. Kiyosaki again encourages the reader to refer to the previous lessons and to pay attention to the asset column and not your paycheck in order to reach financial independence. Lesson 4- Mind Your Own Business, explains how the national tax code evolved since its inception. The lesson is that taxes were implemented as a way to tax the rich and give to the poor like the story of Robin Hood. Mr. Kiyosaki explains that the rich did not just sit by idly and accept the tax burden. He explains that the rich found a way around the law legally by using corporations to shelter their assets, thus lessening the tax responsibility of the rich. Mr. Kiyosaki encourages the reader to learn the tax laws and use them to an advantage to not pay the high tax rate imposed on most. He offers the use of a corporation as an example that the rich use to keep more of their money. This strategy allows the rich to invest more in their asset column and have their money work for them. Money making money is the way rich stay rich. By: Rick Ribar Finance 1050 11/24/2015 Lesson 5- The Rich Invent Money This chapter talks a great deal about financial intelligence and the ability to see and make opportunities that others don’t. While I think this topic is very important, I believe that developing this skill is probably going to be difficult. Not everyone has developed their financial creativity (speaking for myself). This type of thought probably takes some practice and some trial and error type of learning. Lesson 6- Work to Learn, Don’t Work for Money The title of the chapter is self-explanatory. Mr. Kiyosaki recommends that working at a job should only be done to gain the knowledge of how the business works. That we should learn as much as we can about our financial interests so that we can make smart informed business decisions. With the completion of the 6 lessons the author offers three more chapters detailing how to get started on our way to financial independence. Each chapter has an example of how Mr. Kiyosaki made smart business decisions using the 6 lessons stated above. In my opinion this book has raised my awareness by showing me that so far in life I have followed the path that most people follow. I have bought with credit, payed interest and have not created an asset column that adds money to my pocket. I have chosen to take part in the “Rat Race” like many others. From reading this book I have established some financial goals (with my wife s’ consent). We have decided to eliminate all of our consumer debt. We have decided to create an emergency fund. We have agreed to look for and purchase income producing assets. We have both come to understand that there is no financial security in working for someone else. We are trying to open our minds and not think like those in the “Rat Race”. We are improving our financial intelligence and making the financial moves to better our position. I may never be able to quit working for someone else, although I’m going to try my best to get to that point. I have already begun teaching my seven year old son that it’s better to own the company rather than work for the company. I’ve already begun talking about interest income and how it’s smart to have his money make money for him. I know he doesn’t totally understand what I mean, but he will. My main goal is to teach my son that he doesn’t have to work a traditional job and rely on someone else for his financial well-being. I can’t say that I can implement all of the lessons contained within “Rich Dad Poor Dad” but I will use the ones that are relevant. I will also keep this book and give it to my son so he can read and understand the lessons when he is ready.