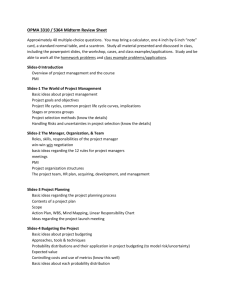

Slides

advertisement

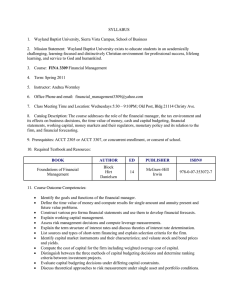

FIN 614: Financial Management Larry Schrenk, Instructor 1. What is Capital Budgeting? 2. Importance of Capital Budgeting 3. Overview of Capital Budgeting (Topics 7 and 8) Decisions about where to Invest the Capital Raised by the Firm Valuation Techniques for Real Asset Investment Decisions Long-Term Decisions Involving Large Expenditures Firm Value Maximization Most Important Financial Function Decisions continue for many future years, so firm loses some flexibility Define firm’s strategic direction Timing Key: Assets must be available when needed Parallel to Valuing Financial Assets Estimate Cash Flows Inflows & Outflows Assess Risk of Cash Flows Determine Discount Rate for Cash Flows Find PV of Cash Flows 1. Replacement to Continue Profitable 2. 3. 4. 5. 6. 7. 8. Operations Replacement to Reduce Costs Expansion of Existing Products or Markets Expansion into New Products/Markets Contraction Decisions Safety and/or Environmental Projects Mergers Other Independent, if the cash flows of one are unaffected by the acceptance of the other. Mutually exclusive, if the cash flows of one can be adversely impacted by the acceptance of the other. Decision Criteria (Topic 7) Cash Flow Analysis (Topic 8) Determining Period Cash Flows for Project Risk Analysis Sensitivity Analysis Scenario Analysis Monte Carlo Simulation Real Options Techniques to Decide which Projects a Firm Should Undertake Goal: Select Only Projects that Increase Firm Value 1. Recognize the Time Value of Money 2. Incorporate All Relevant Free Cash Flows 3. Avoid Arbitrary Assumptions 4. Avoid Need for Uncertain Data 5. Avoid Excessive Complexity in Calculation 6. Avoid Technical Problems 1. Net Present Value (NPV) 2. Internal Rate of Return (IRR) 3. Modified Internal Rate of Return (MIRR) 4. Profitability Index (PI) 5. Payback Period 1. Non-Discounted 2. Discounted Determining Period Cash Flows for Project Depreciation, Sunk Costs, Externalities Risk Analysis Sensitivity Analysis Scenario Analysis Monte Carlo Analysis Real Options Application of Techniques of Financial Options, e.g., Puts and Calls, to Capital Budgeting Abandonment Options, Flexibility Options FIN 614: Financial Management Larry Schrenk, Instructor