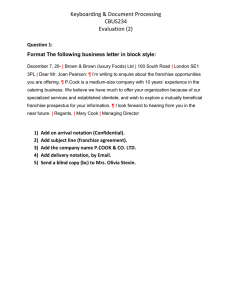

Richard Dawson

advertisement

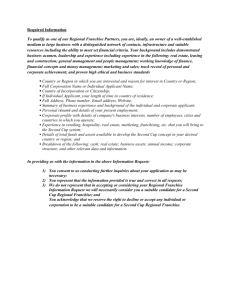

Franchising in the USA the Stagecoach Theatre Arts experience • Introduction and background • How to enter the US • What are the legal requirements • Ongoing legal requirements • Further Advice Introduction Presentation by Richard Dawson 1. Chartered Accountant, KPMG 2. BoS Corporate Finance 3. Co-founded Internet Shopping Website 4. Group Finance Director, Stagecoach Theatre Arts plc – appointed 2001 5. CEO, StageCoach Theatre Arts Background Stagecoach Theatre Arts • Founded in 1988 by Stephanie Manuel and David Sprigg in Surrey, UK • Franchisor of part-time performing arts schools • Children aged 6 to 16 attend for 3 hours per week, learning: Dance Drama Singing • Emphasis on confidence-building, creativity, life skills • 31 May 07 Financial Year: £26.5 million network turnover, 39,200 students worldwide and £310,000 profit Statistics - last Financial YearUSA German Other UK y Network turnover, £ 24.2m 0.4m 0.5m 1.4m Commenced franchising 1994 2004 2005 2000 Franchisees 261 10 8 39 34,974 542 725 2,957 Profit Breakeven Loss Profit 60m 300m Students Company profit, £ Population GDP/Capita $ (IMF) 35k (11th) 82m n/a 43k(4th) 31k(17th n/a Direct Franchising from UK • Medium risk, medium reward. Costs are significantly higher than a UK franchise because of travel (as expected) and local legal, accountancy and tax advice (higher than expected). eg Spain and Ireland • Stagecoach’s direct franchises outside the UK have developed organically as UK staff have emigrated. They are happy to continue to deal direct with the UK. • Success is dependant upon both the UK Head Office and local franchisee • But to truly develop a country I believe a local operation within that country will be needed Licensing • Low risk. Low reward. • This has proved to be the correct vehicle for Stagecoach to develop a territory that is small or inaccessible and to which one must commit limited resources in order to achieve a return eg Malta • A strategic method of protecting trade marks and copyright materials ready for later expansion eg Canada • Success is heavily dependent on the Licensee Master Franchise • Medium risk, low reward • The correct vehicle for Stagecoach to develop a Territory that is inaccessible and/or where one would not wish to run company-owned operations or to joint venture eg Australia • The Master Franchisee takes on the risk and deserves the majority of the rewards • Success is heavily dependant on the Master Franchisee Joint Ventures • Medium risk, medium reward • JV’s have been an essential part of Stagecoach’s successful overseas expansion eg initially in Germany and USA • They reduce capital requirements and management commitment in the initial stages • But are they the correct vehicle for the longterm? • For the long-term the type of Joint Venture partner may need to change Direct Franchising via Subsidiary • High cost, high risk, high reward. We believe that Stagecoach can be just as successful in North America and the major European markets as it has been in the UK • Prior to the IPO Stagecoach did not have the resources to develop these markets • Post IPO Stagecoach has invested in those markets where it expects to achieve the greatest return eg USA Managed units or franchise units? • Managed units are an important part of franchising – testing new concepts, current experience, quality control • Cost – money and management time • Different States • Short-term/long-term strategy Conclusion –on how to enter the US • Overseas expansion should be driven by long-term strategy • Appropriate resources must be devoted to it • However, for smaller companies, a low cost start-up strategy may be the only option • Arrangements should be kept flexible to take advantage of longer term opportunities Legal requirements for franchising in USA: • You will need a franchising lawyer! • Federal Trade Commission (FTC) • State Specific laws on franchising • Uniform Franchise Disclosure Document (until recently called the Uniform Franchise Offer Document, UFOC) Uniform Franchise Disclosure Document Contents: 1. The Franchisor and any Parents, Predecessors and Affiliates 2. Business Experience 3. Litigation 4. Bankruptcy 5. Initial Fees 6. Other Fees 7. Estimated Initial Investment 8. Restrictions on Sources of Products and Services 9. Franchisee’s Obligations 10. Financing 11. Franchisor’s Assistance, Advertising, Computer Systems and Training 12. Territory 13. Trademarks Contents continued 14. Patents, Copyrights and Proprietary Information 15. Obligation to Participate in the Actual Operation of the Franchise Business 16. Restrictions on What the Franchisee may sell 17. Renewal, Termination, Transfer and Dispute Resolution 18. Public Figures 19. Financial Performance Representations 20. Outlets and Franchisee Information 21. Financial Statements 22. Contracts 23. Receipts Exhibits A. Franchise Agreement Addenda B. Subsequent Franchise Agreements C. Financing Documents D. Ownership Agreement Uniform Franchise Disclosure Document (UFDD) • 2007 Franchise Rule adopted by the FTC in January 2007 – after a 12 years Regulatory Review • New requirements for franchisors preparing franchise disclosure documents (offering circulars) • Follows closely the old UFOC Guidelines • Some areas the 2007 Franchise Rule omits or streamlines the UFOC Guidelines (eg broker disclosures, cover page risk factors and detailed computer requirements). • Some new areas (eg parent company disclosures, Franchisor initiated litigations, confidentiality clauses) • The biggest change appears to be more statistical information to be provided on franchise and managed outlets over the last 3 years Registration States • Registration States – since 1993, 15 States (the Registration States) require franchisors to prepare UFOC’s to comply with their State Laws • Many States have additional State specific requirements (we found Illinois particularly challenging and time consuming) • Franchisors may continue to file and use in the Registration States Franchise Disclosure Documents prepared under the UFOC Guidelines until July 1 2008 Other documents required by the Registration States: A. B. C. D. E. F. G. H. I. Uniform Franchise Registration Application Page Supplemental Information page(s) Certification page Uniform Consent to Service of Process Sales Agent Disclosure Form If the applicant is a corporation or partnership or limited liability company, an authorising resolution if the application is verified by a person other than applicant’s officer or general partner Uniform Franchise Offering Circular or Uniform Franchise Disclosure Document Application Fee (varies by state) Auditor’s consent (or a photocopy of the consent) to the use of the latest audited financial statements in the offering circular Marketing • UFDD is not a ‘natural’ marketing tool • 3 stage interview process (product, financials + legals) using the UFDD as part of this process can be helpful • Some states require pre-approval of additional marketing materials • New York requires additional disclosure note on all adverts Cost of Entry • Franchising, Joint Venture or Licencing? Cost/benefits analysis • Franchise Consultants • Initial Legal Costs • You need a good Franchise Lawyer (I recommend Mary Beth Brody at Faerge & Benson, MN) • Audited Accounts required • State Application Fees Cost of the Uniform Franchise Disclosure Document Factors effecting the cost: • Is there already an existing franchise agreement or can the existing one be simply “Americanized”? • Whether any kind of franchise disclosure document has been used for other countries (eg Australia) • The complexities of the business model (a straight forward restaurant/retail model or more complex services concept) • Use of area developers or sales representatives • Up to $50,000 • In total,with legal, accounting, state filing, flights, expenses etc - do not expect any change from $100,000 • Allow up to 6 months planning and implementation Ongoing requirements: • Annual submission of the UFDD (UFOC) • State specific requirements • Marketing – updating the Earnings Estimate • Issuing new Franchise Agreements, addendums, termination agreements etc • In-house Franchising expertise to keep legal costs down Further advice? For more information on the legal requirements: 1. Speak to a US Franchise Lawyer (eg Mary Beth Brody at Faegre & Benson, mbrody@faegre.com, www.faegre.com) 2. Visit the NASSA website (North American Administration Association Inc.) for some useful FAQ’s: http://www.ftc.gov/bcp/franchise/amendedrule-faqs-shtml