FBT_GST - The University of Sydney

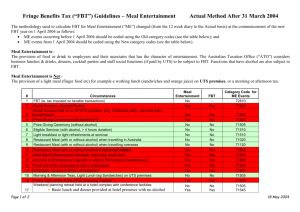

advertisement

FBT and GST 24 June 2008 Organised by the Office of Chief Accountant 3/23/2016 Salary Packaging at the University • Future direction is to continue to outsource provision of benefits to external service providers • Examples are novated car leases and laptops • However University still must determine its FBT and GST compliance on expense reimbursements – mainly entertainment 3/23/2016 Entertainment Expenditure • FBT year 2008 University spent $1.6M on entertainment • The FBT cost associated with this was $0.7M • About 1,000 transactions per month 3/23/2016 Why is “Entertainment” important to identify? • University is liable to FBT on the provision of entertainment as a tax exempt body • As a tax exempt body some exemptions that are available to private sector bodies do not apply to the University 3/23/2016 FBT exemptions not applicable to the University Where “entertainment” can be identified - • Minor benefits <= $300 e.g. Xmas party • “At Work” provision of food and drink 3/23/2016 There must be “Entertainment” • “Entertainment” v “Sustenance” • Food and drink is not always entertainment e.g. business travel, light meals • Entertainment may also include ancillary costs and non-food and drink items e.g. taxis to venue, gym membership etc 3/23/2016 Why is “Entertainment” important to identify? • University is able to calculate its FBT liability on meal entertainment on a deemed basis e.g. 50/50 split between non-employees and employees • University currently uses an actual “per head” method 3/23/2016 Example of Actual “Per Head” basis Business Lunch is attended by 2 employees and 5 visitors. University reimburses its employee for entire cost of the meal. FBT portion is 2/7th of the expenditure on the lunch. 3/23/2016 Finance and Accounting Manual “Non-Allowable Expense Procedures” 4 December 2007 • Monetary limits on social functions • Restriction on entertainment to legitimate University business e.g. business travel • Light meals at staff meeting e.g. sandwiches and non-alcoholic drinks • Training seminars and work retreats 3/23/2016 Spendvision • Correct use of classification codes • Classification codes reflect Taxation Office administrative guidelines 3/23/2016 Spendvision • We still need to make thresholds decisions about what is “entertainment” and what is not – we’ll run through some examples • We cannot be descriptive about this – some judgment must be exercised! 3/23/2016 SOCIAL FUNCTIONS Spouse/ Other Entertainment? Employee family persons On Premises YES FBT FBT - Off Premises YES FBT FBT - 3/23/2016 Social Functions • Regarded as meal entertainment • Non-food and drink expenditure ancillary to the social function e.g. taxis, venue hire • Minor benefit exemption (<=$300 per head) will not apply to University • Friday night drinks • Staff meetings at cafes, restaurants 3/23/2016 Example Staff meeting takes place at a restaurant or café outside the University – does this involve the provision of entertainment? Staff member seeks reimbursement of meal costs. What happens if staff meeting takes place at the University and alcohol is provided? 3/23/2016 Coding – Social Function Food & Drink Taxi to venue Other Costs Employee Meal Entertainment FBT Meal Entertainment NO FBT/NO GST Entertainment FBT Family Meal Entertainment FBT Meal Entertainment FBT Entertainment FBT Non Employee Meal Entertainment NO FBT/NO GST Meal Entertainment NO FBT/NO GST Entertainment NO FBT/NO GST 3/23/2016 Coding – Social Function When we say “NO GST” on non-employee entertainment we mean no entitlement to a GST input tax credit whether GST is on the invoice or not 3/23/2016 Social Functions – other costs • Transport expenses and other non food and drink costs e.g. venue hire can be included in entertainment • Code these costs to Entertainment and Meal Entertainment • Taxi travel from work to venue is FBT exempt 3/23/2016 PROMOTIONS Spouse/ Other family persons Entertainment? Employee On Premises YES FBT FBT - Off Premises YES FBT FBT - 3/23/2016 Promotional Events • Food and drink is normally regarded as being provided by way of entertainment • Promotional events e.g. cocktail parties that are not open to the general public 3/23/2016 Coding – Promotions Food & Drink Other Costs Employee Meal Entertainment FBT Entertainment FBT Family Meal Entertainment FBT Entertainment FBT Non Employee 3/23/2016 Meal Entertainment Entertainment NO FBT/NO GST NO FBT/NO GST BUSINESS DINNERS Spouse/ Other family persons Entertainment? Employee On Premises YES FBT FBT - Off Premises YES FBT FBT - 3/23/2016 Business Dinners Example • University of NSW employee is invited to dinner by a University of Sydney staff member and his wife • Neither person is travelling on business • The entire meal cost is treated as meal entertainment 3/23/2016 Coding - Business Dinners Food & Drink 3/23/2016 Employee Meal Entertainment FBT Family Meal Entertainment FBT Non Employee Meal Entertainment NO FBT/NO GST BUSINESS TRAVEL Off Premises 3/23/2016 Spouse/ Other Entertainment? Employee family persons NO - FBT - YES FBT FBT - Business Travel • Food and drink is regarded as being provided by way of “self-entertainment” even if two or more employees dine together • Remember “substantiation” requirements • Contrast to Per Diem Allowances 3/23/2016 Example Two staff members travel to Brisbane to meet Uni Qld staff. If the employees dine in the evening alone or together this is not entertainment. 3/23/2016 Example Two staff members travel to Brisbane to meet Uni Qld staff. While there, they meet up with a Uni Melb employee who is also travelling on business If all three dine together this is not entertainment. 3/23/2016 Example Two staff members travel to Brisbane to meet Uni Qld staff. While there they meet up with a Uni Melb employee who is also travelling on business. In the evening all three dine with a Uni Qld employee who is not travelling. Syd Uni picks up the tab. The Qld Uni staff member’s meal is entertainment. The other meals are not entertainment. 3/23/2016 Example A Uni Qld staff member travels on business to Sydney to meet with a Uni Syd employee. The Uni Qld employee is invited to lunch. Wine is served with the meal. Uni Syd employee pays for the meal and seeks reimbursement. The portion of the meal costs attributable to the Uni Qld employee is not entertainment. The meal cost attributable to the Uni Syd employee is entertainment. 3/23/2016 Example • What if I travel to Melbourne and back within the day? • I pay for a business lunch while I’m there. Is this regarded as travelling on business? • Taxation Office uses a rule of thumb that travel must involve an overnight stay. 3/23/2016 Coding – Business Travel Food & Drink Employee Travelling Travel Expense NO FBT Employee Non Travelling Meal Entertainment FBT Non Employee Travelling Other expense NO FBT Non Travelling Meal Entertainment NO FBT/NO GST Non Employee 3/23/2016 LIGHT MEALS OFF CAMPUS Off Premises 3/23/2016 Spouse/ Other Entertainment? Employee family persons NO FBT FBT - Light meals off campus What happens if I invite someone for coffee or a light lunch? I invite a Uni NSW employee for coffee and muffins in a local café. 3/23/2016 Light meals off campus What happens if I invite someone for coffee or a light lunch while travelling? I’m travelling in Paris and I invite a French academic for brunch. 3/23/2016 Light meals off campus THIS IS NOT MEAL ENTERTAINMENT! 3/23/2016 Coding – Light meals off campus Food & Drink Employee Travelling Travel Expense NO FBT Employee Non Travelling FBT Other payment Non Employee Travelling Other expense NO FBT Non Employee Non Travelling Other expense NO FBT 3/23/2016 STAFF MEETING On Premises 3/23/2016 Spouse/ Other Entertainment? Employee family persons NO - FBT - Staff Meetings • Light meals are regarded as sustenance or refreshment in this instance – and not as entertainment • Examples are sandwich lunches even if served with moderate amounts of alcohol 3/23/2016 Staff Meetings • Staff farewell – if on premises and consists of a cake, maybe some drinks, this is not entertainment • But if at a restaurant or held on premises with more than moderate alcohol – then it is meal entertainment 3/23/2016 Coding – Staff Meetings Food & Drink 3/23/2016 Employee Business meetings NO FBT Family Other payment FBT Non Employee Other expense NO FBT AWARD PRESENTATIONS On Premises 3/23/2016 Spouse/ Other Entertainment? Employee family persons NO - FBT - Award Presentations • Large number of attendees. How do we apportion? • A light meal served at an award presentation is not regarded as meal entertainment 3/23/2016 Coding – Award Presentations Food & Drink 3/23/2016 Employee Award Presentations NO FBT Family Other payment FBT Non Employee Other expense NO FBT TRAINING SEMINARS > = 4 HOURS DURATION Spouse/ Other family persons Entertainment? Employee On Premises NO YES - FBT FBT - Off Premises NO YES - FBT FBT - 3/23/2016 TRAINING SEMINARS < 4 HOURS DURATION Entertainment? Employee Spouse/ family On Premises NO YES FBT N/A N/A - Off Premises NO YES FBT N/A N/A - 3/23/2016 Other persons WORK RETREATS Off Premises 3/23/2016 Spouse/ Other Entertainment? Employee family persons YES - FBT - Training Seminars Not subject to FBT • Seminars > = 4 hours duration • Work retreats held off premises Subject to FBT • Other seminars but only if entertainment is provided e.g. would not include a light meal provided at the seminar 3/23/2016 Training Seminars (cont.) • Food costs e.g. light breakfast at a morning seminar or a light meal with alcoholic drinks at an evening seminar • These costs are normally not separated from training costs and are not considered to be entertainment – relevant to external training • Entertainment will exist if seminar <= 4 hours duration and a substantial meal with alcohol is served – rarely the case these days! 3/23/2016 Training Seminars (cont.) • If the training seminar is held at the University and is catered, identifying and separating meal expenditure is an issue • But again – light breakfasts and other meals will not be seen as entertainment 3/23/2016 Work Retreats The key is that the work retreat must: • involve some discussion of business matters/policy and/or training • is held at an external conference centre 3/23/2016 Coding - Training Business Seminars FBT exempt Remember that it is unlikely that food and drink served at seminars will be regarded as meal entertainment! 3/23/2016 Coding - Training But what about dinner provided at an outside restaurant during the conference/retreat? This is a social function 3/23/2016 Recent FBT changes • Increase in Reportable Fringe Benefit reporting exemption limit to $2,000 taxable value from 2008 FBT • Budget announcement to reduce scope of work related items exemption to one item per employee e.g. one laptop per employee 3/23/2016 QUESTIONS 3/23/2016 Question 1 Please explain the GST treatment of grants and appropriations received by the University 3/23/2016 Grants, Appropriations and Transfers These are subject to GST: • Transfer of funds from another Uni • Grants from a private sector business 3/23/2016 Grants, Appropriations and Transfers These are NOT subject to GST: • Appropriations from DEEWR • Private grants and bequests 3/23/2016 Example The University receives appropriation money from DEST which is to be disbursed to Uni NSW. The funds received from DEEWR by the University are not subject to GST. Uni NSW will need to raise a GST tax invoice for the transfer from Uni Sydney. Uni Sydney is entitled to a GST input tax credit. 3/23/2016 Example The University receives grant money from ARC – advice from ARC that these grants are not subject to GST NHMRC grants are not subject to GST Remember we receive RCTI’s from NHMRC 3/23/2016 Question 2 How do we know if a course charge is GST-free? 3/23/2016 GST Free Education • GST Ruling 2000/27 Adult and Community Education • GST Ruling 2001/1 Tertiary Education Courses • GST Ruling 2003/1 Trade and Professional Courses 3/23/2016 GST Free Education • Fee for Tertiary Education Course (“TEC”) • Admin services related to a TEC • Not Accommodation or Lease of Goods associated with a TEC • Excursions or field trips related to a TEC – but not food and accommodation 3/23/2016 Education Courses • Tertiary – Bachelor, Master and Doctor • Adult and Community – can be offered by a University – adds to employment related skills • Professional or Trade • Tertiary Residential College 3/23/2016 Tertiary Education Courses What are administrative services? • Includes in the view of the Taxation Office: – program changes – enrolment services, including the processing of late enrolments – late issue or replacements of student cards – examination arrangements and assessments of students including re-assessment of results where a student has failed – processing academic results including duplicate degree copies – overdue charges or late payment charges – record-keeping – administration of the library – administration of a textbook scheme – administration of the supply of course materials – graduation certificates – course reinstatement – charges for HECS statements 3/23/2016 Tertiary Education Courses What are NOT administrative services? – Student hall application fees – Foreign student application fees – Graduation dinner – Hire of academic dress 3/23/2016 Question The University of Sydney is providing On-line writing support in English for students at University of Hong Kong? Is the supply subject to GST? Where services are being provided to a non-resident who is not in Australia and the effective use/enjoyment is outside Australia, the supply is not subject to GST. It is treated as a export of services. Question If the University is to assemble an equipment in Australia for an overseas client will the supply be subject to GST? The supply for consideration would not attract GST because the effective use or enjoyment is not within Australia even though the goods have been assembled in Australia. Question University hosts a career development day for students. An external organisation agrees to donate some funds to the Uni provided they are allowed to set up a stall for their marketing purposes. Is it subject to GST? Donations with material benefit by the donor is subject to GST. If the donor was not receiving a material benefit then GST would not apply. But in this instance the donor is receiving a material benefit. Question Food and drink provided at a staff function is generally funded from staff contribution. However in some instances University may make some contribution. Is the University contribution subject to FBT? The University contribution is subject to FBT. For more information • GST - http://www.finance.usyd.edu.au/docs/GSTguide.pdf • FBT - http://www.finance.usyd.edu.au/docs/fbt_guide.pdf • FBT (summary) - http://www.finance.usyd.edu.au/docs/entertainment.pdf IF IN DOUBT Contact Nilesh Chand 9351-4396 nchand@finance.usyd.edu.au 3/23/2016